Ruta de navegación

Menú de navegación

Blogs

Entries with Categories Global Affairs Latin America .

Beijing is no longer just a commercial partner and infrastructure lender: it is catching up with the West in pharmaceutical excellence and provider healthcare.

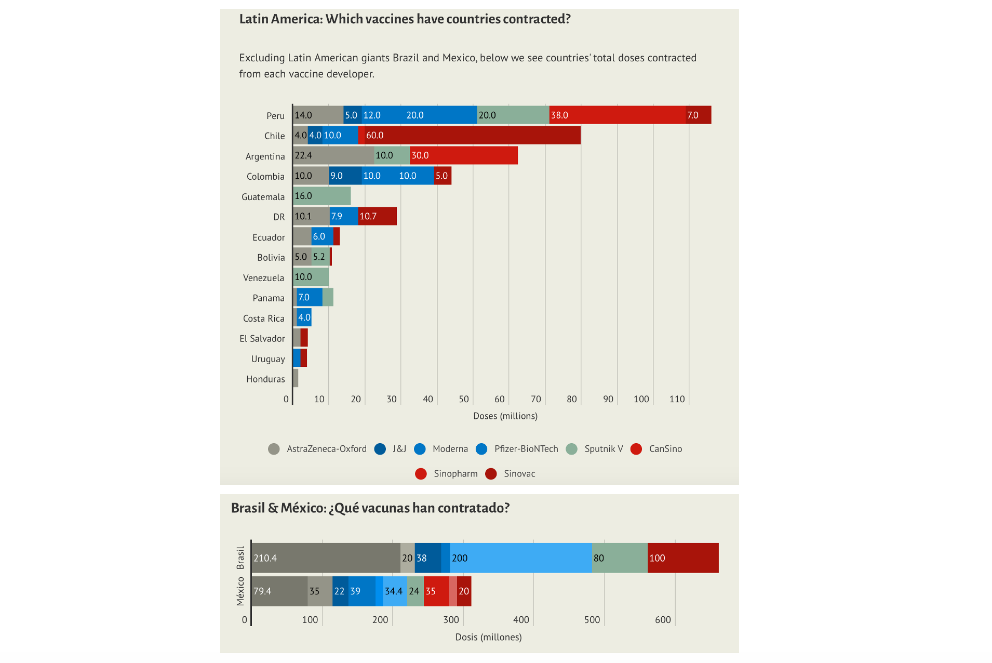

° Only Peru, Chile and Argentina have contracted more Chinese and Russian doses; in Brazil and Mexico, doses from the US and Europe predominate, as in the rest of the countries in the region.

° Huawei wins Brazilian 5G bid in exchange for vaccines; Beijing offers them to Paraguay if it abandons its recognition of Taiwan

° In addition to clinical trials in several nations in the second half of 2020, Argentina and Mexico will produce or package Sputnik V from June.

Arrival of a shipment of Sputnik V vaccines in Venezuela in February 2021 [Miraflores Palace].

report SRA 2021 / Emili J. Blasco [ PDF version].

Vaccination in Latin America is being done substantially with preparations developed in the United States and Europe, although media attention has privileged doses from China and Russia. The particular vaccine diplomacy carried out in recent months by Beijing and Moscow - which, with public funds, have promoted the export of injections ahead of the needs of their own inhabitants - has certainly been active and has managed to give the impression of greater influence than is real, often promising volumes of supplies that have rarely been delivered on time.

When, from June onwards, with most Americans already immunised, the Biden Administration turns its attention to providing vaccines to the region, the imbalance in favour of formulas from "Western" laboratories - also basically used in the UN's Covax system stockpiles - will be even greater. Nonetheless, the development of the health crisis over the past year will have served to consolidate China and Russia's foothold in Latin America.

To date, only Peru, Chile and Argentina have contracted more vaccines from China (CanSino, Sinopharm and Sinovac) and Russia (Sputnik V) than from the United States and Europe (AstraZeneca, J&J, Moderna and Pfizer). In the case of Peru, of the 116 million doses committed, 51 million correspond to European and/or US laboratories, 45 million to Chinese laboratories and 20 million to Russian laboratories. In the case of Chile, of the 79.8 million doses, 18 million are from the first group, while 61.8 million are Chinese. For Argentina, of the 62.4 million doses reserved, 22.4 million are "Western", 10 million are Russian and 30 million are Chinese. These are data from AS/COA, which keeps a detailed account of various aspects of the evolution of the health crisis in Latin America.

As for the two largest countries in the region, the preference for US and European formulations is notorious. Of the 661.4 million doses contracted by Brazil, 481.4 million come from the US, compared to 100 million Chinese doses and 80 million doses of Sputnik V (moreover, it is not clear that the latter will ever arrive, given the recent rejection of their authorisation by Brazilian regulators). Of the 310.8 million contracted by Mexico, 219.8 million are "Western" vaccines, 67 million are Chinese vaccines and 24 million are Sputnik V vaccines.

Tables: reproduction of AS/COA, database online, information as of 31 March 2021

Testing and production

The Chinese and Russian vaccines were not unknown in Latin American public opinion, as in the second half of 2020 they were frequently in the news as a result of clinical trials carried out in some countries. South America was of particular interest to the world's leading laboratories, as it was home to a high incidence of the epidemic along with a certain medical development that allowed for serious monitoring of the efficacy of the preparations, compatible with a level of economic need that facilitated thousands of volunteers for the trials. This made the region the focus of global clinical trials of the main anti-Covid-19 vaccines, with Brazil being the epicentre of degree program experimentation. In addition to trials conducted by Johnson & Johnson in six countries, and by Pfizer and Moderna in two, Sputnik V was tested in three (Brazil, Mexico and Venezuela) and in two by Sinovac (Brazil and Chile) and Sinopharm (Argentina and Peru).

Experimentation, however, was due to private agreements between laboratories, which required little involvement of the health or political authorities of the country in question. The commitment of certain governments to the Chinese and Russian vaccines came with purchase negotiations and then with their subsequent authorisation for use, a final step that has not always taken place. A further alliance in the case of Sputnik V has been Argentina's project to produce the Russian preparation on its territory from next June, for its own vaccination and distribution to neighbouring countries, as well as that of Mexico for the packaging of the doses, also from June. Argentina was the first country to register and approve Sputnik V, using information it has since shared with other countries in the region. Mexico's move has been interpreted as a way to put pressure on the US to liberalise the export of its vaccines as soon as possible.

China has also exerted pressure on some South American countries. It has taken advantage of Brazil's dire need for vaccines to force Jair Bolsonaro's government to allow Huawei to bid for Brazil's 5G network , despite having initially vetoed the Chinese business . Similarly, Beijing seems to have promised vaccines to Paraguay in exchange for the country ceasing to recognise Taiwan. In addition, the Chinese government last year averaged a billion-dollar credit for health procurement, as the head of the US Southern Command has warned, drawing attention to China's use of the crisis to gain further penetration in the hemisphere.

Consolidation

Whatever the final map of the application of each preparation in the vaccination process, what is certain is that above all Beijing, but in some ways also Moscow, has achieved an important victory, even though its vaccines may be far behind in the total number of doses injected in Latin America issue . In a region accustomed to identifying the United States and Europe with scientific capacity and high medical and pharmaceutical development , for the first time China is no longer seen as the source of cheap and unsophisticated products, but on a par in terms of research and health efficacy. Beyond Beijing's successful management of the pandemic, which can be relativised considering the authoritarian nature of its political system, China emerges as a leading country, capable of reaching a vaccine as quickly as the West and, to a certain extent, comparable to it. Russia's image lags somewhat behind, but Sputnik V consolidates Russia's "return" to a position of reference letter that it had lost completely in recent decades.

As a result of the emergence of Covid-19, in the collective Latin American imagination, China is no longer just a factor in trade, infrastructure construction and the granting of credits for development , but has established its penetration as a full-fledged power, also in terms of a central element in the lives of individuals, such as overcoming the pandemic.

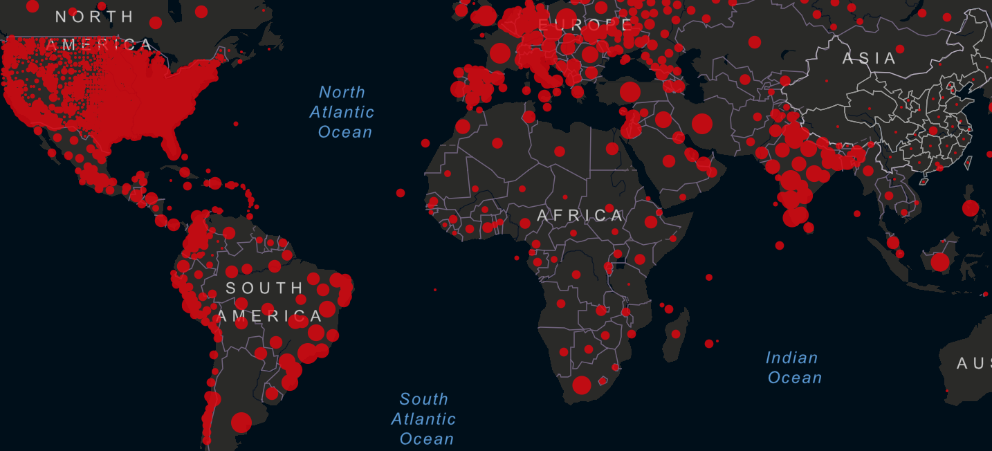

Latin American countries have suffered the health and economic crisis of the coronavirus like no other region in the world. With 8.2% of the world's population, by October 2020 it accounted for 28% of global Covid-19 positive cases and 34% of deaths. The worsening of status in countries such as India may have changed these percentages somewhat, but the region has maintained important hotspots of infection, such as Brazil, followed by Mexico and Peru. To cope with this status, Latin America receives two-thirds of the IMF's global financial aid pandemic: the region has 17 million more poor people and will not recover its previous per capita income until 2025, later than the rest of the world.

China's growing fishing fleet sparks complaints of alleged encroachment into exclusive economic zones and illegal activity

° The presence of more than 500 vessels raises concerns about continued radar evasion, use of unauthorised extraction systems and disobedience to coastguards.

° The governments of Chile, Colombia, Ecuador and Peru issued a statement calling for the supervision of an activity that Beijing refuses to submit to international inspection.

° Intimidation is reminiscent of the use of Chinese fishermen as a "strike force" in the South China Sea; here the goal is not about gaining sovereignty, but about fishing.

► The Chinese ship Hong Pu 16, followed by the Argentine patrol vessel ARA Bouchard, in May 2020 [Argentine Navy].

report SRA 2021 / Paola Rosenberg [ PDF version].

Over the last year, several Latin American countries have complained about Chinese economic predation, due to the massive presence of Chinese fishing boats in the vicinity of their Exclusive Economic Zone (EEZ) and the poaching that is taking place there. They have also denounced the use by Chinese fishing vessels of unauthorised fishing techniques that deplete key fishing grounds and erode marine sustainability.

issue The arrival from China of fishing vessels of what is normally categorised as the Distant Water Fleet (DWF) began to occur in the Latin American maritime contour in 2001 with around twenty vessels; since then their number has been rapidly increasing and the most recent figures speak of some 500 ships. The unease of the most affected countries is not new, but in 2020 the complaints were louder and more formal. Moreover, in the open era of confrontation with Beijing, Washington came out in defence of the interests of its hemispheric neighbours.

China has the world's largest deep-sea fishing fleet, which is expanding as the fleets of other fishing nations are shrinking. Its size is unclear, as it often operates through small front companies that blur its national origin, but it has been estimated to total 17,000 vessels. In this activity far from China itself, the fleet catches two million tonnes of fish, accounting for 40 per cent of the world total in distant waters. Some of its catch is result illegal fishing; China has the worst record in the world for illegal fishing practices, according to Global Initiative's evaluation .

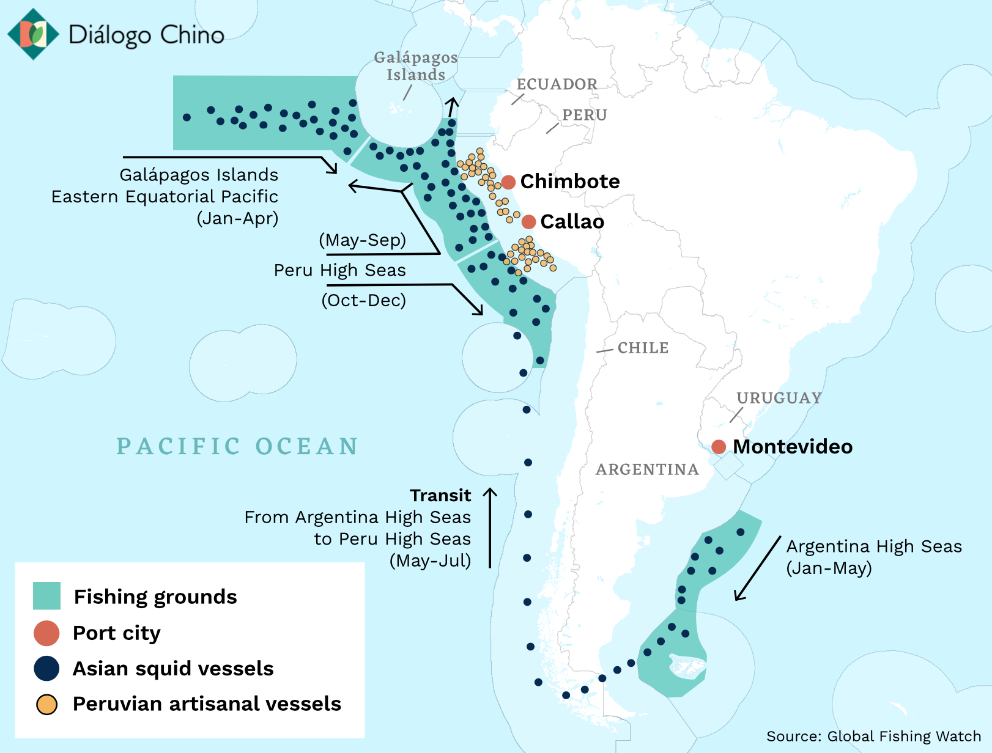

Map taken from China Dialogue and Global Fishing Watch

The strategic Galapagos

Fishing is one of the most important resources for several Latin American countries, which is why the massive Chinese presence in the vicinity of their exploitation waters, if there has been no penetration of these waters, has generated concern. In the last year, there have been many reports of Chinese fishing off Ecuador, Peru, Chile and Argentina, mostly linked to the capture of squid, but also of other species such as horse mackerel, mackerel, tuna and southern hake. These countries believe that overfishing and the capture of endangered species such as the giant squid are taking place, threatening the preservation of fish stocks and biodiversity, as well as the possession of false licences and the violation of the sovereignty of coastal states by allegedly illegally entering their EEZs. Fishermen from these coastal states increasingly report the presence of Chinese vessels in an intimidating attitude, carrying out acts that threaten not only their natural resources but also their security.

The main accusations came from July onwards in Ecuador. Earlier that month, the Ecuadorian navy warned of the presence of a Chinese fishing fleet of some 260 vessels fishing just outside the EEZ of the Galapagos Islands, which are under Ecuadorian sovereignty. By the end of the month, the fleet had increased to more than 342 vessels. The Galapagos archipelago was declared by Unesco as reservation of the biosphere, because it is home to hundreds of species of flora and fauna unique in the world. For this reason, exploitation in this area implies very large losses in terms of marine biodiversity.

In addition, half of the Chinese fleet behaved suspiciously, turning off the tracking and identification system. It was an evasion of marine radars that lasted for almost three weeks, as denounced by the Ecuadorian defence minister, Oswaldo Jarrín. The minister implied that this attitude was intended to conceal illegal fishing and perhaps also incursion into waters under Ecuadorian protection in order to fish there. In any case, he specified that the Ecuadorian navy was only able to find a couple of vessels within the Galapagos EEZ, which claimed to be using "innocent passage".

The country's president, Lenín Moreno, formally raised the complaints with the Beijing authorities, informing them that Ecuador would strongly assert its maritime rights over its EEZ, and announced a coordinated position with other Latin American governments. In fact, other countries in the region soon saw the Chinese fleet arrive in the vicinity of their waters. The ships left the corridor of international waters that exists between the Galapagos EEZ and the Ecuadorian coast, where they spent some time to catch the fish that migrate from one side to the other, and then moved south, first in the vicinity of the waters of Peru and Chile, and then, passing from the Pacific to the Atlantic, of Argentina.

These countries were backed by the United States, whose department of state said in August that the massive presence of Chinese fishing vessels and their internship to disable tracking systems, rename vessels and dispose of marine debris was "very troubling". President Donald Trump also spoke negatively on the occasion of his September speech to the United Nations. Washington has long been attentive to China's growing presence on the continent, not only commercially, but also in the management of strategic infrastructure such as port terminals. The Galapagos, specifically, have a special strategic value due to their status access routes to the Panama Canal.

Request for inspections

After Ecuador, due to the threat off their waters, Peru and Chile activated Global Fisheries Surveillance and mobilised air and naval patrols to closely monitor the advance of the Chinese fishing fleet. When the Chinese fishing fleet moved into the Atlantic in December 2020, the Argentine naval force also deployed naval and air units to ensure control over its maritime spaces.

In November, the governments of Ecuador, Chile, Peru and Colombia (the latter's EEZ borders the corridor between the two Ecuadorian maritime areas) issued a joint statement, in which they expressed their concern over the presence "of a large fleet of foreign-flagged vessels that have been carrying out fishing activities in recent months in international waters close to our jurisdictional waters". The grade chose not to explicitly mention China (moreover, several vessels in the fleet were flagged differently, although they were Chinese for all intents and purposes), but it was clear in which direction they were directing their denunciation of "fishing activities not subject to control or reporting".

Latin American countries are demanding that China agree to inspections, in the presence of staff if necessary, of suspicious vessels, even if they have remained in international waters. Beijing responds that it has already established moratoriums at certain times of the year on squid fishing in the region. However, the lack of cooperation so far and the growing demand from the Chinese market suggests that this subject of activities will continue to increase.

As it has done in the Pacific, the United States has sent Coast Guard vessels to the South Atlantic to confront Chinese incursions, in this case in joint exercises with Brazil and Uruguay. It is precisely with the latter country that Washington is trying to arrange some kind of subject of partnership that would allow for greater inspection of the maritime area , as it considers that Argentina could lend itself excessively to Chinese requirements.

Image of the world map produced by the John Hopkins Coronavirus Resource Center.

report SRA 2021 / presentation

The pandemic caused by the Covid-19 virus has had a major impact on the entire world and especially on American nations: three of the four countries with the most deaths - the United States, Brazil and Mexico, with more than one million deaths - are in the Western Hemisphere. Latin America has been the area most affected by the disease, in proportion to its population, and with the worst economic consequences. This status has meant, in terms of security, a special regional vulnerability to external powers and internal mafias.

If two years ago we launched this report of American Regional Security (ARS) stating that geopolitics had returned to the continent, due to the growing interest of China and Russia in the area of traditional US influence, it can now be said that these two extra-hemispheric powers have taken advantage of the health emergency to deploy a "diplomacy of vaccines" and consolidate their influence, while the US prepares its own flow of neighbouring financial aid , on the verge of concluding the inoculation of its population.

In this context, significant episodes occurred during 2020. China's food security demands have reinforced the presence of Chinese fishing fleets in the vicinity of the waters of several South American countries, whose fishing grounds are threatened by illegal fishing practices and alleged encroachment on their exclusive economic zones. This has led to some collective security movement and increased engagement with the US Southern Command.

On the other hand, organised crime has also taken advantage of the pandemic status , relying on the distraction of the authorities in another subject of efforts. In the last year, Paraguay has emerged as a major hub for cocaine outflows from the interior of the continent, while at the same time consolidating its position as South America's main producer of marijuana, at a time when this crop is emerging as a legal business opportunity in new countries. For their part, Guatemala and Honduras are consolidating their 'trials' in coca cultivation, making a leap - scarcely quantitative, but certainly qualitative - in the world of drug trafficking. The positive news is that the peace process and the confinements of the pandemic have reduced homicides in Colombia to historic lows.

CONTENTS

summary executive

Covid makes Latin America more vulnerable to external powers and internal mafias

Maritime safety

China's uncontrolled fishing alerts governments with major fishing grounds under threat

Extra-hemispheric presence

Vaccine diplomacy: more 'Western' doses, but China and Russia consolidate penetration

Extra-hemispheric presence

Iran takes gold from a Venezuela that no longer has oil to pay for the favours.

US reaction

The US Southern Command is warning more about China's advance in the region.

Maras

US begins to prosecute MS-13 members as terrorists

Citizen security

Peace process and Covid reduce homicides in Colombia to historic lows

Drug trafficking

Coca cultivation 'trials' increase in Honduras and Guatemala, once only transit countries

Drug trafficking

Temporary Protected Status for Venezuelans and pending TPS termination for Central Americans amid a migration surge at the US-Mexico border

The Venezuelan flag near the US Capitol [Rep. Darren Soto].

ANALYSIS / Alexandria Angela Casarano

On March 8, the Biden administration approved Temporary Protected Status (TPS) for the cohort of 94,000 to 300,000+ Venezuelans already residing in the United States. Nicaragua, Honduras, El Salvador, and Haiti await the completion of litigation against the TPS terminations of the Trump administration. Meanwhile, the US-Mexico border faces surges in migration and detention facilities for unaccompanied minors battle overcrowding.

TPS and DED. The case of El Salvador

TPS was established by the Immigration Act of 1990 and was first granted to El Salvador that same year due to a then-ongoing civil war. TPS is a temporary immigration benefit that allows migrants to access education and obtain work authorization (EADs). TPS is granted to specific countries in response to humanitarian, environmental, or other crises for 6, 12, or 18-month periods-with the possibility of repeated extension-at the discretion of the Secretary of Homeland Security, taking into account the recommendations of the State Department.

The TPS designation of 1990 for El Salvador expired on June 30,1992. However, following the designation of Deferred Enforced Departure (DED) to El Salvador on June 26, 1992 by George W. Bush, Salvadorans were allowed to remain in the US until December 31, 1994. DED differs from TPS in that it is designated by the US President without the obligation of consultation with the State Department. Additionally, DED is a temporary protection from deportation, not a temporary immigration benefit, which means it does not afford recipients a legal immigration status, although DED also allows for work authorization and access to education.

When DED expired for El Salvador on December 31, 1994, Salvadorans previously protected by the program were granted a 16-month grace period which allowed them to continue working and residing in the US while they applied for other forms of legal immigration status, such as asylum, if they had not already done so.

The federal court system became significantly involved in the status of Salvadoran immigrants in the US beginning in 1985 with the American Baptist Churches v. Thornburgh (ABC) case. The ABC class action lawsuit was filed against the US Government by more than 240,000 immigrants from El Salvador, Guatemala, and former Soviet Bloc countries, on the basis of alleged discriminatory treatment of their asylum claims. The ABC Settlement Agreement of January 31, 1991 created a 240,000-member immigrant group (ABC class members) with special legal status, including protection from deportation. Salvadorans protected under TPS and DED until December 31, 1994 were allowed to apply for ABC benefits up until February 16, 1996.

Venezuela and the 2020 Elections

The 1990's Salvadoran immigration saga bears considerable resemblance to the current migratory tribulations of many Latin American immigrants residing in the US today, as the expiration of TPS for four Latin American countries in 2019 and 2020 has resulted in the filing of three major lawsuits currently working their way through the US federal court system.

Approximately 5 million Venezuelans have left their home country since 2015 following the consolidation of Nicolás Maduro, on economic grounds and in pursuit of political asylum. Heavy sanctions placed on Venezuela by the Trump administration have exacerbated-and continue to exacerbate, as the sanctions have to date been left in place by the Biden administration-the severe economic crisis in Venezuela.

An estimated 238,000 Venezuelans are currently residing in Florida, 67,000 of whom were naturalized US citizens and 55,000 of whom were eligible to vote as of 2018. 70% of Venezuelan voters in Florida chose Trump over Biden in the 2020 presidential elections, and in spite of the Democrats' efforts (including the promise of TPS for Venezuelans) to regain the Latino vote of the crucial swing state, Trump won Florida's 29 electoral votes in the 2020 elections. The weight of the Venezuelan vote in Florida has thus made the humanitarian importance of TPS for Venezuela a political issue as well. The defeat in Florida has probably made President Biden more cautious about relieving the pressure on Venezuela's and Cuba's regimes.

The Venezuelan TPS Act was originally proposed to the US Congress on January 15, 2019, but the act failed. However, just before leaving office, Trump personally granted DED to Venezuela on January 19, 2021. Now, with the TPS designation to Venezuela by the Biden administration on March 8, Venezuelans now enjoy a temporary legal immigration status.

The other TPS. Termination and ongoing litigation

Other Latin American countries have not fared so well. At the beginning of 2019, TPS was designated to a total of four Latin American countries: Nicaragua, Honduras, El Salvador, and Haiti. Nicaragua and Honduras were first designated TPS on January 5, 1999 in response to Hurricane Mitch. El Salvador was redesignated TPS on March 9, 2001 after two earthquakes hit the country. Haiti was first designated TPS on January 21, 2010 after the Haiti earthquake. Since these designations, TPS was continuously renewed for all four countries. However, under the Trump administration, TPS was allowed to expire without renewal for each country, beginning with Nicaragua on January 5, 2019. Haiti followed on July 22, 2019, then El Salvador on September 9, 2019, and lastly Honduras on January 4, 2020.

As of March 2021, Salvadorans account for the largest share of current TPS holders by far, at a total of 247,697, although the newly eligible Venezuelans could potentially overshadow even this high figure. Honduras and Haiti have 79,415 and 55,338 TPS holders respectively, and Nicaragua has much fewer with only 4,421.

The elimination of TPS for Nicaragua, Honduras, El Salvador, and Haiti would result in the deportation of many immigrants who for a significant continuous period of time have contributed to the workforce, formed families, and rebuilt their lives in the United States. Birthright citizenship further complicates this reality: an estimated 270,000 US citizen children live in a home with one or more parents with TPS, and the elimination of TPS for these parents could result in the separation of families. Additionally, the conditions of Nicaragua, Honduras, El Salvador, and Haiti-in the context of the COVID-19 pandemic, recent natural disasters (i.e. hurricanes Matthew, Eta, and Iota), and other socioeconomic and political issues-remain far from ideal and certainly unstable.

Three major lawsuits were filed against the US Government in response to the TPS terminations of 2019 and 2020: Saget v. Trump (March 2018), Ramos v. Nielsen (March 2018), and Bhattarai et al. v. Nielsen (February 2019). Kirstjen Nielsen served as Secretary of Homeland Security for two years (2017 - 2019) under Trump. Saget v. Trump concerns Haitian TPS holders. Ramos v. Nielsen concerns 250,000 Salvadoran, Nicaraguan, Haitain and Sudanese TPS holders, and has since been consolidated with Bhattarai et al. v. Nielsen which concerns Nepali and Honduran TPS holders.

All three (now two) lawsuits appeal the TPS eliminations for the countries involved on similar grounds, principally the racial animus (i.e. Trump's statement: "[Haitians] all have AIDS") and unlawful actions (i.e. violations of the Administrative Procedure Act (APA)) of the Trump administration. For Saget v. Trump, the US District Court (E.D. New York) blocked the termination of TPS (affecting Haiti only) on April 11, 2019 through the issuing of preliminary injunctions. For Ramos v. Nielson (consolidated with Bhattarai et al. v. Nielson), the US Court of Appeals of the 9th Circuit has rejected these claims and ruled in favour of the termination of TPS (affecting El Salvador, Nicaragua, Haiti, Honduras, Nepal, and Sudan) on September 14, 2020. This ruling has since been appealed and is currently awaiting revision.

The US Citizenship and Immigration Services (USCIS) and the Department of Homeland Security (DHS) have honored the orders of the US Courts not to terminate TPS until the litigation for these aforementioned cases is completed. The DHS issued a Federal Register Notice (FRN) on December 9, 2020 which extends TPS for holders from Nicaragua, Honduras, El Salvador, and Haiti until October 14, 2021. The USCIS has similarly cooperated and has ordered that so long as the litigation remains effective, no one will lose TPS. The USCIS has also ordered that in case of TPS elimination once the litigation is completed, Nicaragua and Haiti will have 120 grace days to orderly transition out of TPS, Honduras will have 180, and El Salvador will have 365 (time frames which are proportional to the number of TPS holders from each country, though less so for Haiti).

The Biden Administration's Migration Policy

On the campaign trail, Biden repeatedly emphasized his intentions to reverse the controversial immigration policies of the Trump administration, promising immediate cessation of the construction of the border wall, immediate designation of TPS to Venezuela, and the immediate sending of a bill to create a "clear [legal] roadmap to citizenship" for 11 million+ individuals currently residing in the US without legal immigration status. Biden assumed office on January 20, 2021, and issued an executive order that same day to end the government funding for the construction of the border wall. On February 18, 2021, Biden introduced the US Citizenship Act of 2021 to Congress to provide a legal path to citizenship for immigrants residing in the US illegally, and issued new executive guidelines to limit arrests and deportations by ICE strictly to non-citizen immigrants who have recently crossed the border illegally. Non-citizen immigrants already residing in the US for some time are now only to be arrested/deported by ICE if they pose a threat to public safety (defined by conviction of an aggravated felony (i.e. murder or rape) or of active criminal street gang participation).

Following the TPS designation to Venezuela on March 8, 2021, there has been additional talk of a TPS designation for Guatemala on the grounds of the recent hurricanes which have hit the country.

On March 18, 2021, the Dream and Promise Act passed in the House. With the new 2021 Democrat majority in the Senate, it seems likely that this legislation which has been in the making since 2001 will become a reality before the end of the year. The Dream and Promise Act will make permanent legal immigration status accessible (with certain requirements and restrictions) to individuals who arrived in the US before reaching the age of majority, which is expected to apply to millions of current holders of DACA and TPS.

If the US Citizenship Act of 2021 is passed by Congress as well, together these two acts would make the Biden administration's lofty promises to create a path to citizenship for immigrants residing illegally in the US a reality. Since March 18, 2021, the National TPS Alliance has been hosting an ongoing hunger strike in Washington, DC in order to press for the speedy passage of the acts.

The current migratory surge at the US-Mexico border

While the long-term immigration forecast appears increasingly more positive as Biden's presidency progresses, the immediate immigration situation at the US-Mexico border is quite dire. Between December 2020 and February 2021, the US Customs and Border Protection (CBP) reported a 337% increase in the arrival of families, and an 89% increase in the arrival of unaccompanied minors. CBP apprehensions of migrants crossing the border illegally in March 2021 have reached 171,00, which is the highest monthly total since 2006.

Currently, there are an estimated 4,000 unaccompanied minors in CBP custody, and an additional 15,000 unaccompanied minors in the custody of the Department of Health and Human Services (HHS).

The migratory CBP facility in Donna, TX designated specifically to unaccompanied minors has been filled at 440% to 900% of its COVID-19 capacity of just 500 minors since March 9, 2021. Intended to house children for no more than a 72-hour legal limit, due to the current overwhelmed system, some children have remained in the facility for more than weeks at a time before being transferred on to HHS.

In order to address the overcrowding, the Biden administration announced the opening of the Delphia Emergency Intake Site (next to the Donna facility) on April 6, 2021, which will be used to house up to 1,500 unaccompanied minors. Other new sites have been opened by HHS in Texas and California, and HHS has requested the Pentagon to allow it to temporarily utilize three military facilities in these same two states.

Political polarization has contributed to a great disparity in the interpretation of the recent surge in migration to the US border since Biden took office. Termed a "challenge" by Democrats and a "crisis" by Republicans, both parties offer very different explanations for the cause of the situation, each placing the blame on the other.

Following referendums in 2018 and 2019, the Guatemalan government submitted its report to The Hague in 2020 and the Belizean government has one year to reply.

Guatemala presented its position before the International Court of Justice in The Hague last December, with a half-year delay attributed to the Covid-19 emergency status ; Belize will now have a year to respond. Although the ICJ will then take its time to draft a judgement, it can be said that the territorial dispute between the two neighbours has entered its final stretch, bearing in mind that the dispute over this Central American enclave dates back to the 18th century.

Coats of arms of Guatemala (left) and Belize (right) on their respective flags.

article / Álvaro de Lecea

The territorial conflict between Guatemala and Belize has its roots in the struggle between the Spanish Empire in the Americas and British activity in the Caribbean during the colonial era. The Spanish Crown's inaction in the late 18th century in the face of British encroachment on what is now Belize, then Spanish territory, allowed the British to establish a foothold in Central America and begin exploiting mainland lands for precious woods such as dyewood and mahogany. However, Guatemala's reservations over part of the Belizean land - it claims over 11,000 square kilometres, almost half of the neighbouring country; it also claims the corresponding maritime extension and some cays - generated a status of tension and conflict that has continued to the present day.

In 2008, both countries decided to hold referendums on the possibility of taking the dispute to the International Court of Justice (ICJ), which would rule on the division of sovereignty. The Belizeans approved taking that step in 2018 and the Guatemalans the following year. The issue was formalised before the ICJ in The Hague on 12 June 2019.

Historical context

The territory of present-day Belize was colonised by Spain in the mid-16th century as part of the Viceroyalty of New Spain and dependent on the captaincy of Guatemala. However, as there were no mineral resources there and hardly any population, the metropolis paid little attention to the area. This scant Spanish presence favoured pirate attacks, and to prevent them, the Spanish Crown allowed increasing English exploitation in exchange for defence. England carried out a similar penetration on the Caribbean coast of Nicaragua, but while the Spanish managed to expel the English from there, they consolidated their settlement at area Belize and finally obtained the territory by the Treaty of Paris in 1783, whereby Spain disengaged itself from this corner of Central America. That concession and another three years later covered just 6,685 square kilometres, a space close to the coast that was later enlarged inland and southward by England, since Spain was not active in the area. From then on the enclave became known as "British Honduras".

The cession did not take into account the claims of the Guatemalans, who considered the space between the Sarstún and Sibún rivers to be their own. Both rivers run west-east, the former forming the border with Guatemala in the south of what is now Belize; the other, further north, runs through the centre of Belize, flowing into the capital, splitting the country in two. However, given the urgency for international recognition when it declared independence in 1821, Guatemala signed several agreements with England, the great power of the day, to ensure the viability of the new state. One of these was the Aycinena-Wyke Treaty (1859), whereby Guatemala accepted Belize's borders in exchange for the construction of a road to improve access from its capital to the Caribbean. However, both sides blamed the other for not complying with the treaty (the road was not built, for example) and Guatemala declared it null and void in 1939.

In the constitution enacted in 1946, Guatemala included the claim in the drafting, and has insisted on this position since the neighbouring country, under the name Belize, gained its independence from the United Kingdom in 1981. As early as 1978, the UN passed a resolution guaranteeing the rights to self-determination and territorial protection of the Belizean people, which also called for a peaceful resolution of the neighbouring conflict. Guatemala did not recognise the existence of the new sovereign state until 1991, and even today still places some limits on Belize's progressive integration into the Central American Integration System. Because of its English background, Belize has historically maintained a closer relationship with the English-speaking Caribbean islands.

Map of Central America and, in detail, the territorial dispute between Guatemala and Belize [Rei-artur / Janitoalevic Bettyreategui].

Adjacency Line and the role of the OAS

Since 2000, the Organisation of American States (OAS), of which both nations are members, has been mediating between the two countries. In the same year, the OAS facilitated a agreement with the goal aim of building confidence and negotiations between the two neighbours. In order to achieve these objectives, the OAS, through its Peace Fund, actively supported the search for a solution by providing technical and political support. Indeed, as a result of this rapprochement, talks on the dispute were resumed and the creation of the "Adjacency Line" was agreed.

This is an imaginary line that basically follows the line that "de facto" separated the two countries from north to south and is where most of the tensions are taking place. Over the years, both sides have increased their military presence there, in response to incidents attributed to the other side. Due to these frequent disputes, in 2015 Belize had to request financial aid military presence from the British navy. It is precisely in the Adjacency Zone that an OAS office is located, whose purpose purpose is to promote contacts between the communities and to verify certain transgressions of the agreements already signed.

One of the most promising developments that took place under the umbrella of the OAS was the signature in 2008 of what was called the "specialagreement between Guatemala and Belize to submit Guatemala's territorial, insular and maritime claim to the International Court of Justice". Under this agreement both countries undertook to submit the acceptance of the Court's mediation to simultaneous popular consultations. However, in 2015, through the protocol of the agreement Special between Belize and Guatemala, these popular consultations were not allowed to take place at the same time. Both parties committed to accept the Court's decision as "decisive and binding" and to comply with and implement it "fully and in good faith".

The Hague and the impact of the future resolution

The referendums were held in 2018 in the case of Guatemala and in 2019 in the case of Belize. Although the percentages of both popular consultations were somewhat mixed, the results were positive. In Belize, the Yes vote won 55.37% of the votes and the No vote 44.63%. In Guatemala, on the other hand, the results were much more favourable for the Yes vote, with 95.88% of the votes, compared to 4.12% for the No vote.

These results show how the Belizeans are wary of resorting to the Hague's decision because, although by fixing final the border they will forever close any claim, they risk losing part of their territory. On the other hand, the prospect of gain is greater in the Guatemalan case, since if its proposal is accepted - or at least part of it - it would strategically expand its access to the Caribbean, now somewhat limited, and in the event of losing, it would simply remain as it has been until now, which is not a serious problem for the country.

The definition of a clear and respected border is necessary at this stage. The adjacent line, observed by the OAS peace and security mission statement , has been successful in limiting tensions between the two countries, but the reality is that certain incidents continue to take place in this unprotected area. These incidents, such as the assassination of citizens of both countries or mistreatment attributed to the Guatemalan military, cause the conflict to drag on and tensions to rise. On the other hand, the lack of a clear definition of borders facilitates drug trafficking and smuggling.

This conflict has also affected Belize's economic and trade relations with its regional neighbours, especially Mexico and Honduras. This is not only due to the lack of land boundaries, but also to the lack of maritime boundaries. This area is very rich in natural resources and has the second largest coral reef reservation in the world, after Australia. This has, unsurprisingly, affected bilateral relations between the two countries. Whilst regional organisations are calling for greater regional integration, the tensions between Belize and Guatemala are preventing any improvement in this regard.

The Guatemalan president has stated that, regardless of the Court's result , he intends to strengthen bilateral relations, especially in areas such as trade and tourism, with neighbouring Belize. For their part, the Caricom heads of state expressed their support for Belize in October 2020, their enthusiasm for the ICJ's intervention and their congratulations to the OAS for its mediation work.

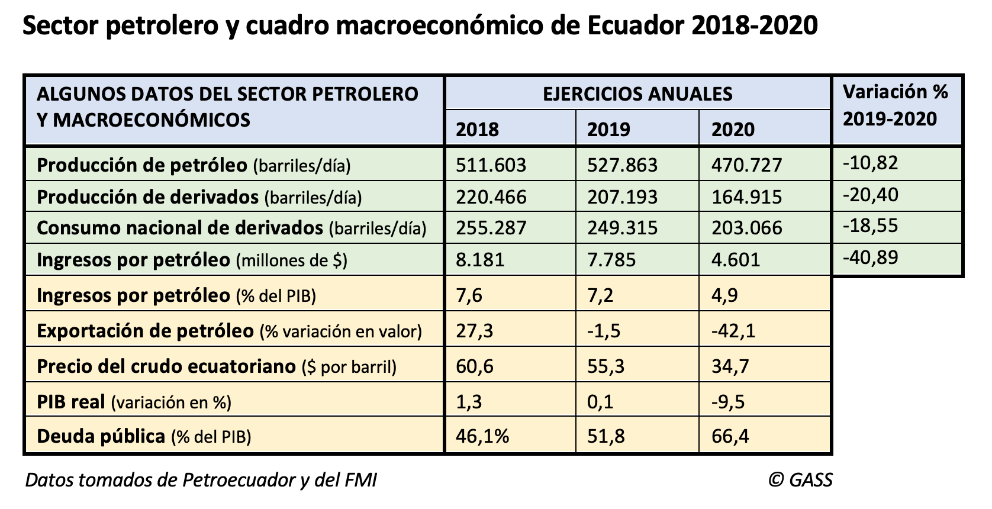

The country left the cartel in order to expand pumping, but the Covid-19 crisis has cut extraction volumes by 10.8%.

Construction of a variant of the oil pipeline that crosses the Andes, from the Ecuadorian Amazon to the Pacific [Petroecuador].

ANALYSIS / Jack Acrich and Alejandro Haro

Ecuador left the Organisation of Petroleum Exporting Countries (OPEC) on 1 January 2020 to avoid having to continue to join the production cuts imposed by group , which it agrees to in order to push up the world price of crude oil. Ecuador preferred to sell more barrels, albeit at a lower price, because by exporting more at the end of the day written request it could increase its income and thus get out of its serious financial situation status , which the coronavirus emergency has only accentuated, with a fall in GDP in 2020 currently estimated at 9.5 per cent.

However, domestic economic difficulties and the difficult international situation have not only prevented Ecuador from expanding pumping, but oil production has fallen by 10.8% in the last year. average In 2020, Ecuador extracted 472,000 barrels of oil per day, especially affected by the sharp reduction in activity in April with the beginning of the confinement, which was not compensated for the rest of the year. agreement This is a volume that is below the 500,000 line that has always been exceeded in recent years (in 2019 production was 528,000), according to figures from Petroecuador, the state hydrocarbons company. The reduction in global consumption during the Covid-19 year also correlated with a drop in the consumption of derivatives in Ecuador, especially gasoline and diesel, which fell by 18.5%.

International investment constrained by the pandemic context and reduced consumption marked a status that could hardly lead to an increase in production. In 2020, Ecuador saw a drop in the value of oil exports of 42.1% (twice as much as total exports), which, combined with a deterioration in the price of a barrel of oil, meant a 40.9% reduction in public revenue from the oil sector, according to the International Monetary Fund (IMF) data .

The figures for the first two months of 2021 indicate an accentuation of the fall in crude oil production (-4.73% compared to January and February 2020) and derivatives (-7.47%), as well as their export (-22.8%).

Cutting expense and seeking oil revenues

Exiting OPEC did not pose any particular risk for Ecuador, which had already left the organisation in a previous period. Its limited weight in OPEC and the progressive decline in the cartel's own strength meant that Ecuador's attempt to go it alone was not particularly costly. The absolute priority of Lenín Moreno's government was to rebalance the country's macroeconomic picture - battered by the high public expense of his predecessor, Rafael Correa - and for this it urgently needed to increase state revenue, a significant part of which in Ecuador normally comes from the hydrocarbons sector.

When he became president in 2017, Moreno set out to steer the country towards more market-friendly energy policies. The president was determined to break with the nationalist approach of his predecessor, whose policies discouraged foreign investment in the oil industry while significantly increasing public debt. Among the most costly programmes undertaken by Correa was to maintain high subsidies for energy consumption, with especially low fuel prices.

In order to overcome the financial status that Ecuador found itself in when he took office, Moreno approached the IMF to apply for financial aid financial, and committed to structural reforms, including the gradual dismantling of subsidies. These reforms, however, were not well received and the social unrest that spread throughout the country put further pressure on the oil industry.

In February 2019, Moreno negotiated an IMF loan to help reduce the country's large fiscal deficit and huge external debt, which by the end of 2018 had reached 46.1 per cent of GDP and twelve months later would reach 51.8 per cent. The committed 'bailout' was for $10.2 billion, of which $6.5 billion came from the IMF and the rest from other international agencies.

As part of austerity measures agreed with the IMF, Moreno was forced to end government subsidies that had kept petrol prices low for decades. In early October 2019 he announced a plan of cuts to save $2.27 billion a year, essentially withdrawing the fuel subsidy. The advertisement decree, which would later be annulled, immediately provoked massive protests, both from transporters and low-income sectors, as well as most notably from indigenous communities. The street violence forced the president to leave Quito for a few days and move to Guayaquil.

To address the need for revenue, Moreno sought to rely on the oil industry, which accounts for roughly a third of the country's total exports. He initially expressed the intention to seek a rise from the 545,000 barrels of crude oil produced at the time to almost 700,000 barrels a day.

goal One of the measures taken in this direction was to promote the development and the exploitation of the Ishpingo-Tiputini-Tambococha field, with the aim of increasing oil production by 90,000 barrels a day. This decision met with social rejection due to the environmental damage it could cause, as the Yasuní National Park, in the Ecuadorian Amazon, has been declared a protected area. The government then decided to postpone the expansion of production, first to 2021 and then to 2022. The civil service examination was especially led by indigenous communities, in a mobilisation that partly explains the success in the 2021 presidential elections of Yaku Pérez's indigenist Pachakutik movement, which almost made it to the second round.

Another measure was to reverse some of his predecessor's emblematic policies. For example, he eliminated the service contracts introduced under President Correa, thus restoring the model production-sharing contract. This reform was more favourable to international oil companies, as it allowed them to retain a share of oil reserves; it also offered them financial incentives to invest in the country. The new model was first applied in the tenders awarded during the twelfth Intracampos oil round, in the Oriente region, which is rich in oil reserves. Under this contract modality , the Moreno administration awarded seven of the eight exploration blocks on offer with a total investment of more than $1.17 billion.

Fall in production

Due to the urgency of increasing revenues, Ecuador resisted the plan of production cuts that OPEC has been imposing on its members at various times since the abrupt fall in oil prices in 2014. Initially, the organisation accepted that some of its members, with moderate or very low production volumes compared to previous figures, as was the case of Venezuela, would maintain their extraction rates. But since it could no longer be an exception, Ecuador preferred to announce at the end of 2019 that it would leave OPEC and not have to reduce its production to 508,000 barrels per day in 2020, which was the quota set for it.

What is striking is that last year production finally fell from 528,000 barrels per day in 2019 to 472,000 (a drop of 10.8%), and not because of decisions taken at OPEC headquarters in Vienna but because of the various difficulties subject caused by the Covid-19 crisis. Petroecuador's oil exports fell from 331,321 barrels per day in 2019 to 316,000, a drop of 4.6%, which in monetary terms was greater, as the price of a barrel of Ecuadorian mixed oil fell from 55.3 dollars in 2019 to 34.7 in 2020.

One element that makes it difficult for Ecuador to take better advantage of its hydrocarbon potential is that it has insufficient infrastructure for refining crude oil. The country has three refineries, but their capacity does not reach the volume of domestic consumption of oil derivatives, which means that it must import diesel, naphtha and other products. This means that in times of high oil prices, Ecuador benefits from exports, but also has to pay a higher invoice price for imports of derivatives. In 2020, Petroecuador had to import 137,300 barrels per day.

The complicated situation caused by the pandemic has continued to put pressure on Ecuador's public debt, which reached 66.4% at the end of 2020, despite all the attempts made by the Moreno government to reduce it.

The next president, due to take office at the end of May 2021, will also have little room for manoeuvre due to these debt volumes and will have to continue to rely on higher oil revenues to balance public finances. The expansionary policies of expense during Correa's presidency took place in the context of the commodity super-cycle, which benefited South America so much, but this is unlikely to be repeated in the short term deadline.

OPEC's loss of weight

With its departure from OPEC, Ecuador left an international organisation that was created in 1960 with the aim of regulating the world oil market and controlling oil prices to a certain extent. goal . The founding members were Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. Over time, other countries joined OPEC and today it is made up of thirteen members: Algeria, Angola, Republic of Congo, Equatorial Guinea, Gabon, Libya, Nigeria, United Arab Emirates and the five founding countries. When it was created, the organisation sought to establish, acting as a cartel, a kind of counterweight to a series of Western energy transnationals, mainly from the United States and the United Kingdom. OPEC members account for about 40 per cent of world oil production and contain about 80 per cent of the world's proven oil reserves. To be admitted as a member of the organisation it is necessary to have substantial oil exports and to share those of the member countries.

Ecuador joined OPEC in 1973, but suspended its membership in 1992. Subsequently, in 2007 it resumed active participation until its leave in January 2020. Considering that Ecuador was one of OPEC's smaller members, it did not really have much influence in the organisation and its exit does not represent a substantial loss for the organisation. However, it is a second departure in just one year, as Qatar, which had more weight in the cartel, left on 1 January 2019. In its case, its divorce from OPEC was due to other reasons, such as its tensions with Saudi Arabia and its desire to focus on the gas sector, of which it is one of the world's largest producers.

These moves are an example of OPEC's loss of influence. This has led it to establish alliances with producers that are not part of the organisation, such as Russia and some other countries forming OPEC+. With the decline of oil production in Venezuela and the decreasing ability of other members to control their production and exports, Saudi Arabia has been increasingly consolidating its position as the cartel's leader, accounting for around a third of the total production, with approximately 9.4 million barrels per day. In a way, Saudi Arabia and Russia remain, in a head to head battle, as the main countries seeking to cut production in an attempt to increase prices. Additionally, thanks to fracking, the United States has become the largest oil producer, representing a major influence on the international crude oil market, affecting the power that OPEC may have.

The hydrocarbon field is the centrepiece of President Alberto Fernández's 2020-2023 Gas Plan, which subsidises part of the investment.

Activity of YPF, Argentina's state-owned hydrocarbon company [YPF].

ANALYSIS / Ignacio Urbasos Arbeloa

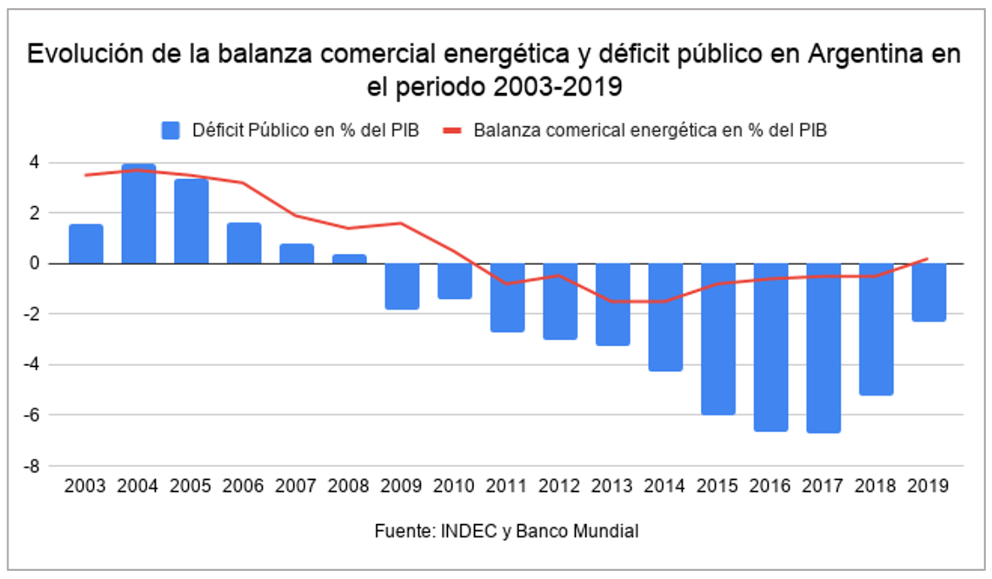

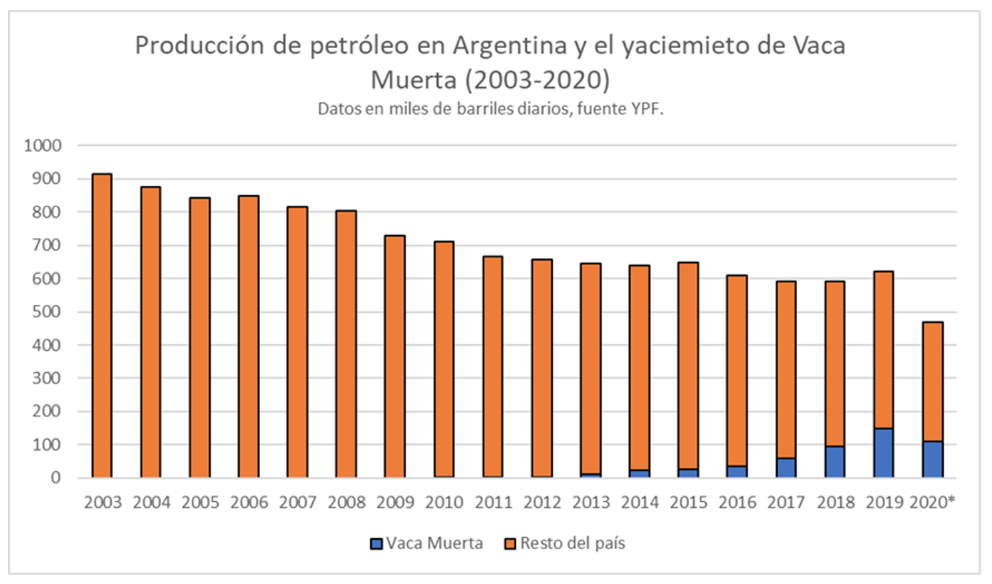

Argentina is facing a deep economic crisis that is having a severe impact on the standard of living of its citizens. The country, which had managed to emerge with enormous sacrifices from the corralito of 2001, sees its leaders committing the same macroeconomic recklessness that led the national Economics to collapse. After a hugely disappointing mandate by Mauricio Macri and his economic "gradualism", the new administration of Alberto Fernández has inherited a very delicate status , now aggravated by the global and national crisis generated by Covid-19. Public debt is now almost 100% of GDP, the Argentine peso is worth less than 90 units to the US dollar, while the public deficit persists. The Economics is still in recession, accumulating four years of decline. The IMF, which lent nearly $44 billion to Argentina in 2018 in the largest loan in the institution's history, has begun to lose patience with the lack of structural reforms and hints of debt restructuring by the government. In this critical status , Argentines are looking to the development unconventional oil industry as a possible way out of the economic crisis. In particular, the Vaca Muerta super field has been the focus of attention of international investors, government and citizens for the last decade, being a very promising project not Exempt of environmental and technical challenges.

The energy sector in Argentina: a history of fluctuations

The oil sector in Argentina has more than 100 years of history since oil was discovered in the Patagonian desert in 1907. The geographical difficulties of area - lack of water, distance from Buenos Aires and salty winds of more than 100 km/h - meant that project advanced very slowly until the outbreak of the First World War. The European conflict interrupted coal imports from England, which until then had accounted for 95% of Argentina's energy consumption. business The emergence of oil in the inter-war period as a strategic raw subject commodity revalued the sector, which began to receive huge foreign and domestic investment in the 1920s. By 1921, YPF, the first state-owned oil company in Latin America, was created, with energy self-sufficiency as its main goal goal. The country's political upheaval during the so-called Década Infame (1930-43) and the effects of the Great Depression damaged the incipient oil sector. The years of Perón's government saw a timid take-off of the oil industry with the opening of the sector to foreign companies and the construction of the first oil pipelines. In 1958, Arturo Frondizi became President of Argentina and sanctioned the Hydrocarbons Law of 1958, achieving an impressive development of the sector in only 4 years with an immense policy of public and private investment that multiplied oil production threefold, extended the network of gas pipelines and generalised access to natural gas for industry and households. The oil regime in Argentina kept the ownership of resource in the hands of the state, but allowed the participation of private and foreign companies in the production process.

Since the successful 1960s in subject oil, the sector entered a period of relative stagnation in parallel with Argentina's chaotic politics and Economics at the time. The 1970s was a complex journey in the desert for YPF, mired in huge debt and unable to increase production and secure the longed-for self-sufficiency.

The so-called Washington Consensus and the arrival of Carlos Menem to the presidency in 1990 saw the privatisation of YPF and the fragmentation of the state monopoly over the sector. By 1998, YPF was fully privatised under the ownership of Repsol, which controlled 97.5% of its capital. It was in the period 1996-2003 that peak oil production was reached, exporting natural gas to Chile, Brazil and Uruguay, and exceeding 300,000 barrels of crude oil per day in net exports.

However, a turnaround soon began in the face of state intervention in the market. Domestic consumption with fixed sales prices for oil producers was less attractive than the export market, encouraging private companies to overproduce in order to export oil and increase revenues exponentially. With the rise in oil prices of the so-called "commodity super-cycle" during the first decade of this century, the price differential between exports and domestic sales widened, creating a real incentive to focus on production. Exploration was thus left in the background, as domestic consumption grew rapidly due to tax incentives and a near horizon was foreseen without the possibility of exports and, therefore, lower income from the increase in reserves.

The exit from the 2001 crisis took place in a context of fiscal and trade surpluses, which allowed the country to regain the confidence of international creditors and reduce the volume of public debt. It was precisely the energy sector that was the main driver of this recovery, accounting for more than half of the trade surplus in the period 2004-2006 and one of Argentina's main sources of fiscal revenue. However, as mentioned above, this production was not sustainable due to the existence of a fiscal framework that distorted oil companies' incentives in favour of immediate consumption without investing in exploration. By 2004, a new tariff was applied to crude oil exports that floated on the basis of the international price of crude, reaching 45% if the price was above 45 dollars. The excessively rentier approach of Néstor Kirchner's presidency ended up dilapidating the sector's investment incentives, although it is true that they allowed for a spectacular increase in derived fiscal revenues, boosting Argentina's generous social and debt repayment plans. sample As a good illustration of this decline in exploration, in the 1980s more than 100 exploratory wells were drilled annually, in 1990 the figure exceeded 90, and by 2010 the figure was 26 wells per year. This figure is particularly dramatic if one takes into account the dynamics that the oil and gas sector tends to follow, with large investments in exploration and infrastructure in times of high prices, as was the case between 2001-2014.

In 2011, after a decade of debate on the oil sector in Argentina, President Cristina Fernández decided to expropriate 51 per cent of the shares of YPF held by Repsol, citing reasons of energy sovereignty and the decline of the sector. This decision followed the line taken by Hugo Chávez and Evo Morales in 2006 to increase the state's weight in the hydrocarbons sector at a time of electoral success for the Latin American left. The expropriation took place in the same year that Argentina became a net energy importer and coincided with the finding of the large shale reserves in Neuquén precisely by YPF, now known as Vaca Muerta. YPF at the time was the direct producer of approximately one third of Argentina's total volume. The expropriation took place at the same time as the imposition of the "cepo cambiario", a system of capital controls that made private foreign investment in the sector even less attractive. Not only was the country unable to recover its energy self-sufficiency, but it also entered a period of intense imports that hampered access to dollars and produced a large part of the macroeconomic imbalance of the current economic crisis.

The arrival of Mauricio Macri in 2015 heralded a new phase for the sector with policies more favourable to private initiative. One of the first measures was to establish a fixed price at the "wellhead" of the Vaca Muerta oil fields with the idea of encouraging the start-up of projects. As the economic crisis worsened, the unpopular measure of increasing electricity and fuel prices by more than 30 per cent was chosen, generating enormous discontent in the context of a constant devaluation of the Argentine peso and the rising cost of living. The energy portfolio was marked by enormous instability, with three different ministers who generated enormous legal insecurity by constantly changing the hydrocarbons regulatory framework . Renewable solar and wind energy, boosted by a new energy plan and greater liberalisation of investment, managed to double their energy contribution during Mauricio Macri's time in the Casa Rosada.

Alberto Fernández's first years have been marked by unconditional support for the hydrocarbons sector, with Vaca Muerta being the central axis of his energy policy, announcing the 2020-2023 Gas Plan that will subsidise part of the investment in the sector. On the other hand, despite the context of the health emergency, 39 renewable energy projects were installed in 2020, with an installed capacity of around 1.5 GW, an increase of almost 60% over the previous year. In any case, the continuity of this growth will depend on access to foreign currency in the country, which is essential to be able to buy panels and windmills from abroad. The boom in renewable energy in Argentina led the Danish company Vestas to install the first windmill assembly plant in the country in 2018, which already has several plants producing solar panels to supply domestic demand.

Characteristics of Vaca Muerta

Vaca Muerta is not a field from a technical point of view, it is a sedimentary training of enormous magnitude with dispersed deposits of natural gas and oil that can only be exploited with unconventional techniques: hydraulic fracturing and horizontal drilling. These characteristics make Vaca Muerta a complex activity, which requires attracting as much talent as possible, especially from international players with experience in the exploitation of unconventional hydrocarbons. Likewise, conditions in the province of Neuquén are complex given the scarcity of rainfall and the importance of the fruit and vegetable industry, in direct competition with the water resources required for the exploitation of unconventional oil.

Since finding, the potential of Vaca Muerta has been compared to that of the Eagle Ford basin in the United States, which produces more than one million barrels per day. Evidently, the Neuquén region has neither Texas' oil business ecosystem nor its fiscal facilities, making what might be geologically similar in reality two totally different stories. In December 2020, Vaca Muerte produced 124,000 barrels of oil per day, a figure that is expected to gradually increase over the course of this year to 150,000 barrels per day, about 30% of the 470,000 barrels per day Argentina produced in 2020. Natural gas follows a slower process, pending the development of infrastructure that will allow the transport of large volumes of gas to consumption and export centres. In this regard, Fernández announced in November 2020 the Plan for the Promotion of Argentine Gas Production 2020-2023, with which the Casa Rosada seeks to save dollars by substituting imports. The plan facilitates the acquisition of dollars for investors and improves the maximum selling price of natural gas by almost 50%, to 3.70 dollars per mbtu, in the hope of receiving the necessary investment, estimated at 6.5 billion dollars, to achieve gas self-sufficiency. Argentina already has the capacity to export natural gas to Chile, Uruguay and Brazil through pipelines. Unfortunately, the floating vessel exporting natural gas from Vaca Muerte left Argentina at the end of 2020 after YPF unilaterally broke the ten-year contract with the vessel's owner, Exmar, citing economic difficulties, limiting the capacity to sell natural gas outside the continent.

One of the great advantages of Vaca Muerta is the presence of international companies with experience in the aforementioned US unconventional oil basins. The post-2014 learning curve of the US fracking sector is being applied in Vaca Muerta, which has seen drilling costs fall by 50% since 2014 while gaining in productivity. The influx of US capital may accelerate if Joe Biden's administration fiscally and environmentally restricts oil activities in the country, from agreement with its environmentalist diary . Currently the main operator in Vaca Muerta after YPF is Chevron, followed by Tecpetrol, Wintershell, Shell, Total and Pluspetrol, in an ecosystem with 18 oil companies working in different blocks.

Vaca Muerta as a national strategy

It is clear that achieving energy self-sufficiency will help Argentina's macroeconomic problems, the main headache for its citizens in recent years. No Exempt of environmental risk, Vaca Muerta could be a lifeline for a country whose international credibility is at an all-time low. Alberto Fernández's pro-hydrocarbon narrative follows the line of his Mexican counterpart Andrés guide López Obrador, with whom he intends to lead a new moderate left-wing axis in Latin America. The spectre of the nationalisation of YPF by the now vice-president Cristina Fernández, as well as the recent breach of contract with Exmar, continue to generate uncertainty among international investors. status Moreover, the poor financial performance of YPF, the main player in Vaca Muerta, with a debt of more than 8 billion dollars, is a major drag on the country's oil prospects. Similarly, Vaca Muerta is far from realising its potential, with significant but insufficient production to guarantee revenues that would bring about a radical change in Argentina's economic and social status . In order to guarantee its success, a context of favourable oil prices and the fluid arrival of foreign investors are needed. Two variables that cannot be taken for granted given Argentina's political context and the increasingly strong decarbonisation policy of traditional oil companies.

The big question now is how to reconcile the large-scale fossil fuel development with Argentina's latest commitments on climate change subject : to reduce CO2 emissions by 19% by 2030 and achieve carbon neutrality by 2050. Similarly, the promising trajectory of renewable energy development during Mauricio Macri's presidency may lose momentum if the oil and gas sector attracts public and private investment, crowding out solar and wind.

Vaca Muerta is likely to advance slowly but surely as international oil prices stabilise upwards. The possibility of generating foreign currency and boosting a Economics on the verge of collapse should not be underestimated, but expecting Vaca Muerta to solve Argentina's problems on its own can only end in a new episode of frustration in the southern country.

Several countries in the Americas are celebrating in 2021 their two hundredth anniversary of a break with Spain that did not always mean independence.ca celebrate in 2021 their two centuries of a break with Spain that did not always mean independence. final

This year, several American nations are commemorating two centuries of their separation from Spain, recalling a process that took place in all the Spanish possessions in continental America within a few years of each other. In some cases, it was a process of successive independence, as was the case with Guatemala, which later belonged to the Mexican Empire and then to a Central American republic, and Panama, which was part of Colombia until the 20th century. But even later, both countries experienced direct interference by the United States, in episodes that were very decisive for the region as a whole.

Ceremony of submission of the Panama Canal to the Panamanian authorities, 31 December 1999

article / Angie Grijalva

During 2021 several American countries celebrate their independence from Spain, the largest and most festively celebrated being Mexico. In other nations, the date of 1821 is qualified by later historical developments: Panama also commemorates every year the day in 1903 when it broke with Bogotá, while in the case of Guatemala that independence did not immediately imply a republic of its own, since together with its neighbouring nations in 1822 it was nominally dependent on Mexico and between 1823 and 1839 it formed part of the United Provinces of Central America and the Federal Republic of Central America. Moreover, US regional hegemony called into question the full sovereignty of these countries in subsequent decades: Guatemala suffered the first coup d'état openly promoted by Washington in the Western Hemisphere in 1954, and Panama did not have full control over its entire territory until the Americans handed over the canal in 1999.

Panama and its canal

The project of the Panama Canal was important for the United States because it made it possible to easily link its two coasts by sea and consolidated the global rise sought by Theodore Roosevelt's presidency, guided by the maxim that only the nation that controlled both oceans would be a truly international power. Given the refusal of Colombia, to which the province of Panama then belonged, to accept the conditions set by the United States to build the canal, resuming the work on the paralysed French project , Washington was faced with two options: invade the isthmus or promote Panama's independence from Colombia[1]. The Republic of Panama declared its independence on 3 November 1903 and with it Roosevelt negotiated a very favourable agreement which gave the United States perpetual sovereignty over the canal and a wide strip of land on either side of it. Washington thus gained control of Panama and extended its regional dominance.

After a decade of difficult work and a high issue death toll among the workforce, who came from all over the Caribbean and also from Asia, not least due to dengue fever, malaria and yellow fever, in 1913 the Atlantic and Pacific oceans were finally connected and the canal was opened to ship traffic.

Over time, US sovereignty over a portion of the country and the instructions military installations there fuelled a rejection movement in Panama that became particularly virulent in the 1960s. The Carter Administration agreed to negotiate the cession of the canal in a 1977 agreement that incorporated the Panamanians into the management of inter-oceanic traffic and set the submission of all installations for 1999. When this finally happened, the country experienced the occasion as a new independence celebration, saying goodbye to US troops that only ten years earlier had been very active, invading Panama City and other areas to arrest President Manuel Noriega for drug trafficking.

Critical moment in Guatemala

The Panama Canal gave the United States an undoubted projection of power over its hemisphere. However, during the Cold War, Washington also found it necessary to use operations, in some cases direct, to overthrow governments it considered close to communism. This happened with the overthrow of Jacobo Árbenz in Guatemala in 1954.

The arrival of Árbenz to the presidency in 1951 was a threat to the United Fruit Company (UFCO) because of the agrarian reform he was promoting[2]. Although the advance of communist parties in Latin America was beginning to grow, the real threat in certain countries was the expropriation of land from US monopolies. It is estimated that by 1950, the UFCO owned at least 225,000 hectares of land in Guatemala, of which the agrarian reform was to expropriate 162,000 hectares in 1952. With political support from Washington, UFCO claimed that the compensation it was being offered did not correspond to the true value of the land and branded the Árbenz government as communist, even though this was not true.

In 1953, the newly inaugurated Eisenhower Administration established a plan to destabilise the government and stage a coup against Árbenz. On the one hand, Secretary of State John F. Dulles sought the support of the Organisation of American States, prompting condemnation of Guatemala for receiving a shipment of arms from the Soviet Union, which had been acquired because of the US refusal to sell arms to the Central American country. On the other hand, the CIA launched the mission statement PBSUCCESS to guarantee the quartermastering of a faction of the Guatemalan army ready to rebel against Árbenz. The movement was led by Colonel Castillo Armas, who was in exile in Honduras and from there launched the invasion on 18 June 1954. When the capital was bombed, the bulk of the army refused to respond, leaving Árbenz alone, who resigned within days.

Once in power, Castillo Armas returned the expropriated land to UFCO and brought new US investors into the country. Dulles called this victory "the greatest triumph against communism in the last five years". The overthrow of Árbenz was seen by the US as a model for further operations in Latin America. development The award Nobel Literature Prize winner Mario Vargas Llosa has pointed out that this action against Árbenz could be seen as "the moment when Latin America was screwed", as for many it was evidence that a normal democracy was not possible, and this pushed certain sectors to defend revolution as the only way to make their societies prosper.

[1] McCullough, D. (2001). The Path Between the Seas: The Creation of the Panama Canal, 1870-1914. Simon & Schuster.

[2] G. Rabe, S. (2017). Intervention in Guatemala, 1953-1954. In S. G. Rabe, Eisenhower and Latin America: The Foreign Policy of Anticommunism. The University of North Carolina Press.

[Daniel Méndez Morán, 136. China's plan in Latin America (2018), 410 pages].

review / Jimena Puga

By means of a first-person on-the-ground research and the testimony staff of Chinese and Latin Americans, who give the story the character of a documented report, Daniel Méndez summarises in detail the mark that the growing Asian superpower is leaving in the region. This gives the reader an insight into the relations between the two cultures from an economic and, above all, political point of view. The figure of degree scroll -136- is the issue that, according to the author, Beijing assigns to its plan for Latin America, in its planning of different sectoral and geographical expansion programmes around the world.

The book begins by briefly reflecting on China's rapid growth since the death of Mao Zedong and thanks to Deng Xiaoping's growth and opening-up policies between 1980 and 2000. This resurgence has not only been reflected in China's Economics but also in society. The new generations of Chinese professionals are better educated training and more fluent in foreign languages than their elders, and therefore better prepared for International Office. However, Liu Rutao, Economic and Commercial Counsellor at the Chinese Embassy in Chile explains to the author that "the history of China's going abroad is only fifteen years old, so neither the government nor the companies have a very mature thinking on how to act abroad, so we all need to study".

However, the country's short experience in the international arena is not an obstacle since, as the book shows, China has a very effective shortcut to accelerate this learning process: money. In fact, the goal of many of the most important Chinese investments in Latin America is not only access to natural resources, but also to human capital and, above all, to knowledge. Thanks to their huge financial resources, Chinese companies are acquiring companies with experience and contacts in the Americas, hiring the best professionals in each country and buying brands and technologies. "This phase is very difficult. Chinese companies are going to pay to learn. But everything is learned by paying," diplomat Chen Duqing, China's ambassador to Brazil between 2006 and 2009, explained to Méndez.

After this overview, the book moves on to China's relationship with different Latin American partners. In the case of Mexico, there is a struggle against the famous made in China. The empire at the centre went to Mexico 40 years ago to study the maquiladora programme; when they returned, Méndez explains, they said: "Mexico is doing that for the United States, we are going to do it for the world". And so, a few years later, China designed and improved the strategy. There is little doubt that made in China has won the day over Mexican maquiladoras, and it is all these decades of skill and frustration that explain the complex political relations between the two countries. This is what the people interviewed by the author testify to. To Jorge Guajardo, this model reminds him of the colonial order imposed by Spain and continued by the United Kingdom: "I sometimes said to the Chinese: 'Gentlemen, you cannot see America: Gentlemen, you cannot see Latin America as anything other than a place where you go for natural resources and in return you send manufactured goods. We were already a colony. And we didn't like it, it didn't work. And we chose to stop being one. You don't want to repeat that model".

The result of these new tensions is that neither country has achieved what it was looking for. Mexico has barely increased its exports to China and the Asian giant has barely increased its investments in the Latin American country. In 2017 there were only 30 Chinese companies installed in Mexico, a very small number compared to the 200 in Peru. Other diplomats on the continent recognise that in any international meeting where both countries are present, the Latin American country is always the most reluctant to accept Beijing's proposals. For China, Mexican 'resistance' is perhaps its biggest diplomatic stumbling block in the region: the best example that its rise has not benefited all countries in the South.