Ruta de navegación

Menú de navegación

Blogs

Entries with Categories Global Affairs Latin America .

Examination of the reformulation of Castro's economic model attempted by Fidel's successor

Next April, a year and a half after Fidel Castro's death, his brother Raúl plans to leave the presidency of Cuba, where he has been for a decade. His bequest is an attempt to lengthen the Castro regime by forcing the island's economic recovery. But the restrictions of the reforms themselves, the slow pace of their implementation and the fact that they are not accompanied by greater political freedom, have limited the effect of the changes. Nevertheless, they may be a good starting point for the next president if he really wants to move towards full openness.

article / Valeria Vásquez

Raúl Castro replaced his brother Fidel as president of Cuba's state committee in 2008. Since then, the island has undergone changes in its organisation, although without abandoning its communist structure or the revolutionary principles set in motion in 1959. On coming to power, Castro decided to embark on a path of structural reforms in order to "update" Cuba's socio-economic model and emerge from the serious economic crisis.

As part of this programme, Raúl Castro approved a series of social and economic reforms of a "transformative" nature, which tended towards the introduction of market mechanisms, while maintaining adherence to socialist principles based on centralised planning (and without accompanying these changes with political liberalisation). Revitalisation was the main goal of the reforms in the economic sphere, turning around what had been a fully socialist approach policy and rejecting free market reforms.

Ten years after the changeover between the Castros brothers, the Cuban regime is preparing for the arrival in April of the first president from outside the family. Although it has not yet been confirmed who the new president will be, it is expected that the current vice-president, Miguel Díaz-Canel, will be appointed as part of a continuity of power.

The country is currently at a disadvantageous status , with political uncertainty over the new phase that is opening up, the serious economic difficulties that Venezuela (the island's main benefactor for more than a decade) is going through, and the truncated foreign expectations that the arrival of Donald Trump in the White House a year ago brought with it.

update from model economic

Since 1959, Cuba's economic model has been based on revolutionary socialist principles. Since Raúl Castro came to power, however, a process of transformation has been undertaken, considered necessary to move forward a Economics that was stagnating and immersed in a serious crisis.

In reality, there was no substantial modification of the economic model , but rather a update of it, maintaining the predominance of central state planning and state ownership over the laws of the free market. The goal of this process has been to guarantee the continuity and irreversibility of socialism, as the Cuban authorities have declared, as well as to promote the country's economic development and improve the standard of living of the population.

The framework reforms were approved at the VI congress of the Cuban Communist Party, held in 2011. Among other points, the approved agreements established the submission of a usufruct to peasants and cooperatives, and opened the door to the mass dismissal of hundreds of state employees. The reform guidelines, however, did not set out the specific role that the state and state-owned sector should play in the Economics.

The so-called update of Cuba's model has led to the expansion of the market and non-state ownership, but in a Economics that is still conditioned by state planning this measure is still inefficient, as it was in China or Vietnam. While the state business still prevails (in a more decentralised form, through self-financing and without fiscal subsidies), the private sector has become more flexible, but heavy taxation of the private sector still hampers development.

Land in usufruct

One of the main pillars of the Castro government's reforms was the submission usufruct of idle state land to peasants and cooperatives, with the purpose aim of reducing imports and increasing production. The usufructuaries have obtained the right to cultivate the land and to keep what they harvest, but the state retains ownership and can terminate the contract for reasons of public interest.

Regulation was carried out through two laws: a first, in 2008, subject to many restrictions and actually disadvantageous for farmers; and a second, in 2012, more flexible, whereby the government expanded the size of the plot (from 13 to 67 hectares), approved the planting of orchards and forests, and also allowed the construction of houses next to the land (previously forbidden).

In March 2011, the government reported that 128,000 usufructs, totalling 1.2 million hectares, had already been handed over. However, although the 2012 law was less restrictive than the previous one, as mentioned above, it still included certain hurdles that discouraged farmers from getting involved: farmers made gains, but only after overcoming various obstacles.

Mass dismissal of civil servants and self-employment

At the beginning of 2011, the state payroll presented an "inflated" rate, with millions of state employees in precarious positions and conditions at work . For this reason, Raúl Castro promoted the dismissal of 500,000 surplus state workers between October 2010 and March 2011, which raised the unemployment rate to 12%. To counteract this measure, 250,000 self-employed jobs were initially created and other private activities were also promoted.

This was necessary to raise labour productivity, reduce costs and increase wages. The agreements of the CCP's VI congress allowed for the approval of 178 self-employed activities: many of them were very specific and unskilled (such as forklift drivers or bath attendants), and a few were skilled (such as translators or insurance agents). This made the private work more flexible.

Thus, in a country with a labour force of 5 million people, out of the total of 11.2 million people living on the island, a total of 4.2 million of those working are state employees and the rest are in the non-state sector, consisting of agricultural cooperatives, private farmers and the self-employed [1]. The latter now number 500,000 people. Despite this development of what is known in Cuba as "cuestapropismo", there are restrictions that prevent most professionals from working on their own in their profession, and this reduces the human capital available to boost the country's Economics .

Openness to foreign investment

The flow of investment from abroad has not accompanied the reforms promoted by Raúl Castro, which has been one of the biggest obstacles to the desired success. In order to attract foreign investment, the Special Zone of development Mariel (ZEDM) was inaugurated in 2013. The port of Mariel, located 45 kilometres west of Havana, was allocated a 465.4 square kilometre industrial zone and an advanced ship terminal. entrance The purpose was to convert the ZEDM, through the existence of incentives to attract investment, into the main gateway for foreign trade and the largest industrial structure in Cuba [2]. However, four years after its inauguration, the results have not been as expected. In an administrative process that has followed an extraordinarily slow pace, today only 33 companies have been set up at C , a far cry from the 2.5 billion dollars that the ZEDM was intended to attract annually.

The restoration of diplomatic relations with Washington at the end of the Obama administration has not accelerated investment from the US or other Western countries. In addition to the US embargo remaining in place, the Trump administration has reversed provisions passed by his predecessor that opened a timid door to greater economic engagement.

status economic

Raúl Castro's reform plan has not been as successful as expected, mainly because of the restrictive Degree that regulates them. The lack of the intended economic revitalisation has manifested itself in the poor performance of Cuba's Economics in recent years. In 2016, Cuba fell into recession, with an economic decline of 0.9%. In 2017, it was able to recover slightly (figures that have not yet been finalised speak of a 1.6% increase in GDP) thanks to a boom in tourism and better agricultural results.

In the last decade, tourism has been precisely one of the assets of the Cuban Economics . agreement According to an ECLACreport , tourism to the island grew by 11.9% in 2017, with 4.7 million visitors. This increase accounts for the largest issue of visits from the United States, made possible by the elimination of restrictions approved by Obama, but which Trump has reimposed.

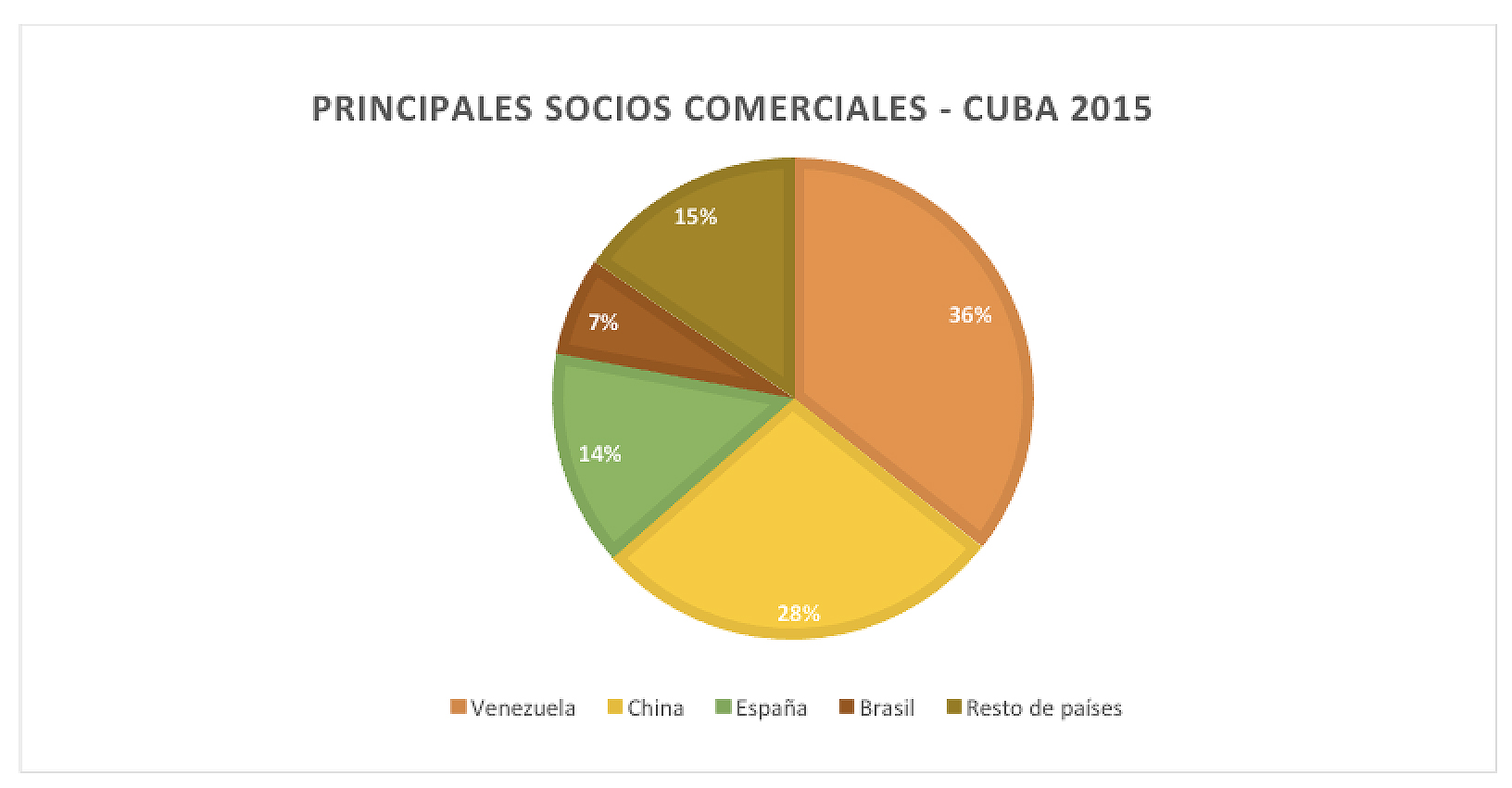

On the other hand, Cuba maintains its chronic trade deficit. Although in 2016 it managed to reduce it to 9.6 per cent of GDP, the outlook is not good, given Venezuela's difficulties in continuing to supply oil, practically on a non-repayable basis. In 2015, Venezuela was Cuba's main trade partner , with which it maintains 36% of its foreign trade, in a exchange valued at 4 billion dollars. It is followed by China, with 28%, a country that sells under soft credit conditions to the island.

|

sourceSOURCE: ONEI. yearbook Estadístico de Cuba 2015, external sector. |

bequest and new challenges

As Raúl Castro's presidency draws to a close, Cuba finds itself in an unfavourable status , with a Economics that is struggling to emerge from stagnation and with a programme of structural reforms that have been insufficient to resolve the problems accumulated over more than 60 years of centralised state socialism. partner-economic problems. The timid nature and slow pace of economic reforms have not helped to revive Economics.

However, during his decade in power, Castro has led changes in the management of model, something that should be taken into account even though in the political sphere he has perpetuated the lack of freedom and the persecution of opposition activity, without undervaluing the moral guilt of the dictatorship. Among the changes that have taken place are the opening up to foreign investment, new diplomatic relations, participation in Latin American forums and the immersion of Cubans in work on their own account.

Probably forced by circumstances, Raúl Castro was able to break down some of the obstacles and ideological barriers that his brother Fidel had implemented on the island for more than 40 years in power. The outgoing president's bequest marks some progress, but it will be the actions of the incoming president that will indicate whether Cuba is truly moving towards the economic - and political - opening that Cubans have longed for.

[1] VIDAL, P. and PÉREZ Villanueva, Omar E. "Se extiende el cuentrapropismo en Cuba". Espacio Laical, vol. 6, n. 3 (2010), p. 53-58.

[2] HERSHBERG, E., & LEOGRANDE, W. M. (2016). A new chapter in US-Cuba relations: social, political, and economic implications. New York: Palgrave Macmillan.

[Riordan Roett, Guadalupe Paz (Eds.). Latin America and the Asian Giants: Evolving Ties with China and India. Brookings Institution Press, 2016, 336 pages]

review / Ignacio Urbasos Arbeloa

Trade between Latin America and the Asia-Pacific region has grown over the last decade at a dizzying rate of 21% per year[1]. However, China's prominence has overshadowed and concentrated the vast majority of academic analyses, leaving other relevant actors such as India in the background. This book by Riordan Roett, Guadalupe Paz and other collaborators from different parts of the world offers an interesting comparison between the two "Asian giants" in their relations with Latin American countries in a new global context. This review, will focus on India's rise in the region, although references to China are inescapable.

Historical ties between Latin America and India, though weak, have existed since the colonial period. Today, one million people[2] descendants of Indian migrants live in the Caribbean, a fact that can be considered an opportunity to generate channels of dialogue, however the magnitude of the Indian diaspora eliminates any trace of exceptionality. Another interesting element directly links India and Brazil, two countries that share to some extent the bequest They have been champions of South-South cooperation to this day, an approach shared by Lula and Dilma as well as Modi. In the section historically, India's relevance is much greater than that of China, which lacks relevant references partner-cultural activities in the region.

|

The growing economic presence of the two Asian giants in Latin America has not gone unnoticed in the discussion politician. Historically, left-wing sectors have been more supportive of increasing trade relations with China, considering it a way to achieve the continent's emancipation and independence from the United States. The right, on the other hand, has been reluctant to have a greater presence of China, aligning itself in the case of the countries of the Pacific Alliance with the TPP, which until the arrival of Trump was intended to be a free trade agreement aimed at increasing the presence of the American continent in the Asia-Pacific outside of China[3]. In the authors' opinion, Latin America lacks a cohesive narrative and strategy on China, thus drastically reducing its negotiating capacity and influence over the Asian country. The case of India is different, as the volume of trade is still a tenth that of China, being a democratic country, an ally of the US and with a better image on the continent.

Despite the fact that the vast majority of Latin American exports to Asia are made up of commodities and imports are made up of manufactured products, there are subtle differences that explain India's better image in the region. First, Chinese imports are much more diversified than Indian imports, generating a general perception of destruction of the industrial fabric and local jobs due to greater competitiveness due to economies of scale and the distortion of the yuan. Likewise, what India exports to Latin America are socially valued products (such as generic drugs, which have reduced the price of medicines) and cheap vehicles, while Indian businessmen set up information companies, which have generated 20,000 jobs in the region.

In terms of imports, both India and China concentrate their purchases on natural products. profile India's most energetic and China's most mining. Both countries concentrate a huge demand for soybeans, a product that agreement with Riordan Roett it will gradually become increasingly important due to its versatility as a feed, feed and biofuel source. It is important to note that Latin America is one of the keys to the energy and food security of these countries, which are facing this enormous challenge The size of its population is derived differently: India is betting on private investment and China on long-term purchase agreements for its state-owned companies. A possible collision between the two Asian giants for access to these markets cannot be ruled out, with the geopolitical implications that this entails.

In terms of India's financial positioning in Latin America, the reality of the sample an almost testimonial presence compared to that of China. However, it should be noted that Indian investment and loans are viewed much better than Chinese ones. Overall, India acts as a partner This is not the case with China, whose actors are more accustomed to dealing with a complex bureaucracy than with a democratic system. Likewise, Chinese loans, increasingly present in certain economies such as Venezuela or Ecuador, have proven to be less advantageous than those of international organizations such as the IMF or IDB as they have higher interest rates and are linked to strict conditions for the purchase of goods. All of this makes India a partner friendlier to the public: a challenge that it will have to face as its presence in the region increases and with it its true way of acting abroad can be appreciated, still an unknown.

In final, India's role in the region is promising but still limited in scope. The annual growth of trade between that country and Latin America was 140% between 2009-2014[4] and India has already signed the first free trade agreements (with MERCOSUR and Chile), although of small magnitude. It should be noted that this is mainly an inter-industrial trade, in which Latin American countries export primary products and manufactures based on natural resources and import manufactures of different technological intensities, which limits the potential for deeper economic relations between the two regions[5] and condemns them to fluctuations in commodity prices. The fact that it takes between 45 and 60 days for a freighter to arrive from the Chilean coast to Indian ports is a real barrier to trade, however there are many reasons to expect India to have a greater regional presence, such as its excellent relations with Brazil, the expectations of annual growth of more than 7% of its GDP and the inescapable importance of Latin America in guaranteeing the energy and food security of the region. the growing population of the Asian country.

[1] CELAC: International Trade and Regional Division DATA.

[2] NRIOL: Non Residents Indian Online DATA

[3] Wilson, J. D. (2015). Mega-regional trade deals in the Asia-Pacific: Choosing between the TPP and RCEP?. Journal of Contemporary Asia.

[4] ECLAC, N. (2016). Strengthening the relationship between India and Latin America and the Caribbean.

[5] ECLAC, N. (2012). India and Latin America and the Caribbean: Opportunities and Challenges in Their Trade and Investment Relations.

[Enrique Serrano, ¿Por qué fracasa Colombia? Delirios de una nación que se desconoce a sí misma, Planeta, Bogotá 2016, 273 pages].

review / María Oliveros [English version].

Colombia's history has often been classified as one of the most violent. The long chapter of FARC terrorism or the confrontation of drug cartels are well present, but before that there were violent events in Colombia such as the Revolt of the Comuneros, the Thousand Days War or the Banana Plantation Massacre. A succession of events that has led most Colombians to believe that violence has characterized the country's history and that perhaps they can do little to avoid it.

That belief is challenged by Colombian communicator, philosopher and writer Enrique Serrano in ¿Por qué fracasa Colombia? Delusions of a nation that does not know itself. The book's purpose is to analyze why Colombia has not prospered more as a country. To answer that question, Serrano reviews in short chapters the Colombian mentality since the beginnings of the nation; there he finds reasons why Colombia is a country that has had a hard time getting ahead, growing in progress and being able to develop to its full potential.

|

¿Por qué fracasa Colombia? is a risky book, which combats thoughts that have long remained in the minds of Colombians. Against that central belief that violence has characterized the country's history, Serrano warns from the very first pages: "It is also presumed that this is a nation plagued by the most vicious violence, from its beginnings to the present day. However, it has been more peaceful than violent, at least during most of its slow training and that although the importance of violence cannot be denied, it is episodic, recent, similar to that of other peoples in transition".

Serrano tries to expose the history of a country that does not begin in 1810 with the independence, but its origins go much further back, to the moment when the Spaniards arrived in America and settled in Colombia. All this in order to show the reader that during the three hundred years that followed the arrival of the first conquistadors, Colombia was a peaceful and measured nation.

Serrano's main premise is that those who arrived in Colombia were mostly new Christians, descendants of Arabs and Jews, coming from southern Spain, who were looking for a place provisional to settle and avoid the religious conflicts that were occurring in Spain at that time. The newcomers settled in small urbanizations, some far from others, not only because that was what the country's geography allowed, but also because the last thing they wanted was to come into conflict with other settlers, both European and indigenous, according to Serrano.

In fact, it is questionable whether the new settlers were dominated by a refractory private religious approach or whether the search for refuge for their consciences motivated, in most cases, their departure to America. It seems that the author adjusts the starting point thinking of those later aspects that he wants to explain.

The author also defends the thesis that in Colombia there was a racial miscegenation, but not a cultural miscegenation, because the indigenous culture was very weak, which contributed to the assumption of the religion brought by the Spaniards. In the culture that the Spaniards transmitted to the new generations were ideas such as provisionality or even getting used to failure: "They also had to react in a peaceful, non-violent way when events were unfavorable and they could not fulfill their desires. Therefore, a relative tolerance and awareness that the frustration of the achievement of desires is something probable, is in the old patterns of upbringing of the Colombian nation".

Serrano suggests that this mentality that originated centuries ago is still present in Colombia: the idea of not making the maximum effort, of not taking too many risks for fear of failure, of doing things half-heartedly so as not to lose too much in case they go wrong. Probably this mentality that was created over the years explains why urbanization projects in the country do not progress properly, why the subway project in the Colombian capital has not been able to materialize, or why it has cost the country so much to exploit its resources to the maximum.

Although the book touches on other aspects such as language, body hygiene and social classes, history is undoubtedly the fundamental component. Referring to historical events of the Colombian past, Serrano proposes a vision of national history far from the usual one. Thus, as has been said, his story does not begin with the cry for independence of 1810, but explains the Spanish society of the 15th and 16th centuries, in order to understand the mentality of the first men, women and families who arrived in America. It is an optimistic vision that seeks to share the idea that not everything has been suffering in Colombian history.

It is a fact that the country's history is not lived or remembered with much encouragement by Colombians. Remembering the past is for many a way of recalling the violence, wars and national polarization that began with the training of the two major parties, Liberals and Conservatives, in the mid-nineteenth century. Knowing the past well, in any case, is paramount for progress; that is what the new law decreed on January 1, 2018, which obliges all schools in the country to teach class Colombian History, seeks to do.

The book concludes with a series of suggestions about the present and the future. That last chapter, graduate Where can such a nation go? tries to transmit a feeling of hope, while at the same time it is a call to a high level of responsibility. According to the author, knowing the past and not running away from it, but accepting it in order to improve mentalities and habits, is what will give the country the basis for not failing.

Washington's Antilles energy diversification initiative moves forward

Given the success of Venezuela's oil diplomacy in the Caribbean countries (the islands account for 13 of the 35 votes in the OAS), the United States launched its own initiative in 2014 so that these small states have greater energy diversity and do not depend on Venezuelan crude. The Maduro regime's financial difficulties have reduced Chavista influence in the Caribbean, but Trump is also cutting back on U.S. aid. Diversification of energy sources, however, is moving forward because it is a real need for the islands.

▲ The tourism boom increases electricity consumption in the Caribbean islands, where there are hardly any energy sources of their own.

article / María F. Zambrano

In the Caribbean islands, energy security is at the center of national strategic concern, due to their high dependence on fossil fuels, mostly imported. Energy security is the focus where the geopolitical, diplomatic and economic interests of these small states converge, and not only of them: the great vulnerability due to the lack of their own energy sources was taken into account by Venezuela to promote in 2005 the Petrocaribe cooperation agreement , which gave it great influence in the Antilles; since 2014, the United States has been trying to counteract that program with the Caribbean Energy Security Initiative (CESI), launched by the Obama Administration.

The rivalry between the two energy diplomacy initiatives will not really be settled by a political pulse between Caracas and Washington, but by the real need of the Caribbean islands to diversify their energy sources. This will reduce Venezuela's influence in the region and open the way for the U.S. offer, focused precisely on promoting alternative sources.

The main risk to national security in the Antilles lies in the high costs of Caribbean electricity. On the one hand, the islands have replaced historically agricultural economies with others driven by tourism, which forces them not only to meet the needs of their citizens but also to rely on the fixed cost of an industry with high levels of electricity consumption. On the other hand, production does not have diversified generation Structures . With the exception of Trinidad and Tobago, Suriname and Belize, the islands are supplied by oil as the only installed production capacity; in addition, 87% of primary energy (basically crude oil) is imported. We are facing a problem of high consumption and another of oil dependence.

In view of this status, and given the demands posed by energy security, understood as the physical protection of infrastructure and also the effort to guarantee the continuity of supply, Petrocaribe became a clear option for Antillean interests. Generous financing credits -from 5% to 70% for a 25-year period- contributed to the extension of the program. During the first 10 years of Petrocaribe's existence, from agreement with data of the Latin American and Caribbean Economic System (SELA), Venezuela covered on average 32% of the energy demand of the participating States; the Dominican Republic, Jamaica, Nicaragua and Haiti received 87% of the supplies. The agreement also led to investments in the islands' refineries, which increased their processing capacity to 135,000 barrels of crude oil per day between Cuba's Camilo Cienfuegos refinery (65,000), the refinery near Jamaica's capital (36,000) and the Dominican Petroleum refinery (34,000).

The alliance alleviated for these countries the rise in the price of crude oil, but the region was left in the hands of the volatility of market prices and those of the main supplier. A November 2017 IMFreport estimates that real crude oil price movements affect GDP growth in the Caribbean by 7%, with wide variations from country to country: 15% in Dominica, 9% in Jamaica and less than 1% in Guyana. In turn, the continued drop in Venezuela's production, which began to allocate fewer barrels to Petrocaribe, left the area predisposed to new approaches that would reduce its exhibition to market shocks.

Caribbean Energy Security Initiative

This expectation was addressed in a new energy security framework that sought to increase independence and reduce vulnerability through diversification. Taking advantage of the steep drop in crude oil prices in 2014, which relaxed energy costs for the islands and gave them more room to maneuver, Washington launched the Caribbean Energy Security Initiative (CESI). The program has focused on supporting countries in diversifying electricity generation, addressing their significant renewable energy potential. Thus, through CESI, US$2 million in technical support has been allocated to C-SERMS (Caribbean Sustainable Energy Roadmap and Strategy), a roadmap developed by CARICOM's energy policy division. This roadmap had already harmonized the goals of the 15 member states at subject in terms of energy efficiency and the implementation of renewable energies: two strategies that sought to solve the problems previously mentioned.

The Inter-American Bank of development (IDB) estimated that for the implementation of the C-SERMS roadmap the Caribbean energy sector would require an investment of 7% of the regional GDP between 2018 and 2023. Countries with stronger financial sectors would have the capacity to finance the projects without altering debt sustainability, with these projects being self-financed over a 20-year period.

In the framework of the U.S. initiative, energy efficiency was materialized in the CHEER program (Caribbean Hotel Energy Efficiency and Renewables program) that has provided attendance technical assistance to the hotel industry, the main consumption source . However, in this field, the IMF urges the implementation of broader public policies to further reduce oil imports and increase GDP in the long term deadline.

In the implementation of renewable energy, the U.S. Overseas Private Investment Corporation (OPIC) has promoted infrastructure with public-private financing. Among other projects, it financed the construction of a 36 MW wind power plant and a 20 MW solar power plant, both inaugurated in 2016 in Jamaica. These projects also have macroeconomic influences on reducing dependence on crude oil; in the case of Jamaica, however, dependence has been decreased mainly by the expansion of natural gas receiving capacity, which has allowed that country a reduction from 97% to 80% dependence on imported oil (in fact, it no longer imports Venezuelan crude oil). Since 2016, the business New Fortress Energy has been working on the submission of liquefied natural gas to Jamaica's Bogue plant.

Since its launch, OPIC has financed up to $120 million in energy agreements. Added to that are those promoted by the CEFF-CCA fund, also from the U.S. Government, which provided $20 million non-refundable for projects in initial phases; in 2015 began the project "Clean Energy in the Caribbean", with a duration of five years and with special incidence in Jamaica.

Venezuela... and Trump's clippings

The U.S. initiative for energy diversification in the Caribbean had its response from Venezuela. In 2015, Petrocaribe held a special summit where it quadrupled the ALBA Caribe fund, raising it from $50 million to $200 million, destined to finance mainly social projects, along the lines of what Javier Corrales and Michael Penfold have called "social power diplomacy". However, Venezuela's severe economic crisis and the reduced finances of its national oil company, PDVSA, have forced the government of Nicolás Maduro to cut back on Venezuelan oil diplomacy.

For its part, the arrival of the Trump Administration has led to a significant decrease in the investment earmarked for CESI. In the framework of a generalized cut to financial aid programs abroad, Washington reduced to $4.3 million the amount earmarked for boosting new energy sources in the Caribbean.

The United States, in any case, is not the only one trying to occupy the energy space previously filled by Venezuela. In 2015, the Renewable Energy and Efficient Energy Center was inaugurated in Barbados, promoted by UNID (United Nations Industrial Development Organization) with the support of Austrian and German funds. In addition, last year Russia made fuel shipments to Cuba, replacing supplies that Venezuela had not been able to cover.

High levels of corruption and impunity in the region make it difficult to eradicate millionaire bribes in public procurement contracts

The confession of the construction and engineering company Odebrecht, one of the most important in Brazil, of having delivered large sums as bribes to political leaders, parties and public officials for the awarding of works in various countries in the region has been the biggest corruption scandal in the history of Latin America. The B budget increase during the "golden decade" of raw materials occurred in a framework of little improvement in the effectiveness of the rule of law and control of corruption, which led to high levels of illicit deviations in public contracts.

article / Ximena Barría [English version].

Odebrecht is a Brazilian company that conducts business in multiple industries through several operating sites. It is engaged in areas such as engineering, construction, infrastructure and energy, among others. Its headquarters in Brazil are located in the city of Salvador de Bahia. The business operates in 27 countries in Latin America, Africa, Europe and the Middle East. Over the years, the construction company has participated in public works contracts in most Latin American countries.

In 2016, the U.S. Justice department published a research denouncing that the Brazilian company had bribed public officials in twelve countries, ten of them Latin American: Argentina, Brazil, Colombia, Ecuador, Guatemala, Mexico, Panama, Peru, Dominican Republic and Venezuela. The research was developed from the confession made by Odebrecht's own top executives once they were discovered.

The company provided officials in these countries with millions of dollars in exchange for obtaining public works contracts and benefiting from the payment for their execution. The business agreed to submit millions of dollars to political parties, public officials, public candidates or persons related to the Government. Its purpose was to have a competitive advantage that would allow it to retain public business in different countries.

In order to cover up these illicit capital movements, business created fictitious corporations in places such as Belize, the Virgin Islands and Brazil. The business developed a secret financial structure to cover up these payments. The research of the U.S. Justice department established that bribes in the aforementioned countries totaled US$788 million (almost half in Brazil alone). Using this illegal method, contrary to all business and political ethics, Odebrecht obtained the commissioning of more than one hundred projects, the execution of which generated profits of US$ 3,336 million.

Lack of an effective judiciary

This matter, known as the Odebrecht case, has created consternation in Latin American societies. Its citizens consider that in order for acts of this nature subject not to go unpunished, countries must have greater efficiency in the judicial sphere and take more accelerated steps towards a true Rule of Law.

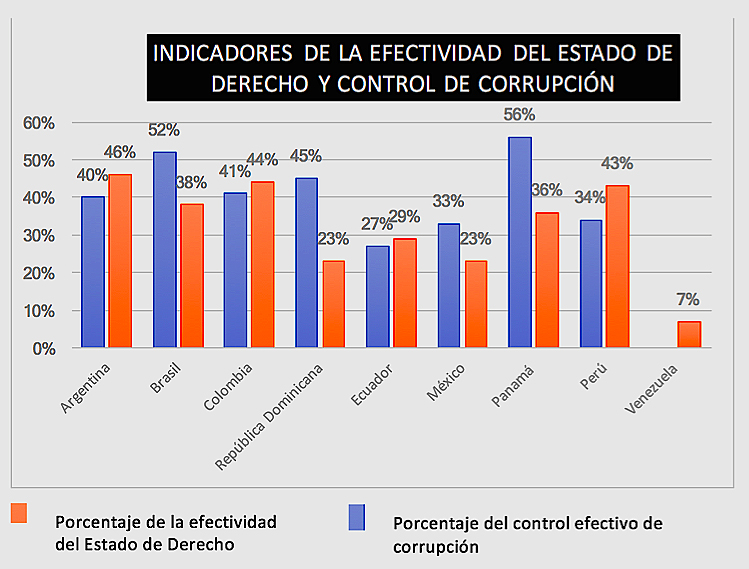

From agreement with World Bank indicators, none of the ten Latin American countries affected by this bribery network reaches 60% of effectiveness of the rule of law and corruption control. This would explain the success of the Brazilian construction company in its bribery policy.

|

source: World Bank, 2016 |

Judicial independence and its effectiveness is essential for the resolution of facts of these characteristics. The proper exercise of justice shapes a proper rule of law, preventing the occurrence of illicit acts or other political decisions that may violate it. Although this is the ideal, the countries involved in the Odebrecht case do not fully comply with this due judicial independence.

Indeed, according to the Global Competitiveness Report for 2017-2018, most of the affected countries obtain a leave grade regarding the independence of their courts, which indicates that they lack an effective judiciary to judge the alleged people involved in this case. This is the case, for example, with Panama and the Dominican Republic, ranked 120th and 127th, respectively, in terms of judicial independence, out of a list of 137 countries.

One of the problems suffered by the Judicial Branch of the Republic of Panama is the high issue of files handled by the Supreme Court of Justice. This congestion makes it difficult for the Supreme Court to work effectively. The high number of processed files doubled between 2013 and 2016: the conference room Criminal Court processed 329 files in 2013; in 2016 there were 857. Although the Panamanian Judicial Branch has improved its budget, that has not represented a qualitative increase in its functions. These difficulties could explain the Court's decision to reject an extension of the research, even though this could mean some impunity. In 2016, there were only two detainees for the Odebrecht case. In 2017, of the 43 defendants who could be involved in the acceptance of bribes valued at US$60 million, only 32 were prosecuted.

The Dominican Republic is also at a similar status . According to a survey of 2016, only 38% of Dominicans trust the judicial institution. This low percentage may have been contributed to by the fact that active members of political parties were elected to serve as Supreme Court judges, something that tarnishes the credibility of the judiciary and its independence. In 2016, Dominican courts only inquired about one person, when the U.S. Supreme Court estimated that the Brazilian business had given $92 million in political bribes, one of the highest amounts outside Brazil. In 2017, the Supreme Court of the Dominican Republic ordered the release from prison of 9 out of 10 allegedly involved in the case due to insufficient evidence.

Need for greater coordination and reform

In October 2017, public prosecutors from Latin America met in Panama City to share information on money laundering, especially in relation to the Odebrecht case. Officials expressed the need to leave no case unpunished, thereby contributing to solving one of the biggest political, economic and judicial problems in the region. Some prosecutors reported having suffered threats in their investigations. All of them valued positively the meeting, as it highlighted the need for greater fiscal coordination and legislative harmony in Latin America. However, it is important to note that the Dominican Republic was absent from meeting.

Any awareness of public ministries in Latin America is essential given the correlation observed between the countries affected by Odebrecht bribes and their poor ranking in indexes provided by different international organizations and centers of research. Ineffective rule of law and lack of control of corruption enable companies like Odebrecht to succeed in their bribery policy to gain a competitive advantage.

The shortcomings of the judicial systems in countries such as Panama and the Dominican Republic, in particular, may make it possible for public officials to go unpunished for crimes committed. In addition, the Odebrecht case, of great magnitude in the region, could further congest judicial activity if effective reforms are not made in each country.

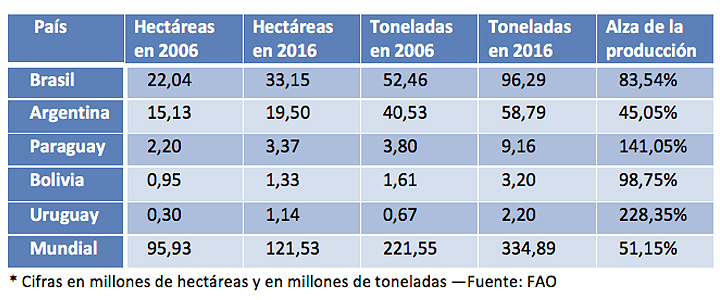

The constant expansion of the crop in Mercosur countries has led them to exceed 50% of world production.

Soybean is the agricultural product with the highest commercial growth in the world. The needs of China and India, major consumers of the fruit of this oleaginous plant and its derivatives, make South America a strategic granary. Its profitability has encouraged the extension of the crop, especially in Brazil and Argentina, but also in Paraguay, Bolivia and Uruguay. Its expansion is behind recent deforestation in the Amazon and the Gran Chaco. After hydrocarbons and minerals, soybeans are the other major commodity in South America subject .

article / Daniel Andrés Llonch [English version].

Soybean has been cultivated in Asian civilizations for thousands of years; today its cultivation is also widespread in other parts of the world. It has become the most important oilseed grain for human consumption and animal feed. With great nutritional properties due to its high protein content, soybeans are marketed both in grain and in their oil and meal derivatives.

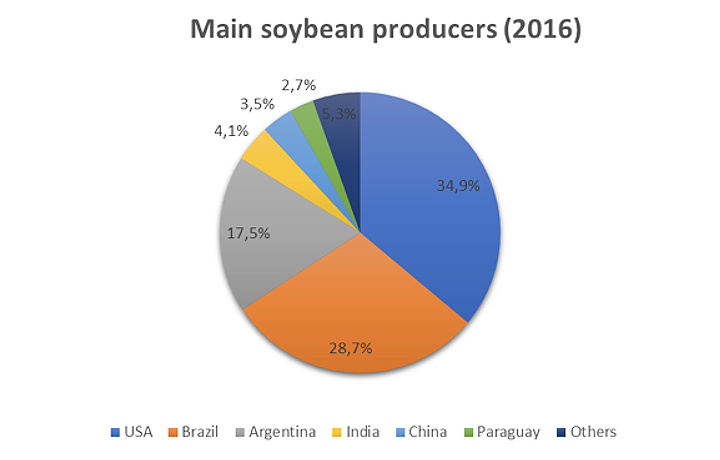

Of the eleven largest soybean producers, five are in South America: Brazil, Argentina, Paraguay, Bolivia and Uruguay. In 2016, these countries were the origin of 50.6% of world production, whose total reached 334.8 million tons, according to FAO's data . The first producer was the United States (34.9% of world production), followed by Brazil (28.7%) and Argentina (17.5%). India and China follow on the list, although what is significant about the latter country is its large consumption, which in 2016 forced it to import 83.2 million tons. A large part of these import needs are covered from South America. South American production is centered in the Mercosur nations (in addition to Brazil and Argentina, also Paraguay and Uruguay) and Bolivia.

Strong international demand and the high relative profitability of soybeans in recent years have fueled the expansion of soybean cultivation in the Mercosur region. The commodity price boom, in which soybeans also participated, led to profits that were directed to the acquisition of new land and equipment, allowing producers to increase their scale and efficiency.

In Argentina, Bolivia, Brazil and Paraguay, the area planted with soybean is the majority (it constitutes more than 50% of the total area planted with the five most important crops in each country). If to group we add Uruguay, where soybean has enjoyed a later expansion, we have that the production of these five South American countries has gone from 99 million tons in 2006 to 169.7 million in 2016, which is an increase of 71.2% (Brazil and Bolivia have almost doubled their production, somewhat surpassed by Paraguay and Uruguay, a country where it has tripled). In the decade, this South American area has gone from contributing 44.7% of world production to total 50.6%. In that time, the cultivated area increased from 40.6 million hectares to 58.4 million hectares.

|

Countries

As the second largest soybean producer in the world, Brazil reached in 2016 a production of 96.2 million tons (28.7% of the world total), with a crop area of 33.1 million hectares. Its production has known a constant increase, so that in the last decade the volume of the crop has increased by 83.5%. The jump has been especially B in the last four years, in which Brazil and Argentina have experienced the highest rate of increase of the crop, with an annual average of 936,000 and 878,000 hectares, respectively, from agreement with the United States Department of Agriculture (USDA) department .

Argentina is the second largest producer in Mercosur, with 58.7 million tons (17.5% of world production) and a cultivated area of 19.5 million hectares. Soybean began to be planted in Argentina in the mid 1970s, and in less than 40 years it has made unprecedented progress. This crop occupies 63% of the country's areas planted with the five most important crops, compared to 28% of the area occupied by corn and wheat.

Paraguay, meanwhile, had a 2016 harvest of 9.1 million tons of soybeans (2.7% of world production). In recent seasons, soybean production has increased as more land is allocated for its cultivation. From agreement with the USDA, over the last two decades, land devoted to soybean cultivation has steadily increased by 6% annually. There are currently 3.3 million hectares of land in Paraguay dedicated to this activity, which constitutes 66% of the land used for the main crops.

In Bolivia, soybeans are grown mainly in the Santa Cruz region. According to the USDA, it accounts for 3% of the country's Gross Domestic Product, and employs 45,000 workers directly. In 2016, the country harvested 3.2 million tons (0.9% of world production), on an area of 1.3 million hectares.

Soybean plantations occupy more than 60 percent of the arable land in Uruguay, where soybean production has been increasing in recent years. In fact, it is the country where production has grown the most in relative terms in the last decade (67.7%), reaching 2.2 million tons in 2016 and a cultivated extension of 1.1 million hectares.

|

Increased demand

Soybean production represents a very important fraction of the agricultural GDP of South American nations. The five countries mentioned above, together with the United States, account for 85.6% of global production, making them the main suppliers of the growing world demand.

This production has experienced a progressive increase since its insertion in the market, with the exception of Uruguay, whose expansion of the product has been more recent. In the period between 1980 and 2005, for example, total world soybean demand expanded by 174.3 million tons, or 2.8 times. During this period, the growth rate of global demand accelerated from 3% per year in the 1980s to 5.6% per year in the last decade.

In all the South American countries mentioned above, soybean cultivation has been especially encouraged, due to the benefits it brings. Thus, in Brazil, the largest regional producer of the oleaginous grain, soybeans contribute revenues estimated at 10 billion dollars in exports, representing 14% of the total products marketed by the country. In Argentina, soybean cultivation went from representing 10.6% of agricultural production in 1980/81 to more than 50% in 2012/2013, generating significant economic benefits.

The outlook for growth in demand suggests that production will continue to rise. The Food and Agriculture Organization of the United Nations estimates that global production will exceed 500 million tons in 2050, double the volume harvested in 2010. Much of this demand will have to be met from South America.

Continental U.S. neighbors are having a hard time interpreting the first year of the new Administration.

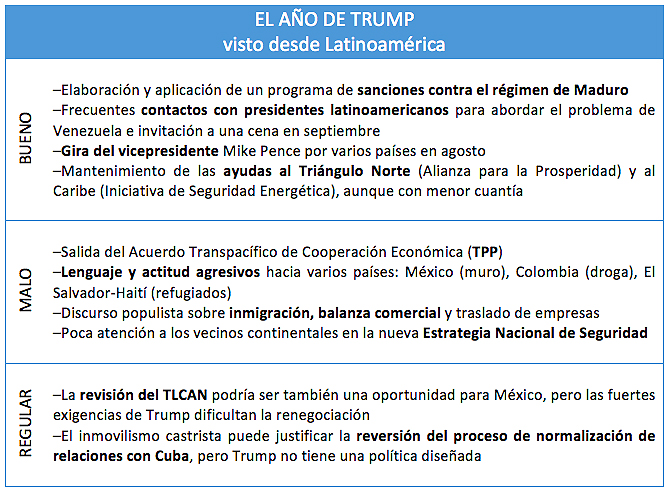

Donald Trump arrives at his first anniversary as president having set some recent fires in Latin America. His rude disregard for El Salvador and Haiti, due to the volume of refugees welcomed in the United States, and his intemperate attention to Colombia for the increase in cocaine production worsen relations that, although already complicated in the case of Mexico, have had some good moments throughout the year, such as the dinner of presidents that Trump convened in September in New York in which a united action on Venezuela was outlined.

▲Trump, on completing 100 days as president [White House].

article / Garhem O. Padilla [English version].

One year after the arrival of the 45th President of the United States of America, Donald John Trump, to the White House -the inauguration ceremony was on January 20-, controversy dominates the balance of the new Administration, both in its domestic and international performance. The continental neighbors of the U.S., in particular, show bewilderment over Trump's policies toward the hemisphere. On the one hand, they regret the U.S. disinterest in commitments to economicdevelopment and multilateral integration; on the other, they note some activity in relation to some regional problems, such as Venezuela. The balance for the moment is mixed, although there is unanimous agreement that Trump's language and many of his manners rather threaten relations.

From TPP to NAFTA

agreement In the economic field, the Trump era began with the withdrawal final of the United States from the Trans-Pacific Partnership (TPP) on January 23, 2017. This made it impossible for entrance to enter into force, as the United States is the market for which the TPP was created agreement, which has affected the prospects of the Latin American countries that participated in the initiative.

The renegotiation of the North American Free Trade Agreement (NAFTA), demanded by Trump, was immediately opened. Doubts about the future of NAFTA, signed in 1994 and which Trump has described as a "disaster", have been prominent so far in his administration. Some of his demands, which Mexico and Canada oppose, are to increase the quota for products manufactured in the United States and the "sunset" clause, which would oblige the treaty to be reviewed methodically every five years and would cause it to be suspended if any of its three members were not in agreement with agreement. All of this stems from the U.S. president's idea of fail the treaty if it is not favorable to his country.

Cuba and Venezuela

If the quarrels with Mexico have not yet reached a conclusion, in the case of Cuba Trump has already retaliated against the Castro regime, with the expulsion in October of 15 Cuban diplomats from the Cuban embassy in Washington as a response to the "sonic attacks" that affected 24 U.S. diplomats on the island. The White House has also reversed some of the Obama Administration's conciliatory measures, when it realized that Castroism is not responding with openness concessions.

As far as Venezuela is concerned, Trump has made forceful efforts to introduce measures and sanctions against corrupt officials, in addition to addressing the political status with other countries, so that they support those efforts aimed at eradicating the Venezuelan crisis, thus generating multilateralism among American countries. However, this policy has its detractors, who believe that the sanctions are not intended to achieve a long-term goal deadline , and it is unclear how they would promote Venezuelan stability.

Although in these actions on Cuba and Venezuela Trump has alluded to the democratic principles violated by the rulers of Havana and Caracas, his Administration has not particularly insisted on the commitment to human rights, democracy and moral values, as had been usual in the argumentation of U.S. foreign policy. Some critics point out that the Trump Administration is willing to promote human rights only when they fit its political objectives.

This could explain the worsening opinion in Latin America about the United States and relations with that country. From agreement with the survey Latinobarómetro 2017, the favorable opinion has fallen to 67%, seven points below the one at the end of the Obama Administration, which was 74%. Said survey sample a relevant difference for Mexico, one of the countries that, without a doubt, has the worst levels of favorable opinion towards the Trump Administration: in 2017 it was 48%, a drop of 29 points compared to 2016, when it was 77%.

|

Immigration, withdrawal, decline

The restrictive immigration policies applied would also explain the rejection of the Trump Administration by Latin American public opinion. In the immigration section the most recent is the decision not to renew the authorization to stay in the United States of thousands of Salvadorans and Haitians, who once arrived fleeing calamities in their countries.

It is also worth mentioning Trump's efforts to achieve one of his main objectives since the beginning of his political campaign: to build a border wall with Mexico. The U.S. president has not been very successful so far in this goal, since despite having sought ways to finance it, what he has managed to introduce in the budgets is very insignificant in relation to the estimated costs. On the other hand, his decision

Trump's protectionism entails a retreat that may be accentuating the decline of the United States as a leader in Latin America, especially vis-à-vis other powers. China has been increasing its economic and political engagement in countries such as Argentina, Brazil, Chile, Peru and Venezuela. Russia, for its part, has strengthened its diplomatic and security relations with Cuba. It could be said that, taking advantage of the conflicts between the island and the United States, Moscow has sought to keep it in its orbit through a series of investments.

Security threats

This leads us to mention the new US National Security Strategy, announced in December. The document, presented by Trump, addresses the rivalry with China and Russia, and also refers to challenge the Cuban and Venezuelan regimes, for the alleged security threats they pose and the Russian support they receive. Trump expressed a strong desire to see Cuba and Venezuela join in "shared freedom and prosperity" and called to "isolate governments that refuse to act as responsible partners in advancing hemispheric peace and prosperity."

Similarly, the new U.S. Security Strategy alludes to other challenges in the region, such as transnational criminal organizations, which impede the stability of Central American countries, especially Honduras, Guatemala and El Salvador. However, the document devotes only one page to Latin America, in line with Washington's traditional focus on the areas of the world that most affect its interests and security.

An opportunity for the United States to get closer to Latin American countries will be the Summit of the Americas, to be held next March in Lima. However, nothing is predictable given the President's characteristic attitude, which leaves a great deal of room for possible surprises.

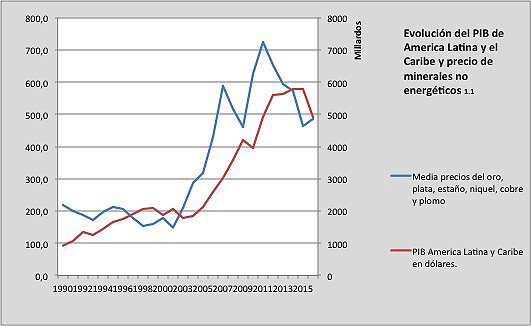

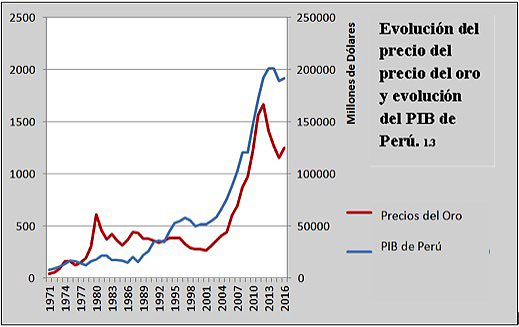

The cycles of the Latin American Economics are closely linked to mineral prices: the graphs are astounding.

Public attention on the price of commodities is often focused on hydrocarbons, preferably oil, because of the direct consequences on consumers. But although Latin America has major crude oil producers, minerals are a more cross-cutting asset on the region's Economics , especially in South America. This is demonstrated by the largely parallel lines that follow the evolution of non-energy minerals and GDP growth, both in times of boom and bust.

article / Ignacio Urbasos Arbeloa [English version].

Mining is a fundamental activity for many Latin American economies. The sector has an enormous weight in exports and foreign investment, making it one of the main sources of foreign exchange. In contrast to the general perception of non-energy mining as a mature industry, the sector continues to be attractive to investors and is capable of continuing to generate employment and wealth. Latin American mining receives 30% of the world's investment in the sector, which expects a recovery in prices. The impact of these fluctuations has direct consequences on the economies of the continent, some of which are highly dependent on the exploitation and sale of these resources. The goal of this analysis is to articulate a convincing explanation of the Degree in which these price variations affect national GDPs.

First of all, it is important to detail the chronological evolution of prices of the main minerals exploited in Latin America. The general trend in commodity prices over the last two decades has been marked by enormous volatility. The so-called commodity super cycle [1] given approximately between 2003 and 2013, with a setback between 2008 and 2009, occurs at the same time as the so-called golden decade in Latin America. This status was produced by an unprecedented rise in world demand, thanks to emerging countries led by China, which has transformed foreign trade in the region, displacing the USA as the first partner of most of these countries.

The evolution in prices has followed a very similar patron saint in non-energy mining, which by rule generally follows the price trends of the rest of the raw materials. As we can see in Figure 1.1, the Latin American and Caribbean region has had an economic growth very similar to the average evolution of gold, silver, tin, nickel, lead and copper prices. It is important to mention that the relationship between these two variables is not isolated, and should be analyzed in the above-mentioned context of a general rise in the prices of other raw materials of vital importance for the region, such as hydrocarbons or agricultural products.

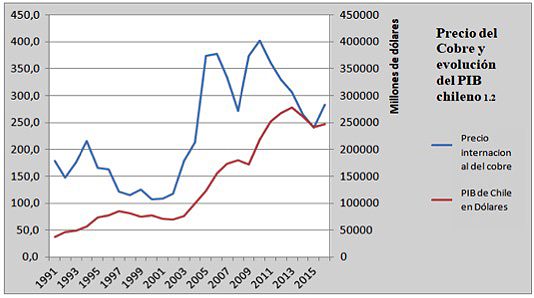

|

[The graphs are based on World Bank Data and national statistics from Peru and Chile] [The graphs are based on World Bank Data and national statistics from Peru and Chile]. |

The case of Chile can be extremely useful. Chile has a Economics particularly specialized in non-energy mining, highlighting the exploitation of copper, an activity in which it is a world leader and which accounts for 50% of its exports. The mining sector in Chile [2] reached almost 20% of GDP in the mid-2000s; in 2017 it has accounted for around 9%. In Figure 1.2 we see how the price of copper sets the country's economic path, with the greatest periods of Chilean economic growth coinciding with the increase in copper prices. Despite being one of the most developed economies in the region [3], with a 74% weight of the services sector in GDP, the country is still conditioned by the situation of its primary sector and specifically mining.

|

|

Another interesting case is Peru, a country whose exports include a good share of non-energy minerals [4], reaching 46% of exports in the case of gold (18%) and copper (26%). Similarly to Chile, the share of mining in the Economics is 15% of GDP. Again, we can appreciate the correlation between the prices of certain strategic non-energy minerals and economic growth.

|

|

This relationship is logical and responds to several realities. On the one hand, the great quantitative value of raw materials in Latin American economies, which concentrate their exports in agricultural, mineral and energy products. On the other hand, its qualitative importance since the sector generates large amounts of employment (up to 9% in Chile), is the object of many of the main companies in the region (5 of the 20 largest in Latin America are dedicated to extraction), is the main source of foreign currency and leaves enormous benefits for the coffers of the States, since they are governed under a particular tax system more burdensome. Likewise, a good part of the payment of foreign debt is covered by these revenues, and price instability could bring back the ghosts of the debt crisis of the eighties, something that is already a reality in the case of Venezuela.

Although the countries of Latin America cannot be analyzed as a heterogeneous unit, in general terms the region does face a common challenge : to be able to reduce the dependence of its economies on the exploitation and export of raw materials. An activity that has problematic elements such as its impact on the environment, a particularly complex issue in the region due to the reticence of indigenous groups, or the quality and stability of the employment they generate. In any case, the region's industrial development is still deficient and there are more and more voices warning that the golden decade of 2003-2013 was not used to make the necessary structural changes to mitigate this status [5].

The existence of complex realities partner-politics in Latin America has often led to the use of the benefits derived from extraction in short term and electoral policies, a scourge that increases the exhibition of social welfare to the ups and downs of the mining and energy sector. Although commodity price predictions point to an imminent recovery [6], status is not expected to be similar to the one around 2008 when prices reached historic highs. This new situation will demand the maximum from Latin American economies, which will not be able to count on such a favorable status from the international Economics .

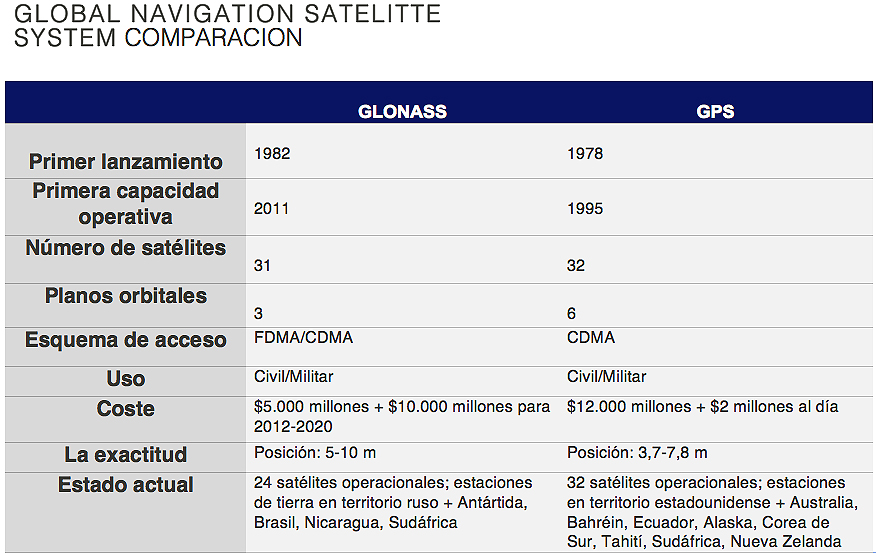

Russia's GLONASS positioning system has placed ground stations in Brazil and Nicaragua; the Brazilian ones are accessible, but the Nicaraguan one is open to conjecture.

At a time when Russia has declared its interest in having military installations in the Caribbean again, the opening of a Russian station in Managua's area has raised some suspicions. Roscosmos, the Russian space agency, has opened four stations in Brazil, managed with transparency and easy access; in contrast, the one it has built in Nicaragua is shrouded in secrecy. The little that is known about the Nicaraguan station, strangely larger than the others, contrasts with how openly data can be collected about the Brazilian ones.

article / Jakub Hodek [English version].

It is well known that information is power. The more information one has and manages, the more power one enjoys. This approach should be taken when examining the station facilities that support the Russian satellite navigation system and their construction in close proximity to the United States. Of course, we are no longer in the Cold War period, but some traumas of those old days can perhaps help us to better understand the cautious position of the United States and the importance Russia sees in having its facilities in Brazil and especially in Nicaragua.

That historical background of the Cold War is at the origin of the two major navigation systems we use today. The United States launched the Global Positioning System (GPS) project in 1973, and possibly in response, the Soviet Union introduced its own positioning system (GLONASS) three years later. [1] Nearly 45 years have passed, and these two systems are no longer serving as a means for Russians and Americans to try to obtain information about the opposing side, but are collaborating and thus providing a more accurate and faster navigation system for consumers who purchase a smartphone or other electronic device. [2]

However, to achieve global coverage both systems need not only satellites, but also ground stations strategically located around the world. With that purpose, Russian Federal Space Agency Roscosmos has erected stations for the GLONASS system in Russia, Antarctica and South Africa, as well as in the Western Hemisphere: it already has four stations in Brazil and since April 2017 it has one in Nicaragua, which due to the secrecy surrounding its function has caused distrust and suspicion in the United States [3] (USA, for its part, has GPS ground stations in its territory and in Australia, Argentina, United Kingdom, Bahrain, Ecuador, South Korea, Tahiti, South Africa and New Zealand).

The Russian Global Navigation Satellite System(Globalnaya Navigatsionnaya Sputnikovaya Sputnikovaya Sistema or GLONASS) is a positioning system operated by the Russian Aerospace Defense Forces. It consists of 28 satellites, allowing real-time positioning and speed data for surface, sea and airborne objects around the world. [ 4] In principle GLONASS does not transmit any identification information staff; in fact, user devices only receive signals from the satellites, without transmitting anything back. However, it was originally developed with military applications in mind and carries encrypted signals that are supposed to provide higher resolutions to authorized military users (same the US GPS). [5]

In Brazil, there are four ground stations used to track signals from the GLONASS constellation. These stations serve as correction points in the western hemisphere and help to significantly improve the accuracy of navigation signals. Russia is in close and transparent partnership with the Brazilian space agency (AEB), promoting the research and development of the South American country's aerospace sector.

|

In 2013, the first station was installed, located at campus of the University of Brasilia, which was also the first Russian station of that subject abroad. Another station followed at the same location in 2014, and later, in 2016, a third one was placed at the high school Federal Science Education and Technology of Pernambuco, in Recife. The Russian Federal Space Agency Roscosmos built its fourth Brazilian station on the territory of the Federal University of Santa Maria, in Rio Grande do Sul. In addition to fulfilling its main purpose of increasing the accuracy and improving the performance of GLONASS, the facility can be used by Brazilian scientists to carry out other types of scientific research . [6]

The level of transparency that surrounded the construction and then prevailed in the management of the stations in Brazil is definitely not the same applied to the one opened in Managua, the capital of Nicaragua. There are several pieces of information that sow doubts regarding the real use of the station. To begin with, there is no information on the cost of the facilities or on the specialization of the staff. The fact that it has been placed a short distance from the U.S. Embassy has given rise to conjecture about its use for eavesdropping and espionage.

In addition, vague answers from representatives of Nicaragua and Roscosmos about the use of the station have failed to convey confidence about project. It is a "strategicproject " for both Nicaragua and Russia, concluded Laureano Ortega, the son of the Nicaraguan president. Both countries claim to have a very fluid and close cooperation in many spheres, such as in projects related to health and development, however none of them have materialized with such speed and dedication. [7]

Given Russia's increased military presence in Nicaragua, empowered by the agreement facilitating the docking of Russian warships in Nicaragua announced by Russian Defense Minister Sergei Shoigu during his visit to the Central American country in February 2015, and also concretized in the donation of 50 Russian T-72B1 tanks in 2016 and the increasing movement of the Russian military staff , it can be concluded that Russia clearly sees strategic importance in its presence in Nicaragua. [ 8] [ 9] All this is viewed with suspicion from the U.S. The head of the U.S. Southern Command, Kirt Tidd, warned in April that "the Russians are pursuing an unsettling posture" in Nicaragua, which "impacts the stability of the region."

Undoubtedly, when world powers such as Russia or the United States act outside their territory, they are always guided by a combination of motivations. Strategic moves are essential in the game of world politics. For this very reason, the financial aid that a country receives or the partnership that it can establish with a great power is often subject to political conditionality. In this case, it is difficult to know for sure what exactly is the goal of the station in Nicaragua or even those in Brazil. At first glance, the goal seems neutral-offering higher quality of navigation system and providing a different option to GPS-but given the new value Russia is placing on its geopolitical capabilities, there is the possibility of a more strategic use.