The hydrocarbon field is the centrepiece of President Alberto Fernández's 2020-2023 Gas Plan, which subsidises part of the investment.

Activity of YPF, Argentina's state-owned hydrocarbon company [YPF].

ANALYSIS / Ignacio Urbasos Arbeloa

Argentina is facing a deep economic crisis that is having a severe impact on the standard of living of its citizens. The country, which had managed to emerge with enormous sacrifices from the corralito of 2001, sees its leaders committing the same macroeconomic recklessness that led the national Economics to collapse. After a hugely disappointing mandate by Mauricio Macri and his economic "gradualism", the new administration of Alberto Fernández has inherited a very delicate status , now aggravated by the global and national crisis generated by Covid-19. Public debt is now almost 100% of GDP, the Argentine peso is worth less than 90 units to the US dollar, while the public deficit persists. The Economics is still in recession, accumulating four years of decline. The IMF, which lent nearly $44 billion to Argentina in 2018 in the largest loan in the institution's history, has begun to lose patience with the lack of structural reforms and hints of debt restructuring by the government. In this critical status , Argentines are looking to the development unconventional oil industry as a possible way out of the economic crisis. In particular, the Vaca Muerta super field has been the focus of attention of international investors, government and citizens for the last decade, being a very promising project not Exempt of environmental and technical challenges.

The energy sector in Argentina: a history of fluctuations

The oil sector in Argentina has more than 100 years of history since oil was discovered in the Patagonian desert in 1907. The geographical difficulties of area - lack of water, distance from Buenos Aires and salty winds of more than 100 km/h - meant that project advanced very slowly until the outbreak of the First World War. The European conflict interrupted coal imports from England, which until then had accounted for 95% of Argentina's energy consumption. business The emergence of oil in the inter-war period as a strategic raw subject commodity revalued the sector, which began to receive huge foreign and domestic investment in the 1920s. By 1921, YPF, the first state-owned oil company in Latin America, was created, with energy self-sufficiency as its main goal goal. The country's political upheaval during the so-called Década Infame (1930-43) and the effects of the Great Depression damaged the incipient oil sector. The years of Perón's government saw a timid take-off of the oil industry with the opening of the sector to foreign companies and the construction of the first oil pipelines. In 1958, Arturo Frondizi became President of Argentina and sanctioned the Hydrocarbons Law of 1958, achieving an impressive development of the sector in only 4 years with an immense policy of public and private investment that multiplied oil production threefold, extended the network of gas pipelines and generalised access to natural gas for industry and households. The oil regime in Argentina kept the ownership of resource in the hands of the state, but allowed the participation of private and foreign companies in the production process.

Since the successful 1960s in subject oil, the sector entered a period of relative stagnation in parallel with Argentina's chaotic politics and Economics at the time. The 1970s was a complex journey in the desert for YPF, mired in huge debt and unable to increase production and secure the longed-for self-sufficiency.

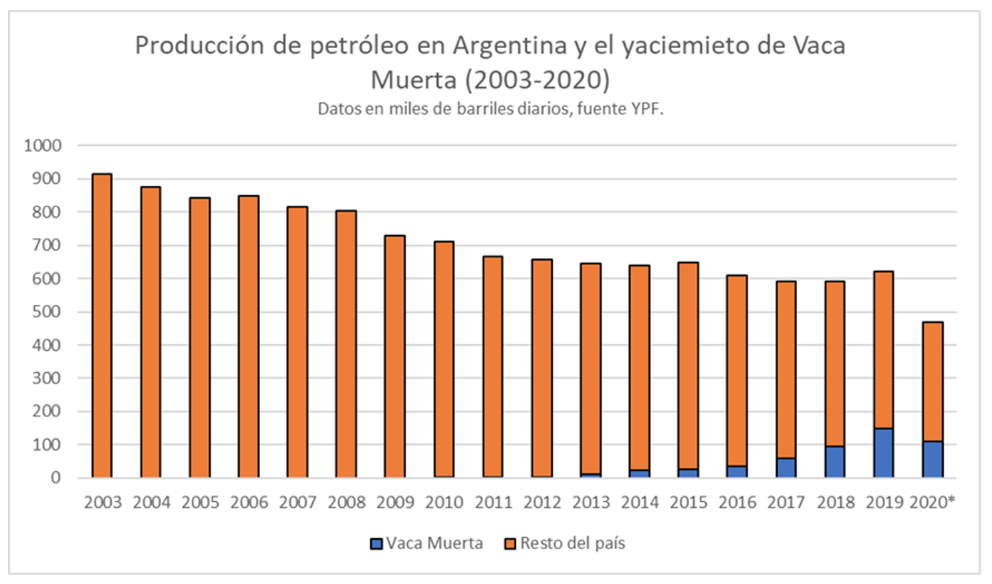

The so-called Washington Consensus and the arrival of Carlos Menem to the presidency in 1990 saw the privatisation of YPF and the fragmentation of the state monopoly over the sector. By 1998, YPF was fully privatised under the ownership of Repsol, which controlled 97.5% of its capital. It was in the period 1996-2003 that peak oil production was reached, exporting natural gas to Chile, Brazil and Uruguay, and exceeding 300,000 barrels of crude oil per day in net exports.

However, a turnaround soon began in the face of state intervention in the market. Domestic consumption with fixed sales prices for oil producers was less attractive than the export market, encouraging private companies to overproduce in order to export oil and increase revenues exponentially. With the rise in oil prices of the so-called "commodity super-cycle" during the first decade of this century, the price differential between exports and domestic sales widened, creating a real incentive to focus on production. Exploration was thus left in the background, as domestic consumption grew rapidly due to tax incentives and a near horizon was foreseen without the possibility of exports and, therefore, lower income from the increase in reserves.

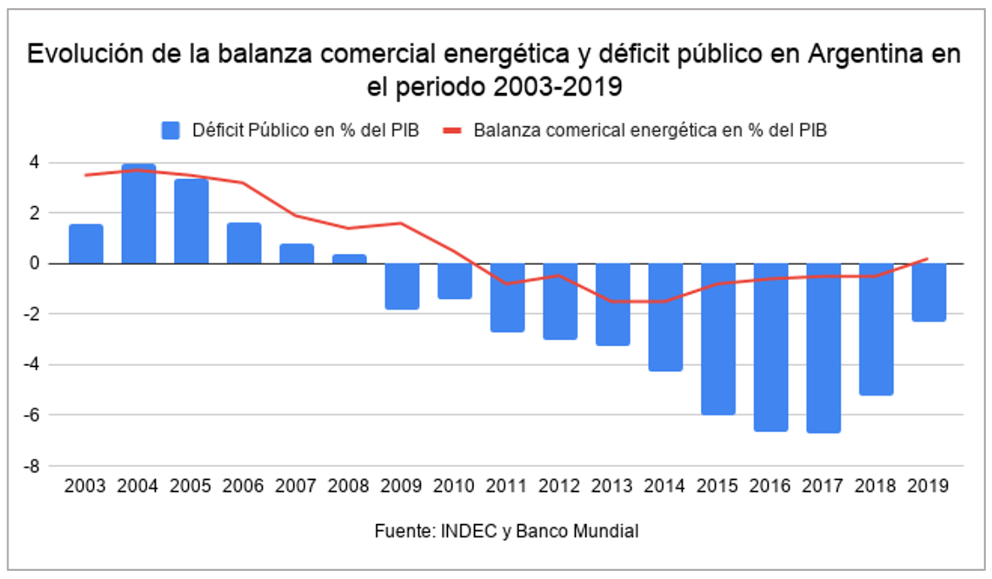

The exit from the 2001 crisis took place in a context of fiscal and trade surpluses, which allowed the country to regain the confidence of international creditors and reduce the volume of public debt. It was precisely the energy sector that was the main driver of this recovery, accounting for more than half of the trade surplus in the period 2004-2006 and one of Argentina's main sources of fiscal revenue. However, as mentioned above, this production was not sustainable due to the existence of a fiscal framework that distorted oil companies' incentives in favour of immediate consumption without investing in exploration. By 2004, a new tariff was applied to crude oil exports that floated on the basis of the international price of crude, reaching 45% if the price was above 45 dollars. The excessively rentier approach of Néstor Kirchner's presidency ended up dilapidating the sector's investment incentives, although it is true that they allowed for a spectacular increase in derived fiscal revenues, boosting Argentina's generous social and debt repayment plans. sample As a good illustration of this decline in exploration, in the 1980s more than 100 exploratory wells were drilled annually, in 1990 the figure exceeded 90, and by 2010 the figure was 26 wells per year. This figure is particularly dramatic if one takes into account the dynamics that the oil and gas sector tends to follow, with large investments in exploration and infrastructure in times of high prices, as was the case between 2001-2014.

In 2011, after a decade of debate on the oil sector in Argentina, President Cristina Fernández decided to expropriate 51 per cent of the shares of YPF held by Repsol, citing reasons of energy sovereignty and the decline of the sector. This decision followed the line taken by Hugo Chávez and Evo Morales in 2006 to increase the state's weight in the hydrocarbons sector at a time of electoral success for the Latin American left. The expropriation took place in the same year that Argentina became a net energy importer and coincided with the finding of the large shale reserves in Neuquén precisely by YPF, now known as Vaca Muerta. YPF at the time was the direct producer of approximately one third of Argentina's total volume. The expropriation took place at the same time as the imposition of the "cepo cambiario", a system of capital controls that made private foreign investment in the sector even less attractive. Not only was the country unable to recover its energy self-sufficiency, but it also entered a period of intense imports that hampered access to dollars and produced a large part of the macroeconomic imbalance of the current economic crisis.

The arrival of Mauricio Macri in 2015 heralded a new phase for the sector with policies more favourable to private initiative. One of the first measures was to establish a fixed price at the "wellhead" of the Vaca Muerta oil fields with the idea of encouraging the start-up of projects. As the economic crisis worsened, the unpopular measure of increasing electricity and fuel prices by more than 30 per cent was chosen, generating enormous discontent in the context of a constant devaluation of the Argentine peso and the rising cost of living. The energy portfolio was marked by enormous instability, with three different ministers who generated enormous legal insecurity by constantly changing the hydrocarbons regulatory framework . Renewable solar and wind energy, boosted by a new energy plan and greater liberalisation of investment, managed to double their energy contribution during Mauricio Macri's time in the Casa Rosada.

Alberto Fernández's first years have been marked by unconditional support for the hydrocarbons sector, with Vaca Muerta being the central axis of his energy policy, announcing the 2020-2023 Gas Plan that will subsidise part of the investment in the sector. On the other hand, despite the context of the health emergency, 39 renewable energy projects were installed in 2020, with an installed capacity of around 1.5 GW, an increase of almost 60% over the previous year. In any case, the continuity of this growth will depend on access to foreign currency in the country, which is essential to be able to buy panels and windmills from abroad. The boom in renewable energy in Argentina led the Danish company Vestas to install the first windmill assembly plant in the country in 2018, which already has several plants producing solar panels to supply domestic demand.

Characteristics of Vaca Muerta

Vaca Muerta is not a field from a technical point of view, it is a sedimentary training of enormous magnitude with dispersed deposits of natural gas and oil that can only be exploited with unconventional techniques: hydraulic fracturing and horizontal drilling. These characteristics make Vaca Muerta a complex activity, which requires attracting as much talent as possible, especially from international players with experience in the exploitation of unconventional hydrocarbons. Likewise, conditions in the province of Neuquén are complex given the scarcity of rainfall and the importance of the fruit and vegetable industry, in direct competition with the water resources required for the exploitation of unconventional oil.

Since finding, the potential of Vaca Muerta has been compared to that of the Eagle Ford basin in the United States, which produces more than one million barrels per day. Evidently, the Neuquén region has neither Texas' oil business ecosystem nor its fiscal facilities, making what might be geologically similar in reality two totally different stories. In December 2020, Vaca Muerte produced 124,000 barrels of oil per day, a figure that is expected to gradually increase over the course of this year to 150,000 barrels per day, about 30% of the 470,000 barrels per day Argentina produced in 2020. Natural gas follows a slower process, pending the development of infrastructure that will allow the transport of large volumes of gas to consumption and export centres. In this regard, Fernández announced in November 2020 the Plan for the Promotion of Argentine Gas Production 2020-2023, with which the Casa Rosada seeks to save dollars by substituting imports. The plan facilitates the acquisition of dollars for investors and improves the maximum selling price of natural gas by almost 50%, to 3.70 dollars per mbtu, in the hope of receiving the necessary investment, estimated at 6.5 billion dollars, to achieve gas self-sufficiency. Argentina already has the capacity to export natural gas to Chile, Uruguay and Brazil through pipelines. Unfortunately, the floating vessel exporting natural gas from Vaca Muerte left Argentina at the end of 2020 after YPF unilaterally broke the ten-year contract with the vessel's owner, Exmar, citing economic difficulties, limiting the capacity to sell natural gas outside the continent.

One of the great advantages of Vaca Muerta is the presence of international companies with experience in the aforementioned US unconventional oil basins. The post-2014 learning curve of the US fracking sector is being applied in Vaca Muerta, which has seen drilling costs fall by 50% since 2014 while gaining in productivity. The influx of US capital may accelerate if Joe Biden's administration fiscally and environmentally restricts oil activities in the country, from agreement with its environmentalist diary . Currently the main operator in Vaca Muerta after YPF is Chevron, followed by Tecpetrol, Wintershell, Shell, Total and Pluspetrol, in an ecosystem with 18 oil companies working in different blocks.

Vaca Muerta as a national strategy

It is clear that achieving energy self-sufficiency will help Argentina's macroeconomic problems, the main headache for its citizens in recent years. No Exempt of environmental risk, Vaca Muerta could be a lifeline for a country whose international credibility is at an all-time low. Alberto Fernández's pro-hydrocarbon narrative follows the line of his Mexican counterpart Andrés guide López Obrador, with whom he intends to lead a new moderate left-wing axis in Latin America. The spectre of the nationalisation of YPF by the now vice-president Cristina Fernández, as well as the recent breach of contract with Exmar, continue to generate uncertainty among international investors. status Moreover, the poor financial performance of YPF, the main player in Vaca Muerta, with a debt of more than 8 billion dollars, is a major drag on the country's oil prospects. Similarly, Vaca Muerta is far from realising its potential, with significant but insufficient production to guarantee revenues that would bring about a radical change in Argentina's economic and social status . In order to guarantee its success, a context of favourable oil prices and the fluid arrival of foreign investors are needed. Two variables that cannot be taken for granted given Argentina's political context and the increasingly strong decarbonisation policy of traditional oil companies.

The big question now is how to reconcile the large-scale fossil fuel development with Argentina's latest commitments on climate change subject : to reduce CO2 emissions by 19% by 2030 and achieve carbon neutrality by 2050. Similarly, the promising trajectory of renewable energy development during Mauricio Macri's presidency may lose momentum if the oil and gas sector attracts public and private investment, crowding out solar and wind.

Vaca Muerta is likely to advance slowly but surely as international oil prices stabilise upwards. The possibility of generating foreign currency and boosting a Economics on the verge of collapse should not be underestimated, but expecting Vaca Muerta to solve Argentina's problems on its own can only end in a new episode of frustration in the southern country.