-

Half of those who pay subscribe to two or more digital media.

-

For the third consecutive year, the percentage of Spaniards who never pay (neither digital nor printed information) stagnated at 66%.

-

The main motivation for subscribing to digital news is the preference for specific journalists (34%), followed by offers and promotions (31%).

-

Those who do not pay would do so if the price of subscriptions were lowered (20%) or the quality of journalistic content increased (17%).

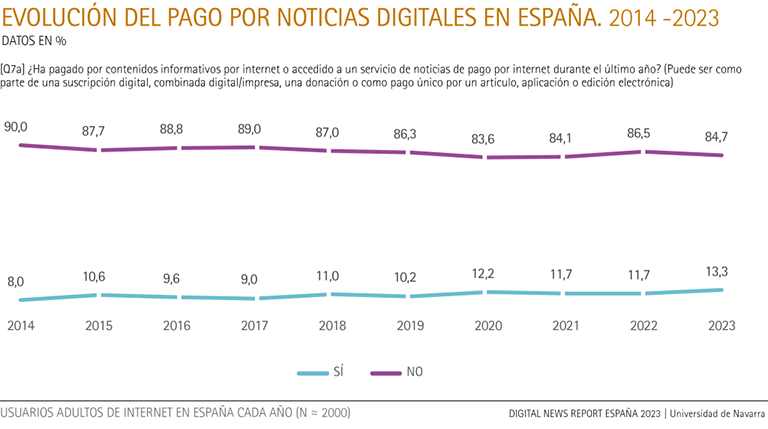

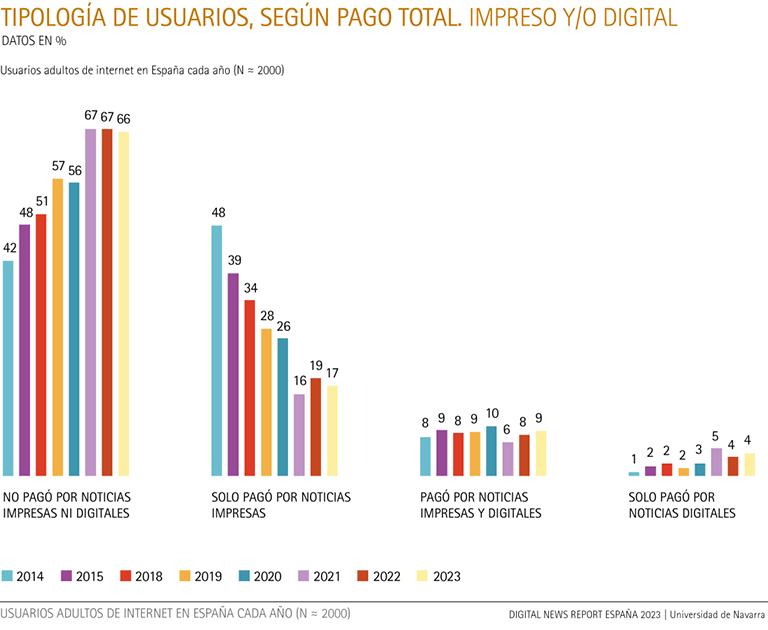

It seems that little by little the payment for digital news in Spain is starting to wake up, three years after the main digital media in the country changed their free income model for another based on subscription or donation. Thus, 13.3% of respondents paid for digital news in 2022, compared to 84.7% who did not. This is the highest percentage of payment in the historical series, as can be seen in the following graph.

The analysis of the evolution of paid news in Spain from 2014 to 2023 sample two distinct phases. An initial stage from 2014 to 2019 of certain stabilization around 10%, in which interest in paid news is maintained, but there is no significant growth. And a second stage of change towards a subscription model (2020 - 2023). During this period, a growth in the percentage of users paying for news is observed, reaching 13% in 2023. This shift in the revenue model of the main Spanish digital media, both native and traditional, towards a subscription model is undoubtedly driving this increase in paying for news.

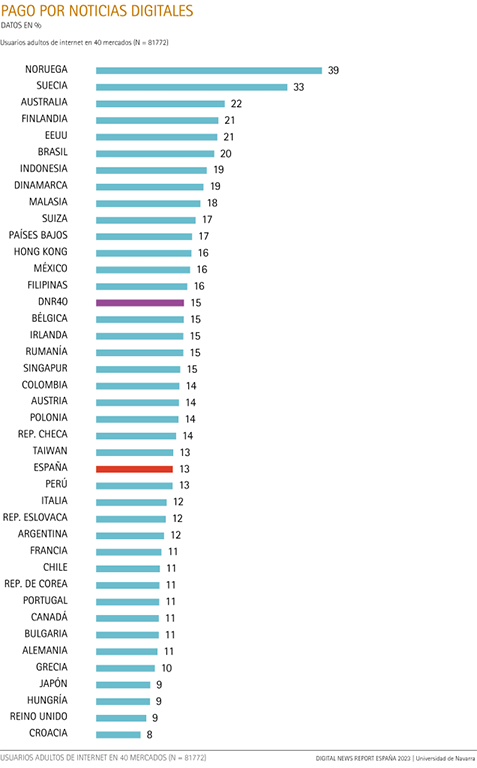

The trend towards greater payment for digital news is not exclusive to Spain. Thus, 15% of all respondents in the countries analyzed paid for this information subject , although there are significant differences by territory. Specifically, the countries with the highest proportion of users who pay for digital news in Europe are Sweden (33%) and Norway (39%), followed by Finland (21%) and outside Europe, other countries such as Australia (22%), the United States (21%) and Brazil (20%). In contrast, the countries with the lowest number of digital news payments are Croatia (8%), United Kingdom (9%), Hungary (9%), Japan (9%) and Greece (10%).

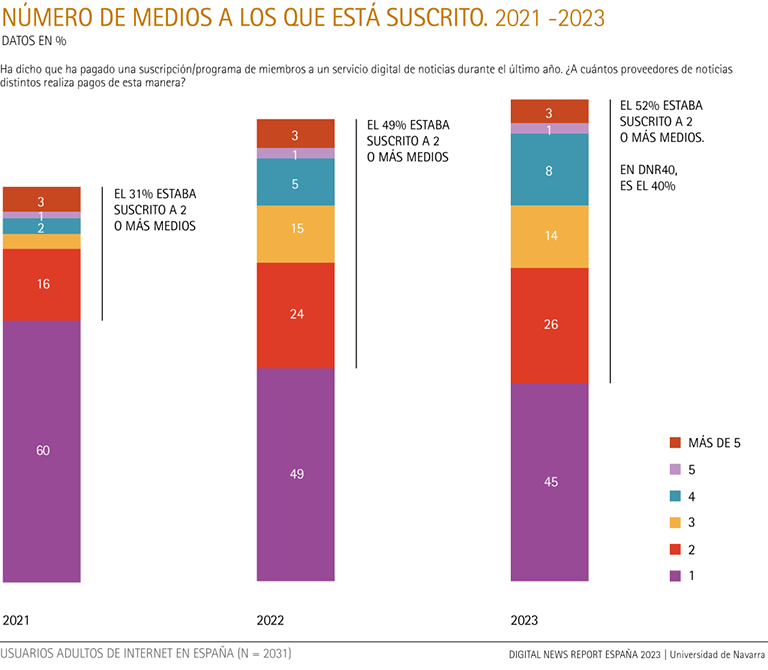

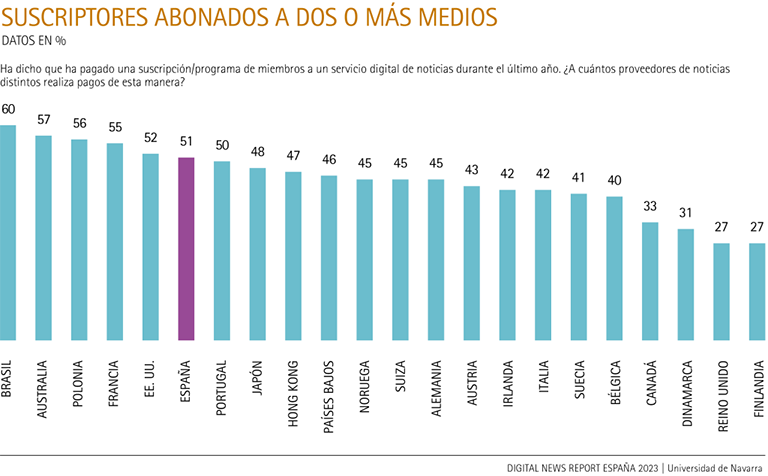

The majority of subscribers (52%) are subscribers to two or more media outlets

Another indicator that the shift to model of revenues is beginning to pay off is the issue of brands to which those who pay for digital news are subscribed. In the case of Spain, 52% of those who pay for this information subscribe to two or more media, and 26% subscribe to three or more news sources. In comparison with the rest of the countries, Spaniards who pay for news subscribe to more media than the rest of the countries, where 45% pay to two media and 20% to three or more (see graph). At summary, Spain is one of the countries where those who pay for news subscribe to more and more media.

Looking at the evolution since 2021, it can be seen that not only the issue of people willing to pay for digital news is progressively increasing, but also the issue of media to which they subscribe. Thus, while in 2021 31% of subscribers were subscribed to two or more media, in 2023 this figure has increased to 52%, almost twenty percentage points more. And the progression is similar among those who subscribe to three or more news services, rising from 14% in 2021 to 26% in 2023.

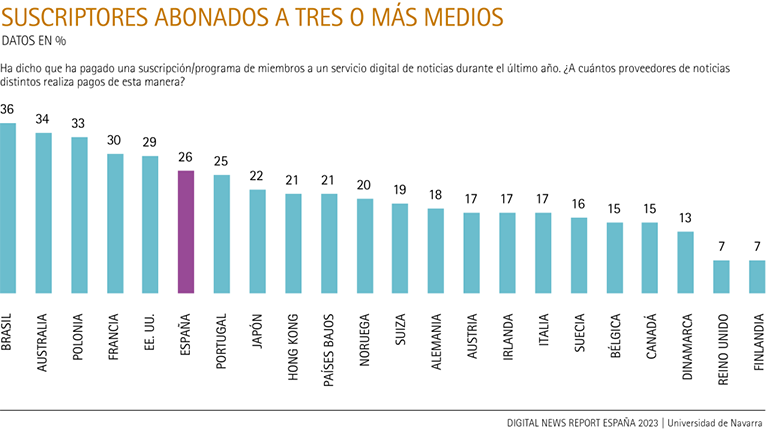

As can be seen in the following graphs, Spain is among the countries with the highest issue of subscribers with three or more media (graph), surpassed only by Brazil, Australia, Poland, France and the USA.

In terms of those who pay for two or more digital news services, Spain ranks fifth out of the 22 countries where this question was asked, behind only Brazil, Australia, the U.S. and Poland.

The profile of digital news buyers

As in the case of print news buyers, we are interested in the main sociodemographic characteristics of those Spanish respondents who say they have paid for digital news in the last year.

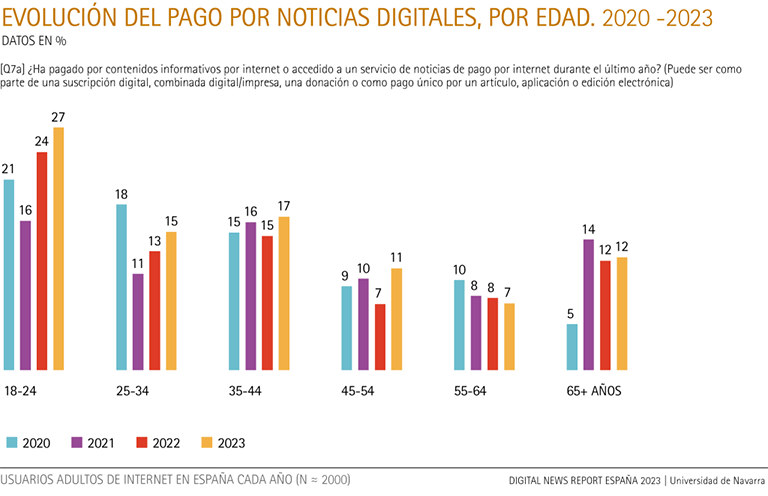

In terms of age (see graph), young people between the ages of 18 and 24 show a greater propensity to pay for digital information. It is not only the group that pays the most (27% in 2023) but also the one in which payment has increased the fastest in the last three years (eleven percentage points). It is followed by the group of respondents aged 35 to 44 (17%) and those aged 25 to 34 (15%). Finally, those over 65 show a relatively moderate tendency to pay for this digital news subject (12%).

Therefore, age seems to be an influential factor in the probability of paying for digital news. So are gender (64% of those who pay are men compared to 46% of women), economic level and educational: those who pay have a high economic level (35%) and high level (42%). educational (42%).

Confident and interested in the news, unconcerned about disinformation

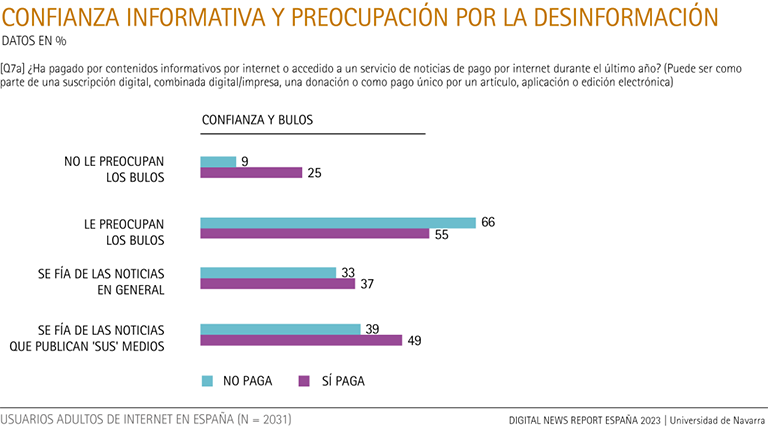

The level of trust in news and concerns about misinformation also differentiate those who pay from those who do not. Those who pay for digital news tend to trust news more in general (37%) and news published by their favorite media outlets (49%). Likewise, paid digital news consumers are more likely to consider themselves extremely interested in news (72% vs. 49%) and politics (50% vs. 27%). They also check the news more frequently throughout the day (36% of those who pay check the news more than 6 times a day, compared to 12% of those who don't pay).

However, there is an opposite trend in terms of concern about hoaxes. Those who do not pay for digital news seem more concerned about disinformation (66% vs. 55%), while those who pay show greater indifference to this problem (25% vs. 9%) (see graph).

News habits of those who pay for digital news

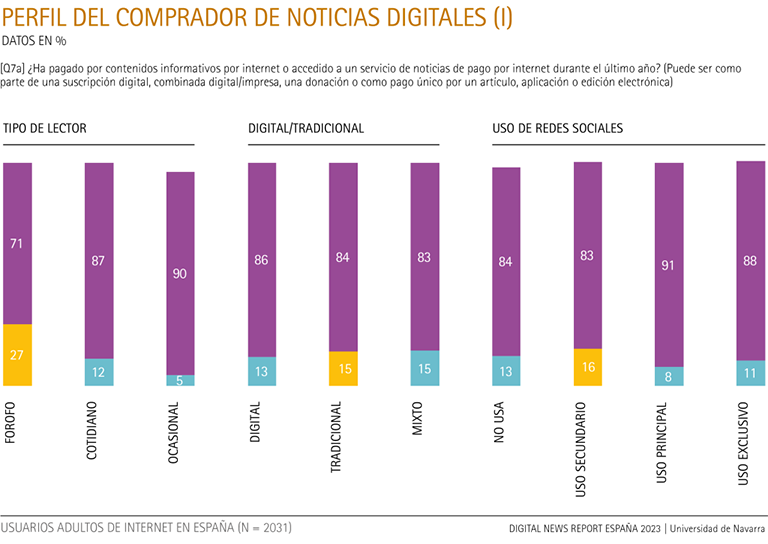

The way in which digital news consumers interact with the media also varies. The digital news buyer tends to show a higher frequency and intensity of information consumption than occasional or daily readers (see graph). Thus, 27% of those labeled as news fans, with a high consumption of information, bought digital news, compared to 12% of daily readers or 5% of occasional users of information. All these data suggest that the frequency and dedication to reading news is linked to the willingness to pay for digital news content.

In terms of subject of news sources used to stay up to date, data seems to indicate that format is not a decisive factor in determining whether or not a person will pay for digital news. Those who are informed by digital or traditional formats are just as likely to pay for news (15%) as purely digital consumers (13%) or traditional media users (15%).

However, differences are observed in the use of social networks as an informative source . Thus, users who use social networks as a secondary information source are more likely to pay for digital news (16%) compared to those who use them as a primary (8%) or exclusive (11%) use. This could indicate that users who rely less on social networks for news may be more willing to pay for digital news content.

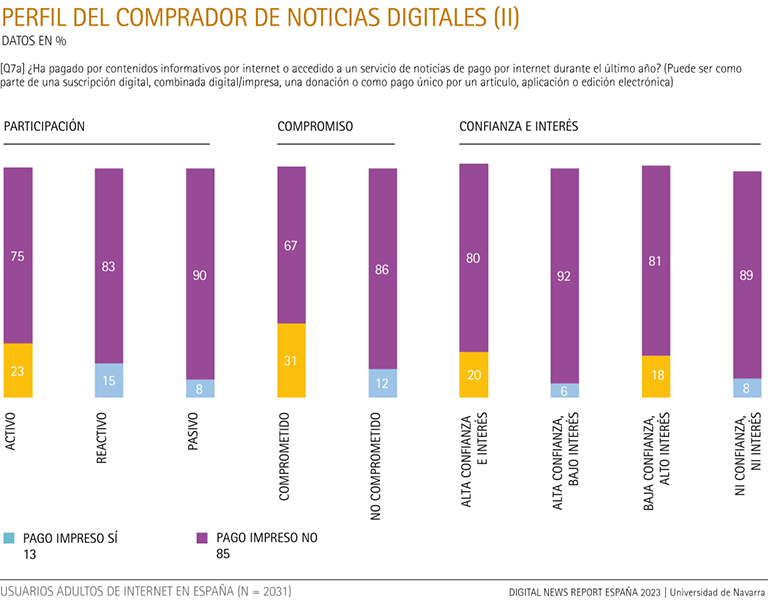

Regarding the level of reader engagement, it appears that those who are more active, i.e., who respond to and participate more in the discussion of the news, are more likely to pay for digital news (23%). This could indicate that individuals who feel more engaged with the news and the discussion around it are more willing to support journalism by paying for content.

Engagement appears to play a significant role in the willingness to pay for digital news. Those who are engaged or committed are significantly more likely to pay for digital news (31%) compared to those who are not (12%). This suggests that the level of connection to a news outlet may be an important factor influencing willingness to pay for digital news.

Finally, levels of interest in news also appear to be correlated with willingness to pay for digital news, as was the case for print news buyers. Individuals who report high trust and interest in news are more likely to pay for digital news (20%), followed by those who report leave trust but high interest (18%), compared to those with high trust but low interest (6%) or no trust and no interest (8%).

At summary, data reveals that Spaniards who acquire digital news tend to have a relative trust in information and a more marked interest in news and politics. Although they show less concern for disinformation, they maintain a frequent and active news consumption. Although format does not appear to be a crucial factor in their payment decision, those who use social networks as a secondary information source are more likely to purchase digital news than those who are informed exclusively through social media. Finally, engagement and interest in news seem to be factors that incentivize willingness to pay for digital news content.

Type of users, according to total paid (digital and/or printed news)

The data of 2023 shows a certain stability in the subject of users who pay (or not) in Spain. Thus, it is not surprising that the largest group is made up of those who say they never pay, neither for print nor for digital news (66%). Secondly, the loss of readers who pay only for print news seems to have stabilized, at around 17% of respondents, while the group of dual readers, who paid for both print and digital news, grew slightly (9%) and the group of those who paid exclusively for digital news remained at 4%.

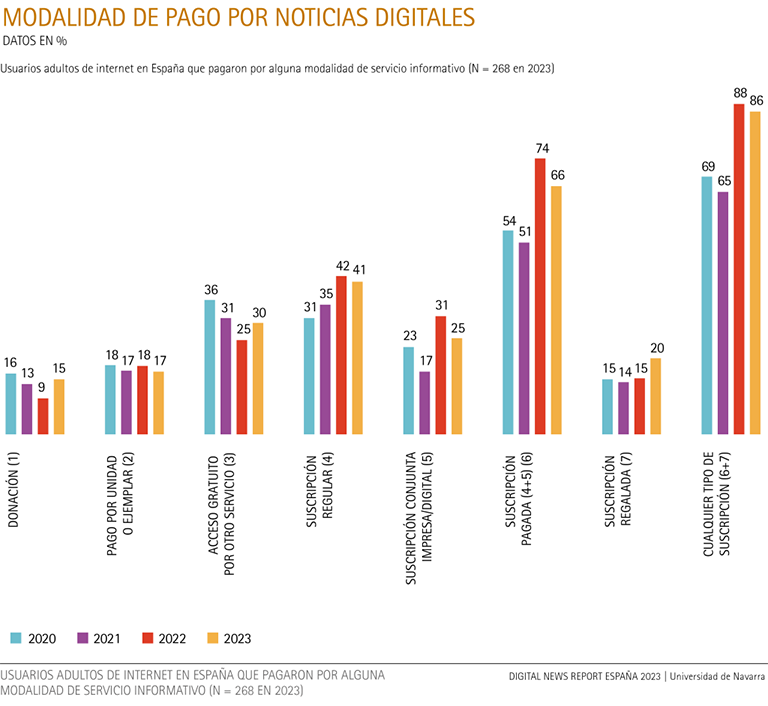

Payment methods for digital news

In Spain, the most widespread payment modality to access digital news continues to be the paid subscription, either regular (41%), joint with the print edition (25%), or free (20%). In total, 86% of those who pay do so through some subscription modality . Also noteworthy is the B increase in 2023 of payment by donation, from 9% in 2022 to 15% today.

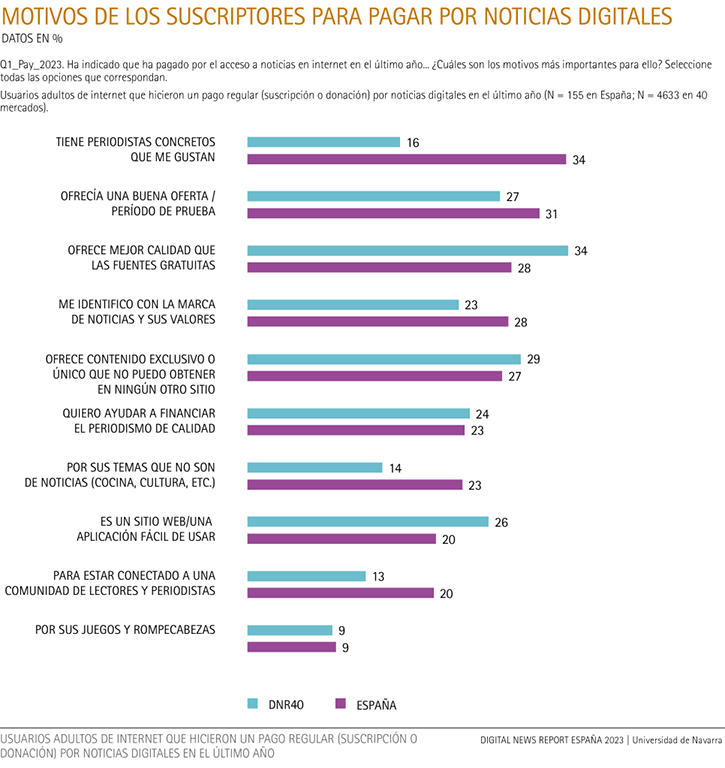

Reasons to subscribe

As will be seen below, subscribers in Spain tend to be motivated by a combination of factors including preference for specific journalists, the availability of good economic offers, the quality and exclusivity of the content and identification with the brand values. In contrast, subscribers in the other countries seem to give more weight to the quality of the content and the ease of use of the website or app. However, they place less importance on individual journalists, connection to the community of readers and journalists, and access to non-news content.

In Spain, the main motivation for subscribing to digital news is a preference for specific journalists, with 34% of respondents citing this factor. This is significantly higher compared to subscribers in the other 40 countries where this question was asked, where only 16% mentioned specific journalists as a reason for subscribing. This suggests that the personality and style of journalists may have a considerable impact on the decision to subscribe in Spain.

In addition to the preference for specific journalists, quality and exclusivity of content were also important motivations in Spain. Some 28% of subscribers mentioned that they subscribe because the service offers better quality than free sources or because they can get exclusive or unique content not accessible in other media (27%). Although these reasons are also important in the other countries, there are some differences. For example, a higher proportion of subscribers in the other countries (34%) mentioned the quality of the content compared to 28% in Spain. Finally, identification with the journalistic brand and its values is a more relevant reason for Spanish subscribers (28%) than in the rest of the countries (23%).

Along with the more journalistic-related reasons, Spaniards subscribe for economic incentives, especially for the availability of a good economic offer or a period of test (31%). In comparison, this reason was less prevalent among subscribers from the rest of the countries, with only 27% mentioning offers as a motivation core topic.

Finally, other motivations, such as being connected to a community of readers and journalists (20% in Spain vs. 13% in the rest of the countries) and having access to non-news content, such as cooking and culture (23% in Spain vs. 14%), were significantly more important for subscribers in Spain compared to the rest.

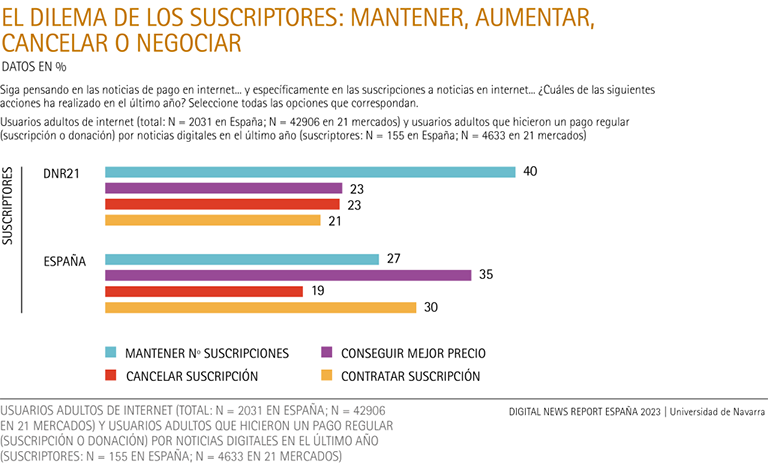

The subscriber dilemma: maintain, increase, cancel or negotiate

The higher relative increase in subscriptions in Spain compared to the rest of the report countries is largely explained by their performance over the last year with respect to their subscription portfolio. In Spain, the most prominent trend is the intention to negotiate a better price, with 35% of subscribers seeking this result. This suggests, as noted above, that price is a significant factor in Spanish subscribers' decisions. In contrast, only 23% of subscribers in the 21 countries where this question was asked expressed a similar interest in getting better prices, which could indicate a greater willingness to pay higher prices in these countries, or that they have fewer opportunities or skills to negotiate price.

Taking out new subscriptions was also a common action in Spain, with 30% of subscribers indicating this intention. However, this action was less common in the other countries where only 21% took out a new subscription. This difference could be indicative of a more dynamic market in Spain, with more subscribers willing to explore new options.

In terms of subscription cancellations, 19% of subscribers in Spain cancelled a subscription, compared to a slightly higher percentage of 23% in the other countries. This small difference could reflect differences in customer satisfaction, the quality of subscription offers or the ease of cancellation.

As result of the above trends, keeping issue of existing subscriptions was less common in Spain (27%) compared to the rest of the countries (40%). This suggests that digital news subscribers in Spain are more focused on getting better prices and are more willing to take out new subscriptions compared to the rest of the countries.

Reasons to subscribe in the future

In most countries, including Spain, economic incentives are the most frequently cited by non-subscribers to subscribe to digital news, suggesting that cost remains a significant barrier to subscription or donation. In Spain, 20% of respondents would subscribe if it were cheaper (22% in all other countries) and 8% would subscribe if they could pay a flat rate to access multiple news sites (14% in all other countries). In relation to the price, the possibility of flexibly sharing the fee with other people is also mentioned by 9% of respondents, both in Spain and in the rest of the countries.

The second motivating factor in Spain to subscribe to digital news is the relevance and interest of the content, selected by 17% of respondents, or the possibility of finding more exclusive content not accessible in free sources (13% vs 11% in other countries).

It should be noted that, in both groups, a large proportion of respondents (45% in Spain and 42% in the rest of the countries) selected neither of these options, suggesting that there is a significant segment of the population that is resistant to subscribing to digital news, regardless of the possible advantages offered. To attract this group, digital news providers may need to explore other motivations or barriers not mentioned in this survey.

International comparison

In general terms, the reasons fall into three categories: price, payment flexibility , and content. From average, price is the most common reason for subscribing in the 21 countries analyzed (32%), followed by content (22%) and flexibility in payment modality (19%). This suggests that overall, subscription cost is the main concern for digital news users internationally.

As we have seen, in the case of Spain, price is also the most determining factor (30%), although it is slightly less influential than in the overall average , especially when compared with its European neighbors. Compared to the southern and central European countries analyzed, Spaniards are more concerned about content (25%), with the exception of Switzerland and Poland. As for Northern European countries, price is much more relevant in this region compared to Spain. In fact, Norway has the highest rate of interest in price (50%) of all the countries studied.