India's trade with the region has increased twenty-fold since 2000, but is only 15% of the trade flow with China.

China's rapid trade, credit and investment spillover into Latin America in the first decade of this century suggested that India, if it intended to follow in the footsteps of its continental rival, could perhaps stage a similar landing in the second decade. This has not happened. India has certainly increased its economic relationship with the region, but it is a far cry from that developed by China. Even Latin American countries' trade flows are greater with Japan and South Korea, although it is foreseeable that in a few years they will be surpassed by those with India given its potential. In an international context of confrontation between the US and China, India emerges as a non-confrontational option, specialising in IT services that are so necessary in a world that has discovered the difficulty of mobility for Covid-19.

article / Gabriela Pajuelo

India has historically paid little attention to Latin America and the Caribbean; the same had been true of China, apart from episodes of migration from both countries. development But China's emergence as a major power and its landing in the region prompted the Inter-American Development Bank (IDB) to ask in a 2009 report whether, after the Chinese push, India was going to be "the next big thing" for Latin America. Even if India's figures were to lag behind China's, could India become an actor core topic in the region?

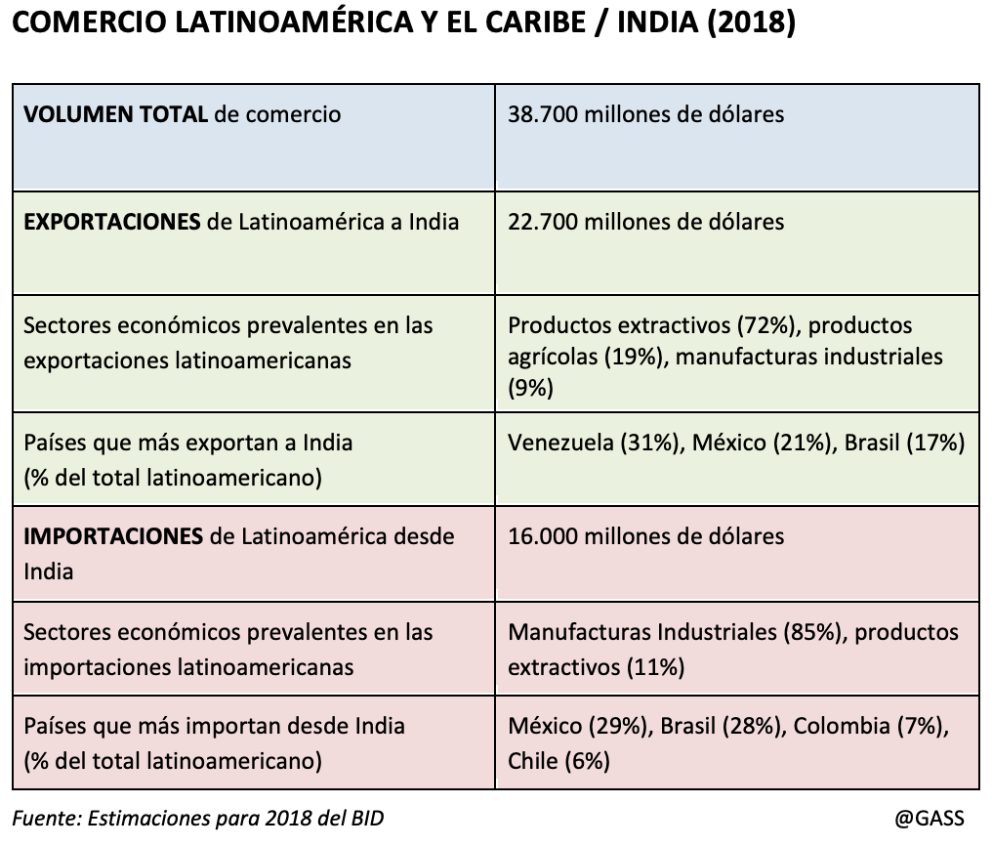

Latin American countries' relationship with New Delhi has certainly grown. Even Brazil has developed a special link with India thanks to the BRICS club, as evidenced by Brazilian president Jair Bolsonaro's visit in January 2020 to his counterpart Narendra Modi. In the last two decades, India's trade with the region has increased twenty-fold, from $2 billion in 2000 to almost $40 billion in 2018, as a new IDB report found last year.

This volume, however, falls far short of the trade flow with China, of which it constitutes only 15 per cent, because if Indian interests in Latin America have increased, Chinese interests have continued to do so to a greater extent. Investment from both countries in the region is even more disproportionate: between 2008 and 2018, India's investment was $704 million, compared to China's $160 billion.

Even India's trade growth is less regionally intertwined than global figures might suggest. Of the total $38.7 billion of transactions in 2018, $22.7 billion were Latin American exports and $16 billion were imports of Indian products. Indian purchases have already surpassed imports from Latin America by Japan ($21 billion) and South Korea ($17 billion), but this is largely due to the purchase of oil from Venezuela. Adding the two directions of flow, the region's trade with Japan and Korea is still larger (around $50 billion in both cases), but the potential for growth in the trade relationship with India is clearly greater.

There is interest not only from American countries, but also from India. "Latin America has a young and skilled workforce, work , and is rich in natural and agricultural resource reserves," said David Rasquinha, director general manager of the Export-Import Bank of India.

Last decade

The two IDB reports cited above are a good reflection of the leap in relations between the two markets in the last decade. In the 2009 report, under degree scroll 'India: Opportunities and Challenges for Latin America', the Inter-American institution presented the opportunities offered by contacts with India. Although it was committed to increasing them, the IDB was uncertain about the evolution of a power that for a long time had opted for autarky, as Mexico and Brazil had done in the past; however, it seemed clear that the Indian government had finally taken a more conciliatory attitude towards the opening up of its Economics.

Ten years later, the report graduate "The Bridge between Latin America and India: Policies for Deepening Economic Cooperation" delved into the opportunities for cooperation between the two actors and noted the importance of strengthening ties to favour the growing internationalization of the Latin American region, through the diversification of trade partners and access to global production chains. In the context of the Asian Century, the flow of exchange trade and direct investment had increased exponentially from previous levels, result largely due to the demand for Latin American raw materials, something that is often criticised as not fostering the region's industry.

The new relationship with India presents an opportunity to correct some of the trends in interaction with China, which has focused on investment by state-owned companies and loans from Chinese state-owned banks. In the relationship with India, there is greater participation of Asian private initiative and a commitment to new economic sectors, as well as the hiring of indigenous staff , including at the management and management levels.

agreement According to General Manager of the IDB's Integration and Trade Sector, Fabrizio Opertti, "the development of an effective institutional framework and business networks" is crucial. The IDB suggests possible governmental measures such as increasing the coverage of trade and investment agreements, the development of proactive and targeted trade promotion activities, boosting investments in infrastructure, promoting reforms in the logistics sector, among others.

Post-Covid context

The questioning of global production chains and, ultimately written request, of globalisation itself because of the Covid-19 pandemic, is not conducive to international trade. Moreover, the economic crisis of 2020 may have a long-lasting effect on Latin America. But it is precisely in this global framework that the relationship with India could be particularly interesting for the region.

Within Asia, in a context of polarisation over the geopolitical interests of China and the United States, India emerges as a partner core topic , one might even say neutral; something that New Delhi could use strategically in its approach to different areas of the world and in particular to Latin America.

Although "India does not have pockets as deep as the Chinese", as Deepak Bhojwani, founder of the consultancy firm Latindia[1], says in relation to the enormous public funding that Beijing manages, India could be the origin of interesting technological projects, given the variety of IT and telecommunications companies and experts it has. Thus, Latin America could be the target of the "technology foreign policy" of a country that, according to agreement with its Ministry of Electronics and IT, has the ambition of growing its digital Economics to "one trillion dollars by 2025". New Delhi will focus its efforts on influencing this economic sector through NEST (New, Emerging and Strategic Technologies), promoting a unified Indian message on emerging technologies, such as governance of data and artificial intelligence, among others. The pandemic has highlighted Latin America's need for more and better connectivity.

There are two prospects for the expansion of India's influence on the continent. One is the obvious path of strengthening its existing alliance with Brazil, within the BRICS, whose pro tempore presidency India holds this year. That should lead to more diversified ties with Brazil, the region's largest market, especially in science and technology cooperation, in the fields of IT, pharmaceuticals and agribusiness. "Both governments committed to expand bilateral trade to 15 billion dollars by 2022. Despite the difficulties brought by the pandemic, we are pursuing this ambitious goal", says André Aranha Corrêa do Lago, Brazil's current ambassador to India.

On the other hand, a greater effort could be made in bilateral diplomacy, insisting on pre-existing ties with Mexico, Peru and Chile. The latter country and India are negotiating a preferential trade agreement and the Bilateral Investment Protection Treaty signature . A rapprochement with Central America, which still lacks Indian diplomatic missions, may also be of interest. These are necessary steps if, closely following in China's footsteps, India wants to be the "next big thing" for Latin America.