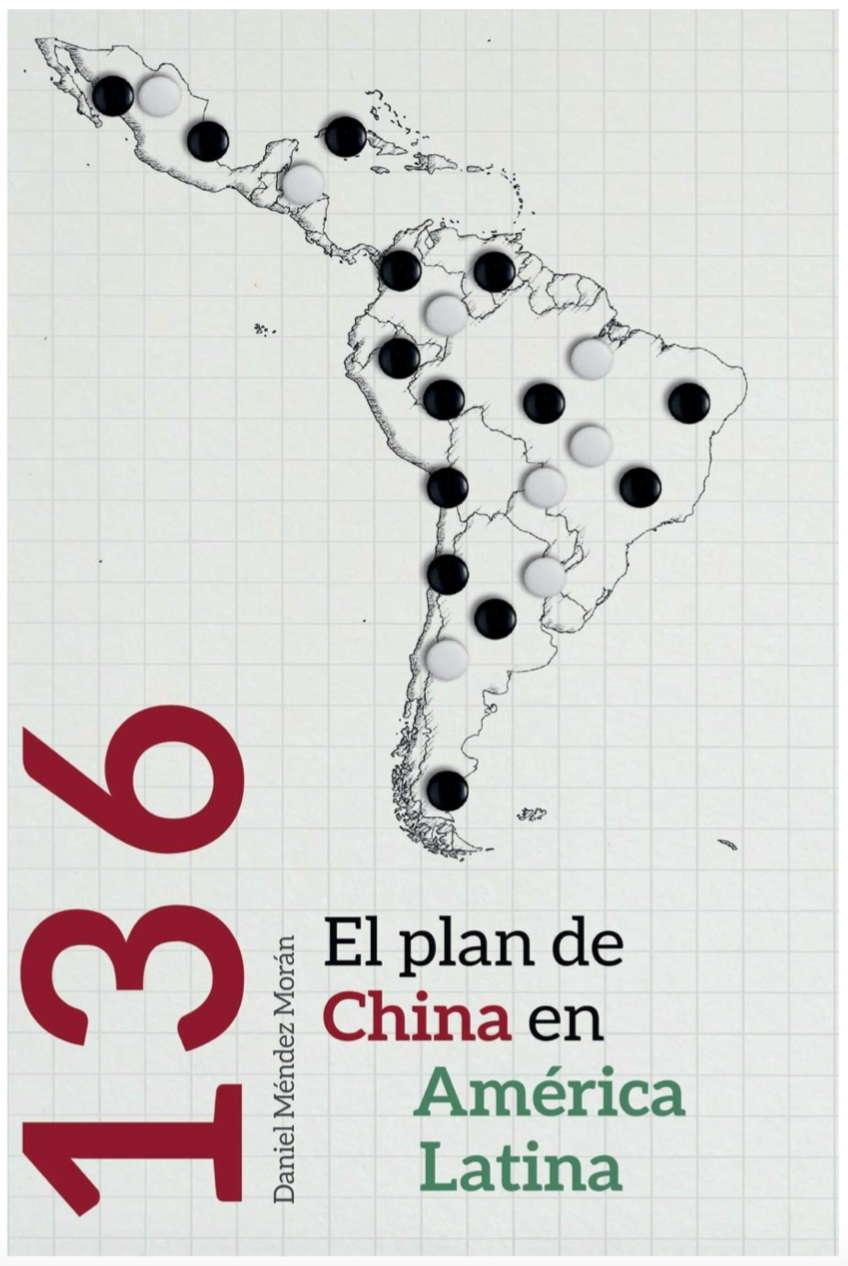

[Daniel Méndez Morán, 136. China's plan in Latin America (2018), 410 pages].

review / Jimena Puga

By means of a first-person on-the-ground research and the testimony staff of Chinese and Latin Americans, who give the story the character of a documented report, Daniel Méndez summarises in detail the mark that the growing Asian superpower is leaving in the region. This gives the reader an insight into the relations between the two cultures from an economic and, above all, political point of view. The figure of degree scroll -136- is the issue that, according to the author, Beijing assigns to its plan for Latin America, in its planning of different sectoral and geographical expansion programmes around the world.

The book begins by briefly reflecting on China's rapid growth since the death of Mao Zedong and thanks to Deng Xiaoping's growth and opening-up policies between 1980 and 2000. This resurgence has not only been reflected in China's Economics but also in society. The new generations of Chinese professionals are better educated training and more fluent in foreign languages than their elders, and therefore better prepared for International Office. However, Liu Rutao, Economic and Commercial Counsellor at the Chinese Embassy in Chile explains to the author that "the history of China's going abroad is only fifteen years old, so neither the government nor the companies have a very mature thinking on how to act abroad, so we all need to study".

However, the country's short experience in the international arena is not an obstacle since, as the book shows, China has a very effective shortcut to accelerate this learning process: money. In fact, the goal of many of the most important Chinese investments in Latin America is not only access to natural resources, but also to human capital and, above all, to knowledge. Thanks to their huge financial resources, Chinese companies are acquiring companies with experience and contacts in the Americas, hiring the best professionals in each country and buying brands and technologies. "This phase is very difficult. Chinese companies are going to pay to learn. But everything is learned by paying," diplomat Chen Duqing, China's ambassador to Brazil between 2006 and 2009, explained to Méndez.

After this overview, the book moves on to China's relationship with different Latin American partners. In the case of Mexico, there is a struggle against the famous made in China. The empire at the centre went to Mexico 40 years ago to study the maquiladora programme; when they returned, Méndez explains, they said: "Mexico is doing that for the United States, we are going to do it for the world". And so, a few years later, China designed and improved the strategy. There is little doubt that made in China has won the day over Mexican maquiladoras, and it is all these decades of skill and frustration that explain the complex political relations between the two countries. This is what the people interviewed by the author testify to. To Jorge Guajardo, this model reminds him of the colonial order imposed by Spain and continued by the United Kingdom: "I sometimes said to the Chinese: 'Gentlemen, you cannot see America: Gentlemen, you cannot see Latin America as anything other than a place where you go for natural resources and in return you send manufactured goods. We were already a colony. And we didn't like it, it didn't work. And we chose to stop being one. You don't want to repeat that model".

The result of these new tensions is that neither country has achieved what it was looking for. Mexico has barely increased its exports to China and the Asian giant has barely increased its investments in the Latin American country. In 2017 there were only 30 Chinese companies installed in Mexico, a very small number compared to the 200 in Peru. Other diplomats on the continent recognise that in any international meeting where both countries are present, the Latin American country is always the most reluctant to accept Beijing's proposals. For China, Mexican 'resistance' is perhaps its biggest diplomatic stumbling block in the region: the best example that its rise has not benefited all countries in the South.

Méndez says that, unlike Mexico, Peru's mining strategy has found an ideal partner on the other side of the Pacific. In need of minerals to feed its industry and build new cities, China's huge demand has pulled strongly on the Peruvian Economics . Between 2004 and 2017, trade between the two countries increased tenfold and the Asian giant became Peru's first commercial partner . China is no longer only important for its demand for copper, lead and zinc, but also for its investment flows and its capacity to implement mining projects. These financial conditions, which are very difficult to obtain from private banks, are often the comparative advantage that allows Chinese state-owned companies to beat their Western competitors.

What does this mean for Latin America, and should Latin American countries be concerned about this political and economic strategy that invests massively in their natural resources through state-owned companies? As the book points out, many diplomats think it is necessary to be vigilant. Unlike private companies, whose primary goal aim is to make profits and submit dividends to their shareholders, Chinese companies are ultimately written request controlled by politicians who may have another diary. In this sense, the expansion of so many state-owned companies in natural resources can also become a weapon of pressure and influence.

If a Latin American leader, for example, decides to meet with the Dalai Lama or opposes a diplomatic initiative led by Beijing, the Asian giant could use its state-owned companies in retaliation, warns Méndez. In the same way that if the Peruvian government wanted to cancel some project chimo for labour or environmental infractions, Beijing could threaten to deny approval of phytosanitary protocols or delay other investments. Moreover, China is increasingly aware that its image, its capacity for persuasion and its cultural attractiveness (soft power) are vital to expand its political and economic project .

On the other hand, further south in the region, Uruguay has become the perfect laboratory for China. Uruguayan factories are prepared for short production runs of a few thousand cars, the country has a specialised workforce and the good infrastructure means that in a very short time it is possible to set up plants in Brazil or Argentina. It should be borne in mind that Chinese companies are still little known in Latin America and do not have many financial resources, and in Uruguay they can test the market.

As for Brazil, Méndez speaks especially of the diplomacy of satellites. Satellites are not only useful for bringing television to homes and for using GPS on mobile phones, but also for their military capabilities and the political prestige they imply. Brazil has collaborated with other countries such as Argentina and the United States, but political and economic tensions almost always limit space cooperation. Paradoxically, in the case of China, distance seems to be a blessing as there are no geopolitical problems between the two: sometimes it is more difficult to work with your neighbours than with people who are far away. For Beijing, space missions serve to enhance all dimensions of its power: it increases its military capabilities and contributes to its space industry and competitiveness in an economic sector with a bright future. And finally, it also serves as a public relations campaign in the world. However, the technological and economic differences are becoming so apparent that even China is outgrowing the South American giant.

From a geostrategic point of view, Méndez does not want to miss the construction of a Chinese space station on a 200-hectare plot of land in the Argentinean province of Neuquén, which has an initial investment of 50 million dollars and is part of China's moon exploration programme. Moreover, Argentina is the only country in which the presence of the Industrial and Commercial Bank of China is so popular in society. B . This Chinese bank has managed to offer the same services as any other banking institution in Argentina.

Finally, Chile is one of the countries with which Beijing has the best relations, but why does China not invest in Chile? The answer is simple. Investment processes in Chile are clear, transparent and equal for all countries. There are no exceptions and investors have to follow complex legal regulations to the letter. The business culture is different, and the Chinese don't like the idea of needing lawyers and 20,000 permits for everything. They like to pay bribes, and in Chile corruption provokes a lot of indignation.

Throughout this country-by-country analysis, the author has made one thing clear: China has a plan. Or at least, it has been able to bet for decades on the training of officials with the goal of designing a strategy in Latin America. This capacity for planning and these long-term objectives deadline have helped the Asian giant to advance its position in recent years and leave a deep mark on many countries in the American continent. And what does the plan consist of? It is clear that China's goal issue one is economic. It has managed to successfully "sneak" into the three major trade blocs that include Latin American countries: NAFTA, the Pacific Alliance and Mercosur.

But Economics per se is not the only thing that drives China. To achieve its economic goals, Beijing also needs to build political relations and allies that can defend its diplomatic positions. Its defence of non-interference in internal affairs and a multipolar world demands in return the silence of Latin American countries on human rights violations in their country and respect, for example, for the one-China policy. The Asian giant wants to expand all its strengths and is not willing to give up any of them.

In conclusion, whether or not China has a strategy for Latin America, Latin America does not have a strategy for China. And China is not an NGO; if recent history shows anything, it is that each country seeks to defend its own selfish national interests at the International Office level. China has its diary and is pursuing it. Perhaps the time has come for Latin America to have its own.