CULTURE, LEADERSHIP AND COMMUNICATION/ Marcos Taboada

By clicking on this link you can access the complete original document.

During 2019, three communications arrived that presaged a new wave of expansion of Sustainability involving its penetration into the elite of boards of directors. First, the letter that BlackRock, the world's largest signature of management funds, addressed to the CEOs of the companies in which it invests, advocating the intrinsic link between profitability and purpose of companies. This was followed by a statement from the Business Roundtable, a forum that brings together the CEOs of the largest companies in the United States, which recognized the duty of companies to be involved in generating value for all their stakeholders. Finally, the World Economic Forum in Davos reformulated its Manifesto in January 2020, defining that the purpose of companies is the creation of shared and sustained value.

These commitments showed that, at last, large corporations were recognizing the importance of purpose and the creation of value for stakeholders in the current economic and social context. However, why has this widespread recognition only happened in 2019, when discussion has been present in academia for more than 70 years?

The answer can be found by looking at four drivers that have propelled development from CSR and sustainability throughout its history to what it is today.

1. Companies today have sufficient - but not unbeatable - know-how on which to consolidate their change towards a more sustainable model that values stakeholders.

On the one hand, the theoretical development of discipline has evolved since the birth of notions such as social responsibility, stakeholders or accountability at subject economic, social and environmental. Sustainability is no longer something alien to the business, but is strategically linked to it, and the concept that in order to satisfy some stakeholders the interests of others, such as shareholders, must be sacrificed for a vision articulated around the creation of shared value, has been left behind.

On the other hand, the last two decades have seen a proliferation of tools such as sustainability indexes, guidelines for reporting non-financial information or guidelines for internal management on environmental, social and corporate governance issues. Some examples are the Dow Jones Sustainability Index (1999), the Global Reporting Initiative (1997) or the rule ISO 26000 (2010).

2. The social pressure exerted by citizens on the commitment of companies has been increasing over the years.

All over the world, citizens have lost confidence in their political institutions, feeling that they are not capable of solving the major challenges facing the planet and society. Thus, they are turning to companies and placing on them the responsibility to get involved and lead the changes needed to solve these problems. Corporate scandals no longer cause a stir just because they break the law; companies are required to go further, to generate a positive impact, and intangibles are more important than ever in the consumer's decision. Of particular concern are climate change, economic inequality and discrimination, as witnessed by the Greta Thunberg phenomenon or movements such as #MeToo or #BlackLivesMatter.

3. Thirdly, the profitability of sustainability is beginning to be solid and palpable.

On the one hand, the first programs of study reports show that the profitability of sustainable financial instruments equals or even exceeds that of their alternatives with poorer ESG ratings. In addition, sustainable finance is emerging as a great refuge from risk: in fact, 2020 and the COVID-19 pandemic have served to demonstrate the robustness of sustainable finance, which has withstood the consequences of the pandemic much better than the general market.

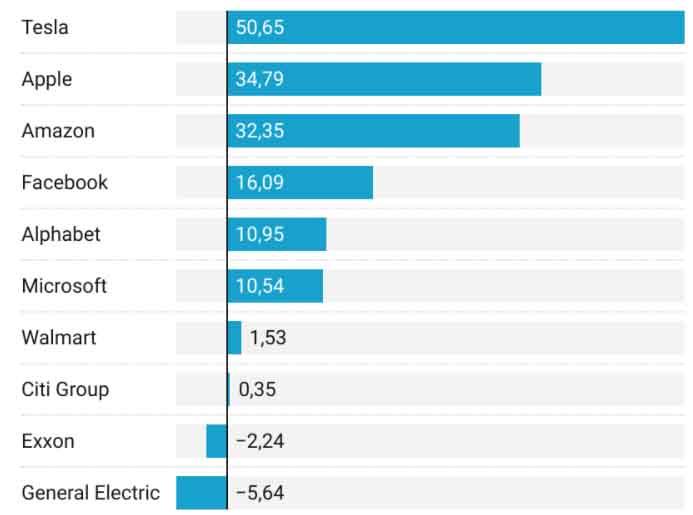

On the other hand, the unstoppable growth in the market capitalization of Big Tech in recent years means that traditional sectors cannot compete in generating value in the short term, and have to rely on strategies that focus on the long term, where sustainability appears as a fundamental ally. An example of a sustainable business model that has demonstrated undeniable success is Tesla, which has managed to beat the technological queens in terms of growth ratios.

4. Political and legislative pressure, in which the European Union plays a leading role, is perhaps the most decisive factor for this definitive shift towards more sustainable business practices to become unpostponable in 2019-2020.

December 2019 saw the arrival of the much-anticipated and much-anticipated Europan Green Deal, which, in order to tackle climate change, ushers in a legislative flurry over the coming years to achieve a complete transformation of the Union's Economics .

This determined and transformative strategy is reinforced by the financing mechanisms designed by the European Union to achieve this change, by the publication of the EU Sustainable Taxonomy - which aims to help both financial agents and citizens and companies to define which subject activities are considered sustainable -, and the inclusion of innovation and sustainability criteria in the allocation of funds of the Next Generation EU plan for economic recovery after the pandemic.

At final, we see how the theoretical evolution and availability of the necessary tools are making companies learn to face the challenges of responsibility and sustainability that citizens are increasingly demanding and that legislators are beginning to implement with ever greater stringency. If we add to this the evidence of the profitability offered by sustainable business models and ESG finance, and the public commitment of corporate elites, there is every reason to expect, over the next few years, an unprecedented expansion in the spread and depth of Corporate Social Responsibility and Sustainability practices, with the capacity to transform the entire economic fabric.