Ruta de navegación

Menú de navegación

Blogs

Entries with Categories Global Affairs Economics, Trade and Technology .

REPORT / Jokin de Carlos Sola

Simplicity is the best word to describe this Baltic country. Its flag represents the main landscape of the country; a white land covered in snow, a black forest, and a blue light sky. And so is its economy, politics and taxation. What a minimalistic artwork is Estonia.

Estonia is the smallest of the three Baltic countries, with the smallest population and a quite big border with Russia, concretely 294 km long. Even so, Estonia has a bigger GDP per capita (17,727.5 USD in 2016 according to World Bank) than the other two Baltic states: Latvia and Lithuania. It has a bigger presence in the markets and a bigger quality of life according to the OECD in a study done it in 2017.

Technology is a very important part of Estonia's economy. According to the World Bank, 15% of Estonia's GDP are high tech industries. Following the example of Finland, Estonia has made technology the most important aspect of their economy and society. But not just that, with the eyes faced towards the future, or as the Estonians call it "Tulevik", this former part of the Soviet Union of 1,3 million inhabitants has become the most modernized state in Europe.

The 24th of February of 2018 Estonia celebrated the 100th anniversary of the its independence, so it is interesting to see how the evolution of this small country is and will continue to be.

All this has been possible because of different figures like Laar, Ilves, Ansip, and Kotka.

download the complete report [pdf. 3,4MB] [pdf. 3,4MB

download the complete report [pdf. 3,4MB] [pdf. 3,4MB

Taiwan imports up to four times more than China from Central American countries that recognize it as a state.

Of the almost two hundred countries in the world, only 19 have diplomatic relations with Taiwan (and therefore do not have diplomatic relations with China). Of these, five are in Central America and four in the Caribbean. The recognition of Taipei has some advantages for these countries, although they have been neutralized by China's commercial weight. Panama established relations with Beijing in 2017 and the Dominican Republic has just done so now. Here we examine the interest that preference for Taiwan still holds for certain Central American countries.

article / Blanca Abadía Moreno

Taiwan's special relationship with Central America dates back to the period following Taiwan's 1971 departure from the United Nations, where Nationalist China was displaced by the People's Republic of China. Several Latin American countries had established relations with Taiwan in the 1960s, but most of them gradually came to recognize Beijing after the UN change. Taiwan retained, however, the support of the Central American nations and in the 1980s also gained the support of small Caribbean islands that then became independent.

The emergence of China as a major international trade partner has been subtracting diplomatic recognition from Taiwan. Costa Rica established full ties with China in 2007, Panama in 2017 and the Dominican Republic last May 1. Even so, of the 19 countries that continue to opt for Taipei over Beijing, five are in Central America: Guatemala, Belize, Honduras, El Salvador and Nicaragua (this country with a five-year hiatus, from 1985-1990). Four others are in the Caribbean: Haiti and three tiny nations in the Lesser Antilles. If one takes into account that the rest of the countries that recognize Taiwan are of little commercial importance, except for Paraguay (they are the Vatican, Burkina Faso, Swaziland and six Polynesian microstates), it is understandable that Central America absorbs Taiwan' s diplomatic interest.

Since the constitutive theory of statehood defines a state as a person in international law if, and only if, it is recognized as sovereign by others, Taiwan strives to ensure that those countries continue to recognize it as a subject of plenary session of the Executive Council law in the concert of nations; losing their support would directly affect the legitimacy of its claims as a sovereign state.

To this end, Taipei promotes trade relations with them, procures investments and uses what is called "checkbook diplomacy": submission of gifts (and bribes) to maintain these relations. Central American countries receive an average of $50 million annually in declared non-reimbursable cooperation. Taiwan directs financial aid to its Latin American partners through the development and International Cooperation Fund(ICDF), with programs ranging from infrastructure construction to coffee production. Taiwan has financed and constructed several government buildings in Nicaragua and El Salvador.

In addition, the Asian nation contributes to programs of the Central American Bank for Economic Integration (CABEI) and is an observer country in the Central American Parliament and other regional organizations.

This effort, however, has not prevented that in recent years there have been casualties among Central American countries that saw him giving diplomatic recognition. Costa Rica's economic development led the country in 2007 to want to improve its trade figures through a rapprochement with China, which involved the opening of an embassy in Beijing and the closure of the one it had in Taipei. For the same reason, Panama also opted in 2017 to break off diplomatic relations with Taiwan, stating that China, a prominent Username of the Panamanian canal, "has always played a relevant role in Panama's Economics " and any restrictions preventing it from remaining so had to be removed.

|

Commercial relations

Trade relations between Taiwan and the Central American countries that recognize it as a State increased significantly thanks to the opening of the Central American Trade Office(CATO) in Taiwan in 1997, the incorporation of this country into CABEI and the entrance entry into force of several trade agreements. Taiwan signed free trade agreements with Guatemala (2006), with Honduras and El Salvador (2006) and with Nicaragua (2008).

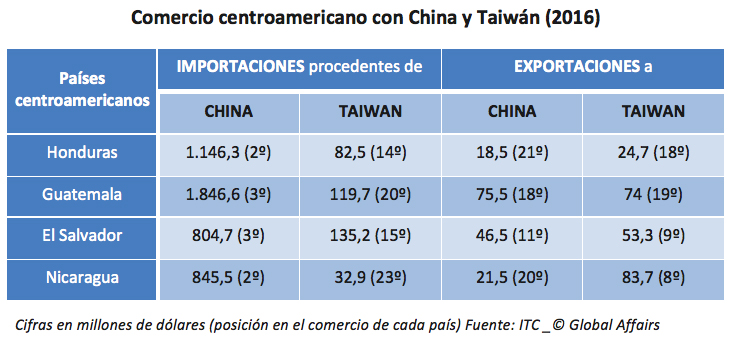

These treaties have especially facilitated Central American exports to Taiwan. As is the case with most Latin American countries, Guatemala, El Salvador, Honduras and Nicaragua have China as one of the main origins of their imports (the first is still the United States). Their political alignment with Taiwan does not prevent them from being customers of Chinese production. Thus, in 2016, China ranked between 2nd and 3rd as a source market, while Taiwan ranked far down the table (between 14th and 23rd). However, the special relationship with Taipei means that Taiwan equals or surpasses China as a destination for the exports of the four Central American countries mentioned. This is the commercial benefit they obtain from the diplomatic recognition of the Asian island.

Of this group of countries, Nicaragua exported the most to Taiwan in 2016 (US$83.7 million) compared to exports to China (US$21.5 million), a ratio of four to one. The main Nicaraguan products exported were shrimp, sugar, beef and coffee.

Honduras exported US$24.7 million to Taiwan -mainly textiles, coffee and aluminum- compared to US$18.5 million to China. El Salvador sent shipments to Taiwan worth US$53.3 million - mainly sugar - and US$46.5 million to China. Guatemala, whose Economics has a larger volume, was the only country to sell more to China (75.5 million), but in figures very similar to those of Taiwan (74 million), to which it sent mainly coffee, paper and cardboard.

With these diplomatic and commercial relations Taiwan intends to show international society that it is a capable ally and manager for international cooperation. It also wants to show the world that Taiwanese diplomacy exists despite China's attempts to isolate it. The fact that China has a special interest in markets that facilitate access to raw materials makes the Asian giant more attentive to relations with several South American countries, rich in minerals; it is there where Beijing concentrates its Latin American investments.

Central America, with less extractive activity, thus escapes China's priority (the interest in the Panama Canal is a case apart), and is left for the time being to Taiwan's action. However, the increasingly residual nature of support for the island and the very weight of relations with China suggest that the Central American countries will continue to join this particular club, one after the other, from leave.

▲Enrique Peña Nieto and Donald Trump at the July 2017 G20 summit in Hamburg [Presidency of Mexico].

ANALYSIS / Dania Del Carmen Hernández [English version].

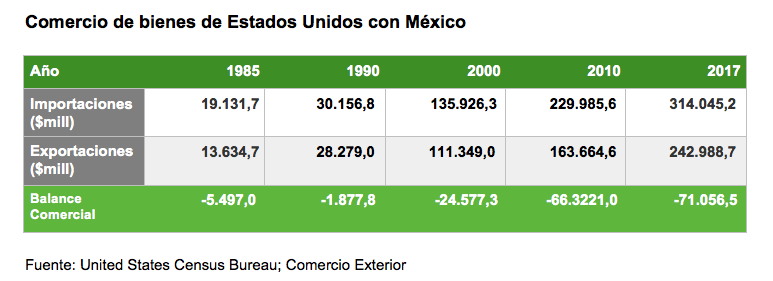

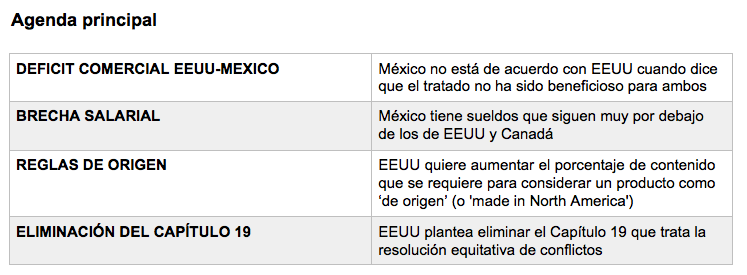

Canada, the United States and Mexico are immersed in the renegotiation of the North American Free Trade Agreement (NAFTA). The trade agreement between these three countries has been somewhat controversial in recent years, especially in the US, where its advisability has been questioned. During the presidential campaign, Donald Trump defended the cancellation of the treaty; later, already in the White House, he accepted that there would be a renegotiation. Trump argued that the pact has reduced US manufacturing jobs and generated a trade deficit of more than $60 billion with Mexico ($18 billion with Canada), so unless new conditions substantially reduced that deficit, the US would withdraw from agreement.

Overall, Americans have positive views of the treaty, with 56% of the population saying NAFTA is beneficial to the country, and 33% saying it is detrimental, from agreement with a November 2017 Pew Researchsurvey . Among those who hold a negative view, the majority are Republicans, with 53% saying Mexico benefits the most, while Democrats overwhelmingly support the pact and only 16% view it negatively.

|

Regardless of public acceptance, opinion about the treaty has not always been so dubious. When President Bill Clinton ratified the treaty, it was considered one of the greatest achievements of his presidency. Just as globalization has liberalized trade around the world, NAFTA has also expanded trade very effectively and presented a great issue of opportunities for the U.S., while strengthening the U.S. Economics .

Under NAFTA, trade in U.S. goods and services with Canada and Mexico grew from $337 billion in 1994, when the treaty entered into force, to $1.4 trillion in 2016. The impact has been even greater when taking into account cross-border investments between the three countries, which went from $126.8 billion in 1993 to $731.3 billion in 2016.

Washington's concern is that, despite this increase in trade volume, in relative terms the United States is not achieving sufficiently fruitful results compared to what its neighbors are getting from the treaty. In any case, Canada and Mexico accept that, after almost 25 years in force, the treaty must be revised to adapt it to the new productive and commercial conditions, marked by technological innovations that, as is the case of the Internet development , were not contemplated when the agreement was signed.

Round-by-round examination

The discussion of the three countries touches on numerous aspects, but three blocks can be mentioned, which have to do with certain red lines set by the different parties to the negotiation: the rules of origin; the desire of the United States to end the independent arbitration system, through which Canada and Mexico have the ability to end measures that violate the trade agreement (elimination of Chapter 19), and finally proposals, perhaps less decisive but equally important, aimed at the general update of the treaty.

When negotiations began in August 2017, it was expressed that they could be concluded by January 2018, with six rounds of meetings planned. This issue is already being exceeded, with a seventh round at the end of February, possibly to be followed by others. Now that the initial deadline has been reached, however, it is time to review the status of the discussions. A good way to do this is to follow the evolution of the talks through the rounds of meetings held and thus be able to assess the results that have been recorded so far.

|

Last North American Summit, with Peña Nieto, Trudeau and Obama, held in Canada in June 2016 [Presidency of Mexico]. |

1st Round (Washington, August 16-20, 2017)

The first round of negotiations put on the table the priorities of each of the three countries; it served to set the diary of the main issues to be discussed in the future, without yet addressing concrete measures.

agreement First of all, Donald Trump already made it clear during his election campaign that he considered NAFTA to be unfair to the United States due to the trade deficit that the United States has mainly with Mexico and, to a lesser extent, with Canada.

According to figures from the Office of the US Trade Representative, the US went from a surplus of $1.3 billion in 1994 to a deficit of $64 billion in 2016. Most of this deficit comes from the automotive industry. For the new U.S. Administration, this calls into question whether the agreement will have beneficial effects for the domestic Economics . Mexico, less inclined to introduce major changes, insists that NAFTA has been good for all parties.

Another topic was the wage gap between Mexico and the United States and Canada. Mexico argues that, despite having one of the lowest minimum wages in Latin America, and having had a stagnant average wage for the last two decades, this should not be taken into account in the negotiations, as it believes that Mexican wages will gradually catch up with those of its trading partners. On the contrary, for the US and Canada it is a topic of concern; both countries warn that a wage increase would not harm the growth of the Mexican Economics .

Rules of origin was one of the main topics of discussion. The United States is seeking to increase the percentage of content required to consider a product as originating so that it is not necessary to pay tariffs when moving it between any of the three countries. This was controversial in this first round, as it could negatively affect Mexican and Canadian companies. Specialists warn that the minimum national content requirement does not exist in any free trade agreement in the world.

Finally, the Trump administration hinted at its intentions to eliminate Chapter 19, which guarantees equality in resolving disputes between countries, so that it is not the national laws of each country that resolve the conflict. The United States sees this as a threat to its sovereignty and believes that conflicts should be resolved in such a way that its own democratic processes are not ignored. Canada has conditioned its continued membership in the treaty on the maintenance of this chapter. Mexico also defends guarantees of independence in conflict resolution, although so far in this discussion it was not categorical.

|

2nd Round (Mexico City, September 1-5, 2017)

Although considered successful by many analysts, the second round of renegotiation continued at a slow pace. Some of the issues that advanced were: wages, market access, investment, rules of origin, trade facilitation, environment, digital trade, SMEs, transparency, anti-corruption, agriculture and textiles.

The president of committee coordinator Mexican Businessmen, Juan Pablo Castañón, insisted that for the moment the wage issue was not subject to negotiation, and denied that any of the parties had any intention of leaving the treaty, despite threats to that effect from the Trump Administration. Castañón said he was in favor of Mexico supporting the maintenance of Chapter 19 or the establishment of a similar instrument for the settlement of trade disputes between the three countries.

Round 3 (Ottawa, September 23-27, 2017)

The delegates made important advances in policies on skill, digital commerce, state-owned enterprises and telecommunications. The main progress was on some aspects related to SMEs.

Canadian Foreign Minister Chrystia Freeland complained that the United States had not made any formal or written proposals in the most complex areas, which in her opinion demonstrates a passive attitude on the part of that country in the context of the negotiations.

U.S. Trade Secretary Robert Lighthizer said that his country is interested in increasing wages in Mexico, under the logic that this is unfair skill , as Mexico has attracted factories and investment with its low wages and weak union rules. However, Mexican business and union leaders are resisting such pressures.

Canada stood firm on its position on Chapter 19, which it considers one of the great achievements of the current agreement. "Our government is absolutely committed to defending it," Freeland said. Washington raised, although without presenting a formal proposal , the modification of the rules of origin to make them stricter and prevent imports from other nations from being considered "made in North America", just because they were assembled in Mexico.

This round took place as the United States slapped a tariff of nearly 220% on C Series aircraft made by Canadian aircraft manufacturer Bombardier, which it considered that business had used a government subsidy to sell its aircraft to the U.S. at artificially low prices.

Round 4 (Virginia, October 11-17, 2017)

The United States presented its formal proposal to raise the rules of origin for the automotive industry and its suggestion to introduce a sunset clause to agreement.

The United States proposed raising from 62.5% to 85% the percentage of components of national origin from one of the three countries in order for the automotive industry to benefit from NAFTA, and that 50% be of U.S. production. association The Mexican Automotive Industry Association (AMIA) rejected proposal.

Washington's interest in weakening the dispute settlement system within the treaty (Chapter 19) was also debated, without a rapprochement of positions.

Finally, there was talk of including a sunset clause, which would cause the treaty to cease to exist after five years, unless the three countries decide to renew it. This proposal was widely criticized, warning that this would go against the essence of agreement and that every five years it would generate uncertainty in the region, as it would affect the investment plans of companies.

These proposals add to the tough negotiating climate, as already in the third round the United States had begun to defend difficult proposals, on issues such as lawsuits for dumping (selling a product below its normal price) in the importation of perishable Mexican products (tomatoes and berries), government purchases and the purchase of textiles.

|

Round 5 (Mexico City, November 17-21, 2017)

The fifth round took place without much progress. The U.S. maintained its demands and this generated great frustration among the representatives of Mexico and Canada.

The United States received no alternatives to its proposal of wanting to increase the regional composition from 62.5% to 85%, with at least 50% being U.S.-based. On the contrary, its trading partners put on the table data showing the damage that this proposal would cause to the three economies.

Faced with the U.S. desire to limit the issue of concessions that its federal government offers to Mexican and Canadian companies, Mexican negotiators responded with a proposal to limit the country's public contracts to issue of contracts reached by Mexican companies with other governments under NAFTA. Given that the issue of these contracts is quite small, U.S. companies would be restricted in their contracting.

At the end of this fifth round, the most advanced issues are the regulatory improvement of telecommunications and the chapter on sanitary and phytosanitary measures. With the latter, the Americans seek to establish new transparent and non-discriminatory rules, allowing each country to establish the Degree protection it deems appropriate.

Round 6 (Montreal; January 23-29, 2018)

The sixth negotiation showed some progress. The chapter on corruption was finally closed, and there was progress in other areas. Some of the important issues that had been left aside in the previous negotiations were discussed. Progress is slow, but seems to be making headway.

Robert Lightizer rejected the compromise on rules of origin that Canada had previously proposed. The framework was based on the idea that rules of origin should be calculated to include the value of software, engineering and other high-value work, facets that today are not taken into account with a view to goal regional content.

As a form of pressure, Canada threatened to reserve the right to treat its neighboring countries worse than other countries if they enter into agreements. One of them could be China. The proposal was not considered, as the United States and Mexico found it unacceptable.

Beyond the deadline

After more than seven months of meetings, as reflected in this round-by-round review of the talks, the negotiations between the three countries have still not reached the threshold of a pre-agreement that, while awaiting the resolution of more or less important points, would confirm the shared will to continue NAFTA. The hard stances of the United States and the pressure from Canada and Mexico to save the treaty have so far resulted in a "tug of war" that has allowed some partial, but not decisive result . Thus, it is yet to be determined whether the treaty has actually reached its expiration date or whether it can be reissued. For the time being, the three countries are at agreement working towards a renewed treaty.

From what has been seen so far in the negotiations, it is difficult to determine which country will be more willing to yield to the pressure exerted by the others. The most controversial issues have hardly been addressed until recently, so it is not possible to say what each country has achieved in this negotiation process.

The two neighbors of the United States, but especially Canada, continue to warn of the risk of Trump wanting to kill the treaty. An acceleration of the negotiations could help the positive resolution of the process, but the electoral calendar rather threatens postponements. On March 30, campaigning begins for Mexico's presidential election, which will take place on July 1. In September, the U.S. will begin to look more closely at the November congressional elections. A substantial breakthrough before the Mexican presidential elections could put agreement back on track, even if some issues remain to be closed, but if no breakthrough is made in the next meetings, the three countries could be getting used to the idea of the end of NAFTA, which would weigh down the negotiations.

Examination of the reformulation of Castro's economic model attempted by Fidel's successor

Next April, a year and a half after Fidel Castro's death, his brother Raúl plans to leave the presidency of Cuba, where he has been for a decade. His bequest is an attempt to lengthen the Castro regime by forcing the island's economic recovery. But the restrictions of the reforms themselves, the slow pace of their implementation and the fact that they are not accompanied by greater political freedom, have limited the effect of the changes. Nevertheless, they may be a good starting point for the next president if he really wants to move towards full openness.

article / Valeria Vásquez

Raúl Castro replaced his brother Fidel as president of Cuba's state committee in 2008. Since then, the island has undergone changes in its organisation, although without abandoning its communist structure or the revolutionary principles set in motion in 1959. On coming to power, Castro decided to embark on a path of structural reforms in order to "update" Cuba's socio-economic model and emerge from the serious economic crisis.

As part of this programme, Raúl Castro approved a series of social and economic reforms of a "transformative" nature, which tended towards the introduction of market mechanisms, while maintaining adherence to socialist principles based on centralised planning (and without accompanying these changes with political liberalisation). Revitalisation was the main goal of the reforms in the economic sphere, turning around what had been a fully socialist approach policy and rejecting free market reforms.

Ten years after the changeover between the Castros brothers, the Cuban regime is preparing for the arrival in April of the first president from outside the family. Although it has not yet been confirmed who the new president will be, it is expected that the current vice-president, Miguel Díaz-Canel, will be appointed as part of a continuity of power.

The country is currently at a disadvantageous status , with political uncertainty over the new phase that is opening up, the serious economic difficulties that Venezuela (the island's main benefactor for more than a decade) is going through, and the truncated foreign expectations that the arrival of Donald Trump in the White House a year ago brought with it.

update from model economic

Since 1959, Cuba's economic model has been based on revolutionary socialist principles. Since Raúl Castro came to power, however, a process of transformation has been undertaken, considered necessary to move forward a Economics that was stagnating and immersed in a serious crisis.

In reality, there was no substantial modification of the economic model , but rather a update of it, maintaining the predominance of central state planning and state ownership over the laws of the free market. The goal of this process has been to guarantee the continuity and irreversibility of socialism, as the Cuban authorities have declared, as well as to promote the country's economic development and improve the standard of living of the population.

The framework reforms were approved at the VI congress of the Cuban Communist Party, held in 2011. Among other points, the approved agreements established the submission of a usufruct to peasants and cooperatives, and opened the door to the mass dismissal of hundreds of state employees. The reform guidelines, however, did not set out the specific role that the state and state-owned sector should play in the Economics.

The so-called update of Cuba's model has led to the expansion of the market and non-state ownership, but in a Economics that is still conditioned by state planning this measure is still inefficient, as it was in China or Vietnam. While the state business still prevails (in a more decentralised form, through self-financing and without fiscal subsidies), the private sector has become more flexible, but heavy taxation of the private sector still hampers development.

Land in usufruct

One of the main pillars of the Castro government's reforms was the submission usufruct of idle state land to peasants and cooperatives, with the purpose aim of reducing imports and increasing production. The usufructuaries have obtained the right to cultivate the land and to keep what they harvest, but the state retains ownership and can terminate the contract for reasons of public interest.

Regulation was carried out through two laws: a first, in 2008, subject to many restrictions and actually disadvantageous for farmers; and a second, in 2012, more flexible, whereby the government expanded the size of the plot (from 13 to 67 hectares), approved the planting of orchards and forests, and also allowed the construction of houses next to the land (previously forbidden).

In March 2011, the government reported that 128,000 usufructs, totalling 1.2 million hectares, had already been handed over. However, although the 2012 law was less restrictive than the previous one, as mentioned above, it still included certain hurdles that discouraged farmers from getting involved: farmers made gains, but only after overcoming various obstacles.

Mass dismissal of civil servants and self-employment

At the beginning of 2011, the state payroll presented an "inflated" rate, with millions of state employees in precarious positions and conditions at work . For this reason, Raúl Castro promoted the dismissal of 500,000 surplus state workers between October 2010 and March 2011, which raised the unemployment rate to 12%. To counteract this measure, 250,000 self-employed jobs were initially created and other private activities were also promoted.

This was necessary to raise labour productivity, reduce costs and increase wages. The agreements of the CCP's VI congress allowed for the approval of 178 self-employed activities: many of them were very specific and unskilled (such as forklift drivers or bath attendants), and a few were skilled (such as translators or insurance agents). This made the private work more flexible.

Thus, in a country with a labour force of 5 million people, out of the total of 11.2 million people living on the island, a total of 4.2 million of those working are state employees and the rest are in the non-state sector, consisting of agricultural cooperatives, private farmers and the self-employed [1]. The latter now number 500,000 people. Despite this development of what is known in Cuba as "cuestapropismo", there are restrictions that prevent most professionals from working on their own in their profession, and this reduces the human capital available to boost the country's Economics .

Openness to foreign investment

The flow of investment from abroad has not accompanied the reforms promoted by Raúl Castro, which has been one of the biggest obstacles to the desired success. In order to attract foreign investment, the Special Zone of development Mariel (ZEDM) was inaugurated in 2013. The port of Mariel, located 45 kilometres west of Havana, was allocated a 465.4 square kilometre industrial zone and an advanced ship terminal. entrance The purpose was to convert the ZEDM, through the existence of incentives to attract investment, into the main gateway for foreign trade and the largest industrial structure in Cuba [2]. However, four years after its inauguration, the results have not been as expected. In an administrative process that has followed an extraordinarily slow pace, today only 33 companies have been set up at C , a far cry from the 2.5 billion dollars that the ZEDM was intended to attract annually.

The restoration of diplomatic relations with Washington at the end of the Obama administration has not accelerated investment from the US or other Western countries. In addition to the US embargo remaining in place, the Trump administration has reversed provisions passed by his predecessor that opened a timid door to greater economic engagement.

status economic

Raúl Castro's reform plan has not been as successful as expected, mainly because of the restrictive Degree that regulates them. The lack of the intended economic revitalisation has manifested itself in the poor performance of Cuba's Economics in recent years. In 2016, Cuba fell into recession, with an economic decline of 0.9%. In 2017, it was able to recover slightly (figures that have not yet been finalised speak of a 1.6% increase in GDP) thanks to a boom in tourism and better agricultural results.

In the last decade, tourism has been precisely one of the assets of the Cuban Economics . agreement According to an ECLACreport , tourism to the island grew by 11.9% in 2017, with 4.7 million visitors. This increase accounts for the largest issue of visits from the United States, made possible by the elimination of restrictions approved by Obama, but which Trump has reimposed.

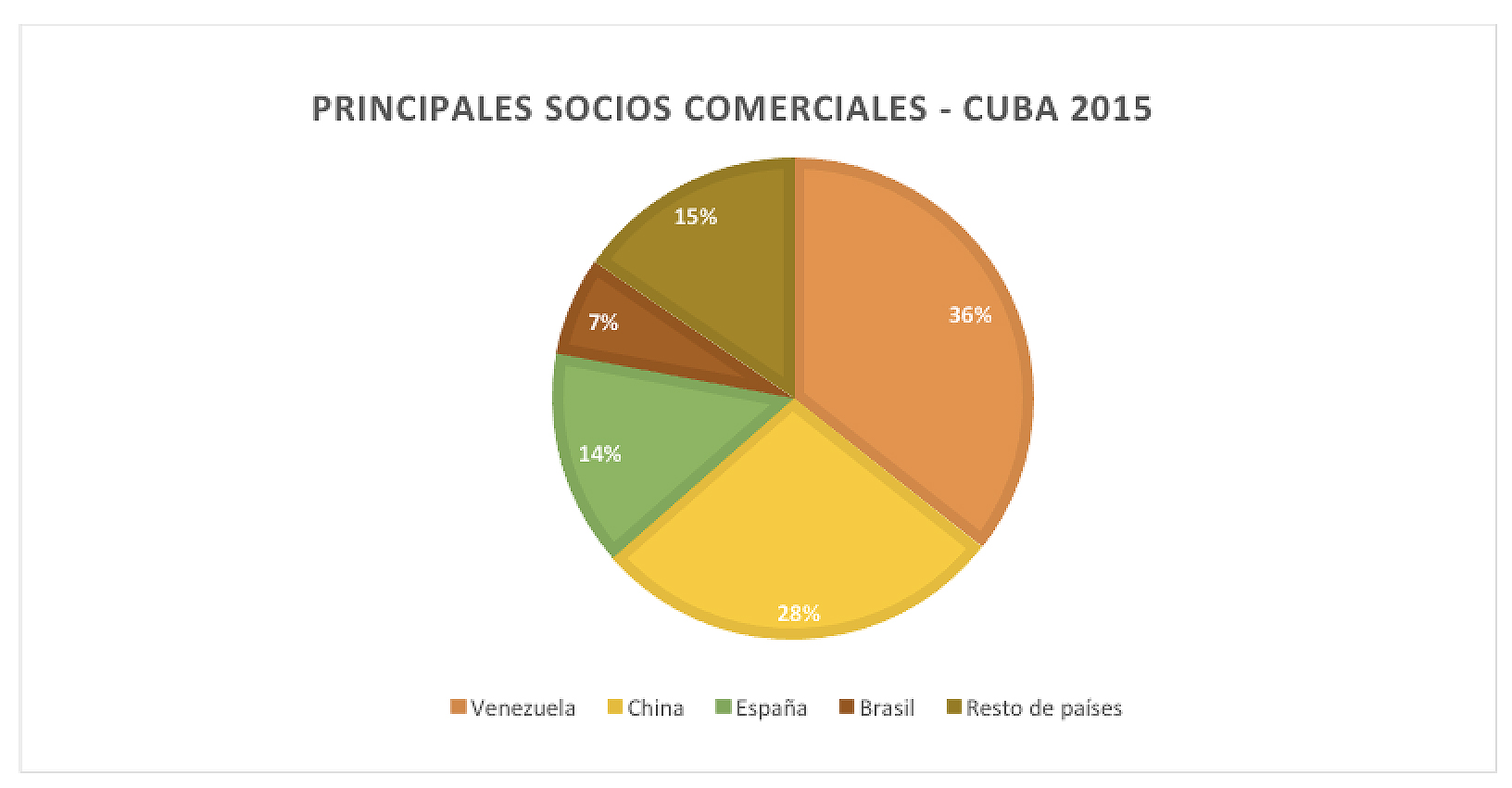

On the other hand, Cuba maintains its chronic trade deficit. Although in 2016 it managed to reduce it to 9.6 per cent of GDP, the outlook is not good, given Venezuela's difficulties in continuing to supply oil, practically on a non-repayable basis. In 2015, Venezuela was Cuba's main trade partner , with which it maintains 36% of its foreign trade, in a exchange valued at 4 billion dollars. It is followed by China, with 28%, a country that sells under soft credit conditions to the island.

|

sourceSOURCE: ONEI. yearbook Estadístico de Cuba 2015, external sector. |

bequest and new challenges

As Raúl Castro's presidency draws to a close, Cuba finds itself in an unfavourable status , with a Economics that is struggling to emerge from stagnation and with a programme of structural reforms that have been insufficient to resolve the problems accumulated over more than 60 years of centralised state socialism. partner-economic problems. The timid nature and slow pace of economic reforms have not helped to revive Economics.

However, during his decade in power, Castro has led changes in the management of model, something that should be taken into account even though in the political sphere he has perpetuated the lack of freedom and the persecution of opposition activity, without undervaluing the moral guilt of the dictatorship. Among the changes that have taken place are the opening up to foreign investment, new diplomatic relations, participation in Latin American forums and the immersion of Cubans in work on their own account.

Probably forced by circumstances, Raúl Castro was able to break down some of the obstacles and ideological barriers that his brother Fidel had implemented on the island for more than 40 years in power. The outgoing president's bequest marks some progress, but it will be the actions of the incoming president that will indicate whether Cuba is truly moving towards the economic - and political - opening that Cubans have longed for.

[1] VIDAL, P. and PÉREZ Villanueva, Omar E. "Se extiende el cuentrapropismo en Cuba". Espacio Laical, vol. 6, n. 3 (2010), p. 53-58.

[2] HERSHBERG, E., & LEOGRANDE, W. M. (2016). A new chapter in US-Cuba relations: social, political, and economic implications. New York: Palgrave Macmillan.

[Riordan Roett, Guadalupe Paz (Eds.). Latin America and the Asian Giants: Evolving Ties with China and India. Brookings Institution Press, 2016, 336 pages]

review / Ignacio Urbasos Arbeloa

Trade between Latin America and the Asia-Pacific region has grown over the last decade at a dizzying rate of 21% per year[1]. However, China's prominence has overshadowed and concentrated the vast majority of academic analyses, leaving other relevant actors such as India in the background. This book by Riordan Roett, Guadalupe Paz and other collaborators from different parts of the world offers an interesting comparison between the two "Asian giants" in their relations with Latin American countries in a new global context. This review, will focus on India's rise in the region, although references to China are inescapable.

Historical ties between Latin America and India, though weak, have existed since the colonial period. Today, one million people[2] descendants of Indian migrants live in the Caribbean, a fact that can be considered an opportunity to generate channels of dialogue, however the magnitude of the Indian diaspora eliminates any trace of exceptionality. Another interesting element directly links India and Brazil, two countries that share to some extent the bequest They have been champions of South-South cooperation to this day, an approach shared by Lula and Dilma as well as Modi. In the section historically, India's relevance is much greater than that of China, which lacks relevant references partner-cultural activities in the region.

|

The growing economic presence of the two Asian giants in Latin America has not gone unnoticed in the discussion politician. Historically, left-wing sectors have been more supportive of increasing trade relations with China, considering it a way to achieve the continent's emancipation and independence from the United States. The right, on the other hand, has been reluctant to have a greater presence of China, aligning itself in the case of the countries of the Pacific Alliance with the TPP, which until the arrival of Trump was intended to be a free trade agreement aimed at increasing the presence of the American continent in the Asia-Pacific outside of China[3]. In the authors' opinion, Latin America lacks a cohesive narrative and strategy on China, thus drastically reducing its negotiating capacity and influence over the Asian country. The case of India is different, as the volume of trade is still a tenth that of China, being a democratic country, an ally of the US and with a better image on the continent.

Despite the fact that the vast majority of Latin American exports to Asia are made up of commodities and imports are made up of manufactured products, there are subtle differences that explain India's better image in the region. First, Chinese imports are much more diversified than Indian imports, generating a general perception of destruction of the industrial fabric and local jobs due to greater competitiveness due to economies of scale and the distortion of the yuan. Likewise, what India exports to Latin America are socially valued products (such as generic drugs, which have reduced the price of medicines) and cheap vehicles, while Indian businessmen set up information companies, which have generated 20,000 jobs in the region.

In terms of imports, both India and China concentrate their purchases on natural products. profile India's most energetic and China's most mining. Both countries concentrate a huge demand for soybeans, a product that agreement with Riordan Roett it will gradually become increasingly important due to its versatility as a feed, feed and biofuel source. It is important to note that Latin America is one of the keys to the energy and food security of these countries, which are facing this enormous challenge The size of its population is derived differently: India is betting on private investment and China on long-term purchase agreements for its state-owned companies. A possible collision between the two Asian giants for access to these markets cannot be ruled out, with the geopolitical implications that this entails.

In terms of India's financial positioning in Latin America, the reality of the sample an almost testimonial presence compared to that of China. However, it should be noted that Indian investment and loans are viewed much better than Chinese ones. Overall, India acts as a partner This is not the case with China, whose actors are more accustomed to dealing with a complex bureaucracy than with a democratic system. Likewise, Chinese loans, increasingly present in certain economies such as Venezuela or Ecuador, have proven to be less advantageous than those of international organizations such as the IMF or IDB as they have higher interest rates and are linked to strict conditions for the purchase of goods. All of this makes India a partner friendlier to the public: a challenge that it will have to face as its presence in the region increases and with it its true way of acting abroad can be appreciated, still an unknown.

In final, India's role in the region is promising but still limited in scope. The annual growth of trade between that country and Latin America was 140% between 2009-2014[4] and India has already signed the first free trade agreements (with MERCOSUR and Chile), although of small magnitude. It should be noted that this is mainly an inter-industrial trade, in which Latin American countries export primary products and manufactures based on natural resources and import manufactures of different technological intensities, which limits the potential for deeper economic relations between the two regions[5] and condemns them to fluctuations in commodity prices. The fact that it takes between 45 and 60 days for a freighter to arrive from the Chilean coast to Indian ports is a real barrier to trade, however there are many reasons to expect India to have a greater regional presence, such as its excellent relations with Brazil, the expectations of annual growth of more than 7% of its GDP and the inescapable importance of Latin America in guaranteeing the energy and food security of the region. the growing population of the Asian country.

[1] CELAC: International Trade and Regional Division DATA.

[2] NRIOL: Non Residents Indian Online DATA

[3] Wilson, J. D. (2015). Mega-regional trade deals in the Asia-Pacific: Choosing between the TPP and RCEP?. Journal of Contemporary Asia.

[4] ECLAC, N. (2016). Strengthening the relationship between India and Latin America and the Caribbean.

[5] ECLAC, N. (2012). India and Latin America and the Caribbean: Opportunities and Challenges in Their Trade and Investment Relations.

The project 'One Belt-One Road' aims to consolidate China's rise as a superpower.

Xi Jinping's ambitious initiative to connect China to the rest of the Eurasian continent may prove costly and difficult. But unlike the overland route through the Central Asian republics, the sea route may not take long to become a reality on certain stretches, as China has already built some ports along part of the route.

▲The land and sea routes of the Chinese initiative [yourfreetemplates].

article / Jimena Puga Gómez [English version].

Following Chinese President Xi Jinping's 2013 revitalisation of the ancient Silk Road speech , the initiative that started as an idea has become the Beijing government's biggest economic challenge: a revolution that, if realised, will change the Asian continent's passenger, freight and hydrocarbon transport infrastructure, as well as high-tech. Dubbed OBOR-OneBelt-One Road, the plan is intended to be the core topic of China's rise as a regional superpower.

The OBOR initiative is a grand plan to reshape China's strategic environment, project Beijing's economic power, secure the communist country's access to energy and mineral supplies, and boost economic growth in the west of the People's Republic. OBOR seeks to achieve these goals by fostering greater and faster connectivity between China and Europe through intermediate points in Central, West and South Asia, as well as with Russia.

For its part, the maritime route that will form one of the pieces core topic of the OBOR initiative, also known as the Silk Road of the 21st century, counts on the fact that seven of the ten largest ports in the world are in China and, as is well known, these infrastructures make the Asian giant an important exporter of port services management .

The Eastbound Maritime Silk Road will start in Fujian province and pass through Guangdong, Guangxi and Hainan, before heading south to the Strait of Malacca. From Kuala Lumpur, the Route will continue to Kolkata and Colombo, then cross the rest of the Indian Ocean towards Nairobi. From there, it will travel through the Horn of Africa, seeking to cross the strategic Gulf of Aden to the Red Sea. Beijing's plan aims to create sufficient infrastructure to allow Chinese ships to safely reach the Mediterranean after sailing through the Suez Canal. But the People's Republic's ambition does not stop at the EU's doorstep, as China wants to reach Athens via the Aegean and from there to Venice, where it will look for land routes to move its goods throughout the Union. Chinese investment has focused, among other things, on the port of Piraeus, with a new logistics centre, and on the development of a network of logistics infrastructures through the Balkans and Hungary.

The South Pacific has also been included in this strategic route map devised in Beijing. Thus, the maritime Silk Road has two routes. The first, as mentioned above, originates on China's east coast and, via the South China Sea, aims to establish strategic control of the Spratley Islands, the Strait of Malacca and the entire Indo-Pacific area, including the Bay of Bengal, in order to reach the heart of Europe. The second sea route will also cross the South China Sea to direct its ships to the coastal ports of the South Pacific. In this way, China would also control the routes for the essential raw materials that come from Latin America.

Although this is a long-term economic project deadline , the Chinese government has already begun the construction of certain infrastructures and the necessary negotiations with different countries. A clear example is Germany. The European Union is China's largest trading partner , while the People's Republic of China is the EU's second largest provider . sample . Germany is a country that not only enjoys an excellent reputation as a reliable partner in China, but is also regarded as "Europe's trade gateway". test This is why, at a meeting in Duisburg, the world's largest inland port and an important transport and logistics hub in Europe, Chinese President Xi Jinping proposed to Germany "to work together to realise the ambitious project of the revival of the economic belt of the new Silk Road of the 21st century". Germany and China are currently connected by the Chongqing-Xinjiang-Duisburg international railway line.

The ports built by China at Hambantota and Colombo in Sri Lanka, the China-Suez Economic and Trade Cooperation Zone in Egypt, Kazakhstan's negotiation of the right to clear its imports and exports through the Chinese port of Lianyungang, and a new alliance between ports in China and Malaysia are further examples of China's ability to leverage its new skill as a port moderniser and manager to support its strategy.

The New Silk Road initiative is a project that will require multi-billion dollar investments in order to build smooth, safe and efficient transport infrastructures. The effects of this economic network ensure benefits not only for China, the leader of the OBOR initiative, but also for all countries affected by it. However, the financing of project is still a question mark that needs to be clarified.