Ruta de navegación

Blogs

Entries with Categories Global Affairs Articles .

Iranian hackers forged pre-election mailings of the Proud Boys, but the actual post-election performance of this and other groups was more disruptive.

If in the 2016 US presidential election foreign meddling operations were led by Russia, in the 2020 election the focus was on Iranian hackers, because of the novelty they represented in a field of operations where Russians and Chinese were equally active, each pursuing their own interests. In particular, Tehran wanted a defeat for Donald Trump so that his Democratic successor would reverse the tough sanctions regime imposed against the Iranian regime. But these cyberspace actions by Iran, Russia and China were ineffective due to the heightened alertness of US security and intelligence agencies. In the end, these outside attempts to discredit US democracy and undermine voter confidence in its electoral system were dwarfed by the damage caused by the domestic chaos itself.

Assault on the Capitol in Washington on 6 January 2021 [TapTheForwardAssist].

article / María Victoria Andarcia

Russia was always in the US security spotlight during the 2020 election year, after its meddling in the presidential election four years earlier. However, while the main concern remained Russia and there were also fears of an expansion of China's operations, Iran made headlines in some of the warnings issued by the US authorities, probably because of the ease with which they were able to attribute various actions to Iranian actors. Despite this multiple front, the development polling did not yield any evidence that foreign disinformation campaigns had been effective. The swift identification of the actors involved and the offensive reaction by US security and intelligence services could have prevented the 2016 status . As the Atlantic Council has noted, this time 'domestic disinformation overshadowed foreign action'.

Given the direct consequences that Joe Biden's arrival in the White House may have on Washington's policy towards Iran, this article pays more attention to Iran's attempts to affect the US election development . The impact of Iranian operations was minimal and had a smaller profile impact than those carried out by Russia in 2016 (which in turn had less involvement than in previous elections).

Iranian operations

In May and June 2020, the first movements in Microsoft accounts were recorded, as the company itself would later reveal. An Iranian group called Phosphorus had succeeded in gaining access to the accounts of White House employees and Trump's re-election campaign team. These were early signs that Tehran was setting up some kind of cyber operation. subject

In early August, the Center for Counterintelligence and National Security's director , William Evanina, accused Tehran - as well as Moscow and Beijing - of using disinformation on the internet to "influence voters, unleash disorder and undermine public confidence" in the system. Regarding Iran, it said: "We assess that Iran seeks to undermine US democratic institutions and President Trump, and to divide the country ahead of the 2020 election". She added that Iranian efforts were focused on spreading disinformation on social media, where it circulated anti-US content. Evanina attributed the motivation for these actions to Iranian perceptions "that President Trump's re-election would result in a continuation of US pressure on Iran in an effort to encourage regime change".

Following the televised discussion between Trump and Biden on 29 September, Twitter deleted 130 accounts that "appeared to originate in Iran" and whose content, which it had placed on knowledge by the Federal Bureau of Investigation (FBI), was intended to influence public opinion during the discussion presidential election. The company provided only four examples. Two of the accounts were pro-Trump: one Username was @jackQanon (at reference letter to the conspiratorial group QAnon) and the other expressed support for the Proud Boys, a far-right organisation with supremacist links to which Trump had order "be on guard and be vigilant". The other two accounts had expressed pro-Biden messages.

In mid-October, director of National Intelligence, John Ratcliffe, referred on press conference to Iranian and Russian cyber action as a threat to the electoral process. According to Ratcliffe, the Iranian operation consisted primarily of a series of emails purporting to be sent by the group Proud Boys. The emails contained threats of physical force for those who did not vote for Trump, and were intended to instigate violence and damage Trump's image by associating his campaign with radical groups and efforts to intimidate voters. Interestingly, the Proud Boys would later gain prominence for themselves in the post-election rallies in Washington and the takeover of the Capitol.

department While Iranian Foreign Ministry spokesman Said Jatibzadeh denied these accusations, stressing that "Iran is indifferent to who wins the US elections", the US authorities insisted on their version and the US Treasury's Office of Foreign Assets Control (OFAC) sanctioned five Iranian entities for attempting to undermine the presidential elections. According to OFAC'sstatement , the Islamic Revolutionary Guard Corps and the Quds Force used Iranian media as platforms to spread propaganda and disinformation to the US population.

agreement According to OFAC, business Iranian audiovisual media company Bayan Gostar, a regular Revolutionary Guard collaborator, had "planned to influence the election by exploiting social problems within the United States, including the COVID-19 pandemic, and by denigrating US political figures". The Islamic Iranian Radio and Television Union (IRTVU), which OFAC considers a propaganda arm of the Revolutionary Guard, and the International Virtual Media Union "assisted Bayan Gostar in his efforts to reach US audiences". These media outlets "amplified false narratives in English and published derogatory propaganda articles and other content directed at the United States with the intent to sow discord among US audiences".

Post-election performance

The US claims that Iranian interference was not limited to the election, which took place on 3 November (with an unprecedented level of advance and postal voting), but continued in the weeks that followed, seeking to take advantage of the turmoil caused by the Trump administration's questioning of the result election. Days before Christmas, the FBI and department 's Cybersecurity and Infrastructure Security Agency (CISA) revealed that Iran was allegedly behind a website and several social media accounts aimed at provoking further violence against various US officials. The website entitled "Enemies of the People" contained photographs and information staff of both officials and staff from the private sector who were involved in the process of counting and authenticating votes cast in the election, sometimes in the face of allegations of fraud maintained by Trump and his supporters.

The action attributed to Iran can be interpreted as a way to avenge the drone strike ordered by Washington to assassinate Qasem Soleimani, head of the Qurds Force in Iraq, for whose death on 3 January 2020 Tehran had vowed retaliation. But above all it reveals a continuing effort by Iran to alleviate the effects of the Trump-driven US policy of 'maximum pressure'. Given Biden's stated intention during the election campaign to change US foreign policy towards the Islamic Republic, the latter would have the opportunity to receive a looser US attention if Trump lost the presidential election. Biden had indicated that if he came to power he would change policy towards Iran, possibly returning to the nuclear agreement signed in 2015 on the condition that Iran respect the limits on its nuclear programme agreed at the time. The Joint Comprehensive Plan of Action (JCPOA) was considered a milestone in the foreign policy of then President Barack Obama, but then the Trump administration decided not to respect it because it considered that issues such as Iran's missile development and its military interference in other countries in the region had been left out.

A few days before the inauguration of the new US president, Iranian President Hassan Rohani urged Biden to lift the sanctions imposed on the Islamic Republic and return to the 2015 nuclear agreement . Iran hopes that the Biden administration will take the first steps to compensate for the actions of the previous administration and thus move towards a possible understanding between the two nations. The decision to return to agreement will not be made immediately as Biden inherits a divided country and it will take time to reverse Trump's policies. With the Iranian presidential elections approaching in June this year, the Biden administration is buying time to attempt a reformulation that will not be easy, as the context of the Middle East has changed substantially over the past five years.

Narratives from the Kremlin, the Duma and nationalist average embellish Russia's history in an open culture warfare against the West.

Russian average and politicians, influenced by a nationalist ideology, often use Russian history, particularly from the Soviet time, to create a national consciousness and praise themselves for their contributions to world affairs. This often results in manipulation and in a rising hostility between Russia and other countries, especially in Eastern Europe.

A colored version of the picture taken in Berlin by the network Army photographer Yevgueni Khaldei days before the Nazi's capitulation

ARTICLE / José Javier Ramírez

average bias. Russia is in theory a democracy, with the current president Vladimir Vladimirovich Putin having been elected through several general elections. His government, nonetheless, has been accused of restricting freedom of opinion. Russia is ranked 149 out of 179 countriesin the Press Freedom Index, so it is no surprise that main Russian average (Pravda, RT, Sputnik News, ITAR-TASS, ...) are strong supporters of the government's version of history. They have been emphasizing on Russia's glorious military history, notoriously since 2015 when they tried to counter international rejection of the Russian invasion of Crimea appealing to the spirit of the 70th World War II anniversary. On the other side, social networks are not often used: Putin lacks a Twitter account, and the Kremlin accounts' posts are not especially significant nor controversial.

Putin's ideology, often called Putinism, involves a domination of the public sphere by former security and military staff, which has led to almost all average pursuing to justify all Russian external aggressions, and presenting Western countries, traditionally opposed to these policies, as hypocritical and Russophobic. Out of the remarkable exceptions to these pro-government public sphere, we might mention Moscow Today newspaper (whose ideology is rather independent, in no way an actual opposition), and the leader of the Communist faction, Gennady Andreyevich Zyuganov, who was labelled Putin several times as a dictator, without too much success among the electorate.

Early period. Russian average take pride in having an enormously long history, to the extent of having claimed that one of its cities, Derbent, played a key role in several civilizations for two thousand years. However, the first millennium of such a long history often goes unmentioned, due to the lack of sources, and even when the role of the Mongolian Golden Horde is often called into question, perhaps in order to avoid recognizing that there was a time where Russians were subjected to foreign domination. In fact, Yuri Petrov, director of RAS Russian History Institute, has refused to accept that the Mongolian conquest was a colonization, arguing that it was a process of mixing with the Slavic and Mongolian elites.

Such arguments do not prevent TASS, Russian state's official average, from having recognized the battle of Kulikovo (1380) as the beginning of Russian state history, since this was the time where all Russian states came together to gain independence. Similarly, Communist leader Zyuganov stated that Russia is to be thanked for having protected Europe from the Golden Horde's invasion. In other words, Russian average have a contradictory position about the nation's beginning: on one hand, they deny having been conquered by the Mongolian, or prefer not to mention such a topic; on the other, they widely celebrate the defeat of the Golden Horde as a symbol of their freedom and power. Similar contradictions are quite common in such an official history, dominated by nationalist bias.

Czarism. Unlike what might be thought, Russian Czars are held in relative high esteem. Orthodox Church has canonized Nicolas II as a martyr for the "patience and resignation" with which he accepted his execution, while public polls carried by TASS argued that most Russians perceive his execution as barbaric and unnecessary. Pravda has even argued that there has been a manipulation of the last Czar's story both by Communists and the West (mutual accusations of manipulation between Russian and Western average are quite common): according to Pyotr Multatuli, a historian interviewed by Pravda, the last Czar was someone with fatherly love towards its citizens, and he just happened to be betrayed by conspirators, who killed him to justify their legitimacy.

But this nostalgic remembrance is not exclusive solely to the last Czar, there are actually multiple complimentary references to several monarchs: Peter the Great was credited by Putin for introducing honesty and justice as the state agencies principles; Catherine the Great for being a pioneer in experimentation with vaccines, and she was even the first monarch to have been vaccinated; Alexander III created a peaceful and strong Russia... Pravda, one of the most pro-monarchy newspapers, has even argued that Czars were actually more responsible and answerable to society than the USA politicians, or that Napoleon's invasion was not actually defeated by General Winter, but by Alexander I's strategy. The appreciation for the former monarchy might be due to the disappointment with the Soviet era, or in some way promoted by Putin, who since the Crimean crisis inaugurated several statues to honour Princes and Czars, without recognizing their tyranny. This can be understood as a way of presenting himself as a national hero, whose decisions must be obeyed even if they are undemocratic.

USSR. The Soviet Union is the most quoted period in the Russian average, both due to their proximity, and because it is often compared to today's government. Perceptions about this period are quite different and to some extent contradictory. Zyuganov, the Communist leader, praises the Soviet government, considering it even more democratic that Putin's government, and has advocated for a re-Stalinisation of Russia. Nonetheless, that is not the vision shared neither by Putin nor by most average.

Generally speaking, Russian average do not support Communist national policy (President Putin himself once took it as "inappropriate" being called neo-Stalinist). There is a recognition of Soviet crimes while, at the same time, they are accepted as something that simply happened, and to what not too much attention should be drawn. Stalin particularly is the most controversial character and a case of "doublethink": President Putin has attended some events to honour Stalin's victims, while at the same time sponsored textbooks that label him as an effective leader. The result, shown in several polls, is that there is a growing indifference towards Stalin's legacy.

However, the approach is quite different when we talk about the USSR foreign policy, which is considered completely positive. The average praise the Russian bravery in defeating Nazi Germany, and doing it almost alone, and for liberating Eastern Europe. This praise has even been shown in the present: Russian anti-Covid vaccine has been given the name of "Sputnik V", subtly linking Soviet former military technology and advancement to the saving of today's world (the name of the first artificial satellite was already used for the news website and broadcaster Sputnik News). Moreover, Putin himself wrote an essay on the World War II where he argued that all European countries had their piece of fault (even Poland, whose occupation he justifies as politically compulsory) and that criticism of Russia's attitude is just a strategy of Western propaganda to avoid accepting its own responsibilities for the war.

This last point is particularly important in Russian average, who constantly criticize Western for portraying Russia and the Soviet Union as villains. According to RT, for instance, Norway should be much more thankful to Russia for its help, or Germany for Russia's promotion of its unification. The reason for this ingratitude is often pointed to the United States and its imperialism, because it has always feared Russia's strength and independence, according to Sputnik, and has tried to destroy it by all means. The accusations to the US vary among the Russian average, from Pravda's accusation of the 1917 Revolution having been sponsored by Wall Street to destabilize Russia, to RT's complaint that the US took advantage of Boris Yeltsin's pro-Western policies to impose severe economic measures that ruined Russian economy and the citizens' well-being (Pravda is particularly virulent towards the West).

What the European neighbours think. As in most countries, politicians in Russia use their national history mostly to magnify the reputation of the nation among the domestic public opinion and among international audiences, frequently emphasizing more the positive aspects than the negative ones. What distinguishes Russian average is the influence the Government has on them, which results in a remarkable history manipulation. Such manipulation has arrived to create some sort of doublethink: some events that glorify Russia (Czars' achievements, Communist military success, etc.) are frequently quoted and mentioned while, at the same time, the dark side of these same events (Czars' tyranny, Stalin's repression, etc.) is ignored or rejected.

Manipulated Russian history is often incompatible with (manipulated or not) Western history, which has led to mutual accusations of hypocrisy and fake news that have severely undermined the relations between Russia and its Western neighbours (particularly Poland, whom Russia insists to blame to some extent for the World War II and to demand gratitude for the liberation provided by Russia). If Russia wants to strengthen its relationships, it must stop idealizing its national history and try to compare it with the Western version, particularly in topics referring to Communism and the 20th century. Only this way might tensions be eased, and there will be a possibility of fostering cooperation.

A separate chapter on this historical reconciliation should be worked with Russia's neighbours in Eastern Europe. Most of them shifted from Nazi occupation to Communist states, and now they are still consolidating its democracies. Eastern Europe societies have mixed feelings of love and rejection towards Russia, what they don't buy any more is the story of the network Army as a force of liberation.

The inclusion of private investment and the requirement of efficient credits differ from the overwhelming amount of loans from Chinese state banks.

The active role of China as lender to an increasing number of countries has forced the United States to try to compete in this area of "soft power". Until last decade the US was clearly ahead of China in official development assistance, but Beijing has used its state-controlled banks to pour loans into ambitious projects worldwide. In order to better compete with China, Washington has created the US International Development Finance Corporation (USIDFC), combining the US Overseas Private Investment Corporation (OPIC) and with USAID's Development Credit Authority (DCA).

▲ The US agency helped to provide clean, safe, and reliable sanitation for more than 100,000 people in Nairobi, at the end of 2020 [USIDFC].

ARTICLE / Alexandria Casarano

It is not easy to know the complete amount of the international loans given by China in recent years, which skyrocketed from the middle of last decade. Some estimates say that the Chinese state and its subsidiaries have lent about US$ 1.5 trillion in direct loans and trade credits to more than 150 countries around the globe, turning China into the world's largest official creditor.

The two main Chinese foreign investment banks, the Export-Import Bank of China and the China Development Bank, were both established in 1994. The banks have been criticised for their lack of transparency and for blurring the lines between official development assistance (ODA) and commercial financial arrangements. To address this issue, Beijing founded the China International Development Cooperation Agency (CIDCA) in April of 2018. The CIDCA will oversee all Chinese ODA activity, and the Chinese Ministry of Commerce will oversee all commercial financial arrangements going forward.

An additional complaint about Chinese foreign investment concerns "debt-trap diplomacy." Since the PRC first announced its "One Belt One Road" initiative in 2013, the Chinese government has steadily increased its investment in the developing world even more dramatically than it had in the early 2000's (when Chinese foreign aid was increasing annually by approximately 14%). At the 2018 China-Africa Convention Forum, the PCR pledged to invest US$ 60 billion in Africa that year alone. The Wall Street Journal said of the PRC in 2018 that it was "expanding its investments at a pace some consider reckless." Ray Washburn, president of the US Overseas Private Investment Corporation (OPIC), called the Chinese One Belt One Road initiative a "loan-to-own" program. In 2018, this was certainly the case with the Chinese funded Sri Lankan port project, which led the Sri Lankan government to lease the port to Beijing for a 99-year period as a result of falling behind on payments.

OPIC, founded in 1971 under the Nixon administration, was recommended for elimination in the Trump administration's 2017 budget. However, following the beginning of the US-China trade war in 2018, Washington reversed course completely. President Trump's February 2018 budget recommended increasing OPIC's funding and combining it with other government programs. These recommendations manifested themselves in the Better Utilization of Investment Leading to Development (BUILD) Act, which was passed by Congress on October 5, 2018. The Center for Strategic and International Studies (CSIS) called the BUILD Act "the most important piece of U.S. soft power legislation in more than a decade."

The US International Development Finance Corporation

The principal achievement of the BUILD Act was the creation of the US International Development Finance Corporation (USIDFC), which began operation as an independent agency on December 20, 2019. The BUILD Act combined OPIC with USAID's Development Credit Authority to form the USIDFC and established an annual budget of US$ 60 billion for the new organisation, which is more than double OPIC's 2018 budget of US$ 29 billion.

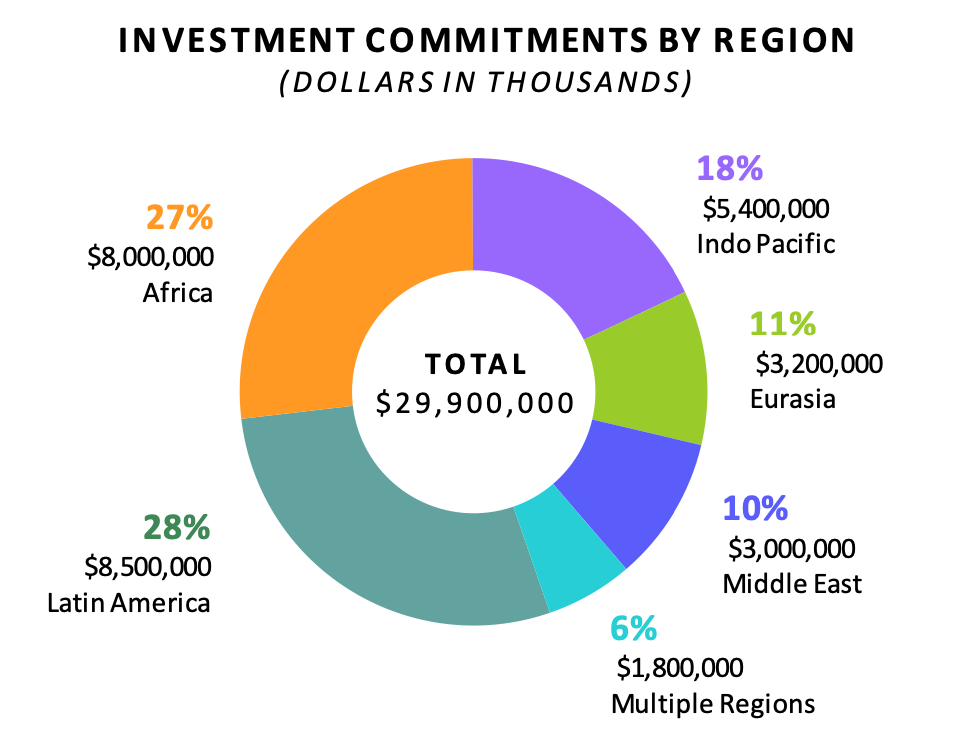

USIDFC's investment commitments by region for the FY 2020. The US$ 29.9 billion is only a fraction of the agency's budget [USIDFC].

According to the Wall Street Journal, OPIC "has been profitable every year for the last 40 years and has contributed US$ 8.5 billion to deficit reduction," a financial success which can primarily be attributed to project management fees. As of 2018, OPIC managed a portfolio valued at US$ 23 billion. OPIC's strong fiscal track record, combined with both the concept of government program streamlining and the larger context of geopolitical competition with China, generated bipartisan support for the BUILD Act and the USIDFC.

The USIDFC has several key new capacities which OPIC lacked. OPIC's business was limited to "loan guarantees, direct lending and political-risk insurance," and suffered under a "congressional cap on its portfolio size and a prohibition on owning equity stakes in projects". The USIDFC, however, is permitted under the BUILD Act to "acquire equity or financial interests in entities as a minority investor."

Both the USIDFC currently and OPIC before its incorporation are classified as Development Finance Institutions (DFIs). DFIs seek to "crowd-in" private investment, that is, attracting private investment that would not occur otherwise. This differs from the Chinese model of state-to-state lending and falls in line with traditional American political and economic philosophy. According to the CSIS, "The USIDFC offers [...] a private sector, market-based solution. Moreover, it fills a clear void that Chinese financing is not filling. China does not support lending to small and medium-sized enterprises (SMEs), and it rarely helps local companies in places like Africa or Afghanistan grow".

In the fiscal year of 2020, the most USIDFC's investments were made in Latin America (US$ 8.5 billion) and Sub-Saharan Africa (US$ 8 billion). Lesser but still significant investments were made in the Indo-Pacific region (US$ 5.4 billion), Eurasia (US$ 3.2 billion), and Middle East (US$ 3 billion). This falls in line with the USIDFC's goal to invest more in lower and lower-middle income countries, as opposed to upper middle countries. OPIC previously had fallen into the pattern of investing predominantly in upper-middle countries, and while the USIDFC is still legally authorised to invest in upper-middle income countries for national security or developmental motives.

These investments serve to further US national interests abroad. According to the USIDFC webpage, "by generating economic opportunities for citizens in developing countries, challenges such as refugees, drug-financed gangs, terrorist organisations, and human trafficking can all be addressed more effectively". Between 2002 and 2014, financial commitments in the DFI sector have increased sevenfold, from US$ 10 billion to US$ 70 billion. In our increasingly globalized world, international interests increasingly overlap with national interests, and public interests increasingly overlap with private interests.

Ongoing USIDFC initiatives

The USIDFC has five ongoing initiatives to further its national interests abroad: 2X Women's Initiative, Connect Africa, Portfolio for Impact and Innovation, Health and Prosperity, and Blue Dot Network. In 2020, the USIDFC "committed to catalyzing an additional US$ 6 billion of private sector investment in global women's economic empowerment" by joining the 2X Women's Initiative which seeks global female empowerment. About US$1 billion for this US$ 6 billion commitment has been specially pledged to Africa. Projects that fall under the 2X Women's Initiative include equity financing for a woman-owned feminine hygiene products online store in Rqanda, and "expanding women's access to affordable mortgages in India".

Continuing the USIDFC's special focus on Africa follows the Connect Africa initiative, under which the USIDFC has pledged US$ 1 billion to promote economic growth and connectivity in Africa. The Connect Africa initiative involves investment in telecommunications, internet access, and infrastructure.

Under the Portfolio for Impact and Innovation initiative, the USIDFC has dedicated US$ 10 million to supporting early-stage businesses. This includes sponsoring the Indian company Varthana, which offers affordable online learning for children whose schools have been shut down due to the Covid-19 crisis.

The Health and Prosperity initiative focuses on "bolstering health systems" and "expanding access to clean water, sanitation, and nutrition". Under the Health and Prosperity initiative, the USIDFC has dedicated US$ 2 billion to projects such as financing a 200+ mile drinking water pipeline in Jordan.

The Blue Dot Network initiative, like the Connect Africa initiative, also invests in infrastructure, but on a global scale. The Blue Dot Network initiative differs from the aforementioned initiatives in being a network. Launched in November 2019, the Blue Dot Network seeks to align the interests of government, private enterprise, and civil society to facilitate the successful development of infrastructure around the globe.

It is important to note that these five initiatives are not entirely separate. Many projects fall under several initiatives at once. The Rwandan feminine products e-store project, for example, falls under both the 2X Women's initiative and the Health and Prosperity initiative.

Could Spain partner up with Morocco in the field of solar energy?

The two countries are greatly exposed to solar radiation and they already share electricity interconnectors.

The two countries are greatly exposed to solar radiation and they already share electricity interconnectors.

Spain was an early developer of solar energy, but it didn't keep the pace with the required investments. The effort in renewables should mean a clear increase in installed capacity for solar energy. A partnership with Morocco, gifted with even stronger solar resources, could benefit both countries in producing and marketing this particular renewable energy. Spain and Morocco are about to have a third electricity interconnector.

ARTICLE / Ane Gil

Spain has a lot of potential in solar energy. Currently, its Germany who produces more photovoltaic electricity than Spain, Portugal or Italy in Europe. In fact, in 2019, Germany produced five times more solar energy than Spain (50 GW of installed capacity versus just 11 GW). This fact has little to do with the raw solar energy that the countries receive, considering that Spain is located in Southern Europe.

For how much solar irradiation Spain receives, the solar energy it produces is scarce. Up until 2013, the installed capacity for solar energy grew rapidly. However, since then, the country has fallen behind many other European countries in the development of capacity. The country initially had a leading role in the development of solar power, with low prices that encouraged a boom in solar power installed capacity. However, because of the 2008 financial crisis, the Spanish government drastically cut its subsidies for solar power and limited any future increases in capacity to 500 MW per year. Between 2012 and 2016, Spain was left waiting while other countries developed. The cost of this was high, seeing as Spain lost much of its world leading status to countries such as Germany, China and Japan.

However, as a legacy from Spain's earlier development of solar power, in 2018 Spain became the first country in the world using concentrated solar power system (CSP), which accounts for almost a third of solar power installed capacity in the country. Nevertheless, in 2019, Spain installed 4,752 MW of photovoltaic solar energy, which situated Spain as the sixth leading country in the world. As of 2019, Spain has a total installed solar generation capacity of 11,015 MW: 8,711 of photovoltaic energy and 2,304 of solar thermal.

Photovoltaic solar (PV) energy is usually used for smaller-scale electricity projects. The devices generate electricity directly from sunlight via an electronic process that occurs naturally on semiconductors, converting it into usable electricity that can be stored in a solar battery of sent to the electric grid. Solar thermal energy (STE) capture is usually used for electricity production on a massive scale, for its use in the industry.

Low solar energy generated in Spain

By 2020, Spain national system has reached the maximum generation capacity ever recorded: 110,000 MW of wind energy, photovoltaic (PV), hydraulic, conventional thermal power (natural gas, coal, fuel oil), nuclear, etc. This amount of energy contrasts with the increasingly thin demand of power, which in 2019 was 40,000 MW (40 GW). According to the data published by network Electrica de España, the renewable quota of energy amount to a total of 55,247 MW (55 GW out of 110 GW). This 55 GW is composed of 46% corresponding to wind energy, 16% are photovoltaic and the rest (38%) corresponds to other renewable technologies. During 2019, the national renewable production has been 97,826 GW-hour, which represents 37.5% of the kilowatt-hour that the country demanded last year (the remaining 62.5% has been produced in nuclear power plants or facilities that burn fossil fuels).

So, we can clearly see that the percentage of solar energy is extremely low (3,5% solar photovoltaic and 2% solar thermic of the total kilowatts-hour generated). Nevertheless, Spain has the capability to increase these numbers. According to a report on power potential by country published by the World Bank, Spain has a long-term energy availability of solar resource at any location (average theoretical potential) of 4.575 kilowatts-hour per square metre (kWh/m2). This potential is indicated by the variable of global horizontal irradiation (GHI) on the country, which will vary according to the local factors of the land. Furthermore, the power output achievable by a typical PV system, taking into consideration the theoretical potential and the local factors of the land (average practical potential) is 4.413 kWh, excluding areas due to physical/technical constraints (rugged terrain, urbanized/industrial areas, forests...) PV power output (PVOUT), power generated per unit of the installed PV capacity over the long-term, is an average of 1.93 kilowatt-hours per installed kilowatt-peak of the system capacity (kWh/kWp). It varies according to the season from 1.43 to 2.67 kWh/kWp. Finally, it's worth mentioning that Spain's electric consumption (balance of production and external trade) in 2019 was of 238 TWh (= 2.38 x1011 kWh).

![The colours indicate the average solar radiation; the black dots indicate places where there could be a greater use of solar energy [Mlino76].](/documents/16800098/0/energia-solar-mapa.png/f4078864-e508-b667-31fc-d8b9e9bb68e1?t=1621870347022&imagePreview=1)

Morocco's solar energy plan

Africa is the continent that receives most solar irradiance, thus being the optimal continent to exploit solar energy. In this regard, Morocco is already aiming to take advantage of this natural resource. At first, this country launched a solar energy plan with investment of USD 9 billion, aiming to generate 2,000 MW (or 2 GW) of solar power by 2020. It has developed mega-scale solar power projects at five locations; at the Sahara (Laayoune), Western Sahara (Boujdour), South of Agadir (Tarfaya), Ain Beni Mathar and Ouarzazate. But Morocco is planning to go further. Morocco announced during COP21 that it planned to increase the renewables capacity to reach 52% of the total by 2030 (20% solar, 20% wind, 12% hydro). To meet the 2030 target, the country aims to add around 10 GW of renewable capacities between 2018 and 2030, consisting of 4,560 MW of solar, 4,200 MW of wind, and 1,330 MW of hydropower capacity. The Moroccan Agency for Renewable Energy revealed that by the end of 2019, Morocco's renewable energy reached 3,685 megawatts (MW), including 700 MW of solar energy, 1,215 MW of wind power, and 1,770 MW of hydroelectricity.

Now, what would happen if Spain partnered up with Morocco? Morocco is the only African country to have a power cable link to Europe. In fact, it's through Spain that these two electricity interconnectors arrive to Europe. The first subsea interconnection, with a technical capacity of 700 MW, was commissioned in 1997 and started commercial operation in 1998. The second was commissioned in the summer of 2016. Furthermore, a new interconnection had been commissioned. This should not only reduce the price of electricity in the Spanish market but it should also allow the integration of renewable energy, mainly photovoltaic, into European electricity system.

Moreover, network Electrica de España (REE) stated that a collaborations agreement between the Spain and Morocco had been formed "to establish a strategic partnership on energy, whose objectives will be focused on the integration of networks and energy markets, the development of renewable energy and energy efficiency". But the possibilities don't stop there. If both countries further develop their solar energy capacities, they could jointly provide enough electricity to sustain Europe, through sustainable and renewable resources.

Behind the tension between Qatar and its neighbours is the Qatari ambitious foreign policy and its refusal to obey

Recent diplomatic contacts between Qatar and Saudi Arabia have suggested the possibility of a breakthrough in the bitter dispute held by Qatar and its Arab neighbors in the Gulf since 2017. An agreement could be within reach in order to suspend the blockade imposed on Qatar by Saudi Arabia, United Arab Emirates, and Bahrain (and Egypt), and clarify the relations the Qataris have with Iran. The resolution would help Qatar hosting the 2022 FIFA World Cup free of tensions. This article gives a brief context to understand why things are the way they are.

Ahmad Bin Ali Stadium, one of the premises for the 2022 FIFA World Cup in Qatar

ARTICLE / Isabelle León

The diplomatic crisis in Qatar is mainly a political conflict that has shown how far a country can go to retain leadership in the regional balance of power, as well as how a country can find alternatives to grow regardless of the blockade of neighbors and former trading partners. In 2017, Saudi Arabia, United Arab Emirates, and Bahrain broke diplomatic ties with Qatar and imposed a blockade on land, sea, and air.

When we refer to the Gulf, we are talking about six Arab states: Saudi Arabia, Oman, UAE, Qatar, Bahrain, and Kuwait. As neighbors, these countries founded the Gulf Cooperation Council (GCC) in 1981 to strengthen their relation economically and politically since all have many similarities in terms of geographical features and resources like oil and gas, culture, and religion. In this alliance, Saudi Arabia always saw itself as the leader since it is the largest and most oil-rich Gulf country, and possesses Mecca and Medina, Islam's holy sites. In this sense, dominance became almost unchallenged until 1995, when Qatar started pursuing a more independent foreign policy.

Tensions grew among neighbors as Iran and Qatar gradually started deepening their trading relations. Moreover, Qatar started supporting Islamist political groups such as the Muslim Brotherhood, considered by the UAE and Saudi Arabia as terrorist organizations. Indeed, Qatar acknowledges the support and assistance provided to these groups but denies helping terrorist cells linked to Al-Qaeda or other terrorist organizations such as the Islamic State or Hamas. Additionally, with the launch of the tv network Al Jazeera, Qatar gave these groups a means to broadcast their voices. Gradually the environment became tense as Saudi Arabia, leader of Sunni Islam, saw the Shia political groups as a threat to its leadership in the region.

Consequently, the Gulf countries, except for Oman and Kuwait, decided to implement a blockade on Qatar. As political conditioning, the countries imposed specific demands that Qatar had to meet to re-establish diplomatic relations. Among them there were the detachment of the diplomatic ties with Iran, the end of support for Islamist political groups, and the cessation of Al Jazeera's operations. Qatar refused to give in and affirmed that the demands were, in some way or another, a violation of the country's sovereignty.

A country that proves resilient

The resounding blockade merited the suspension of economic activities between Qatar and these countries. Most shocking was, however, the expulsion of the Qatari citizens who resided in the other GCC states. A year later, Qatar filed a complaint with the International Court of Justice on grounds of discrimination. The court ordered that the families that had been separated due to the expulsion of their relatives should be reunited; similarly, Qatari students who were studying in these countries should be permitted to continue their studies without any inconvenience. The UAE issued an injunction accusing Qatar of halting the website where citizens could apply for UAE visas as Qatar responded that it was a matter of national security. Between accusations and statements, tensions continued to rise and no real improvement was achieved.

At the beginning of the restrictions, Qatar was economically affected because 40% of the food supply came to the country through Saudi Arabia. The reduction in the oil prices was another factor that participated on the economic disadvantage that situation posed. Indeed, the market value of Qatar decreased by 10% in the first four weeks of the crisis. However, the country began to implement measures and shored up its banks, intensified trade with Turkey and Iran, and increased its domestic production. Furthermore, the costs of the materials necessary to build the new stadiums and infrastructure for the 2022 FIFA World Cup increased; however, Qatar started shipping materials through Oman to avoid restrictions of UAE and successfully coped with the status quo.

This notwithstanding, in 2019, the situation caused almost the rupture of the GCC, an alliance that ultimately has helped the Gulf countries strengthen economic ties with European Countries and China. The gradual collapse of this organisation has caused even more division between the blocking countries and Qatar, a country that hosts the largest military US base in the Middle East, as well as one of Turkey, which gives it an upper hand in the region and many potential strategic alliances.

The new normal or the beginning of the end?

Currently, the situation is slowly opening-up. Although not much progress has been made through traditional or legal diplomatic means to resolve this conflict, sports diplomacy has played a role. The countries have not yet begun to commercialize or have allowed the mobility of citizens, however, the event of November 2019 is an indicator that perhaps it is time to relax the measures. In that month, Qatar was the host of the 24th Arabian Gulf Cup tournament in which the Gulf countries participated with their national soccer teams. Due to the blockade, UAE, Saudi Arabia, and Bahrain had boycotted the championship; however, after having received another invitation from the Arabian Gulf Cup Federation, the countries decided to participate and after three years of tensions, sent their teams to compete. The sporting event was emblematic and demonstrated how sport may overcome differences.

Moreover, recently Saudi Arabia has given declarations that the country is willing to engage in the process to lift-up the restrictions. This attitude toward the conflict means, in a way, improvement despite Riyadh still claims the need to address the security concerns that Qatar generates and calls for a commitment to the solution. As negotiations continue, there is a lot of skepticism between the parties that keep hindering the path toward the resolution.

Donald Trump's administration recently reiterated its cooperation and involvement in the process to end Qatar's diplomatic crisis. Indeed, US National Security Adviser Robert O'Brien stated that the US hopes in the next two months there would be an air bridge that will allow the commercial mobilization of citizens. The current scenario might be optimistic, but still, everything has remained in statements as no real actions have been taken. This participation is within the US strategic interest because the end of this rift can signify a victorious situation to the US aggressive foreign policy toward Iran and its desire to isolate the country. This situation remains a priority in Trump's last days in office. Notwithstanding, as the transition for the administration of Joe Biden begins, it is believed that he would take a more critical approach on Saudi Arabia and the UAE, pressuring them to put an end to the restrictions.

This conflict has turned into a political crisis of retention of power or influence over the region. It is all about Saudi Arabia's dominance being threatened by a tiny yet very powerful state, Qatar. Although more approaches to lift-up the rift will likely begin to take place and restrictions will gradually relax, this dynamic has been perceived by the international community and the Gulf countries themselves as the new normal. However, if the crisis is ultimately resolved, mistrust and rivalry will remain and will generate complications in a region that is already prone to insurgencies and instability. All the countries involved indeed have more to lose than to gain, but three years have been enough to show that there are ways to turn situations like these around.

US LNG sales to its neighbours and exports from Latin American and Caribbean countries to Europe and Asia open up new prospects

Not relying on pipelines, but being able to buy or sell natural gas also to distant or land-locked countries improves the energy prospects of many nations. The success of fracking has generated a surplus of gas that the US has begun to sell in many parts of the world, including to its hemispheric neighbours, who in turn have more choice provider. At the same time, being able to submit gas in tankers has expanded the customer portfolio of Peru and above all Trinidad and Tobago, which until last year were the only two American countries, apart from the US, with liquefaction plants. Argentina joined them in 2019, and Mexico in 2020 has promoted investments to join this revolution.

![A liquefied natural gas (LNG) freighter [Pline]. A liquefied natural gas (LNG) freighter [Pline].](/documents/16800098/0/gas-natural-blog.jpg/bc7b4699-c26c-a2d1-2971-f57cbb0345b8?t=1621873574093&imagePreview=1)

▲ A liquefied natural gas (LNG) freighter [Pline].

article / Ann Callahan

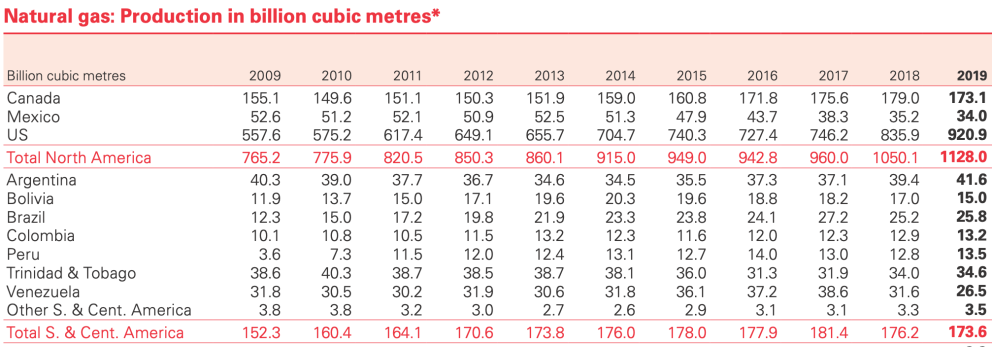

The United States is connected by pipeline only to Canada and Mexico, but is selling gas by ship to some thirty other countries (Spain, for example, has become a major buyer). In 2019, the US exported 47.5 billion cubic metres of liquefied natural gas (LNG), of which one-fifth went to American neighbours, according to agreement with report BP 2020 on the sector.

Eight countries in Latin America and the Caribbean already have regasification plants for gas arriving by cargo ship in liquid form: there are three plants in Mexico and Brazil; two in Argentina, Chile, Jamaica and Puerto Rico, and one each in Colombia, the Dominican Republic and Panama, according to the annual summary association of LNG importing countries. In addition to the US, LNG also arrives in these countries from Norway, Russia, Angola, Nigeria and Indonesia. Two countries export LNG to various parts of the world: Trinidad and Tobago, which has three liquefaction plants, and Peru, which has one (another became operational in Argentina last year).

In an attempt to mitigate the risk of electricity shortages due to a decrease in hydropower production due to drought or other difficulties in accessing energy sources, many countries in Latin America and the Caribbean are turning to LNG. As a cleaner energy source, it is also an attractive option for countries already struggling with climate change. In addition, gas financial aid will help overcome the discontinuity of alternative sources, such as wind and solar power.

In the case of small island countries, such as those in the Caribbean, which for the most part lack energy sources, cooperation programmes for the development of LNG terminals can provide them with a certain independence from certain oil supplies, such as the influence exerted on them by Chavista Venezuela through Petrocaribe.

LNG is natural gas that has been liquefied (cooled to about -162°C) for storage and transport. The volume of natural gas in its liquid state is reduced by approximately 600 times compared to its gaseous state. The process makes it possible and efficient to transport it to places that cannot be reached by pipelines. It is also much more environmentally friendly, as the carbon intensity of natural gas is about 30% less than that of diesel or other heavy fuels.

The global natural gas market has evolved rapidly in recent years. Global LNG capacities are expected to continue to grow until 2035, led by Qatar, Australia and the US. According to BP's report on the sector, in 2019 the share of gas in primary energy reached an all-time high of 24.2%. Much of the growth in gas production in 2019, when it increased by 3.4%, was due to additional LNG exports. LNG exports last year grew by 12.7% to 485.1 billion cubic metres.

Liquefaction and regasification plants in the Americas [report GIIGNL].

Boom

While the United States lagged behind in gas production at the beginning of the first decade of this century, the shale boom since 2009 has led the US to exponentially increase gas extraction and play a key role in the global trade of the liquefied product. With the relatively easy transportation of LNG, the US has been able to export and ship it to many parts of the world, with Latin America, due to its proximity, being one of the regions that is feeling the shift the most. Of the 47.5 billion cubic metres of LNG exported by the US in 2019, 9.7 billion went to Latin America; the main destinations were Mexico (3.9 billion), Chile (2.3 billion), Brazil (1.5 billion) and Argentina (1 billion).

While the region has promising export potential, given its proven natural gas reserves, demand exceeds production and it must import. Venezuela is the country with the largest reserves in Latin America (although its gas power is smaller than its oil power), but its hydrocarbon sector is in decline and the largest production in 2019 came from Argentina, an emerging shale country, followed by Trinidad and Tobago. Brazil matched Venezuela's output, followed by Bolivia, Peru and Colombia. In total, the region produced 207.6 billion cubic metres, while its consumption was 256.1 billion.

Some countries receive gas by pipeline, as is the case of Mexico and Argentina and Brazil: the former receives gas from the US and the latter from Bolivia. But the growing option is to install regasification plants to receive liquefied gas; such projects require some investment, usually foreign. The largest exporter of LNG to the region in 2019 was the US, followed by Trinidad and Tobago, which, due to its low domestic consumption, exports practically all its production: of its 17 billion cubic metres of LNG, 6.1 billion went to Latin American countries. The third largest exporter is Peru, which sent its 5.2 billion cubic metres to Asia and Europe (it did not sell on the continent itself). Argentina joined exports in 2019 for the first time, although with a leave amount, 120 million cubic metres, almost all destined for Brazil.

The region imported a total of 19.7 billion cubic metres of LNG in 2019. The main buyers were Mexico (6.6 billion cubic metres), Chile (3.3 billion), Brazil (3.2 billion) and Argentina (1.7 billion).

Some of those that imported smaller quantities then re-exported part of the supplies, as did the Dominican Republic, Jamaica and Puerto Rico, generally with Panama as the main destination.

Tables extracted from report Statistical Review of World Energy 2020 [BP].

By country

Mexico is the largest importer of LNG in Latin America; its supplies come mainly from the US. For a long time, Mexico has relied on gas shipments from its northern neighbour via pipelines. However, the LNG development has opened up new prospects, as the country's location can help it boost both capacities: improved pipeline connections with the US may allow Mexico to have a gas surplus at Pacific terminals for re-exporting LNG to Asia, complementing the absence of liquefaction plants on the US West Coast for the time being.

The possibility of re-exporting from Mexico's Pacific coast to the large and growing Asian LNG market - without the need for tankers to pass through the Panama Canal - is a major attraction. agreement The US Energy department granted in early 2019 two authorisations to Mexico's project Energía Costa Azul to re-export US-derived natural gas in the form of LNG to those countries that do not have a free trade agreement (FTA) with Washington, as stated in the 2020 report of the group International Importers of Liquefied Natural Gas(GIIGNL).

For the past decade, Argentina has been importing LNG from the US; however, in recent years it has reduced its purchases by more than 20 per cent as domestic gas production has increased thanks to the exploitation of Vaca Muerta. These fields have also allowed it to reduce gas purchases from neighbouring Bolivia and sell more gas, also via pipeline, to its neighbours Chile and Brazil. In addition, in 2019 it will begin exporting LNG from the Bahía Blanca plant.

With Argentina pumping gas to neighbouring Chile, in 2019 Chilean LNG imports declined to their lowest Degree in three years, although it remains one of the important buyers in Latin America, having switched Trinidad and Tobago to the US as its preferred provider . It should be noted, however, that Argentina's export capacity depends on the levels of domestic flows, especially during winter seasons when widespread heating is a necessity for Argentines.

Over the past decade, Brazil' s LNG imports have varied significantly from year to year. However, it is projected to be more consistent in its reliance on LNG until at least the next decade, as renewable energy is developed. In Brazil, natural gas is largely used to back up Brazilian hydropower.

In addition to Brazil, Colombia also considers LNG as an advantageous resource to back up its hydroelectric system in low periods. On its Pacific coast, Colombia is currently planning a second regasification terminal. Ecopetrol, the state hydrocarbon business , will allocate USD 500 million to unconventional gas projects in addition to oil. Along with the government's authorisation to allow fracking, currently stagnant reserves are projected to increase.

Bolivia also has significant natural gas production potential and is the country in the region whose Economics is most dependent on this sector. It has the advantage of existing infrastructure and the size of neighbouring gas markets; however, it faces skill production from Argentina and Brazil. Also, being a landlocked country, it is limited in the commercialisation of LNG.

Although Peru is the seventh largest producer of natural gas in the region, it has become the second largest exporter of LNG. Lower domestic consumption, compared to other neighbouring markets, has led it to develop LNG exports, reinforcing its profile as a nation focused on Asia.

For its part, Trinidad and Tobago has adapted its gas production to its status as an island country, basing its hydrocarbon exports on tankers, which gives it access to distant markets. It is the leading exporter in the region and the only one with customers in all continents.

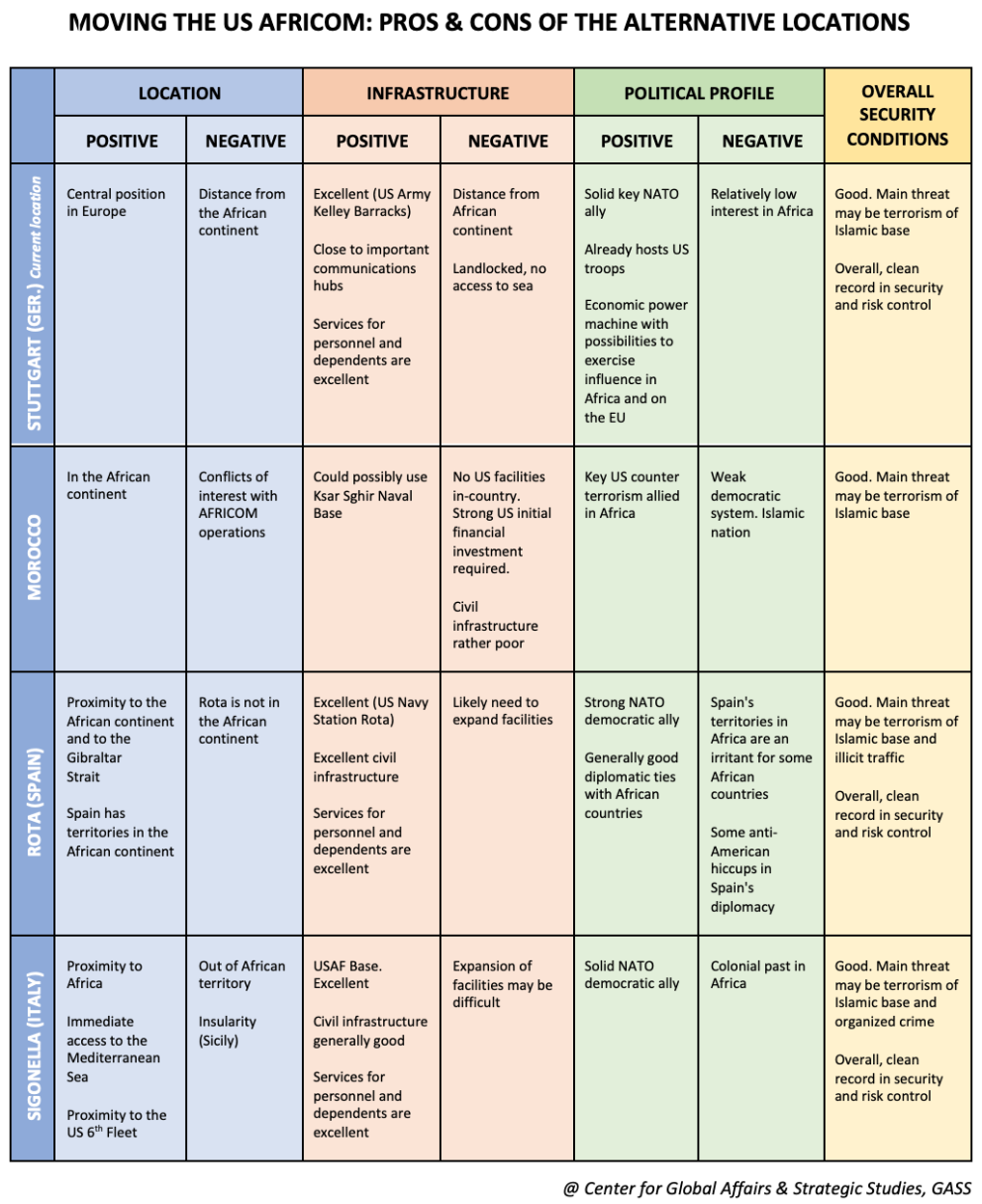

As the United States considers moving its AFRICOM from Germany, the relocation to US Navy Station Rota in Spain offers some opportunities and benefits

The United States is considering moving its Africa Command (USAFRICOM) to a place closer to Africa and the US base in Rota, Spain, in one of the main alternatives. This change in location would undoubtedly benefit Spain, but especially the United States, we argue. Over the past years, there has been a 'migration' of US troops from Europe, particularly stationed in Germany, to their home country or other parts of the hemisphere. In this trend, it has been considered to move AFRICOM from "Kelly Barracks," in Stuttgart, Germany, to Rota, located in the province of Cádiz, near the Gibraltar Strait.

![Entrance to the premises of the US Navy Station Rota [US DoD]. Entrance to the premises of the US Navy Station Rota [US DoD].](/documents/16800098/0/rota-blog.jpg/3d6dc4ec-a235-79a3-e478-4706f1f129e7?t=1621877332236&imagePreview=1)

Entrance to the premises of the US Navy Station Rota [US DoD].

ARTICLE / José Antonio Latorre

The US Africa Command is the military organisation committed to further its country's interests in the African continent. Its main goal is to disrupt and neutralize transnational threats, protect US personnel and facilities, prevent and mitigate conflict, and build defense capability and capacity in order to promote regional stability and prosperity, according to the US Department of Defense. The command currently participates in operations, exercises and security cooperation efforts in 53 African countries, committing around 7,200 active personnel in the continent. Its core mission is to assist African countries to strengthen defense capabilities that address security threats and reduce threats to US interests, as the command declares. In summary, USAFRICOM "is focused on building partner capacity and develops and conducts its activities to enhance safety, security and stability in Africa. Our strategy entails an effective and efficient application of our allocated resources, and collaboration with other U.S. Government agencies, African partners, international organizations and others in addressing the most pressing security challenges in an important region of the world". The headquarters are stationed in Stuttgart, Germany, more than 1,500 kilometers away from Africa. The United States has considered to move the command multiple times for logistical and strategic reasons, and it might be the time the government takes the decision.

Bilateral relations between Spain and the United States

When it comes to the possible relocation of AFRICOM, the main competitor is Italy, with its military base in Sigonella. An ally that has been increasingly important to the United States is Morocco, which has offered to accommodate more military facilities as its transatlantic ally continues to provide the North African country with weapons and armament. However, it is important to remember that the United States and Spain cooperate in NATO, fortifying their security and defense relations in the active participation in international missions. Although Italy also belongs to the same organizations, it is important to emphasize the strategic advantages of placing the command in Rota as opposed to in Sigonella: Rota it is a key point which controls the Strait of Gibraltar and contains much of the needed resources for the relocation. Spain combines the fact that it is a European Union and NATO member, while it has territories in Africa and shares key interests in the region due to multiple current and historical reasons. Spain acts as the bridge with Northern Africa in the West. This is an argument that neither Morocco nor Italy can offer.

The relations between Spain and the United States are regulated by the Mutual Defense Assistance Agreement and Agreement on Defense Cooperation (1988), following the Military Facilities in Spain: Agreement Between the United States and Spain Pact (1953), enacted to formalize the alliance in common objectives and where Spain permits the United States to use facilities in its territory. There are two US military instructions in Spanish territory: US Air Force Base Morón and US Naval Station Rota. Both locations are strategic as they are in the south, essential for their proximity to the entrance to the Mediterranean Sea and, particularly, to Africa. Although it is true that Morocco offers the same strategic advantages as Rota, it is important to take into account the similarities in culture, the Western point of view, the shared strategies in NATO, and the shared democratic and societal values that the Spanish alternative offers. The political stability that Spain can offer as part of the European Union and as a historical ally to the United States is not comparable with Morocco's.

If a relocation is indeed in the interest of the United States, then Spain is the ideal country for the placement of the command. Since the consideration is on the Naval Station in Rota, then the article will evidently focus on this location.

Rota as the ideal candidate

Rota Naval Station was constructed in 1953 to heal bilateral relations between both countries. It was placed in the most strategic position in Spain, and one of the most in Europe. Naval Station Rota is home to Commander, Naval Activities Spain (COMNAVACT), responsible for US Naval Activities in Spain and Portugal. It reports directly to Commander, Navy Region Europe, Africa and Southwest Asia located in Naples, Italy. There are around 3,000 US citizens in the station, a number expected to increase by approximately 2,000 military personnel and dependents due to the rotation of "Aegis" destroyers.

Currently, the station provides support for NATO and US ships as well as logistical and tactical aid to US Navy and US Air Force units. Rota is key for military operations in the European theatre, but obviously unique to interests in Africa. To emphasize the importance of the facility, the US Department of Defense states: "Naval Station (NAVSTA) Rota plays a crucial role in supporting our nation's objectives and defense, providing unmatched logistical support and strategic presence to all of our military services and allies. NAVSTA Rota supports Naval Forces Europe Africa Central (EURAFCENT), 6th Fleet and Combatant Command priorities by providing airfield and port facilities, security, force protection, logistical support, administrative support and emergency services to all U.S. and NATO forces". Clearly, Naval Station Rota is a US military base that will be maintained and probably expanded due to its position near Africa, an increasingly important geopolitical continent.

Spain's candidacy for accommodating USAFRICOM

Why would Spain be the ideal candidate in the scenario that the United States decides to change its USAFRICOM location? Geographically speaking, Spain actually possesses territories in Africa: Ceuta, Melilla, "Plazas de Soberanía," and Canary Islands. Legally, these territories are fully incorporated as autonomous cities and an autonomous community, respectively.

Secondly, the bilateral relations between Spain and the United States, from the perspective of security and defense, have been very fluid and dynamic, with benefits for both. After the 1953 convention between both Western countries, there have been joint operations co-chaired by the Secretary General of Policy of Defense (SEGENPOL) of the Spanish Ministry of Defense and the Under Secretary General for Defense Policy (USGDP) in the United States Department of Defense. Both offices plan and execute plans of cooperation that include: The Special Operations "Flint Lock" Exercise in Northern Africa, bilateral exercises with paratrooping units, officer exchanges for training missions, etc. It is important to add to this list that Spain and the United States share a special relationship when it comes to officers, because all three branches (Air Force, Army, Navy) have exchange programs in military academies or instructions.

Finally, when it comes to Spain, it must be noted that the fluid relationship maintained between both countries has created a very friendly and stable environment, particularly in the area of Defense. Spain is a country of the European Union, a long-time loyal ally to the United States in the fight against terrorism and in the shared goals of strengthening the transatlantic partnership. This impeccable alliance offers stability, mutual confidence and reciprocity in terms of Defense. The United States Africa Command needs a solid "host", committed to participating in active operations in Africa, and there is no better candidate than Spain. Its historical relationship with the countries in Northern Africa is important to take into account for perspective and information gathering. The Spanish Armed Forces is the most valued institution in society, and it is for sure more than capable of accommodating USAFRICOM to its needs in the South of the country, as it has always done for the United States, however, this remains a fully political decision.

The United States' position

Rota is an essential strategic point in Europe, and increasingly, in the world. The US base is well known for its support to missions from the US Navy and the US Air Force, and its responsibility only seems to increase. In 2009, the United States sent four destroyers from the Naval Base in Norfolk, Virginia, to Rota, as well as a large force of US Naval Construction units, known as "Seabees" and US Marines. It is also worth noting that NATO has its most important pillar of an antimissile shield in Rota, given the geographical ease and the adequate facilities. From the perspective of infrastructure, on-hand station services, security and stability, Rota is the ideal location of the USAFRICOM compared to Morocco.

Moreover, Rota is, and continues to be, a geographical pinnacle for flights from the United States heading to the Middle East, particularly Iraq and Afghanistan. Most recently, USS Hershel "Woody" Williams arrived in Rota and joined NATO allies in the Grand African Navy Exercise for Maritime Operations (NEMO) that took place in the Gulf of Guinea in the beginning of October of 2020. In terms of logistics, Rota is more than equipped to host a headquarters of the magnitude of USAFRICOM and it would be economically efficient to relocate the personnel and their families as the station counts with a US Naval Clinic, schools, a commissary, a Navy Exchange, and other services.

The United States has not made a formal proposition to transfer Africa Command to Rota, but if there is a change of location, it is one of the main candidates. As Spain's Minister of Foreign Affairs González Laya stated, the possible transfer of USAFRICOM to Rota is a decision that corresponds only to the United States, but Spain remains fully committed with its transatlantic ally. González Laya emphasized that "Spain has a great commitment to the United States in terms of security and defense, and it has been demonstrated for many years from Rota and Morón". The minister reminded that Spain maintains complicity and joint work in the fight against terrorism in the Sahel with an active participation in European and international operations in terms of training local armies to secure order. A perfect example of the commitment is Spain's presidency of the Sahel Alliance, working for a secure Sahel under the pillars of peace and development.

In 2007, when USAFRICOM was established, it could have been reasonable to install the headquarters in Germany, but now geographical proximity is key, and what better country for hosting the command than Spain, which has territories in the continent. The United States already has a fully equipped military base in Rota, and it can count on Spain to guarantee a smooth transition. Spain's active participation in missions, her alliance with the United States and her historic and political ties with Africa are essential reasons to heavily consider Rota as the future location of USAFRICOM. Spain has been, and will continue to be, a reliable ally in the war against terrorism and the fight for peace and security. Spain is a country that believes in democracy, freedom and justice, like the United States. It is a country that has sacrificed soldiers in the face of freedom and has stood shoulder to shoulder with its transatlantic friend in the most difficult of moments. As a Western country, both countries have been able to work together and achieve many common objectives, and this will only evolve. As the interests in Africa expand, it is undoubtedly important to choose the best military facility to accommodate the command's military infrastructure as well as its personnel and their families. The United States, in benefit of its strategic objectives, would be making a very effective decision if it decides to move the Africa Command to Rota, Spain.

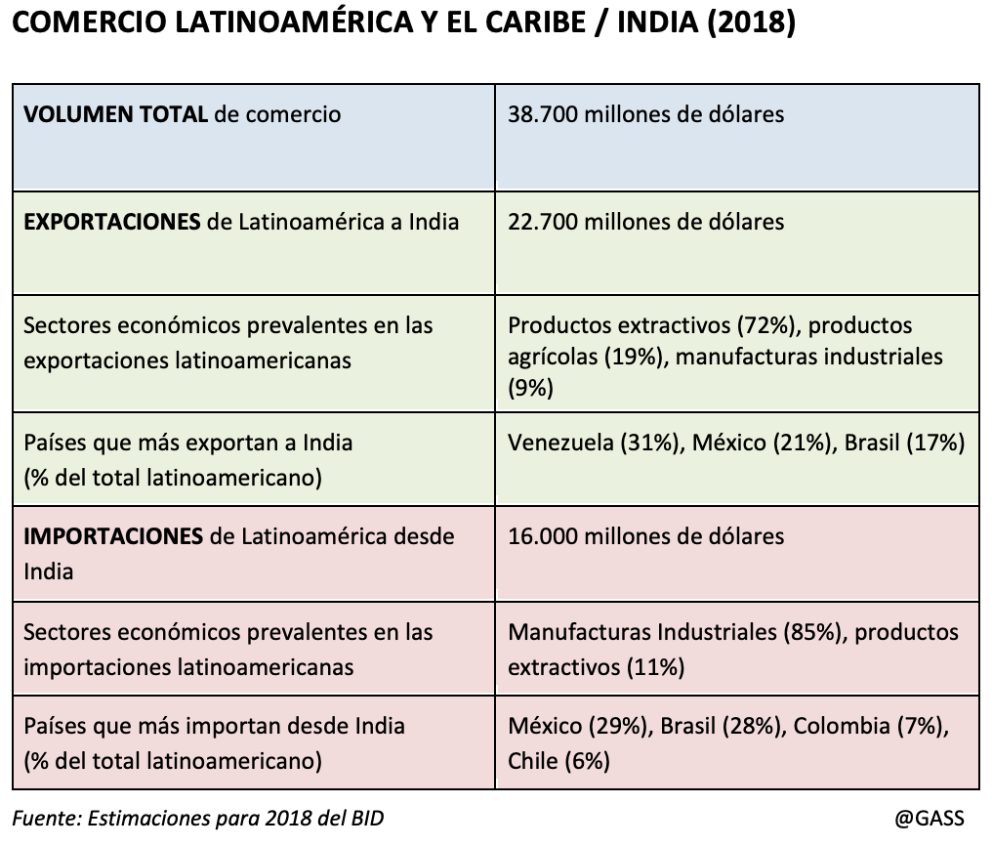

India's trade with the region has increased twenty-fold since 2000, but is only 15% of the trade flow with China.

China's rapid trade, credit and investment spillover into Latin America in the first decade of this century suggested that India, if it intended to follow in the footsteps of its continental rival, could perhaps stage a similar landing in the second decade. This has not happened. India has certainly increased its economic relationship with the region, but it is a far cry from that developed by China. Even Latin American countries' trade flows are greater with Japan and South Korea, although it is foreseeable that in a few years they will be surpassed by those with India given its potential. In an international context of confrontation between the US and China, India emerges as a non-confrontational option, specialising in IT services that are so necessary in a world that has discovered the difficulty of mobility for Covid-19.

article / Gabriela Pajuelo

India has historically paid little attention to Latin America and the Caribbean; the same had been true of China, apart from episodes of migration from both countries. development But China's emergence as a major power and its landing in the region prompted the Inter-American Development Bank (IDB) to ask in a 2009 report whether, after the Chinese push, India was going to be "the next big thing" for Latin America. Even if India's figures were to lag behind China's, could India become an actor core topic in the region?

Latin American countries' relationship with New Delhi has certainly grown. Even Brazil has developed a special link with India thanks to the BRICS club, as evidenced by Brazilian president Jair Bolsonaro's visit in January 2020 to his counterpart Narendra Modi. In the last two decades, India's trade with the region has increased twenty-fold, from $2 billion in 2000 to almost $40 billion in 2018, as a new IDB report found last year.

This volume, however, falls far short of the trade flow with China, of which it constitutes only 15 per cent, because if Indian interests in Latin America have increased, Chinese interests have continued to do so to a greater extent. Investment from both countries in the region is even more disproportionate: between 2008 and 2018, India's investment was $704 million, compared to China's $160 billion.

Even India's trade growth is less regionally intertwined than global figures might suggest. Of the total $38.7 billion of transactions in 2018, $22.7 billion were Latin American exports and $16 billion were imports of Indian products. Indian purchases have already surpassed imports from Latin America by Japan ($21 billion) and South Korea ($17 billion), but this is largely due to the purchase of oil from Venezuela. Adding the two directions of flow, the region's trade with Japan and Korea is still larger (around $50 billion in both cases), but the potential for growth in the trade relationship with India is clearly greater.

There is interest not only from American countries, but also from India. "Latin America has a young and skilled workforce, work , and is rich in natural and agricultural resource reserves," said David Rasquinha, director general manager of the Export-Import Bank of India.

Last decade

The two IDB reports cited above are a good reflection of the leap in relations between the two markets in the last decade. In the 2009 report, under degree scroll 'India: Opportunities and Challenges for Latin America', the Inter-American institution presented the opportunities offered by contacts with India. Although it was committed to increasing them, the IDB was uncertain about the evolution of a power that for a long time had opted for autarky, as Mexico and Brazil had done in the past; however, it seemed clear that the Indian government had finally taken a more conciliatory attitude towards the opening up of its Economics.

Ten years later, the report graduate "The Bridge between Latin America and India: Policies for Deepening Economic Cooperation" delved into the opportunities for cooperation between the two actors and noted the importance of strengthening ties to favour the growing internationalization of the Latin American region, through the diversification of trade partners and access to global production chains. In the context of the Asian Century, the flow of exchange trade and direct investment had increased exponentially from previous levels, result largely due to the demand for Latin American raw materials, something that is often criticised as not fostering the region's industry.

The new relationship with India presents an opportunity to correct some of the trends in interaction with China, which has focused on investment by state-owned companies and loans from Chinese state-owned banks. In the relationship with India, there is greater participation of Asian private initiative and a commitment to new economic sectors, as well as the hiring of indigenous staff , including at the management and management levels.

agreement According to General Manager of the IDB's Integration and Trade Sector, Fabrizio Opertti, "the development of an effective institutional framework and business networks" is crucial. The IDB suggests possible governmental measures such as increasing the coverage of trade and investment agreements, the development of proactive and targeted trade promotion activities, boosting investments in infrastructure, promoting reforms in the logistics sector, among others.

Post-Covid context

The questioning of global production chains and, ultimately written request, of globalisation itself because of the Covid-19 pandemic, is not conducive to international trade. Moreover, the economic crisis of 2020 may have a long-lasting effect on Latin America. But it is precisely in this global framework that the relationship with India could be particularly interesting for the region.

Within Asia, in a context of polarisation over the geopolitical interests of China and the United States, India emerges as a partner core topic , one might even say neutral; something that New Delhi could use strategically in its approach to different areas of the world and in particular to Latin America.

Although "India does not have pockets as deep as the Chinese", as Deepak Bhojwani, founder of the consultancy firm Latindia[1], says in relation to the enormous public funding that Beijing manages, India could be the origin of interesting technological projects, given the variety of IT and telecommunications companies and experts it has. Thus, Latin America could be the target of the "technology foreign policy" of a country that, according to agreement with its Ministry of Electronics and IT, has the ambition of growing its digital Economics to "one trillion dollars by 2025". New Delhi will focus its efforts on influencing this economic sector through NEST (New, Emerging and Strategic Technologies), promoting a unified Indian message on emerging technologies, such as governance of data and artificial intelligence, among others. The pandemic has highlighted Latin America's need for more and better connectivity.

There are two prospects for the expansion of India's influence on the continent. One is the obvious path of strengthening its existing alliance with Brazil, within the BRICS, whose pro tempore presidency India holds this year. That should lead to more diversified ties with Brazil, the region's largest market, especially in science and technology cooperation, in the fields of IT, pharmaceuticals and agribusiness. "Both governments committed to expand bilateral trade to 15 billion dollars by 2022. Despite the difficulties brought by the pandemic, we are pursuing this ambitious goal", says André Aranha Corrêa do Lago, Brazil's current ambassador to India.

On the other hand, a greater effort could be made in bilateral diplomacy, insisting on pre-existing ties with Mexico, Peru and Chile. The latter country and India are negotiating a preferential trade agreement and the Bilateral Investment Protection Treaty signature . A rapprochement with Central America, which still lacks Indian diplomatic missions, may also be of interest. These are necessary steps if, closely following in China's footsteps, India wants to be the "next big thing" for Latin America.

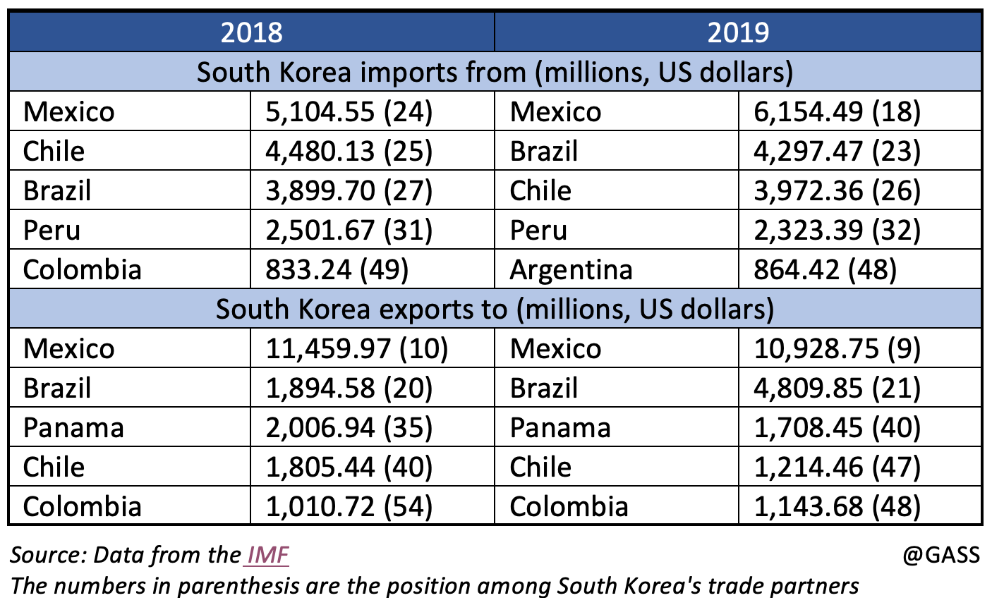

The increase in South Korean trade with Latin American countries has allowed the Republic of Korea to reach Japan's exchange figures with the region.

Throughout 2018, South Korea's trade with Latin America exceeded USD 50 billion, putting itself at the same level of trade maintained by Japan and even for a few months becoming the second Asian partner in the region after China, which had flows worth USD 300 billion (half of the US trade with its continental neighbours). South Korea and Japan are ahead of India's trade with Latin America (USD 40 billion).

ARTICLE / Jimena Villacorta

Latin America is a region highly attractive to foreign markets because of its immense natural resources which include minerals, oil, natural gas, and renewable energy not to mention its agricultural and forest resources. It is well known that for a long time China has had its eye in the region, yet South Korea has also been for a while interested in establishing economic relations with Latin American countries despite the spread of new protectionism. Besides, Asia's fourth largest economy has been driving the expansion of its free trade network to alleviate its heavy dependence on China and the United States, which together account for approximately 40% of its exports.

The Republic of Korea has already strong ties with Mexico, but Hong Nam-ki, the South Korean Economy and Finance Minister, has announced that his country seeks to increase bilateral trade between the regions as it is highly beneficial for both. "I am confident that South Korea's economic cooperation with Latin America will continue to persist, though external conditions are getting worse due to the spread of new protectionism", he said. While Korea's main trade with the region consists of agricultural products and manufacturing goods, other services such as ecommerce, health care or artificial intelligence would be favourable for Latin American economies. South Korean investment has significantly grown during the past decades, from USD 620 million in 2003, to USD 8.14 billion in 2018. Also, their trade volume grew from USD 13.4 billion to 51.5 billion between the same years.