Ruta de navegación

Menú de navegación

Blogs

Entries with label peru .

High incidence of Covid-19 in the country contrasts with the government's swiftness in implementing measures

Peru has been an example in the Covid-19 crisis for its speed in applying containment measures and for approve one of the largest economic stimulus packages in the world, close to 17% of GDP. However, the high incidence of the pandemic, which has made Peru the second Latin American country in terms of cases of the coronavirus and the third in terms of deaths, has made it necessary to prolong the restrictions on activity longer than expected. This and lower external demand, weaker than initially predicted, have "more than eclipsed" the government's significant economic support, according to the IMF, which forecasts a 13.9% drop in GDP for Peru in 2020, the largest of the region's main economies.

![lecture of the Peruvian president, Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru]. lecture of the Peruvian president, Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru].](/documents/10174/16849987/peru-covid-blog.jpg)

lecture of the Peruvian President, Martín Vizcarra (r), in the presence of the head of Economics, María Antonieta Alva (l) [Gov. of Peru].

ARTICLE / Gabriela Pajuelo

International media such as Bloomberg y The Wall Street Journal have shown admiration for Peru's young minister of Economics , María Antonieta Alva. At 35, with a master's degree from Harvard and some experience in Peru's own administration, Alva designed one of the most ambitious economic stimulus plans in all of South America at the beginning of the crisis.

"From a Latin perspective, Peru is a clear leader in terms of macro response; I could have imagined a very different result if Toni wasn't there," he said. Ricardo HausmannAlva's Harvard professor, who is leading a team of experts advising Peru and ten other countries on how to mitigate the effects of the coronavirus. The minister has also become one of the best-known faces of President Martin Vizcarra's government among the working classes.

Peru was one of the first countries in Latin America to apply a state of emergency, limiting the freedom of meeting and transit in Peruvian territory and restricting economic activity. To prevent mass infection with the virus, the government decreed the closure of borders, restrictions on interprovincial movement, a daily curfew and a mandatory period of national isolation, which has been extended several times and has become one of the longest in the world.

This prolongation, agreed in the face of the high incidence of the pandemic, has damaged the economic outlook more than expected. Moreover, the prolongation of the emergency in countries to which Peru's exports are destined has weakened their demand for raw materials and damaged the resurgence of Peru's Economics . This is the IMF's estimate, which between its April forecast and the one updated in June has added nine more points to the fall in Peru's GDP for 2020. The IMF now considers that Peru's Economics will fall by 13.9% this year, the largest among the region's major countries. Although the ambitious stimulus package will not have prevented this decline, it will boost the recovery, with GDP rising by 6.5% in 2021, the strongest rebound among the largest Latin American economies. With regard to the latter forecast, the IMF specifies that, nevertheless, "there are significant risks to leave , linked to national and global challenges to control the epidemic".

A socio-economic context that does not financial aid to containment

Despite restrictive social distancing measures, the pandemic has had a high incidence in Peru, with 268,602 diagnosed cases (second only to Brazil in Latin America) and 8,761 deaths (behind Brazil and Mexico) as of 25 June. These high figures are partly due to the fact that the country's socio-economic conditions have meant that compliance with containment has not been very strict in certain situations. The social context has made it difficult to respect the mandatory quarantine due to structural problems such as the fragility of health services and infrastructure, the difficulty of efficient public procurement, prison overcrowding and the digital divide.

The high level of labour informalityThe fact that in 2019 it was 72% explains why many people have to continue working to ensure their subsistence, without following certain protocols or having access to certain material; at the same time, this informality prevents greater tax collection that would help to improve budgetary items such as health. Peru is the second Latin American country with the lowest health investment.

On the other hand, inequalitywhich in 2018 was 42.8 in the Gini index, is aggravated by the territorial distribution of expense, linked to the centralisation of employment of the rural population in Lima. During the pandemic, workers from the country's highlands who have migrated to the capital have wanted to return to their places of origin, as many are not on the payroll and have no labour rights, in contravention of the restrictions of mobility.

This social context makes it possible to question some of the economic measures approved, according to some Peruvian academics. The president of high school Peruano de Economics (IPE), Roberto Abusada, warned that Peru's macroeconomic strengths will not help forever. He considered that certain regulations are unenforceableThe "setting parameters such as body mass index (BMI) or an age limit, creates obstacles for this group of people, who could be highly qualified, and could not return to their centre of work".

Economic package

In late April, Minister Alva presented a $26 billion economic stimulus package, representing 12 per cent of GDP. Additional measures a month later raised that percentage to 14.4 per cent of GDP, and even then it would have been closer to 17 per cent. Comparatively speaking, this is one of the largest stimulus packages adopted in the world (in Latin America, the second largest is Brazil, with a stimulus of 11.5 per cent of GDP).

From agreement with the monitoring that the IMF Peru has adopted measures in three different areas: fiscal, monetary and macro-financial, and in terms of the exchange rate and the balance of payments.

First, in terms of fiscal measures, the government approved 1.1 billion soles (0.14% of GDP) to address the health emergency. In addition, various measures have been implemented, among which two stand out: the "Stay at home" voucher and the creation of the Business Support Fund for Micro and Small Enterprises (FAE-MYPE).

The first measure, for which the government approved approximately 3.4 billion soles (0.4% of GDP) in direct transfers, is a 380 soles (US$110) voucher targeted at poor households and vulnerable populations, of which there have been two disbursements. The second measure concerns the creation of a fund of 300 million soles (0.04% of GDP) to support MSEs, in an attempt to guarantee credit for capital for work and to restructure or refinance their debts.

Among other fiscal measures, the government approved a three-month extension of the income tax declaration for SMEs, some flexibility for businesses and households in paying tax obligations and a deferral of household electricity and water payments. The whole package of fiscal support amounts to more than 7% of GDP.

On the other hand, in terms of monetary and macro-financial measures, the Central Bank reservation (BCR) reduced the reserve requirement rate by 200 basis points, bringing it to 4%, and is monitoring the evolution of inflation and its determinants to increase monetary stimulus if necessary. It has also reduced reserves requirements , provided liquidity to the system with a package backed by government guarantees of 60 billion soles (more than 8% of GDP) to support lending and the chain of payments.

In addition, exchange rate and balance of payments measures have been implemented through the BCR's intervention in the foreign exchange market. By 28 May, the BCR had sold approximately USD 2 billion (0.9% of GDP) in foreign exchange swaps. International reserves remain significant, at more than 30% of GDP.

On the other hand, in the field of trade relations, Peru agreed not to impose restrictions on foreign trade operations, while at the same time liberalising the loading of goods, speeding up the issuance of certificates of origin, temporarily eliminating some tariffs and waiving various infractions and penalties contained in the General Customs Law. This was particularly the case for transactions with strategic partners, as the European UnionAccording to Alberto Almendres, the president of Eurochambres (the association of European Chambers in Peru). 50% of foreign investment in Peru comes from Europe.

In terms of Peruvian exports, although the emergence of the coronavirus in China at the beginning of the year slowed down transactions with that country, mining and agricultural exports remained positive. in the first two months of the yearas indicated in the high school research and of the Lima Chamber of Commerce. development (Idexcam). Subsequently, exports of raw materials and tourism have been more affected, especially in the case of exports of raw materials and tourism.

Comparison with Chile and Colombia

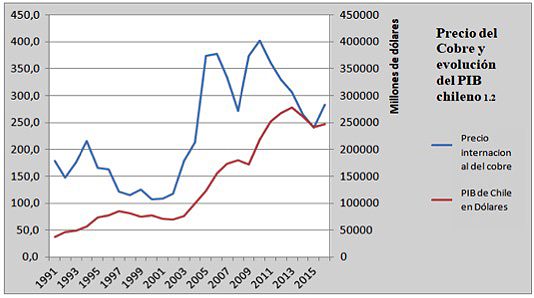

The status in Peru can be analysed in comparison with its neighbours Chile and Colombia, which will have a somewhat smaller fall in GDP in 2020, although their recovery will also be somewhat smaller.

issue As for the issue of confirmed Covid-19 cases as of 25 June, Chile (259,064 cases) is similar in size to Peru (268,602), although the number of deaths is almost half that of Peru (4,903 Chileans and 8,761 Peruvians), which corresponds to the proportion of its total population.

In response to the pandemic, Chilean authorities implemented a series of measures, including the declaration of a state of catastrophe, travel restrictions, school closures, curfews and bans on public gatherings, and a teleworking law. This crisis came just months after the social unrest experienced in the country in the last quarter of 2019.

On the economic front, Chile approved a stimulus of 6.7% of GDP. On 19 March, the authorities presented a fiscal package of up to $11.75 billion focused on supporting employment and corporate liquidity (4.7% of OPIB), and on 8 April an additional $2 billion of financial aid to vulnerable households was announced, as well as a $3 billion (2%) guarantee plan from credit . In its June forecast update , the IMF expects Chile's GDP to fall by 7.5% in 2020 and increase by 5% in 2021.

In Colombia, the level of contagion has been lower (77,313 cases and 2,611 deaths), and its economic package to cope with the crisis has also been smaller: 2.8 per cent of GDP. The government created a National Emergency Mitigation Fund, which will be partially financed by regional and stabilisation funds (around 1.5 per cent of GDP), complemented by the issuance of national bonds and other budgetary resources (1.3 per cent). In its recent update, the IMF forecasts that Colombia's GDP will fall by 7.8% in 2020 and rise by 4% in 2021.

Bolivia has established itself in the role of distributing Peruvian cocaine and its own cocaine for consumption in South America and export to Europe.

-

In 2019, Martin Vizcarra's government eradicated 25,526 hectares of coca cultivation, half of the estimated total area of plantations.

-

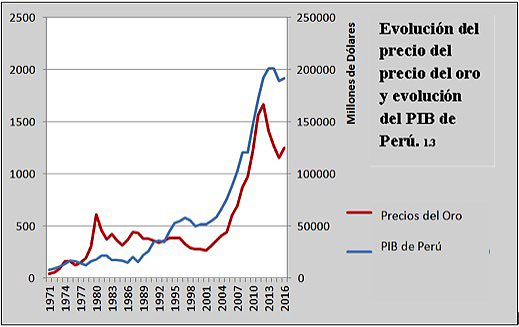

Peru had a record potential cocaine production of 509 tonnes in 2018; Bolivia's was 254 tonnes, one of the highest historically, according to the US.

-

The US accused Morales towards the end of his term of office of having "manifestly failed" to meet his international obligations with his 2016-2020 counter-narcotics plan.

Coca crop eradication operation in Alto Huallaga, Peru [project CORAH]

report SRA 2020 / Eduardo Villa Corta [PDF version].

Since Peru's national plans against coca cultivation began in the 1980s, eradication campaigns have never reached what is known as the VRAEM (Valley of the Apurímac, Ene and Mantaro Rivers), a difficult-to-access area in the centre of the southern half of the country. Organised crime operates in this area, especially the remnants of the old Shining Path guerrillas, now dedicated to drug trafficking and other illicit businesses. The area is the source of 64% of the country's potential cocaine production. Peru is the world's second largest producer, after Colombia.

The government of President Martín Vizcarra carried out a resolute policy of suppressing illicit crops in 2019. The eradication plan (project Especial de Control y Reducción del Cultivo de Coca en el Alto Huallaga or CORAH) was applied last year to 25,526 hectares of coca crops (half of the existing ones), of which 750 were in the VRAEM (operations were carried out in the areas of Satipo, Tambo River and Alto Anapati, in the Junín region).

These actions should result, when the figures for 2019 are presented, in a reduction in total coca cultivation and potential cocaine production, thus breaking the increase experienced in recent years. According to the latest report International Narcotics Control Strategy Report (INCSR), from the US State Department's department , which closely monitors this illicit activity in the countries of the region, in 2018 there were 52,100 hectares of coca in Peru (compared to 44,000 in 2016 and 49,800 in 2017), whose extent and quality of cultivation could generate a record production of 509 tonnes of cocaine (compared to 409 in 2016 and 486 in 2017). Although in 2013 there was even more area cultivated (59,500 hectares), then the cocaine potential stood at 359 tonnes.

From Peru to Bolivia

This increase in recent years in the generation of cocaine in Peru has consolidated Bolivia's role in the trafficking of this drug, since in addition to being the world's third largest producer (in 2018, 32,900 hectares were under cultivation, with a potential production of 254 tonnes of narcotic substance, according to the US), it is a transit zone for cocaine of Peruvian origin.

The fact that only around 6% of the cocaine reaching the US comes from Peru (the rest comes from Colombia) indicates that most Peruvian production goes to the growing market in Brazil and Argentina and to Europe, and therefore its natural outlet is through Bolivia. Bolivia is thus considered a major "distributor".

Some of the drugs arrive in paste form and are refined in Bolivian laboratories. The goods are brought into Bolivia using small planes, which sometimes fly at less than 15 metres above the ground and drop the cocaine packages in uninhabited rural areas; they are then picked up by elements of the organisation. The movement is also carried out by road, with the drugs camouflaged on cargo roads, and to a lesser extent using Lake Titicaca and other waterways connecting the two countries.

Once across the border, drugs from Peru, along with those produced in Bolivia, travel to Argentina and Chile, especially through the Bolivian city of Santa Cruz and the Chilean border crossing of Colchane, or enter Brazil - directly or through Paraguay, using for example the crossing between the Paraguayan town of Pedro Juan Caballero and the Brazilian town of Ponta Pora - for consumption in South America's largest country, whose volume has climbed to second place in the world, or to reach international ports such as Santos. This port, which is Sao Paulo's outlet to the sea, has become the new hub of the global narcotics trade, from which almost 80 per cent of Latin America's drugs leave for Europe (sometimes via Africa).

Production in Bolivia has been growing again since the middle of the last decade, although in the Bolivian case there is a notable difference between the often divergent figures provided by the United States and the United Nations Office on Drugs and Crime (UNODC). Both estimates agree that there was a previous decline, attributed by the La Paz government to the so-called "rationalisation of coca production", which reduced production by 35 per cent and adjusted cultivation areas to those permitted by law in a country where traditional uses of coca are allowed.

However, the Coca Law promoted in 2017 by President Evo Morales (his political degree program originated in the coca growers' unions, whose interests he later continued to defend) protected an extension of production, raising the permitted hectares from 12,000 to 22,000. The new law covered an increase that was already occurring and encouraged further excesses that have far exceeded the volume required for traditional uses, which programs of study from the European Union puts at less than 14,700 hectares. In fact, the UNODC estimated in its 2019 report that between 27% and 42% of the coca leaf grown in 2018 was not sold in the only two local markets authorised for this purpose, indicating that at least the rest was destined for cocaine production.

For 2018, the UNODC determined a production of 23,100 hectares, in any case above what is allowed by law. The US data reported 32,900 hectares, an increase of 6% over the previous year, and a potential cocaine production of 254 tons (2% more).

Sixty-five percent of Bolivian production takes place in the Yungas area, near La Paz, and the remaining 35 percent in Chapare, near Cochabamba. In the latter area, crops are expanding, encroaching on the Tipnis natural park -reservation . The park, which runs deep into the Amazon, suffered major fires in 2019: whether intentional or not, the destroyed tropical vegetation could give way to clandestine coca plantations.

After Morales

The report of the 2020 US State department highlights the greater anti-drug commitment of the Bolivian authorities who succeeded the Morales government in November 2019, which had maintained "inadequate controls" over coca cultivation. The US considers that Morales' 2016-2020 anti-drug plan "prioritised" actions against criminal organisations rather than combating coca growers' production that exceeded the permitted volume. Shortly before leaving office in September, Morales was accused by the US of having "manifestly failed" to comply with international obligations at subject on drug control.

According to the US, the transitional government "has made important strides in drug interdiction and extradition of drug traffickers". This increased control by the new Bolivian authorities, together with the determined action of the Vizcarra government in Peru, should lead to a reduction in coca cultivation and cocaine production in both countries, and therefore in its export.

Cyclical movements in the Latin American economy show close links to fluctuations in mineral pricing

The attention of public opinion on the price of commodities usually focuses on hydrocarbons, especially oil, because of the direct consequences on consumers. But although there are important oil producers in Latin America, minerals are a more transversal asset in the region's economy, especially in South America. This is shown by the largely parallel lines that follow the evolution of non-energy minerals and GDP growth, both in times of boom and of decline.

ARTICLE / Ignacio Urbasos Arbeloa [English version] [Spanish version].

Mining activity is a fundamental sector for most of the Latin American economies. The sector has a huge weight on exports and the attraction of foreign direct investment making it one of the most important sources of international currencies. Against the general perception of the non-energetic mining activities as a mature industry, the sector has demonstrated its capability to be attractive for investment and able to produce jobs and wealth. Latin American mining is the destiny of 30% of world investment in the sector, which is waiting for a rising in prices. The effect of these price fluctuations have direct consequences on the economies of the continent, some of them being deeply dependent on the exploitation and sell of its natural resources. The main goal of this analysis is to articulate a convincing explanation of the impact of price fluctuation on non-energetic minerals on national GDPs.

Firstly, it is important to explain the chronological evolution of prices in the most exploited minerals of Latin America. The general tendency of commodity prices during the last two decades has been marked by a great volatility. The so called super cycle of commodities [1] produced between 2003 and 2013, with recoil during 2008 and 2009, coincides with the golden decade of Latin America. This situation was produced thanks to an unprecedented rising of global demand, mainly of the emerging countries led by China. In fact, the rising of China has transformed the trade pattern in the region which is today the main trade partner of a large number of countries.

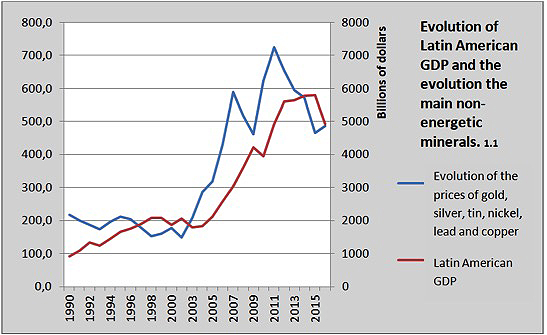

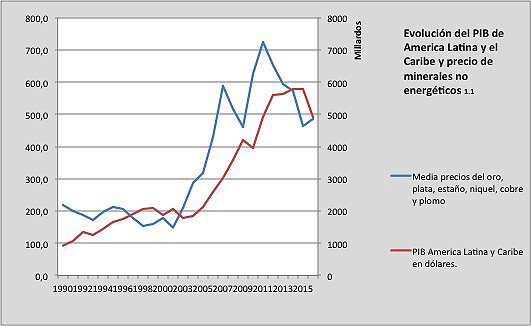

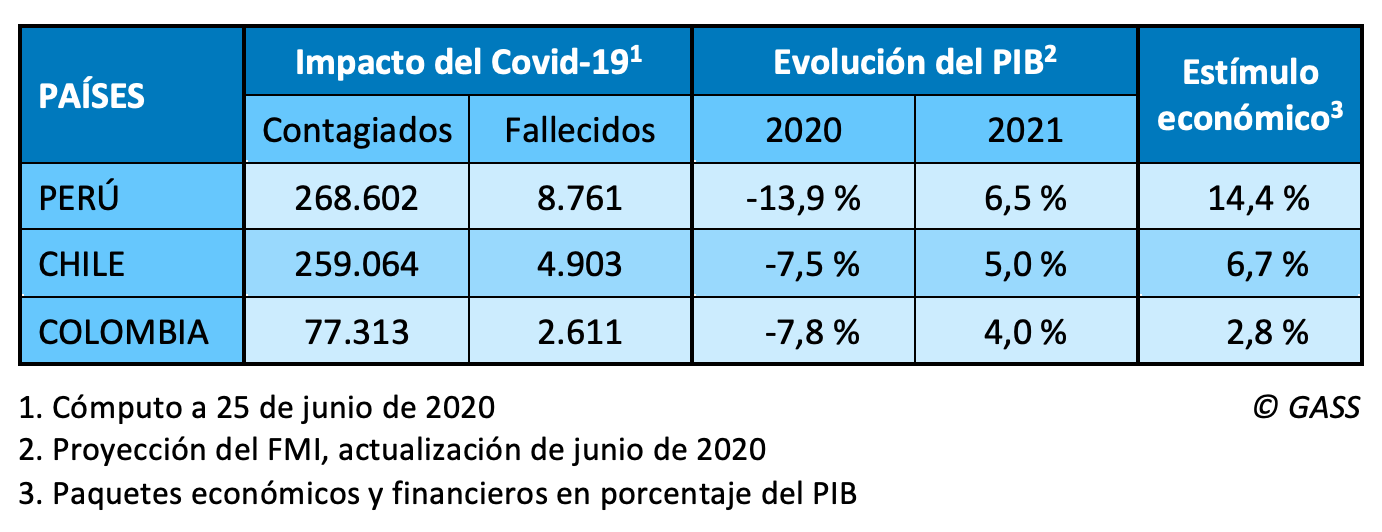

The mentioned evolution in commodity prices is similar to the one of the non-energetic minerals, which generally follows the tendencies of raw materials. As graph 1.1 shows, the region of Latin America and Caribbean has growth in correlation to the average evolution of the prices of gold, silver, tin, nickel, lead and copper. It is important to mention that this correlation in not an isolated one, and has to be analyzed in the context of a general rising in natural resource-based products such as hydrocarbons and agricultural goods.

|

[The graphics have been made from World Bank Data and national statistics of Peru and Chile]. |

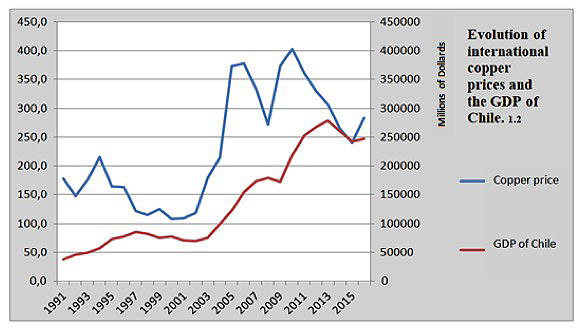

The Chilean case can be illustrative. The country has an economy particularly specialized on non-energetic minerals, outstanding copper as a core mineral for the country. Chile is the main producer of copper in the world and this mineral is around 50% of the national exports. The mining sector in Chile [2] represented 20% of the country's GDP during the 2000's, in 2017 it is only 9% of its economy. In graph 1.2 it is evident how the economic growth of Chile is directly linked with the different prices of copper. Even though it is one of the most complex and developed economies in the continent, with a tertiary sector [3] representing 74% of its GDP, Chilean economy is still dependent and affected by copper prices and the situation of the mining industry.

|

|

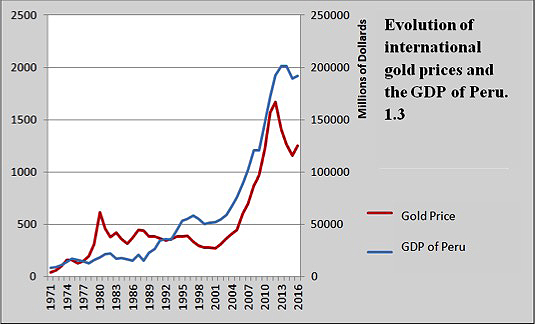

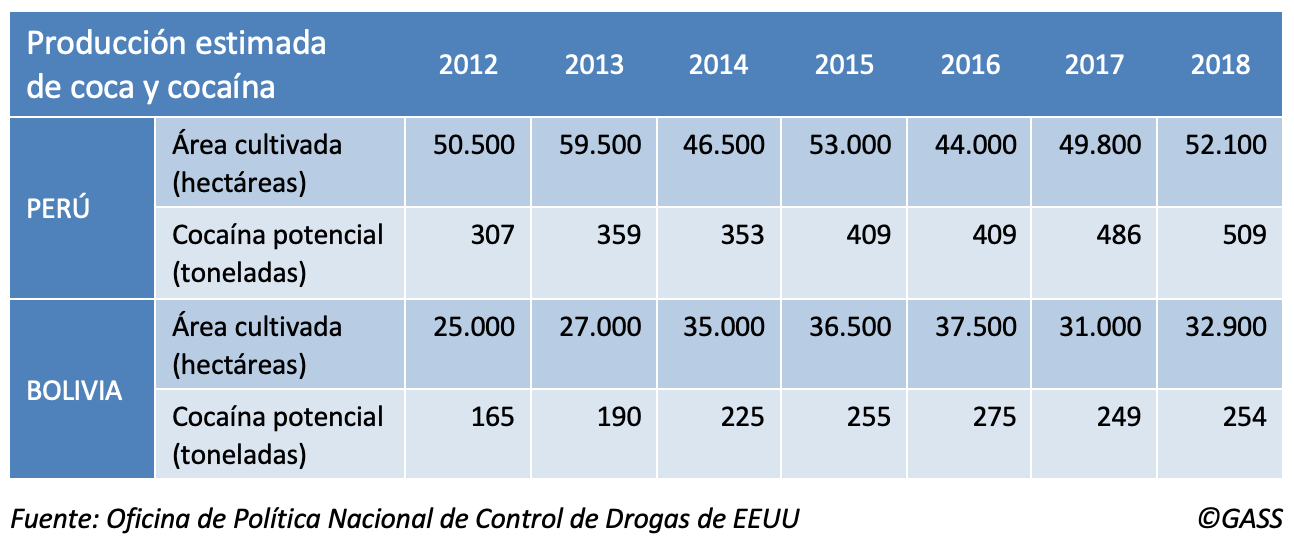

Another interesting case is the Peruvian one, a country whose exports are in a big proportion composed by non-energetic minerals. Gold is 18% and copper is 26% of all exports [4], reaching both more than 46% of them. Similar to the case of Chile, 15% of its national GDP comes from the mining activities. Again, the correlation of mineral prices and economic growth is evident in graph 1.3, showing the huge dependence of these economies to the international prices of their exports.

|

|

This relationship is logical and has its answer in different realities. On the one hand, the quantitative value of natural resources on the Latin American economies, whose exports are mainly composed by mineral, agricultural or energetic commodities. On the other hand, the qualitative importance of the mining sector, which creates huge amounts of employs (up to 9% of the total in Chile), is the activity of some of the main companies in the region (among the 20 biggest companies in the Latin America, 5 are related to the mining activities), it is the main source of currencies and support public budgets by its particular fiscal regime. Equally, a big amount of national public debts are covered by those particular taxes, creating a situation of possible default in case of great fluctuations of prices. This menace brings back the memories of the debt crisis in the 80's, something that it is now a reality in the case of Venezuela.

Must be taken into account that Latin American countries are not a unicity or a homogeneous reality, in general it is true that the region confronts a general challenge: be able of reduce the dependence of their economies to the exploitation and sell of its natural resources. An economic structure that is problematic because of its impact on the environment, a particularly complex issue because of the resistance of indigenous groups to suffer from it. The nature of the employs created by this activity is sometimes disappointing, with low wages and bad labor conditions. Anyway, the industrial development of the region is still far from being sufficient and there is a rising awareness about the lack of economic structural reforms during the golden decade of 2003-2013 that could have changed the situation [5]. The profits derived from the mining sector are used to promote political interest or short-term goals with electoral sights.

This inefficient use of the public resources increases the vulnerability of the general welfare to the mentioned continuous shifts in prices. Even though perspectives about prices are optimistic and expect an imminent rise [6], they will not reach the levels of 2008, when they were at their historical maximum. This new context will demand a new approach to Latin American economies, which will not have access to the huge amount of money that they had during the past decade. Its economic growth will not come from an external favorable context, but from internal efforts to modernize and renovate its economic capability.

The cycles of the Latin American Economics are closely linked to mineral prices: the graphs are astounding.

Public attention on the price of commodities is often focused on hydrocarbons, preferably oil, because of the direct consequences on consumers. But although Latin America has major crude oil producers, minerals are a more cross-cutting asset on the region's Economics , especially in South America. This is demonstrated by the largely parallel lines that follow the evolution of non-energy minerals and GDP growth, both in times of boom and bust.

article / Ignacio Urbasos Arbeloa [English version].

Mining is a fundamental activity for many Latin American economies. The sector has an enormous weight in exports and foreign investment, making it one of the main sources of foreign exchange. In contrast to the general perception of non-energy mining as a mature industry, the sector continues to be attractive to investors and is capable of continuing to generate employment and wealth. Latin American mining receives 30% of the world's investment in the sector, which expects a recovery in prices. The impact of these fluctuations has direct consequences on the economies of the continent, some of which are highly dependent on the exploitation and sale of these resources. The goal of this analysis is to articulate a convincing explanation of the Degree in which these price variations affect national GDPs.

First of all, it is important to detail the chronological evolution of prices of the main minerals exploited in Latin America. The general trend in commodity prices over the last two decades has been marked by enormous volatility. The so-called commodity super cycle [1] given approximately between 2003 and 2013, with a setback between 2008 and 2009, occurs at the same time as the so-called golden decade in Latin America. This status was produced by an unprecedented rise in world demand, thanks to emerging countries led by China, which has transformed foreign trade in the region, displacing the USA as the first partner of most of these countries.

The evolution in prices has followed a very similar patron saint in non-energy mining, which by rule generally follows the price trends of the rest of the raw materials. As we can see in Figure 1.1, the Latin American and Caribbean region has had an economic growth very similar to the average evolution of gold, silver, tin, nickel, lead and copper prices. It is important to mention that the relationship between these two variables is not isolated, and should be analyzed in the above-mentioned context of a general rise in the prices of other raw materials of vital importance for the region, such as hydrocarbons or agricultural products.

|

[The graphs are based on World Bank Data and national statistics from Peru and Chile] [The graphs are based on World Bank Data and national statistics from Peru and Chile]. |

The case of Chile can be extremely useful. Chile has a Economics particularly specialized in non-energy mining, highlighting the exploitation of copper, an activity in which it is a world leader and which accounts for 50% of its exports. The mining sector in Chile [2] reached almost 20% of GDP in the mid-2000s; in 2017 it has accounted for around 9%. In Figure 1.2 we see how the price of copper sets the country's economic path, with the greatest periods of Chilean economic growth coinciding with the increase in copper prices. Despite being one of the most developed economies in the region [3], with a 74% weight of the services sector in GDP, the country is still conditioned by the situation of its primary sector and specifically mining.

|

|

Another interesting case is Peru, a country whose exports include a good share of non-energy minerals [4], reaching 46% of exports in the case of gold (18%) and copper (26%). Similarly to Chile, the share of mining in the Economics is 15% of GDP. Again, we can appreciate the correlation between the prices of certain strategic non-energy minerals and economic growth.

|

|

This relationship is logical and responds to several realities. On the one hand, the great quantitative value of raw materials in Latin American economies, which concentrate their exports in agricultural, mineral and energy products. On the other hand, its qualitative importance since the sector generates large amounts of employment (up to 9% in Chile), is the object of many of the main companies in the region (5 of the 20 largest in Latin America are dedicated to extraction), is the main source of foreign currency and leaves enormous benefits for the coffers of the States, since they are governed under a particular tax system more burdensome. Likewise, a good part of the payment of foreign debt is covered by these revenues, and price instability could bring back the ghosts of the debt crisis of the eighties, something that is already a reality in the case of Venezuela.

Although the countries of Latin America cannot be analyzed as a heterogeneous unit, in general terms the region does face a common challenge : to be able to reduce the dependence of its economies on the exploitation and export of raw materials. An activity that has problematic elements such as its impact on the environment, a particularly complex issue in the region due to the reticence of indigenous groups, or the quality and stability of the employment they generate. In any case, the region's industrial development is still deficient and there are more and more voices warning that the golden decade of 2003-2013 was not used to make the necessary structural changes to mitigate this status [5].

The existence of complex realities partner-politics in Latin America has often led to the use of the benefits derived from extraction in short term and electoral policies, a scourge that increases the exhibition of social welfare to the ups and downs of the mining and energy sector. Although commodity price predictions point to an imminent recovery [6], status is not expected to be similar to the one around 2008 when prices reached historic highs. This new situation will demand the maximum from Latin American economies, which will not be able to count on such a favorable status from the international Economics .