-

60 hours

-

Face-to-face. Campus Madrid

-

14 October-17 February. 15 weeks (4 hours per week). Fridays, from 16:00-20:30 h.

-

3,200 Discount of 20% for alumni and for registrations formalized before September 16.

3,200 Discount of 20% for alumni and for registrations formalized before September 16.

-

Limited places

-

Spanish

![]()

specialization and update of the rules on company restructuring from agreement to the latest reform of the bankruptcy law.

Learning objectives:

UPDATE

Immersion at knowledge of the new rules on corporate restructuring.

360º PROGRAMME

Understanding of the economic and financial coordinates that allow the restructuring of the financial status of companies in crisis.

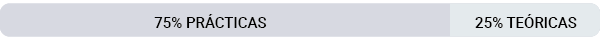

HANDS-ON LEARNING

Acquisition of practical skills for the exercise of position of company restructuring. The assessment of the programme consists of the resolution of a practical case of business restructuring.

Programme and contents

-

General principles of preventive restructuring frameworks

-

Restructuring assumptions

-

Feasibility analysis, management of Bursar's Office and business plan

-

Debt structuring

-

evaluation of the business debtor, sustainable and unsustainable debt

-

rules and regulations bank accounts and provisions for risks

-

requirementsincompatibilities and appointment of the expert

-

Status of the expert: functions and responsibilities

-

Communication of the opening of negotiations

-

The effects of the communication. Extension

-

Restructuring plans. Concept and general aspects

-

Affected creditors and computation rules

-

Contracts concerned: termination in the interest of restructuring

-

The training of classes of creditors. Criteria and judicial confirmation

-

Possible contents of the restructuring plans

-

procedure of approval of consensual restructuring plans

-

Best interests of creditors and sacrifice significantly in excess of what is necessary

-

Approval of non-consensual plans: "Cross-class cramdown", parity of attention and absolute priority rule

-

The approval of restructuring plans. procedure and effectiveness of the order.

-

Challenging the approval: grounds for challenge and effects of the approval

-

Non-compliance with restructuring plans

-

The protection of plans in the event of consecutive insolvency: interim money, new money and reinstatement actions

-

Partners in restructuring plans: the dragging in of partners

-

The public creditor in financial restructuring processes

-

The entities of credit in financial restructuring I

-

credit entities in financial restructurings II

-

Debt funds in restructurings

-

Investors (M&A Distress): disposal of production units in restructuring processes. The insolvency prepack

-

Specialities of restructuring of SMEs and micro-enterprises

-

The problem of cross-border restructurings

Programme management

Ibon Hualde López

Full Professor of Procedural Law of the University of Navarra

José Carlos González

partner Director of area of Restructuring and Insolvency of Ceca Magán Abogados. Senior Associate Professor of Commercial Law of the UCM. Member of CEDI.

Faculty

![]()

The team of lecturers is made up of experts from the University of Navarra and external lecturers from different Spanish universities, professionals working in official institutions and legal and economic professionals from firms specialising in insolvency law.

- Miguel Ángel Agüero Caballero. Director of Risk Control and Analysis at Banco de Santander.

- Jesús Álamo Matas. manager advisory service Legal Department, Territorial Management of Aragón, Navarra and La Rioja, Caixabank.

- Dolores Alemany Pozuelo. Managing Partner at Amelegal.

- Cruz Amado de la Riega. Director- manager Restructuring & Insolvency at Deloitte Legal .

- Carlos Ara Triadú. partner of Cuatrecasas.

- Cristina Asencio Pascual. Managing Partner of Restructuring & Insolvency at Fieldfisher.

- Alexandra Borrallo Veiga. Senior Associate of Litigation and Insolvency at Clifford Chance.

- Enrique Calabuig Salañer. Risk and Restructuring Unit at Caixabank.

- Javier Castresana Oliver. partner of Allen & Overy.

- José Ramón Couso Pascual. partner-Director Corporate at Ceca Magán Abogados.

- Amanda Cohen Benchetrit. Magistrate-Judge specializing in Commercial Law.

- Josu Echevarría Larrañaga. partner-Business Recovery Services at PwC.

- Ignacio García-Escorial de León. Senior Portfolio Manager at Fidera Limited.

- Manuel García-Villarrubia Bernabé. partner of Uría & Menéndez.

- Francisco Garcimartín Alférez. Full Professor of International Private Law of the UAM. consultant external Linklaters

- María Gómez-Zubeldia Soroa. manager advisory service Legal advisor at advisory service Legal Department of Restructuring and Special Situations at Banco de Santander.

- Carmen González Suárez. Magistrate-Judge specializing in Commercial Matters (Commercial Court No. 14 of Madrid).

- José Carlos González Vázquez. partner Director of area of Restructuring and Insolvency of Ceca Magán Abogados.

- Rosa Mª Gual Tomás. Partner of Cuatrecasas

-Ibon Hualde López. Full Professor of Procedural Law of the University of Navarra.

- Cayetana Lado Castro-Rial. Director of the legal advisory service and administrative assistant of committee of high school of credit Official (ICO)

- Ángel Martin Torres. Senior advisor and independent director

- Ricardo Medina Tamayo. Director of Provisions of credit at Banco de Santander.

- Alejandro Rey Suañez. partner Director of RS Boutique Legal. Chairman of CEDI

- Pedro de Rojas Sánchez. partner-Restructuring and Special Situations at Latham & Watkins.

- Luis M. Sánchez Velo. Director of advisory service Legal Restructuring and Special Situations at Banco de Santander.

- Adrián Thery Martí. partner of Garrigues. Head of Restructuring & Insolvency Department.

- Elisa Torralba Mendiola. Professor of International Private Law of the UAM and academic advisor of Gómez-Acebo y Pombo.

- Eduardo Valpuesta Gastaminza. Full Professor of Commercial Law of the University of Navarra.

-Iñigo Villoria Ribera. partner of department of Litigation and Arbitration of Clifford Chance.

- Javier Yáñez Evangelista. partner of Uría Menéndez.

- Ángel Zamora González de la Peña. partner of Zurbarán Abogado.

profile from candidate

-

The programme is aimed at graduates in Law or Economics and Business Studies, who are professionals in the legal and economic fields with an interest in specialising or retraining in the field of insolvency area .

01Request your Admissions Office through our form. |

02We will analyse your application and will contact you at contact to validate your application. |

03Make the payment of the enrollment by bank transfer. |

Course fee: 3,200 euros.

20% discount for alumni and for enrollments formalized before September 16: 2,560 euros.

The corresponding payment will be made by bank transfer to the following account issue :

Banco Santander Central Hispano

SWIFT: BSCHESMM

IBAN: ES18 0049.1849.1821.00.2010571564

In the concept of the transfer you must put: DTM100025 + name and surname of the future student.

Once the transfer has been made, he will send the certificate of the payment to Javier Ilardia, manager of Admissions Office of the program: jilardia@unav.es.