US LNG sales to its neighbours and exports from Latin American and Caribbean countries to Europe and Asia open up new prospects

Not relying on pipelines, but being able to buy or sell natural gas also to distant or land-locked countries improves the energy prospects of many nations. The success of fracking has generated a surplus of gas that the US has begun to sell in many parts of the world, including to its hemispheric neighbours, who in turn have more choice provider. At the same time, being able to submit gas in tankers has expanded the customer portfolio of Peru and above all Trinidad and Tobago, which until last year were the only two American countries, apart from the US, with liquefaction plants. Argentina joined them in 2019, and Mexico in 2020 has promoted investments to join this revolution.

![A liquefied natural gas (LNG) freighter [Pline]. A liquefied natural gas (LNG) freighter [Pline].](/documents/16800098/0/gas-natural-blog.jpg/bc7b4699-c26c-a2d1-2971-f57cbb0345b8?t=1621873574093&imagePreview=1)

▲ A liquefied natural gas (LNG) freighter [Pline].

article / Ann Callahan

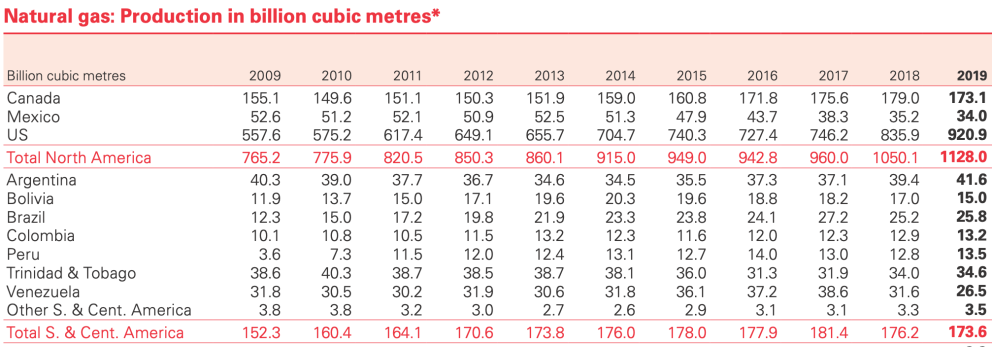

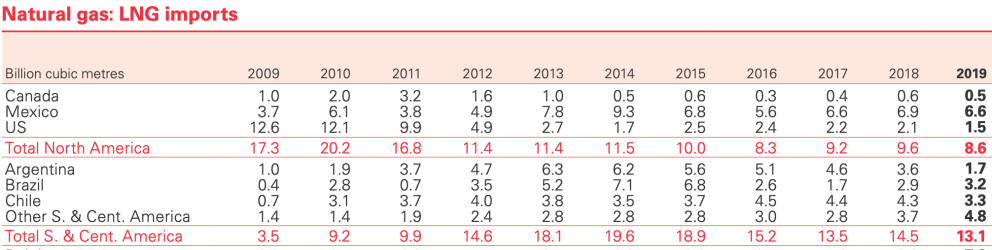

The United States is connected by pipeline only to Canada and Mexico, but is selling gas by ship to some thirty other countries (Spain, for example, has become a major buyer). In 2019, the US exported 47.5 billion cubic metres of liquefied natural gas (LNG), of which one-fifth went to American neighbours, according to agreement with report BP 2020 on the sector.

Eight countries in Latin America and the Caribbean already have regasification plants for gas arriving by cargo ship in liquid form: there are three plants in Mexico and Brazil; two in Argentina, Chile, Jamaica and Puerto Rico, and one each in Colombia, the Dominican Republic and Panama, according to the annual summary association of LNG importing countries. In addition to the US, LNG also arrives in these countries from Norway, Russia, Angola, Nigeria and Indonesia. Two countries export LNG to various parts of the world: Trinidad and Tobago, which has three liquefaction plants, and Peru, which has one (another became operational in Argentina last year).

In an attempt to mitigate the risk of electricity shortages due to a decrease in hydropower production due to drought or other difficulties in accessing energy sources, many countries in Latin America and the Caribbean are turning to LNG. As a cleaner energy source, it is also an attractive option for countries already struggling with climate change. In addition, gas financial aid will help overcome the discontinuity of alternative sources, such as wind and solar power.

In the case of small island countries, such as those in the Caribbean, which for the most part lack energy sources, cooperation programmes for the development of LNG terminals can provide them with a certain independence from certain oil supplies, such as the influence exerted on them by Chavista Venezuela through Petrocaribe.

LNG is natural gas that has been liquefied (cooled to about -162°C) for storage and transport. The volume of natural gas in its liquid state is reduced by approximately 600 times compared to its gaseous state. The process makes it possible and efficient to transport it to places that cannot be reached by pipelines. It is also much more environmentally friendly, as the carbon intensity of natural gas is about 30% less than that of diesel or other heavy fuels.

The global natural gas market has evolved rapidly in recent years. Global LNG capacities are expected to continue to grow until 2035, led by Qatar, Australia and the US. According to BP's report on the sector, in 2019 the share of gas in primary energy reached an all-time high of 24.2%. Much of the growth in gas production in 2019, when it increased by 3.4%, was due to additional LNG exports. LNG exports last year grew by 12.7% to 485.1 billion cubic metres.

Liquefaction and regasification plants in the Americas [report GIIGNL].

Boom

While the United States lagged behind in gas production at the beginning of the first decade of this century, the shale boom since 2009 has led the US to exponentially increase gas extraction and play a key role in the global trade of the liquefied product. With the relatively easy transportation of LNG, the US has been able to export and ship it to many parts of the world, with Latin America, due to its proximity, being one of the regions that is feeling the shift the most. Of the 47.5 billion cubic metres of LNG exported by the US in 2019, 9.7 billion went to Latin America; the main destinations were Mexico (3.9 billion), Chile (2.3 billion), Brazil (1.5 billion) and Argentina (1 billion).

While the region has promising export potential, given its proven natural gas reserves, demand exceeds production and it must import. Venezuela is the country with the largest reserves in Latin America (although its gas power is smaller than its oil power), but its hydrocarbon sector is in decline and the largest production in 2019 came from Argentina, an emerging shale country, followed by Trinidad and Tobago. Brazil matched Venezuela's output, followed by Bolivia, Peru and Colombia. In total, the region produced 207.6 billion cubic metres, while its consumption was 256.1 billion.

Some countries receive gas by pipeline, as is the case of Mexico and Argentina and Brazil: the former receives gas from the US and the latter from Bolivia. But the growing option is to install regasification plants to receive liquefied gas; such projects require some investment, usually foreign. The largest exporter of LNG to the region in 2019 was the US, followed by Trinidad and Tobago, which, due to its low domestic consumption, exports practically all its production: of its 17 billion cubic metres of LNG, 6.1 billion went to Latin American countries. The third largest exporter is Peru, which sent its 5.2 billion cubic metres to Asia and Europe (it did not sell on the continent itself). Argentina joined exports in 2019 for the first time, although with a leave amount, 120 million cubic metres, almost all destined for Brazil.

The region imported a total of 19.7 billion cubic metres of LNG in 2019. The main buyers were Mexico (6.6 billion cubic metres), Chile (3.3 billion), Brazil (3.2 billion) and Argentina (1.7 billion).

Some of those that imported smaller quantities then re-exported part of the supplies, as did the Dominican Republic, Jamaica and Puerto Rico, generally with Panama as the main destination.

Tables extracted from report Statistical Review of World Energy 2020 [BP].

By country

Mexico is the largest importer of LNG in Latin America; its supplies come mainly from the US. For a long time, Mexico has relied on gas shipments from its northern neighbour via pipelines. However, the LNG development has opened up new prospects, as the country's location can help it boost both capacities: improved pipeline connections with the US may allow Mexico to have a gas surplus at Pacific terminals for re-exporting LNG to Asia, complementing the absence of liquefaction plants on the US West Coast for the time being.

The possibility of re-exporting from Mexico's Pacific coast to the large and growing Asian LNG market - without the need for tankers to pass through the Panama Canal - is a major attraction. agreement The US Energy department granted in early 2019 two authorisations to Mexico's project Energía Costa Azul to re-export US-derived natural gas in the form of LNG to those countries that do not have a free trade agreement (FTA) with Washington, as stated in the 2020 report of the group International Importers of Liquefied Natural Gas(GIIGNL).

For the past decade, Argentina has been importing LNG from the US; however, in recent years it has reduced its purchases by more than 20 per cent as domestic gas production has increased thanks to the exploitation of Vaca Muerta. These fields have also allowed it to reduce gas purchases from neighbouring Bolivia and sell more gas, also via pipeline, to its neighbours Chile and Brazil. In addition, in 2019 it will begin exporting LNG from the Bahía Blanca plant.

With Argentina pumping gas to neighbouring Chile, in 2019 Chilean LNG imports declined to their lowest Degree in three years, although it remains one of the important buyers in Latin America, having switched Trinidad and Tobago to the US as its preferred provider . It should be noted, however, that Argentina's export capacity depends on the levels of domestic flows, especially during winter seasons when widespread heating is a necessity for Argentines.

Over the past decade, Brazil' s LNG imports have varied significantly from year to year. However, it is projected to be more consistent in its reliance on LNG until at least the next decade, as renewable energy is developed. In Brazil, natural gas is largely used to back up Brazilian hydropower.

In addition to Brazil, Colombia also considers LNG as an advantageous resource to back up its hydroelectric system in low periods. On its Pacific coast, Colombia is currently planning a second regasification terminal. Ecopetrol, the state hydrocarbon business , will allocate USD 500 million to unconventional gas projects in addition to oil. Along with the government's authorisation to allow fracking, currently stagnant reserves are projected to increase.

Bolivia also has significant natural gas production potential and is the country in the region whose Economics is most dependent on this sector. It has the advantage of existing infrastructure and the size of neighbouring gas markets; however, it faces skill production from Argentina and Brazil. Also, being a landlocked country, it is limited in the commercialisation of LNG.

Although Peru is the seventh largest producer of natural gas in the region, it has become the second largest exporter of LNG. Lower domestic consumption, compared to other neighbouring markets, has led it to develop LNG exports, reinforcing its profile as a nation focused on Asia.

For its part, Trinidad and Tobago has adapted its gas production to its status as an island country, basing its hydrocarbon exports on tankers, which gives it access to distant markets. It is the leading exporter in the region and the only one with customers in all continents.