The increase in South Korean trade with Latin American countries has allowed the Republic of Korea to reach Japan's exchange figures with the region.

Throughout 2018, South Korea's trade with Latin America exceeded USD 50 billion, putting itself at the same level of trade maintained by Japan and even for a few months becoming the second Asian partner in the region after China, which had flows worth USD 300 billion (half of the US trade with its continental neighbours). South Korea and Japan are ahead of India's trade with Latin America (USD 40 billion).

ARTICLE / Jimena Villacorta

Latin America is a region highly attractive to foreign markets because of its immense natural resources which include minerals, oil, natural gas, and renewable energy not to mention its agricultural and forest resources. It is well known that for a long time China has had its eye in the region, yet South Korea has also been for a while interested in establishing economic relations with Latin American countries despite the spread of new protectionism. Besides, Asia's fourth largest economy has been driving the expansion of its free trade network to alleviate its heavy dependence on China and the United States, which together account for approximately 40% of its exports.

The Republic of Korea has already strong ties with Mexico, but Hong Nam-ki, the South Korean Economy and Finance Minister, has announced that his country seeks to increase bilateral trade between the regions as it is highly beneficial for both. "I am confident that South Korea's economic cooperation with Latin America will continue to persist, though external conditions are getting worse due to the spread of new protectionism", he said. While Korea's main trade with the region consists of agricultural products and manufacturing goods, other services such as ecommerce, health care or artificial intelligence would be favourable for Latin American economies. South Korean investment has significantly grown during the past decades, from USD 620 million in 2003, to USD 8.14 billion in 2018. Also, their trade volume grew from USD 13.4 billion to 51.5 billion between the same years.

Apart from having strong ties with Mexico, South Korea signed a Free Trade Agreement with the Central American countries and negotiates another FTA with the Mercosur block. South Korea would like to join efforts with other Latin American countries in order to breathe life into the Trans-Pacific Partnership, bringing the US again into the negotiations after a change of administration in Washington.

Mexico

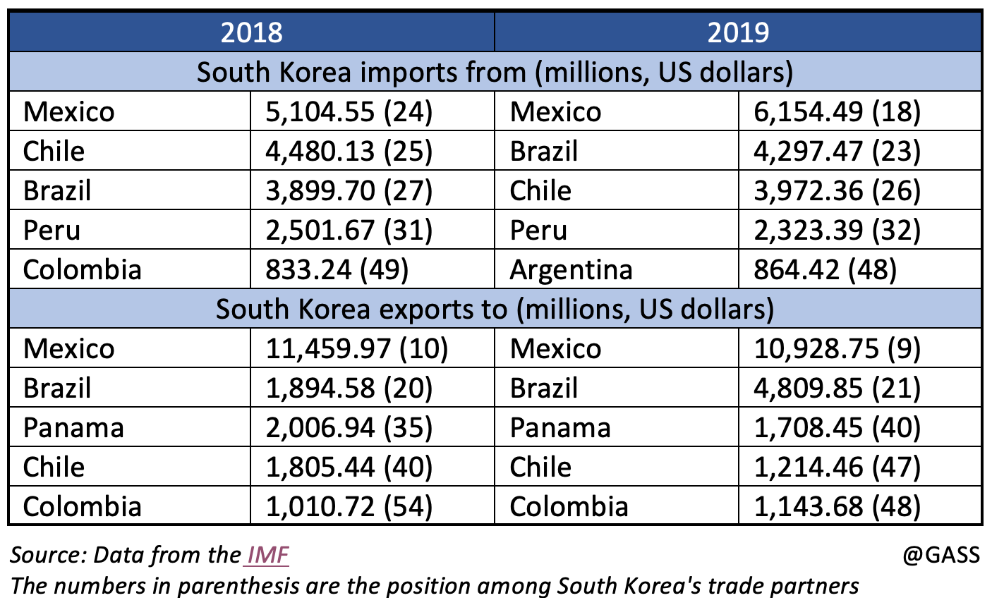

Mexico and South Korea's exports and imports have increased in recent years. Also, between 1999 and 2015, the Asian country's investments in Mexico reached USD 3 billion. The growth is the result of tied partnerships between both nations. Both have signed an Agreement for the Promotion and Reciprocal Protection of Investments, an Agreement to Avoid Income Tax Evasion and Double Taxation and other sectoral accords on economic cooperation. Both economies are competitive, yet complementary. They are both members of the G20, the OECD and other organisations. Moreover, both countries have high levels of industrialization and strong foreign trade, key of their economic activity. In terms of direct investment from South Korea in Mexico, between 1999 and June 2019, Mexico received USD 6.5 billion from Korea. There are more than 2,000 companies in Mexico with South Korean investment in their capital stock, among which Samsung, LG, KORES, KEPCO, KOGAS, Posco, Hyundai and KIA stand out. South Korea is the 12th source of investment for Mexico worldwide and the second in Asia, after Japan. Also, two Mexican multinationals operate in South Korea, group Promax and KidZania. Mexico's main exports to South Korea are petrol-based products, minerals, seafood and alcohol, while South Korea's main exports to Mexico are electronic equipment like cellphones and car parts.

Mercosur

Mercosur is South America's largest trading economic bloc, integrated by Argentina, Brazil, Paraguay and Uruguay. With a GDP exceeding USD 2 trillion, it is one of the major suppliers of raw materials and agricultural and livestock products. South Korea and Mercosur launched trade negotiations on May 2018, in Seoul. Actually, the Southern Common Market and the Republic of Korea have been willing to establish a free trade agreement (FTA) since 2005. These negotiations have taken a long time due to Mercosur's protectionism, so the Asian country has agreed on a phased manner agreement to reach a long-term economic cooperation with the bloc. The first round of negotiations finally took place in Montevideo, the Uruguayan capital, in September 2018. Early this year, they met again in Seoul to review the status of the negotiations for signing the Mercosur-Korea trade agreement. This agreement covers on the exchange of products and services and investments, providing South Korean firms faster access to the Latin American market. The Asian tiger main exports to South America are industrial goods like auto parts, mobile devices and chips, while its imports consist of mineral resources, agricultural products, and raw materials like iron ore.

Among Mercosur countries, South Korea has already strong ties with Brazil. Trade between both reached USD 1.70 billion in 2019. Also, South Korean direct investments totaled USD 3.69 billion that same year. With the conclusion of the trade agreement with the South American block, Korean products exported to Brazil would benefit from tariff eliminations, as would Korean position trucks, and other products going to Argentina. It would also be the first Asian country to have established a trade agreement with Mercosur.

Central America

South Korea is the first Asian-Pacific country to have signed a FTA with Central American countries (Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama). According to Kim Yong-beom, South Korean Deputy Minister of Economy and Finance, bilateral cooperation will benefit both regions as state regulatory powers won't create unnecessary barriers to commercial exchange between both. "The FTA will help South Korean companies have a competitive edge in the Central American region and we can establish a bridgehead to go over to the North and South American countries through their FTA networks", said Kim Hak-do, Deputy Trade Minister, when the agreement was reached in November 2016. Also, both economic structures will be complimented by each other by encouraging the exchange between firms from both regions. They signed the FTA on February 21st, 2018, after eighth rounds of negotiations from June 2015 to November 2016 that took place in Seoul, San Salvador, Tegucigalpa and Managua. Costa Rica also signed a memorandum of understanding with South Korea to boost trade cooperation and investment. This partnership will create new opportunities for both regions. South Korean consumers will have access to high-quality Central American products like grown coffee, agricultural products, fruits like bananas, and watermelons, at better prices and free of tariffs and duties. Additionally, Central American countries will have access to goods like vehicle parts, medicines and high-tech with the same advantages. Besides unnecessary barriers to trade, the FTA will promote fair marketing, ease the exchange of goods and services, to encourage the exchange businesses to invest in Central America and vice versa. Moreover, having recently joined the Central American Bank for Economic Integration (CABEI) as an extra-regional member, has reinforced the development of partner-economic projects around the region.

Opportunity

The Republic of Korea faces challenges related to the scarcity of natural resources, there are others, such as slower growth in recent decades, heavy dependence on exports, competitors like China, an aging population, large productivity disparities between the manufacturing and service sectors, and a widening income gap. Inasmuch, trade between Latin America and the Caribbean and the Republic of Korea, though still modest, has been growing stronger in recent years. Also, The Republic of Korea has become an important source of foreign direct investment for the region. The presence of Korean companies in a broad range of industries in the region offers innumerable opportunities to transfer knowledge and technology and to create links with local suppliers. FTAs definitely improve the conditions of access to the Korean market for the region's exports, especially in the most protected sectors, such as agriculture and agro-industry. The main challenge for the region in terms of its trade with North Korea remains export diversification. The region must simultaneously advance on several other fronts that are negatively affecting its global competitiveness. It is imperative to close the gaps in infrastructure, education and labor training.