The high incidence of Covid-19 in the country contrasts with the government's swiftness in implementing measures

Peru has been an example in the Covid-19 crisis for its speed in applying containment measures and for approve one of the largest economic stimulus packages in the world, close to 17% of GDP. However, the high incidence of the pandemic, which has made Peru the second Latin American country in coronavirus cases and the third in deaths, has made it necessary to prolong the restrictions on activity longer than expected. This and lower external demand, weaker than initially forecast, have "more than eclipsed" the government's significant economic support, according to the IMF, which forecasts a 13.9% drop in GDP for Peru in 2020, the largest of the region's main economies.

![lecture by Peruvian President Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru]. lecture by Peruvian President Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru].](/documents/10174/16849987/peru-covid-blog.jpg)

lecture by Peruvian President Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru] [Gov. of Peru].

ARTICLE / Gabriela Pajuelo

International media such as Bloomberg y The Wall Street Journal have shown admiration for Peru's young Economics Minister, Maria Antonieta Alva. At 35, after a master's degree from Harvard and some experience in Peru's own administration, Alva designed one of the most ambitious economic stimulus plans in all of South America at the beginning of the crisis.

"From a Latin perspective, Peru is a clear leader in terms of macro response; I could have imagined a very different result if Toni wasn't there," he said. Ricardo Hausmannwho was Alva's professor during his stay at Harvard and leads a team of experts advising Peru and ten other countries to mitigate the effects of the coronavirus. The minister has also become one of the best known faces of President Martin Vizcarra's government among the popular classes.

Peru was one of the first countries in Latin America to apply a state of emergency, limiting freedom of meeting and transit in Peruvian territory and restricting economic activity. To prevent the massive spread of the virus, the government decreed the closure of borders, restrictions on interprovincial movement, a daily curfew and a mandatory period of national isolation, which has been extended several times and has become one of the longest in the world.

This extension, which was agreed upon due to the high incidence of the pandemic, has damaged the economic outlook more than expected. In addition, the prolongation of the emergency in countries to which Peruvian exports are destined has weakened their demand for raw materials and damaged the resurgence of Peru's Economics . This is what the IMF estimates, which between its April forecast and the one updated in June has added nine more points to the fall in Peruvian GDP for 2020. The IMF now considers that Peruvian Economics will fall by 13.9% this year, the highest among the region's main countries. Although the ambitious stimulus package will not have prevented this decline, it will boost the recovery, with a GDP increase of 6.5% in 2021, in turn the strongest rebound among the largest Latin American economies. Regarding this last forecast, the IMF specifies that, nevertheless, "there are significant leave risks, linked to national and global challenges to control the epidemic".

A socioeconomic context that does not financial aid to confinement

Despite restrictive social distancing measures, the pandemic has had a high incidence in Peru, with 268,602 diagnosed cases (in Latin America, second only to Brazil) and 8,761 deaths (behind Brazil and Mexico) as of June 25. These high figures are partly due to the fact that the country's socioeconomic conditions have meant that compliance with containment has not been very strict in certain situations. The social context has hindered compliance with mandatory quarantine due to structural problems such as the fragility of health services and infrastructure, the difficulty in making efficient public purchases, prison overcrowding and the digital divide.

The high level of labor informalityThe fact that in 2019 it was 72%, explains why many people must continue working to ensure their subsistence, without following certain protocols or access to certain material; at the same time, this informality prevents greater tax collection that would help to improve budget items such as healthcare. Peru is the second Latin American country with the lowest investment in healthcare.

On the other hand, inequalityThe Gini index, which in 2018 was 42.8, is aggravated by the territorial distribution of the expense, linked to the centralization of employment of the rural population in Lima. During the pandemic, workers from the country's highlands who have migrated to the capital have wanted to return to their places of origin, as many are not on the payroll and do not have labor rights, in contravention of mobility restrictions.

This social context makes it possible to question some of the approved economic measures, according to some Peruvian academics. The president of the Peruvian Institute of Economics (IPE), Roberto Abusada, warned that Peru's macroeconomic strengths will not help forever. He considered that certain regulations cannot be complied withThe "setting parameters such as body mass index (BMI) or an age limit generates obstacles for this group of people, who could be highly qualified, and could not return to their workcenter".

Economic package

At the end of April, Minister Alva presented a $26 billion economic stimulus package, representing 12% of GDP. Additional measures raised this percentage to 14.4% of GDP a month later, and even then it would have been closer to 17%. Comparatively, this is one of the largest stimulus packages adopted in the world (in Latin America, the second country is Brazil, with a stimulus of 11.5% of GDP).

In agreement with the monitoring that the IMF Peru has adopted measures in three different areas: fiscal, monetary and macro-financial, and in terms of the exchange rate and balance of payments.

First, in terms of fiscal measures, the government approved 1.1 billion soles (0.14% of GDP) to address the health emergency. In addition, different measures have been implemented, among which two stand out: the "Stay in your home" bonus and the creation of the Business Support Fund for Micro and Small Enterprises (FAE-MYPE).

The first measure, for which the government approved approximately 3.4 billion soles (0.4% of GDP) in direct transfers, is a 380 soles (US$110) bond, targeted at poor households and vulnerable populations, of which there have been two disbursements. The second measure refers to the creation of a fund of 300 million soles (0.04% of GDP) to support MSEs, in an attempt to guarantee credit for work capital and to restructure or refinance their debts.

Among other fiscal measures, the government approved a three-month extension of the income tax declaration for SMEs, some flexibility for companies and households in the payment of tax obligations, and a deferral of household electricity and water payments. The entire fiscal support package accounts for more than 7% of GDP.

On the other hand, in terms of monetary and macro-financial measures, the Central reservation Bank (BCR) reduced the reserve requirement rate by 200 basis points, bringing it to 4%, and is monitoring the evolution of inflation and its determinants to increase monetary stimulus if necessary. It has also reduced reserve requirements , provided liquidity to the system with a package backed by government guarantees of 60 billion soles (more than 8% of GDP) to support loans and the chain of payments.

In addition, exchange rate and balance of payments measures have been implemented through the BCR's intervention in the foreign exchange market. By May 28, the BCR had sold approximately US$2 billion (0.9% of GDP) in foreign exchange swaps. International reserves remain significant at over 30% of GDP.

On the other hand, in the area of trade relations, Peru agreed not to impose restrictions on foreign trade operations, while liberalizing the loading of goods, speeding up the issuance of certificates of origin, temporarily eliminating some tariffs and waiving various infractions and penalties contained in the General Customs Law. This was especially true for transactions with strategic partners, as the European UnionAccording to Alberto Almendres, the president of Eurochambres (the association of European Chambers in Peru). 50% of foreign investment in Peru comes from Europe.

Peruvian exports, although the emergence of the coronavirus in China at the beginning of the year led to a slowdown in transactions with that country, mining and agricultural exports remained positive. in the first two months of the yearas indicated by the research and development Institute of Foreign Trade of the Lima Chamber of Commerce (Idexcam). Subsequently, the impact has been greater, especially in the case of raw material exports and tourism.

Comparison with Chile and Colombia

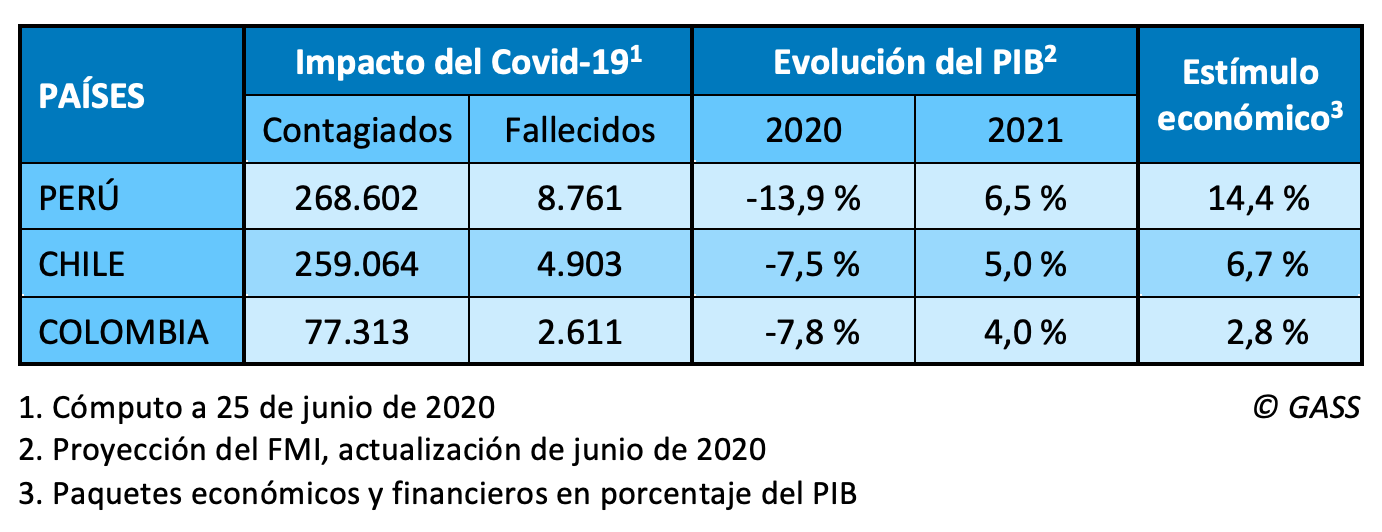

The status in Peru can be analyzed in comparison with its neighbors Chile and Colombia, which will have a somewhat smaller drop in GDP in 2020, although their recovery will also be somewhat smaller.

In terms of the issue of confirmed Covid-19 cases as of June 25, Chile (259,064 cases) is similar in size to Peru (268,602), although the issue of deaths is almost half (4,903 Chileans and 8,761 Peruvians), which corresponds to the proportion of its total population.

In response to the pandemic, Chilean authorities implemented a series of measures, including the declaration of a state of catastrophe, travel restrictions, school closures, curfews and bans on public gatherings, and a telework law. This crisis came only a few months after the social unrest experienced in the country in the last quarter of 2019.

On the economic front, Chile approved a stimulus of 6.7% of GDP. On March 19, the authorities presented a fiscal package of up to US$11.75 billion focused on supporting corporate employment and liquidity (4.7% of OPIB), and on April 8, an additional US$2 billion of financial aid to vulnerable households was announced, as well as a credit guarantee scheme of US$3 billion (2%). In its June forecast update , the IMF expects Chile's GDP to fall by 7.5% in 2020 and increase by 5% in 2021.

As for Colombia, the level of contagion has been lower (77,313 cases and 2,611 deaths), and its economic package to deal with the crisis has also been smaller: 2.8% of GDP. The Government created a National Emergency Mitigation Fund, which will be partially financed by regional and stabilization funds (about 1.5% of GDP), complemented by the issuance of national bonds and other budgetary resources (1.3%). In its recent update, the IMF forecasts that Colombia's GDP will fall by 7.8% in 2020 and rise by 4% in 2021.