Ruta de navegación

Menú de navegación

Blogs

Entries with label venezuela .

Washington's Antilles energy diversification initiative moves forward

Given the success of Venezuela's oil diplomacy in the Caribbean countries (the islands account for 13 of the 35 votes in the OAS), the United States launched its own initiative in 2014 so that these small states have greater energy diversity and do not depend on Venezuelan crude. The Maduro regime's financial difficulties have reduced Chavista influence in the Caribbean, but Trump is also cutting back on U.S. aid. Diversification of energy sources, however, is moving forward because it is a real need for the islands.

▲ The tourism boom increases electricity consumption in the Caribbean islands, where there are hardly any energy sources of their own.

article / María F. Zambrano

In the Caribbean islands, energy security is at the center of national strategic concern, due to their high dependence on fossil fuels, mostly imported. Energy security is the focus where the geopolitical, diplomatic and economic interests of these small states converge, and not only of them: the great vulnerability due to the lack of their own energy sources was taken into account by Venezuela to promote in 2005 the Petrocaribe cooperation agreement , which gave it great influence in the Antilles; since 2014, the United States has been trying to counteract that program with the Caribbean Energy Security Initiative (CESI), launched by the Obama Administration.

The rivalry between the two energy diplomacy initiatives will not really be settled by a political pulse between Caracas and Washington, but by the real need of the Caribbean islands to diversify their energy sources. This will reduce Venezuela's influence in the region and open the way for the U.S. offer, focused precisely on promoting alternative sources.

The main risk to national security in the Antilles lies in the high costs of Caribbean electricity. On the one hand, the islands have replaced historically agricultural economies with others driven by tourism, which forces them not only to meet the needs of their citizens but also to rely on the fixed cost of an industry with high levels of electricity consumption. On the other hand, production does not have diversified generation Structures . With the exception of Trinidad and Tobago, Suriname and Belize, the islands are supplied by oil as the only installed production capacity; in addition, 87% of primary energy (basically crude oil) is imported. We are facing a problem of high consumption and another of oil dependence.

In view of this status, and given the demands posed by energy security, understood as the physical protection of infrastructure and also the effort to guarantee the continuity of supply, Petrocaribe became a clear option for Antillean interests. Generous financing credits -from 5% to 70% for a 25-year period- contributed to the extension of the program. During the first 10 years of Petrocaribe's existence, from agreement with data of the Latin American and Caribbean Economic System (SELA), Venezuela covered on average 32% of the energy demand of the participating States; the Dominican Republic, Jamaica, Nicaragua and Haiti received 87% of the supplies. The agreement also led to investments in the islands' refineries, which increased their processing capacity to 135,000 barrels of crude oil per day between Cuba's Camilo Cienfuegos refinery (65,000), the refinery near Jamaica's capital (36,000) and the Dominican Petroleum refinery (34,000).

The alliance alleviated for these countries the rise in the price of crude oil, but the region was left in the hands of the volatility of market prices and those of the main supplier. A November 2017 IMFreport estimates that real crude oil price movements affect GDP growth in the Caribbean by 7%, with wide variations from country to country: 15% in Dominica, 9% in Jamaica and less than 1% in Guyana. In turn, the continued drop in Venezuela's production, which began to allocate fewer barrels to Petrocaribe, left the area predisposed to new approaches that would reduce its exhibition to market shocks.

Caribbean Energy Security Initiative

This expectation was addressed in a new energy security framework that sought to increase independence and reduce vulnerability through diversification. Taking advantage of the steep drop in crude oil prices in 2014, which relaxed energy costs for the islands and gave them more room to maneuver, Washington launched the Caribbean Energy Security Initiative (CESI). The program has focused on supporting countries in diversifying electricity generation, addressing their significant renewable energy potential. Thus, through CESI, US$2 million in technical support has been allocated to C-SERMS (Caribbean Sustainable Energy Roadmap and Strategy), a roadmap developed by CARICOM's energy policy division. This roadmap had already harmonized the goals of the 15 member states at subject in terms of energy efficiency and the implementation of renewable energies: two strategies that sought to solve the problems previously mentioned.

The Inter-American Bank of development (IDB) estimated that for the implementation of the C-SERMS roadmap the Caribbean energy sector would require an investment of 7% of the regional GDP between 2018 and 2023. Countries with stronger financial sectors would have the capacity to finance the projects without altering debt sustainability, with these projects being self-financed over a 20-year period.

In the framework of the U.S. initiative, energy efficiency was materialized in the CHEER program (Caribbean Hotel Energy Efficiency and Renewables program) that has provided attendance technical assistance to the hotel industry, the main consumption source . However, in this field, the IMF urges the implementation of broader public policies to further reduce oil imports and increase GDP in the long term deadline.

In the implementation of renewable energy, the U.S. Overseas Private Investment Corporation (OPIC) has promoted infrastructure with public-private financing. Among other projects, it financed the construction of a 36 MW wind power plant and a 20 MW solar power plant, both inaugurated in 2016 in Jamaica. These projects also have macroeconomic influences on reducing dependence on crude oil; in the case of Jamaica, however, dependence has been decreased mainly by the expansion of natural gas receiving capacity, which has allowed that country a reduction from 97% to 80% dependence on imported oil (in fact, it no longer imports Venezuelan crude oil). Since 2016, the business New Fortress Energy has been working on the submission of liquefied natural gas to Jamaica's Bogue plant.

Since its launch, OPIC has financed up to $120 million in energy agreements. Added to that are those promoted by the CEFF-CCA fund, also from the U.S. Government, which provided $20 million non-refundable for projects in initial phases; in 2015 began the project "Clean Energy in the Caribbean", with a duration of five years and with special incidence in Jamaica.

Venezuela... and Trump's clippings

The U.S. initiative for energy diversification in the Caribbean had its response from Venezuela. In 2015, Petrocaribe held a special summit where it quadrupled the ALBA Caribe fund, raising it from $50 million to $200 million, destined to finance mainly social projects, along the lines of what Javier Corrales and Michael Penfold have called "social power diplomacy". However, Venezuela's severe economic crisis and the reduced finances of its national oil company, PDVSA, have forced the government of Nicolás Maduro to cut back on Venezuelan oil diplomacy.

For its part, the arrival of the Trump Administration has led to a significant decrease in the investment earmarked for CESI. In the framework of a generalized cut to financial aid programs abroad, Washington reduced to $4.3 million the amount earmarked for boosting new energy sources in the Caribbean.

The United States, in any case, is not the only one trying to occupy the energy space previously filled by Venezuela. In 2015, the Renewable Energy and Efficient Energy Center was inaugurated in Barbados, promoted by UNID (United Nations Industrial Development Organization) with the support of Austrian and German funds. In addition, last year Russia made fuel shipments to Cuba, replacing supplies that Venezuela had not been able to cover.

The neighbors of the United States in the Western Hemisphere find it difficult to interpret the first year of the new administration

Donald Trump reaches his first anniversary as president of the United States having caused some recent fires in Latin America. His rude disregard for El Salvador and Haiti, due to the high figures of refugees sheltered in the U.S., and his harsh treatment of Colombia, for the increase in cocaine production, had damaged relations. Although they were already complicated in the case of Mexico, throughout the year they had some good times, such as the presidents' dinner that Trump summoned in September in New York in which a united action was drawn on Venezuela.

▲Trump in his first 100 days as president [White House].

ARTICLE / Garhem O. Padilla [English version] [Spanish version].

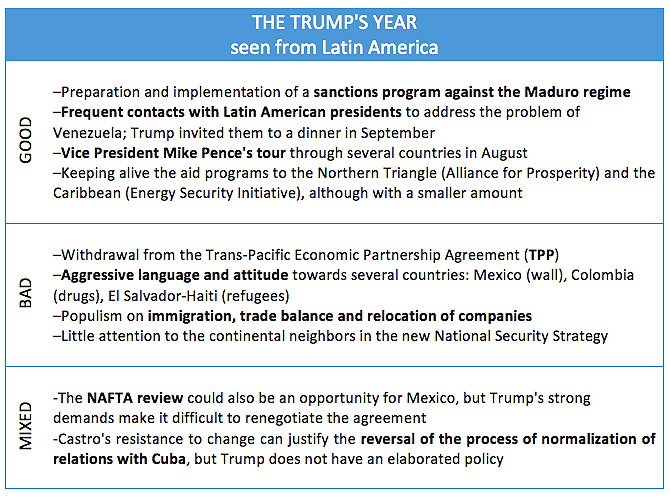

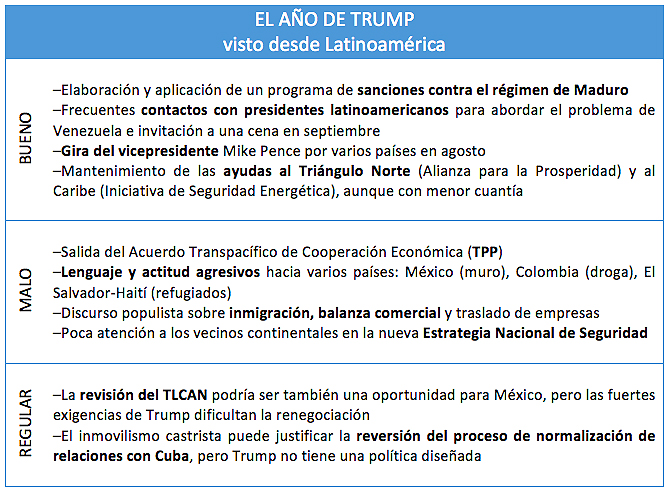

One year after the inauguration of the 45th President of the United States of America, Donald John Trump (the ceremony was on January 20), the controversy dominates the balance of the new administration, both in his domestic as well as international performance. The continental neighbors of the United States, in particular, show bewilderment about Trump's policies towards the hemisphere. On the one hand, they regret the American disinterest in commitments of economic development and multilateral integration; on the other hand, they note some activity in relation to some regional problems, such as the Venezuelan one. The actual balance is mixed, although there is unanimity that the language and many of Trump's forms threaten relationships.

From the TPP to NAFTA

In the economic field, the Trump era started with the definitive withdrawal of the United States from the Trans-Pacific Strategic Economic Partnership Agreement (TPP), on January 23, 2017. This made it impossible to enter into force since the United States is the market through which above all, this agreement emerged. The U.S. withdrawal affected the perspectives of the Latin American countries participating in the initiative.

Then, the renegotiation of the North American Free Trade Agreement (NAFTA), demanded by Trump, was opened. The doubts about the future of the NAFTA, signed in 1994 and that Trump has described as "disaster", have stood out in what is going of the administration. Some of its demands, which Mexico and Canada oppose, are to increase the share of products manufactured in the United States, and the "sunset" clause, which would force the treaty to be reviewed methodically every five years and suspend it if any of its three members did not agree. All this, arises from the idea of the U.S. president to suspend the treaty if it is not favorable for his country.

Cuba and Venezuela

If the quarrels with Mexico have not yet reached to an end, in the case of Cuba, Trump has already retaliated against the Castro regime, with the expulsion in October of 15 Cuban diplomats from the Cuban Embassy in Washington in response to"the sonic attacks" that affected 24 U.S. diplomats on the island. The White House, in addition, has revoked some conciliatory measures of the Obama administration because the Castro regime is not responding with open-ended concessions.

As far as Venezuela is concerned, Trump has made strong efforts in terms of introducing measures and sanctions against corrupt officials, in addition to addressing the political situation with other countries, so that they support those efforts aimed at eradicating the Venezuelan crisis, thus generating multilateralism between American countries. However, this policy has detractors, who believe that the sanctions are not intended to achieve a long-term objective, and it is not clear how they would promote Venezuelan stability.

Although in those actions on Cuba and Venezuela Trump has alluded to the democratic principles violated by the governors of Havana and Caracas, his administration has not insisted especially on the commitment to human rights, democracy and moral values, as being usual in the argumentation of the U.S. foreign policy. Some critics point out that the Trump administration is willing to promote human rights only when they meet its political objectives.

This could explain the worsening of the opinion that exists in Latin America about the United States and about the relations with that country. According to the Latinobarómetro survey 2017, the favorable opinion has fallen to 67%, seven points below that at the end of the Obama administration, which was 74%. This survey shows a significant difference for Mexico, one of the countries that, without a doubt, has the worst levels of favorable opinion towards the Trump administration: in 2017 it was 48%, which means a fall of 29 points in comparison with 2016, in which it was 77%.

|

Immigration, withdrawal, decline

The restrictive immigration policies applied would also explain that rejection of the Trump administration by Latin American public opinion. In the immigration section the most recent is the decision not to renew the authorization to stay in the United States of thousands of Salvadorans and Haitians, who once entered the U.S. fleeing calamities in their countries.

We must also allude to Trump's efforts to achieve one of its main objectives since the beginning of his political campaign: to build a border wall with Mexico. The U.S. president has not had much success at this time, since although he has looked for ways to finance it, what he has managed to introduce in the budgets is very insignificant in relation to the estimated costs.

Trump's protectionism entails a withdrawal that may be accentuating the decline of the U.S. leadership in Latin America, especially against other powers. China has been increasing its economic and political performance in countries such as Argentina, Brazil, Chile, Peru and Venezuela. Russia, for its part, has strengthened diplomatic and security relations with Cuba. It could be said that, taking advantage of the conflicts between Cuba and the United States, Moscow has tried to keep the island in its orbit through a series of investments.

Threats to security

This leads us to mention the new National Security Strategy of the United States, announced in December. The document presented by Trump addresses the rivalry with China and Russia, and also refers to the challenge posed by the regimes of Cuba and Venezuela, by the supposed threats to security they represent and the support of Russia they receive. Trump expressed great desire to see Cuba and Venezuela join "shared freedom and prosperity" and called for "isolating governments that refuse to act as responsible partners in advancing hemispheric peace and prosperity."

Similarly, the new U.S. Security Strategy refers to other challenges in the region, such as transnational criminal organizations, which impede the stability of Central American countries, especially Honduras, Guatemala and El Salvador. All in all, the document only dedicates one page to Latin America, in line with Washington's traditional attention given to the areas of the world that most affect their interests and security.

An opportunity for the United States to approach the Latin American countries will be the Summit of the Americas, which will be held next March in Lima. However, nothing is predictable given the characteristic attitude of the president, which leaves a large open space for possible surprises.

Continental U.S. neighbors are having a hard time interpreting the first year of the new Administration.

Donald Trump arrives at his first anniversary as president having set some recent fires in Latin America. His rude disregard for El Salvador and Haiti, due to the volume of refugees welcomed in the United States, and his intemperate attention to Colombia for the increase in cocaine production worsen relations that, although already complicated in the case of Mexico, have had some good moments throughout the year, such as the dinner of presidents that Trump convened in September in New York in which a united action on Venezuela was outlined.

▲Trump, on completing 100 days as president [White House].

article / Garhem O. Padilla [English version].

One year after the arrival of the 45th President of the United States of America, Donald John Trump, to the White House -the inauguration ceremony was on January 20-, controversy dominates the balance of the new Administration, both in its domestic and international performance. The continental neighbors of the U.S., in particular, show bewilderment over Trump's policies toward the hemisphere. On the one hand, they regret the U.S. disinterest in commitments to economicdevelopment and multilateral integration; on the other, they note some activity in relation to some regional problems, such as Venezuela. The balance for the moment is mixed, although there is unanimous agreement that Trump's language and many of his manners rather threaten relations.

From TPP to NAFTA

agreement In the economic field, the Trump era began with the withdrawal final of the United States from the Trans-Pacific Partnership (TPP) on January 23, 2017. This made it impossible for entrance to enter into force, as the United States is the market for which the TPP was created agreement, which has affected the prospects of the Latin American countries that participated in the initiative.

The renegotiation of the North American Free Trade Agreement (NAFTA), demanded by Trump, was immediately opened. Doubts about the future of NAFTA, signed in 1994 and which Trump has described as a "disaster", have been prominent so far in his administration. Some of his demands, which Mexico and Canada oppose, are to increase the quota for products manufactured in the United States and the "sunset" clause, which would oblige the treaty to be reviewed methodically every five years and would cause it to be suspended if any of its three members were not in agreement with agreement. All of this stems from the U.S. president's idea of fail the treaty if it is not favorable to his country.

Cuba and Venezuela

If the quarrels with Mexico have not yet reached a conclusion, in the case of Cuba Trump has already retaliated against the Castro regime, with the expulsion in October of 15 Cuban diplomats from the Cuban embassy in Washington as a response to the "sonic attacks" that affected 24 U.S. diplomats on the island. The White House has also reversed some of the Obama Administration's conciliatory measures, when it realized that Castroism is not responding with openness concessions.

As far as Venezuela is concerned, Trump has made forceful efforts to introduce measures and sanctions against corrupt officials, in addition to addressing the political status with other countries, so that they support those efforts aimed at eradicating the Venezuelan crisis, thus generating multilateralism among American countries. However, this policy has its detractors, who believe that the sanctions are not intended to achieve a long-term goal deadline , and it is unclear how they would promote Venezuelan stability.

Although in these actions on Cuba and Venezuela Trump has alluded to the democratic principles violated by the rulers of Havana and Caracas, his Administration has not particularly insisted on the commitment to human rights, democracy and moral values, as had been usual in the argumentation of U.S. foreign policy. Some critics point out that the Trump Administration is willing to promote human rights only when they fit its political objectives.

This could explain the worsening opinion in Latin America about the United States and relations with that country. From agreement with the survey Latinobarómetro 2017, the favorable opinion has fallen to 67%, seven points below the one at the end of the Obama Administration, which was 74%. Said survey sample a relevant difference for Mexico, one of the countries that, without a doubt, has the worst levels of favorable opinion towards the Trump Administration: in 2017 it was 48%, a drop of 29 points compared to 2016, when it was 77%.

|

Immigration, withdrawal, decline

The restrictive immigration policies applied would also explain the rejection of the Trump Administration by Latin American public opinion. In the immigration section the most recent is the decision not to renew the authorization to stay in the United States of thousands of Salvadorans and Haitians, who once arrived fleeing calamities in their countries.

It is also worth mentioning Trump's efforts to achieve one of his main objectives since the beginning of his political campaign: to build a border wall with Mexico. The U.S. president has not been very successful so far in this goal, since despite having sought ways to finance it, what he has managed to introduce in the budgets is very insignificant in relation to the estimated costs. On the other hand, his decision

Trump's protectionism entails a retreat that may be accentuating the decline of the United States as a leader in Latin America, especially vis-à-vis other powers. China has been increasing its economic and political engagement in countries such as Argentina, Brazil, Chile, Peru and Venezuela. Russia, for its part, has strengthened its diplomatic and security relations with Cuba. It could be said that, taking advantage of the conflicts between the island and the United States, Moscow has sought to keep it in its orbit through a series of investments.

Security threats

This leads us to mention the new US National Security Strategy, announced in December. The document, presented by Trump, addresses the rivalry with China and Russia, and also refers to challenge the Cuban and Venezuelan regimes, for the alleged security threats they pose and the Russian support they receive. Trump expressed a strong desire to see Cuba and Venezuela join in "shared freedom and prosperity" and called to "isolate governments that refuse to act as responsible partners in advancing hemispheric peace and prosperity."

Similarly, the new U.S. Security Strategy alludes to other challenges in the region, such as transnational criminal organizations, which impede the stability of Central American countries, especially Honduras, Guatemala and El Salvador. However, the document devotes only one page to Latin America, in line with Washington's traditional focus on the areas of the world that most affect its interests and security.

An opportunity for the United States to get closer to Latin American countries will be the Summit of the Americas, to be held next March in Lima. However, nothing is predictable given the President's characteristic attitude, which leaves a great deal of room for possible surprises.