Ruta de navegación

Blogs

Entries with label uyuni .

Nearly two-thirds of the world's identified lithium reserves are in Bolivia, Chile and Argentina

The explosion of the electric automotive industry through the use of lithium-ion batteries has put the large reserves of this metal in the Bolivian highlands and the Atacama Desert at the center of global interest in this new industry. Will South America take advantage of the opportunity to enter into processes of technological innovation itself, or will it resign itself, as has happened with so many other minerals, to a mere work of extraction?

▲Salar de Uyuni, in the highlands of Bolivia [Luca Galuzzi, Wikimedia Commons]

article / Milene Pardo-Figueroa

With the gradual introduction of electric vehicles into the market, as well as the increase in the sale of smartphones, laptops, tablets and other electronic devices – all of which are powered by lithium-ion batteries – the global demand for lithium is increasing. This alkaline chemical element, which in its pure form occurs as a soft, particularly light metal, is abundant in nature, although the largest reserves are concentrated in a few countries. Due to the conditions of its extraction, it is especially profitable in the dry areas of the triangle bounded by the borders of Bolivia, Chile and Argentina. If lithium is known as "white oil" or "new gasoline", because of the color of the saltpeter of the deposits where it is found and because it is the driving force of modern automobiles, the border area of these countries is called the "Saudi Arabia of lithium".

The lithium "fever" has led to a current production of 40,000 tonnes per year, a figure that falls short of the huge demand that currently poses a need of 180,000 tonnes. Although this volume may be reached in the coming years, estimates speak of a demand of between 500,000 and 800,000 tons in 2025. By then, agreement With some forecasts, the global lithium battery market could be worth $46 billion. Part of the industry's push comes from the innovation of electric cars. The expansion of that market, however, could be slowed if lithium production is not accelerated. As visionary entrepreneur Elon Musk, promoter of the high-end electric car brand Tesla, has warned, "in order to create 500,000 vehicles a year, we basically have to retain all the lithium generation on the planet."

The difficulty in meeting this growing demand comes from the high extraction costs, which vary considerably depending on the characteristics of the deposit. The most profitable deposits are found in brine concentrates in arid climates, which experience rapid evaporation when brought to light. The place where this especially happens is the area formed by the Atacama Desert and the Bolivian highlands.

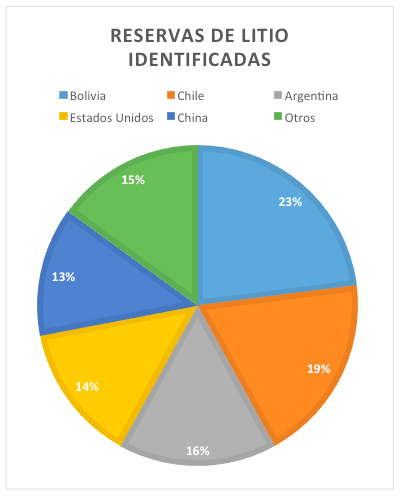

World production is led by Australia, which in 2016 extracted 14,300 tonnes, followed by Chile, with 12,000, and Argentina, with 5,700, of all tonnes. agreement with figures from the U.S. Geological Survey . The volume of reserves identified places the South American countries clearly ahead, especially Bolivia, which has the largest deposits, although for now there are development There is little mining activity for this metal. Thus, Bolivia has identified reserves of 9 million tonnes (22.7% of the world total), Chile 7.5 million (18.9%) and Argentina 6.5 million (16.4%), which means that the three countries have 58% of the world's reserves. They are followed by the United States, with 5.6 million (13.9%), and China, with 5.4 million (13.6%). Other estimates give China reserves similar to Argentina's. The sector is dominated by five large companies, which control 90% of global production: SQM (Chile), FMC and Albermarle (USA), Talison (Australia) and Tianqi Lithium (China).

|

The Lithium Triangle |

Lithium reserves identified |

The White Triangle

The Salar de Uyuni in the Bolivian highlands – a salt-covered surface generated by the evaporation of seawater that was enclosed in a lake when the Andes mountain range emerged in its training– is home to what could be the world's largest lithium deposit. Obtaining it faces the problem that here the metal is specially mixed with magnesium and the separation of the two requires access to technology that Bolivia does not currently have on a large scale. Faced with the fear that foreign companies will be the ones to control the extraction and leave little benefit to the country, as happened historically with the development For the time being, the government of Evo Morales has opted for limited exploitation. Bolivian authorities have preferred to prevent the penetration of multinationals, in order to ensure that the South American nation maintains control of the business. Morales has announced plans for the commissioning, with public funding, of a facility for the manufacture of lithium carbonate at the Uyuni salt plant.

Lithium exploitation is much more advanced in Chile, a country that accounts for around 33% of the world's supply, thanks to the large deposits in the Atacama Desert and the development of an industry of its own. The Society Chemistry and Minera de Chile (SQM), a private Chilean company, leads the national sector, where concessions are tightly controlled by the state. For its part, Argentina is taking steps to boost the lithium business; To that end, the government of Mauricio Macri is proceeding with the liberalization of the sector and has established contacts to attract foreign capital.

Beyond the economic benefits that these South American countries can obtain from the lithium mining boom, a discussion about the ecological impact that it can cause in places as unique due to their natural characteristics as Atacama or Uyuni; There are voices that warn that the Andean saline solution may be doomed to disappear in order to satisfy foreign interest in batteries. There are also fears of a social impact, with no compensation for the human groups settled in the affected territories.

On the other hand, the negative impact that the perpetuation of an economic culture of extraction has historically had in Latin America advises Bolivia, Chile and Argentina to take advantage of the occasion to try to develop their own transformation initiatives and new technologies in the generation of batteries, without limiting themselves, as is the case with so many other minerals, to an extractive activity.