Ruta de navegación

Menú de navegación

Blogs

Entries with label oil .

The finding of a "significant" amount of oil in offshore wells puts the former Dutch colony in the footsteps of neighbouring Guyana.

The intuition has proved to be correct, and explorations carried out under Suriname's territorial waters, together with the successful hydrocarbon reserves that are being exploited in Guyana's maritime borders, have found abundant oil. The finding could be a decisive boost for the development of what is, after Guyana, the second poorest country in South America, but it could also be an opportunity, as with its neighbour, to accentuate the economic and political corruption that has been hindering the progress of the population.

![Suriname's presidential palace in the country's capital, Paramaribo [Ian Mackenzie]. Suriname's presidential palace in the country's capital, Paramaribo [Ian Mackenzie].](/documents/10174/16849987/surinam-oil-blog.jpg)

Suriname's presidential palace in the country's capital, Paramaribo [Ian Mackenzie].

article / Álvaro de Lecea

So far this year, drilling in two offshore fields in Suriname has been positive result , confirming the existence of "significant" oil in block 58, operated by France's Total, in partnership with US-based Apache. Everything indicates that the same success could be obtained in block 52, operated by the also American ExxonMobil and the Malaysian Petronas, which were pioneers in prospecting in Surinamese waters with operations since 2016.

Both blocks adjoin the fields under the waters of neighbouring Guyana, where it is currently estimated that there are some 3.2 billion barrels of extractable oil. In the case of Suriname, exploration in the first viable field, Maka Central-1, discovered in January 2020, indicates 300 million barrels, but estimates from Sapakara West-1, discovered in April, and subsequent planned exploration, have yet to be added. It is estimated that some 15 billion barrels of oil reserves may exist in the Guyana-Suriname basin.

Until this new oil era in the Guianas (the former British and Dutch Guianas; the French Guianas remains an overseas dependency of France), Suriname was considered to have reserves of 99 million barrels, which at the current rate of exploitation left two decades to deplete. In 2016, the country produced just 16,400 barrels per day.

status political, economic and social

With just under 600,000 inhabitants, Suriname is the least populated country in South America. Its Economics is heavily dependent on the export of metals and minerals, especially bauxite. The fall in commodity prices since 2014 has particularly affected the country's accounts. GDP contracted by 3.4% in 2015 and by 5.6% in 2016. Although the trend then turned positive again, the IMF forecasts a 4.9% drop in GDP for 2020, as a result of the global crisis caused by Covid-19.

Since gaining independence from the Netherlands in 1975, its weak democracy has suffered three coups d'état. Two of them were led by the same person: Desi Bouterse, the country's president until this July. Bouterse staged a coup in 1980 and remained in power indirectly until 1988. During those years, he kept Suriname under a dictatorship. In 1990 he staged another coup d'état, although this time he resigned the presidency. He was accused of the 1982 murder of 15 political opponents, in a long judicial process that finally ended in December 2019 with a twenty-year prison sentence, which is now being appealed by Bouterse. He has also been convicted of drug trafficking in the Netherlands, for which the resulting international arrest warrant prevents him from leaving Suriname. His son Dino has also been convicted of drug and arms trafficking and is in prison in the United States. Bouterse's Suriname has come to be presented as the paradigm of the mafia state.

In 2010 Desi Bouterse won the elections as candidate of the National Democratic Party (NDP); in 2015 he was re-elected for another five years. In the 25 May elections, despite some controversial measures to limit the options of the civil service examination, he lost to Chan Santokhi, leader of the Progressive Reform Party (VHP). He tried to delay the counting and validation of votes, citing the health emergency caused by the coronavirus, but the new National Assembly was finally constituted at the end of June and is due to appoint the country's new president in July.

![Total's operations in Surinamese and Guyanese waters [Total]. Total's operations in Surinamese and Guyanese waters [Total].](/documents/10174/16849987/surinam-oil-mapa.png)

Total's operations in Surinamese and Guyanese waters [Total].

Relationship with Venezuela

Suriname intends to use the prospect of the oil bonanza to strengthen Staatsolie, the state oil company. In January, before the Covid-19 crisis became widespread, it announced purpose to expand its presence in the bond market in 2020 and also, conditions permitting, to list its shares in London or New York. This would serve to raise up to $2 billion to finance the national oil company's exploration campaign over the next few years.

On the other hand, Venezuela's territorial claims against Guyana, which affect the Essequibo - the western half of the former British colony - and which are being studied by the International Court of Justice, include part of the maritime space in which Guyana is extracting oil, but do not affect the case of Suriname, whose delimitations are outside the scope of this long-standing dispute.

Venezuela and Suriname have maintained special relations during Chavismo and while Desi Bouterse has been in power. On occasions, a certain connection has been made between drug trafficking under the protection of the Chavista authorities and that attributed to Bouterse. The offer made by Bouterse's son to Hezbollah to have training camps in Suriname, for which he was arrested in 2015 in Panama at the request of the United States and tried in New York, can be understood in light of the relationship between Chavism and Hezbollah, to whose operatives Caracas has provided passports to facilitate their movements. Suriname has supported Venezuela in regional forums at times of international pressure against the regime of Nicolás Maduro. In addition, the country has increasingly strengthened its relations with Russia and China, from which in December 2019 it secured the commitment of a new credit .

With the political change of the last elections, Maduro's Venezuela has in principle lost a close ally, while gaining an oil competitor (at least as long as Venezuelan oil exploitation remains at a low level).

March and April 2020 will be remembered in the oil industry as the months in which the perfect storm occurred: a drop of more than 20% in world demand at the same time as a price war was unleashed that increased the supply of crude oil, generating an unprecedented status of abundance. This status has highlighted the end of OPEC's dominance over the rest of the oil producers and consumers after almost half a century.

![Pumping structure in a shale oil field [Pixabay]. Pumping structure in a shale oil field [Pixabay].](/documents/10174/16849987/precio-petroleo-blog.jpg)

▲ Pumping structure in a shale oil field [Pixabay].

ANALYSIS / Ignacio Urbasos Arbeloa

On 8 March, in view of the failure of the so-called group OPEC+ negotiations, Saudi Arabia offered its crude oil at a discount of between 6 and 8 dollars on the international market while announcing an increase in production from 1 April to a record 12 million barrels per day. The Saudi move was imitated by other producers such as Russia, which announced an increase of 500,000 barrels per day (bpd) from the same date, when the cartel's previous agreements expire. The reaction of the markets was immediate, with a historic drop in prices of more than 30% in all international indices and the opening of headlines announcing the start of a new price war. The oil world was stunned by the collapse in the price of crude oil, which reached historic lows on 30 March, with the price of a barrel of WTI dropping below 20 dollars, a psychological barrier that demonstrated the harshness of the confrontation and the historic consequences it could have for a sector of particular geopolitical sensitivity.

Previous experiences

Saudi Arabia, the world leader in the oil industry because of its vast reserves and huge, export-oriented production, has resorted three times to a price war to obtain commitments from other producers to make supply cuts to stabilise international prices. The oil market, accustomed to an artificially high price, tends to suffer dramatic price declines when supply is unrestricted available . committee Due to the economic and political instability that these prices generate in the producing countries, they usually return quickly to the negotiating table, where Saudi Arabia and its partners in the Gulf Cooperation Council (GCC) always await them.

The first experience of this subject took place in 1985, after the Iran-Iraq war and the oil crisis of the 1970s, Saudi King Fahd bin Abdulaziz Al Saud took the decision to increase production unilaterally in order to recover the market share he had lost to the emergence of new producing regions such as the North Sea or the Gulf of Mexico. The experience led to a 50% drop in prices after more than a year of unrestricted production, which ended with a agreement in December 1986 by 12 OPEC countries to make the cuts demanded by Saudi Arabia and its allies.

In 1997, in response to Saudi Arabia's concern over the increasing displacement of its oil from US refineries in favour of Venezuelan and Mexican crude, the newly arrived Saudi monarch Abdullah bin Abdulaziz decided to announce in the midst of an OPEC summit in Jakarta that he would proceed to increase production without restrictions. The Saudi strategy did not count on the fact that the following year an economic crisis would break out among emerging markets with particular virulence in Southeast Asia and Russia, which plunged prices by 50% again until a new agreement was reached in April 1999.

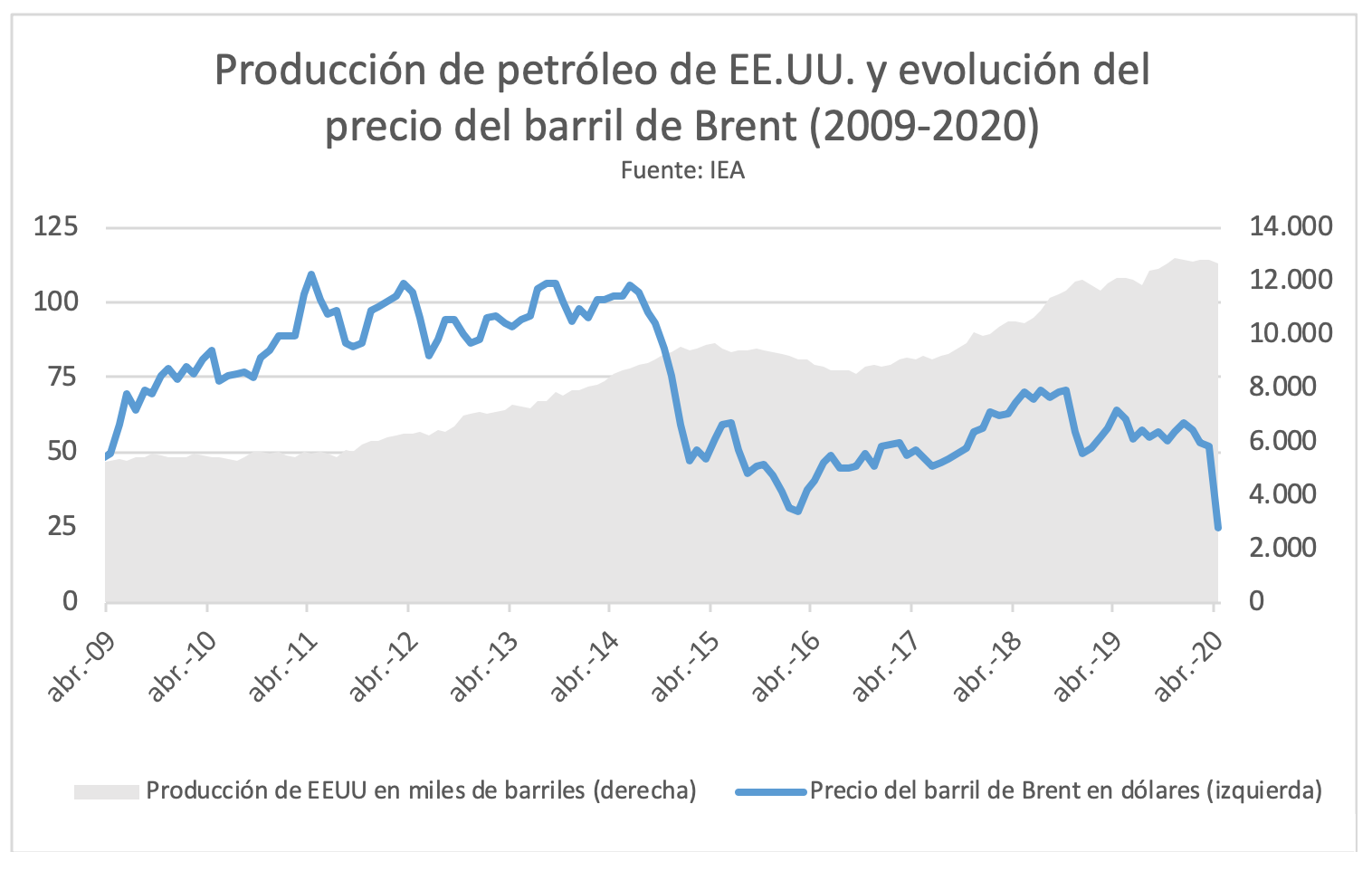

With the 21st century, came the oil bonanza with the so-called commodity super cycle (2000-2014) that kept oil prices at unknown levels above 100 dollars between 2008 and 2010-2014. This bonanza made it possible to increase investment in exploration and production, generating new extraction techniques that were previously unknown or simply economically unfeasible. In 2005, the US was experiencing a worrying oil crisis, with production at an all-time low of only 5.2 million bpd compared to 9.6 million bpd in 1970. Moreover, energy dependence of approximately 6 million bpd was being met by increasingly expensive crude oil imports from the Persian Gulf, which after 9/11 was viewed with greater scepticism, and Venezuela, which already had Hugo Chávez as its political leader. goal High oil prices allowed the recovery of previously frustrated ideas such as hydraulic fracturing, which was given massive permits to be developed from 2005 onwards with the aim of mitigating the country's other major energy crisis: the rapid decline in domestic production of natural gas, a much more expensive and difficult commodity for the US to import. Hydraulic fracturing, also known as fracking, enabled an unexpected growth in natural gas production, which soon attracted the attention of the US oil sector. By 2008, a variant of fracking could be applied to oil extraction, a technique later called shale, leading to an unprecedented revolution in the United States that increased the country's production by more than 5 million barrels per day in the period 2008-2014. The change in the US energy landscape was such that in 2015 Barack Obama withdrew a 1975 law that prohibited the US from exporting domestically produced oil.

The Saudi reaction was swift, and at OPEC's Vienna headquarters in November 2014, it launched a new campaign of unrestricted production that would allow the Kingdom to recover part of its market share. The effects on international markets were more dramatic than ever, with a 50% drop in price in just 7 months. Multinational oil companies (IOCs) and national oil companies (NOCs) dramatically reduced their profits and were forced to make cuts not seen since the beginning of the century. Exporting countries also suffered the effects of lower fiscal revenues with many emerging markets plunged into unmanageable fiscal deficits, inflation and even recession, with Venezuela in particular sliding into the socio-economic chaos we know today. To Saudi Arabia's despair, the US shale industry showed unexpected resilience by maintaining production at 4 million barrels per day for 2016 from a peak of 5 million in 2014. Saudi Arabia did not understand that shale oil, unlike conventional oil, was not a mature industry, but an expanding one and development. US producers managed to increase the oil recovery rate from 5% to 12% between 2008-2016, the equivalent of increasing productivity by 2.4 times. In addition, the elimination of less competitive companies allowed for a reduction in the cost of services and easier access to transportation infrastructure. The nature of shale, with wells maturing in 18 months to 3 years, compared to 30 years or more for a conventional well, allowed production to be shut in for a short enough period of time to minimise the impact of lower prices, opting to keep the most competitive wells. Saudi Arabia gave up and opted for a 180 degree turnaround Degrees in its strategy, although it did manage to bring Russia to the negotiating table. The longest price war in history, after almost 22 months, ended with an unprecedented agreement among OPEC countries with the incorporation of Russia and its sphere of energy influence, group known as OPEC+. A Russia wounded by international sanctions and the weakness of its currency had given in to Saudi Arabia, which, however, had not managed to defeat the US shale oil revolution.

North American shale production has not stopped growing, and despite its effectiveness, it is the only region in the world with a similar industry, growing at a rate of more than one million barrels per day per year. This status has provided the US with robust energy security as it is not dependent on imports of Venezuelan or Gulf crude. The country achieved positive net oil exports at the end of 2019 for the first time in more than half a century, in addition to being a net exporter of natural gas, coal and refined products. Much of the Trump administration's geostrategic retreat in the Middle East is a response to the country's growing energy independence, which reduces its interests in the region.

The breakdown of group OPEC+:

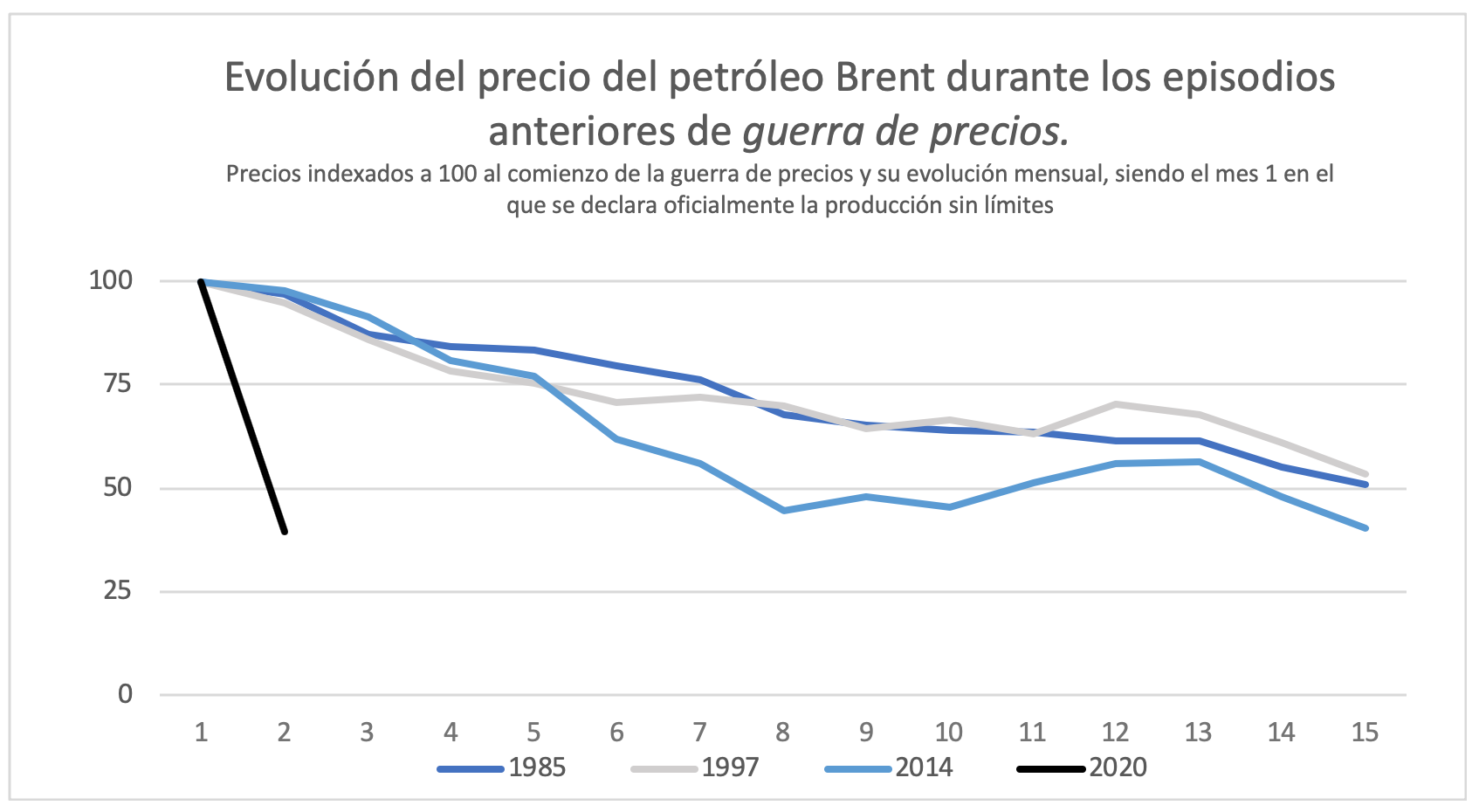

As mentioned, during the first week of March, OPEC+ met in Vienna seeking a agreement for a further cut of some 1.8 million barrels per day to mitigate the effects of the COVID-19 quarantine in China. The unease among producers was evident, having executed a similar cut in December 2019. Saudi Arabia was trying to share out as much of the production cuts as possible when Russian energy minister Alexander Novak said "niet", citing economic solvency for a drop in prices, scuppering any subject from agreement. It is not known whether Russia's refusal was the result of a well-thought-out plan or simply a bluff to gain ground in the negotiations, but it was the beginning of a new price war. As can be seen in the graph below, the drop in the price of crude oil in the first month has been historic, without a similar reference letter in the history of negotiations between producers. The increase in the availability of oil in the markets due to the Saudi strategy of loading tankers with crude from its strategic reserves, together with a dry stop of the Economics and the demand for oil, generated a sudden price depression hitherto unknown in the sector. Previous price wars normally had the stabilising element that the lower the price of oil products, the higher the consumption in the short term deadline. However, due to the economic effects of the quarantine, this market counterweight disappears, generating in one month what would otherwise have taken 12 to 15 months.

The effects of COVID-19 on global oil demand are estimated to have fallen by 12.5% in March and are expected to reach 20% in April. In the areas of Europe most affected by the quarantine, the drop in fuel sales at service stations has reached 75%, a figure that is very likely to be replicated in the rest of the advanced economies as the measures are tightened and which China is already beginning to leave behind after two months of confinement. The case of air transport is particular, as it consumes 16 million bpd and is currently totally suspended, with no clear date for a return to normality in international aviation. The partial stoppage of industrial production, the extent of which is still unknown, could lead to even greater drops in consumption. Such a status would not require increased production to generate a collapse in prices, which with the added pressure on the supply side are generating unprecedented levels of stress on storage, transport and refining capacity.

A historic agreement :

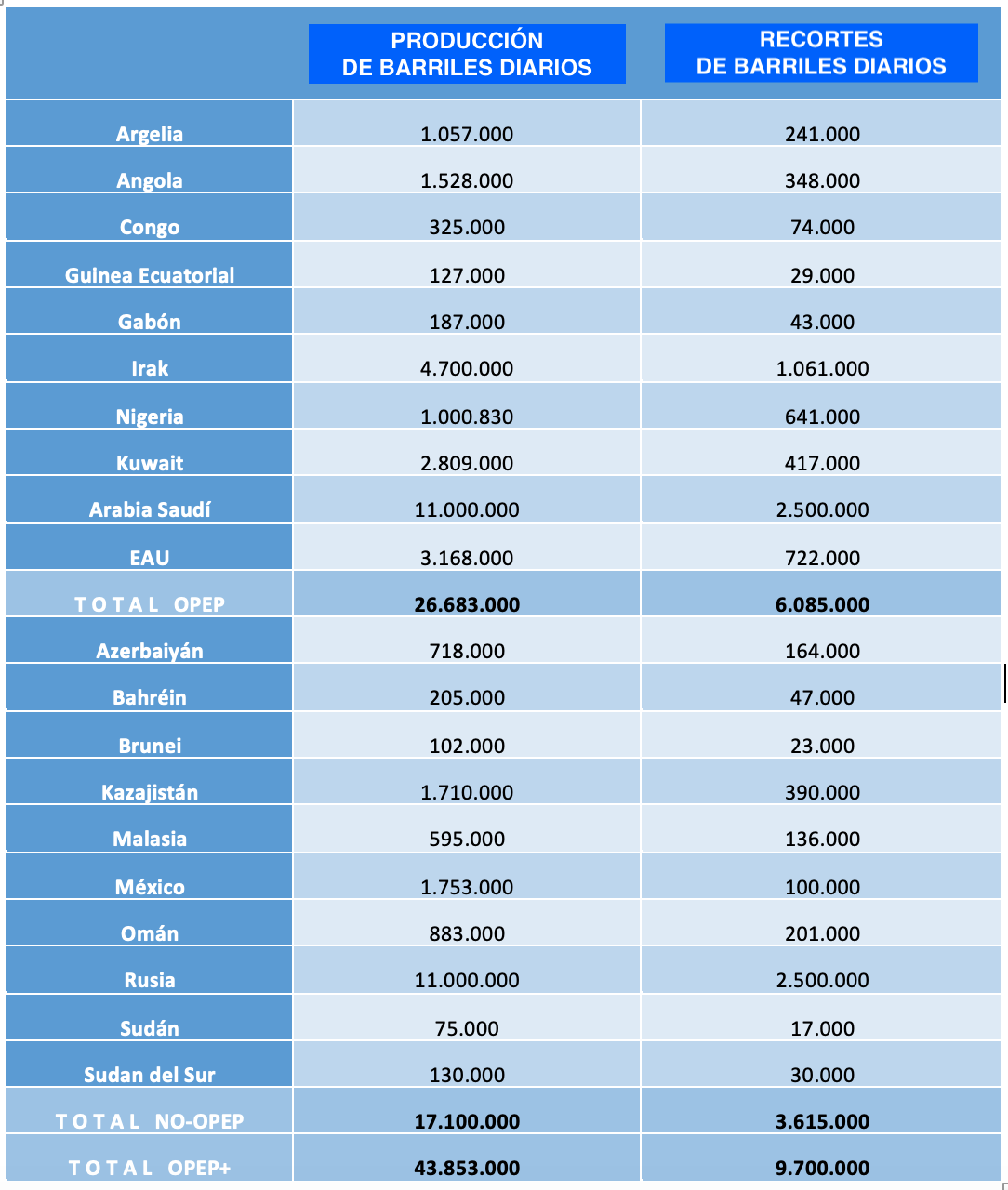

In early April, Donald Trump, fearful that an oil glut could further depress prices and destroy the US hydrocarbon industry, took the initiative to speak by telephone with the leaders of Saudi Arabia and Russia. In a paradoxical move, the US President succeeded in bringing the major producers closer together to establish new cuts that would put an end to the price war. On 9 April, after several weeks of speculation, the largest ever producers' meeting took place at group , including OPEC members and 10 non-member countries among which Russia, Kazakhstan and Mexico stood out. After several days of negotiations, it was agreed to cut production by 23% in 20 countries with a combined output of more than 40 million barrels, leaving almost 10 million barrels out of the market, starting on the first day of May. The negotiations were coordinated by OPEC and the G20, which at the time was chaired by Saudi Arabia. In this way, a picturesque agreement was reached whereby the aforementioned 10 million barrels were reduced among the OPEC+ members, included in the table below, and another 5 million barrels were estimated to be reduced in an unspecified manner among the US, Canada, Brazil and Norway. The latter cuts, by the nature of their sectors, would be made through the free market and it remains to be seen how they will materialise.

There is some scepticism in the industry and markets about the effectiveness of these cuts, which amount to 10-15% of the oil consumed globally before the COVID-19 crisis. Consumption has fallen by around 20% and oil storage capacity is starting to run out, reducing the margin for absorbing surplus oil. In addition, the cuts will start to be implemented on 1 May, leaving a three-week window that could further depress prices. The nature of agreement, which is voluntary and difficult to monitor, leaves the door open to non-compliance with the established cuts, which are often difficult to apply due to the geological conditions of certain old wells or the existence of contracts that require financial compensation if supply is interrupted. In general, the level of compliance with OPEC agreements has been low, with a greater incidence in countries that export by sea and a lesser incidence in those that export by pipeline, which, unlike maritime cargoes, cannot be controlled by satellite.

The main actors:

Saudi Arabia:

Amid the wreckage of the OPEC+ negotiations, on 6 March Mohammed bin Salman (MBS) led a new palace coup in which former heir to the Saudi throne Mohammed bin Nayef and other members of the royal family were arrested and charged with plotting against Crown Prince MBS and his father Salman bin Abdulaziz. All this at a time when the heir to the Saudi throne seemed to want to consolidate his power with a risky new strategy after the utter failure of the Yemen War and the Vision 2030 national modernisation plan.

Saudi Arabia's undisputed leadership in driving the oil market is based on its ability to increase production by several million barrels in less than six months, something no other country in the world is able to do. The increase in production also allows Saudi Arabia to partially compensate for the decline in prices per barrel, which together with its foreign exchange reserves and access to cheap credit allows Saudi Arabia to face a price war with an apparent resilience far superior to that of any other OPEC country. The low cost of producing a barrel of oil in the country, at around $7, also allows it to maintain revenues in almost any market environment.

However, foreign exchange reserves, at $500 billion, are 30% lower than in 2016, and may be insufficient to maintain dollar-rial parity for more than two years without oil revenues, which is essential for a society accustomed to import-dependent opulence. Moreover, the fiscal deficit has been a major problem for the country, which has been unable to reduce it below 4% after reaching a peak of 16% in 2016 as result of an insufficient recovery in oil prices and the costs of the war in Yemen. Oil's energy dominance has an expiry date and Saudi Arabia's finances are addicted to an activity that accounts for 42% of its GDP and generates 87% of tax revenues. For the moment, the Saudi minister of Economics has already announced a 5% cut in budget by 2020, sample , agreement oil does not ensure an optimistic scenario. In any case, Saudi Arabia has been one of the big winners in the price war. In the failed March negotiations, Saudi Arabia produced 9.7 million barrels per day, a figure that had risen to 11 million barrels per day in the April negotiations. As the cuts are set on a proportional basis, in just one month the Saudi kingdom gained 1.3 million barrels of market share. Similarly, the Saudi sovereign wealth fund Petroleum Investment Fund (PIF) bought shares in Eni, Total, Equinor, Shell and Repsol during the month of April, in a context of stock market falls in these companies.

Russian Federation:

Russia stood firm at the start of the price war, highlighting the resilience of the Russian energy sector and the volume of the country's sovereign reserves, which are lower than those of Saudi Arabia but amount to 435 billion dollars and a stabilisation fund of another 100 billion: 33% more than in 2014. Paradoxically, international sanctions on the Russian oil sector have reduced its dependence on the outside world, allowing the devaluation of the freely convertible rouble not to affect production and partially compensate for lower prices. Russia' s capacity to increase production in the short term deadline, unlike Saudi Arabia, is less than 500,000 bpd, which leaves Russia unable to compensate lower prices with higher production, the main reason for the country's acceptance of the April negotiations result .

Vladimir Putin's leadership is unquestionable with a possible constitutional reform that would allow for an extension of his term of office delayed due to COVID-19. The Russian political elite's good relations with the oil oligarchy allow for unity of action in a country with greater atomisation and the presence of private capital in its companies. Alexander Novak's strategy seems to be in line with that of Igor Sechin, CEO of Rosneft, who is betting on a context of low prices that will end up deeply damaging the US shale industry. There is speculation about a possible US diplomatic intervention with the Russian government in favour of April's agreement OPEC+. Russia's Rosneft's latest move , abandoning Venezuela by selling all its assets to a Russian government-controlled business , may be one explanation for Moscow's concession to accept a agreement that for a month it tried, at least rhetorically, to avoid. The development of future US sanctions on the Russian oil sector will be a good indicator of this possible agreement.

United States:

For the US, falling oil prices mean one of the biggest tax cuts of all time, in the words of its president, with a price of less than a dollar per gallon. However, the oil industry generates more than 10 million jobs in the US and is a central activity in many states such as Texas, Oklahoma or New Mexico, which are fundamental for a hypothetical Republican victory in the 2020 elections. Moreover, the geostrategic importance of the sector, which has allowed the US to reduce its energy dependence to historic lows, has led Donald Trump to take on the responsibility of safeguarding the US oil industry. He himself coordinated the first steps for a major agreement, by means of pressure, threats and concessions. The truth is that the price crisis has come at a time of certain exhaustion for the sector, which was beginning to suffer the effects of over-indebtedness and pressure from investors to increase profits. Since 2011, North American crude oil, priced on the West Texas Intermediate (WTI) index, has experienced an evaluation 10% lower than that of Brent or the OPEC Basket, the other global indices, generating a hyper-competitive environment that was beginning to take its toll on shale producers, which since the end of 2019 have seen a 20% drop in the total drillingissue year-on-year. The North American market, which had already been experiencing storage and transportation problems since 2017, collapsed in the third week of April with negative prices due to the limitations to store oil and speculation in the futures markets.

Donald Trump has finally secured a global agreement that does not bind the US directly, but leaves it to the market to regulate the cuts that seem more than foreseeable. In this way, the Trump administration allows itself not to have to intervene in the oil market, something that would surely force the development of legislation and a complex discussion to save the polluting oil industry at the taxpayer's expense. From the Senate, several politicians from both parties have tried to introduce the need for tariffs or sanctions on those producers who flood the domestic market to the parliamentary discussion , recovering old initiatives such as the NOPEC Act. These threats have allowed the President to gain a strong position at the international level, being one of the big winners at the agreement OPEC+ in April. In fact, when negotiations seemed on the verge of collapse due to Mexico's refusal to take on 400,000 barrels per day of cuts, the US intervened by announcing that it would be the US that would take them on. Subsequent leaks have shown the existence of financial insurance taken out by Mexico in case of low oil prices, which would be charged per barrel produced. The US intervention, more rhetorical than internship since the country has no concrete production to cut, saved agreement from another failure.

![Facilities for the refining of petroleum products [Pixabay]. Facilities for the refining of petroleum products [Pixabay].](/documents/10174/16849987/precio-petroleo-blog-2.jpg)

Facilities for the refining of petroleum products [Pixabay].

Nothing will ever be the same again:

The shale oil revolution has transformed the oil industry and generated a new geopolitical balance to the detriment of OPEC. Since 2016, OPEC+ countries have made cuts estimated at 5.3 million barrels per day, while the North American shale industry has increased its production by 4.2 million barrels, making it clear that the oligopolistic strategy of the producing countries has come to an end. All that remains is the free market, in which they have an advantage due to lower production costs. However, eliminating a large part of the North American shale final would take more than three years of prices below 30 dollars, at which point a large part of the companies' debt would mature and the drop in new wells issue would seriously affect total production. A journey in the desert for many producing countries that have billion-dollar plans for economic diversification during this decade, probably the last decade of absolute energy domination by hydrocarbons. The world, unlike what was expected at the beginning of the century, has entered a period of oil abundance that will reduce energy costs unless coordinated intervention in the market remedies this. The emergence of new producers, mainly the United States, Canada and Brazil, coupled with the collapse of Venezuelan and Libyan production, has left OPEC 's market share in 2020 at around 33%, in free fall since the beginning of the century when it exceeded 40%.

Global demand for crude oil has declined to such an extent that cutbacks can only be expected to prevent a fall below $15 a barrel by prolonging the full filling of remaining oil storage systems as long as possible. Global oil storage capacity is one of the great unknowns in the sector, with diverging estimates. The bulk of the storage capacity is supported by importing countries, which since the 1973 oil crisis decided to create the International Energy Agency, among other things, to coordinate infrastructure to mitigate dependence on OPEC. The strategic nature of these reserves, coupled with the rapid development of these reserves in the last decade by China and its companies, make access to this information very difficult. In particular, China's Sinopec has developed a strategy of building oil storage facilities throughout the China Sea, including in foreign countries such as Indonesia, to resist any possible blockade of the Strait of Malacca, China's geopolitical weak point. Private companies also have onshore and floating storage capacity of undetermined volume that has already begun to be used in imaginative ways: disused pipelines, oil tankers and even trains and trucks now grounded by quarantine. In the short term, deadline, these strategic reserves will be gradually replenished at a rate similar to 20 million barrels per day, an estimate of the current differential between supply and demand. In 50 days, if no agreement is reached to cut production, the amount in storage would exceed 1 billion barrels, which would probably saturate the market's capacity to absorb more oil, leading to a total collapse in prices.

A return to economic normality is increasingly on the distant horizon, with sectors such as aviation and tourism set to be weighed down by COVID-19 for a long time to come. The impact on oil demand will be prolonged, especially given the storage capacity that will now act as a counterweight to any upward movement in international prices. The shale industry, with great flexibility, will begin to hibernate while waiting for a new, more favourable context. The COVID-19 crisis will have a particularly virulent impact on the oil-exporting countries at development , which have more delicate socio-economic balances. The oil world is undergoing major changes as part of the energy transition and development of new technologies. The COVID-19 crisis is only the beginning of the major transformations that the industry will undergo in the coming decades. An oft-repeated phrase to refute the already dismissed Peak Oil theory is that the Stone Age did not end because of a lack of stones, and contemporary society will not stop using hydrocarbons because of their depletion, but because of their obsolescence.

Domestic demand will increase, unlike in more advanced regions

In the coming decades, oil consumption in Latin America will continue to grow, in the face of a trend towards leave which is already on the horizon of many advanced countries. Population growth and the increase in class average explains this increase in demand. This domestic demand will serve to strengthen the extractive industries of Latin American crude oil producers, but it will make the region's refining deficit chronic.

article / Ignacio Urbasos

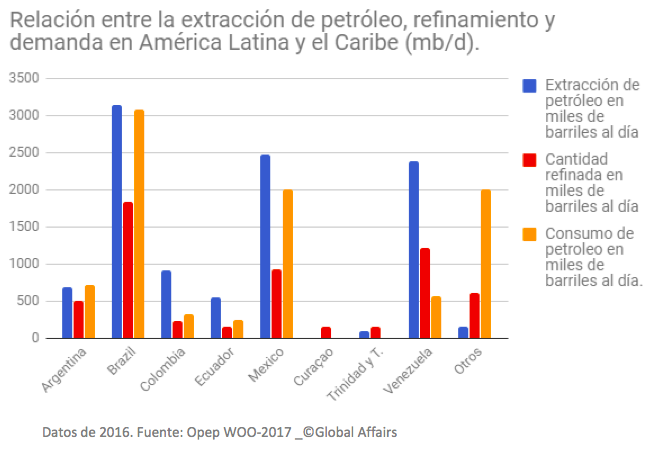

The oil industry is experiencing a change in export and consumption patterns in the Latin American region. The sector's classic orientation towards the United States has changed in a new context in which exports are much more diversified with a tilt towards emerging Asian countries. Similarly, domestic demand is steadily increasing due to population and economic growth. However, the region's refining capacity will remain inadequate. This paper will offer a long-term analysis to try to offer a better understanding of the region's energy future, mainly in its consumption, extraction and subsequent refinement.

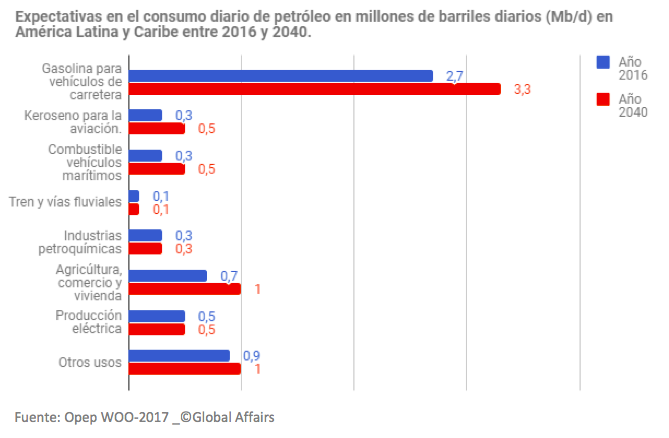

First of all, Latin America's demographic and economic expectations must be taken into account: population growth will increase by 800 million people by 2050, and economic growth could be 2% per year for at least the next decade. The direct effect of this will be the increase in electricity demand by 91% by 2040 and the increase in issue of vehicles in the region from 94 million in 2016 to the 165 million expected by 2040.

As can be seen in the graph below, the greater demand for oil in the region will be associated with transport, which will tend to be more efficient in consumption, but the promised arrival of the electric car is still far away, with expectations of less than 4% by 2030 worldwide. Similarly, the increase in the class average 126 million people by 2030 will have a direct impact on the increase in air travel, which is projected to grow by average 3.4% per annum until 2034, agreement to the last report of ICAO, with a consequent increase in kerosene consumption.

|

It should be borne in mind that in Latin America there are subsidies for both gasoline and diesel, which generates more affordable prices and distorts demand clearly upwards. These subsidies respond mainly to the logic that citizens should be beneficiaries of their country's possession of natural resources, and are concentrated in traditionally oil-producing countries such as Ecuador, Venezuela, Mexico or Argentina. However, these countries import fuel to a large extent due to their limited refinery capacity, generating a double trade and fiscal deficit, as ECLAC points out. The future of these subsidies is unknown, but any change would have a high political cost, since by affecting the price of a basic good it would have consequences on broad social sectors with great electoral impact.

For its part, oil's contribution to electricity generation will remain constant at 500,000 barrels per day, decreasing its importance from the current 46%, according to figures for Latin America from the International Renewable Energy Agency. The region will benefit enormously from the increased presence of renewable energies, a sector that it already leads due to incomparable geographical conditions, highlighting the enormous importance of hydropower.

Over the next few decades, two major phenomena will occur in Latin America: the universalization of access to energy and a new model energy with less presence of oil and biofuel (wood and waste) in favour of gas and alternative energies. One of the great challenges facing the region is to develop a more integrated electricity system nationally and internationally that increases consumption efficiency and allows greater flexibility in production sources. The geographical uniqueness of the region requires enormous investments to carry out this task; however, there are already several regional projects in this direction: the Andean Electrical Interconnection System, which includes the countries of the Andean Community plus Chile, and the Central American Electrical Interconnection System (SIEPAC).

Refining deficit

This increase in consumption is not accompanied by greater refinery capacity, which is already enormously deficient, and generates a critical dependence on imports of gasoline and other derivatives from the US. A trend that is likely to be a constant in the short and medium term for the region and is added to the 14% decline in refinery activity in the region since 2012 (World Oil Outlook 2017), which already adds up to a loss of one million refined barrels per day since that year. High installation and maintenance costs, around 2% of the annual installation cost, add to the region's chronic political uncertainty that largely scares away private investment.

An illustrative case is that of the Pacific refinery in Ecuador, which was presented as the largest project refinery in the country at the beginning of Rafael Correa's presidency in 2007. The project began with a financial stake of 49% by PDVSA and 51% by Petroecuador, in addition to the award of the project to the construction company Odebrecht. As of today, PDVSA has withdrawn its contribution and the Brazilian construction company is facing trials in the country for corruption. result a lost decade and forcing Lenin Moreno to reformulate the project, including the name: now Manabi Refinery.

|

As we can see in the graph, the large oil producers in Latin America have a deficient refinery capacity. It should be borne in mind that there is not only an undercapacity in the region, but also an under-activity, which creates an even greater gap. The activity of these plants is currently around 70% of their total capacity. Those countries that do not have oil production, but do have a relevant refining industry, are Curaçao, which has one of the largest PDVSA centers, Chile and Peru.

In final, the Latin American oil sector faces the coming decades with enormous doubts about its refining capacity and far from achieving self-sufficiency. The lack of capacity to attract foreign investment from historically oil-producing countries has generated a disappointing scenario that aggravates the already limited industry in the region. The social transformations inherent in a society that is growing demographically and economically require investment in infrastructure in order to meet the expectations of universal access to education. network and the incipient consumption of the incipient class average.