Given that this is the first time we have dedicated a special study to economic information, it is not possible to offer time series, but the data does allow us to establish comparisons between those countries where this issue has been analyzed. In the specific case of Spain, it should be recalled that the survey took place between the second half of January and the first half of February 2023. Year-on-year inflation in January rose by 5.9%, according to the National Statistics Institute (INE), and core inflation (which eliminates products with more volatile prices such as unprocessed food and energy) rose to 7.5% year-on-year, the highest since December 1986. The prices of the most common products in the Spanish shopping basket -food and alcoholic beverages- increased by 15.4% with respect to the previous year, reaching historical highs.

Perception of the increase in the cost of living

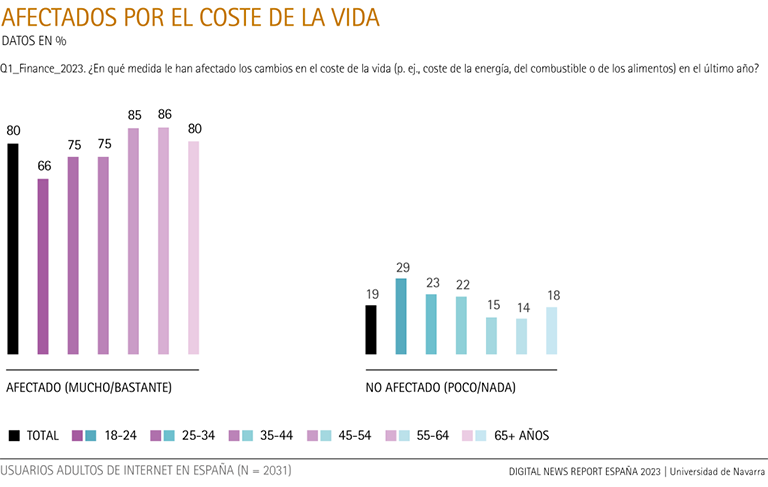

According to data provided by survey, 80% of Spaniards have been very affected by changes in the cost of living in the last year. Specifically, the increase in the cost of products has been felt more by women (83%) than by men (76%), and by the more mature age groups. Thus, while 66% of adults under the age of 24 said they had been affected, this figure rose to 85% among the 45-64 age group.

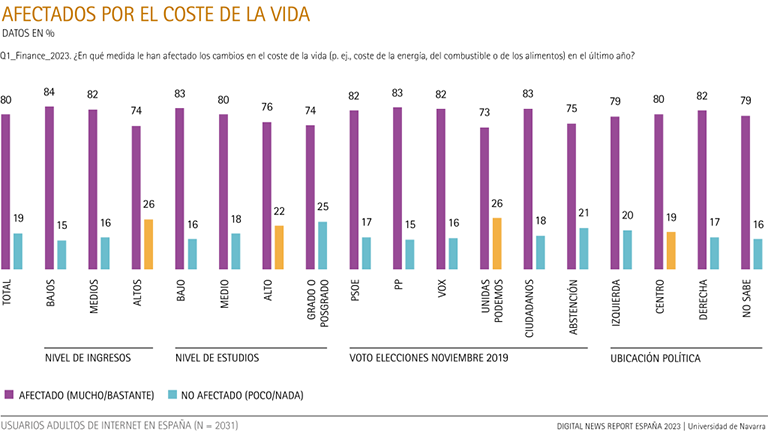

It is not surprising to find that respondents with a lower income level said they felt more affected by the increase in inflation (84%) than those with a higher income level (74%), which is consistent with the fact that low-income households have less capacity to absorb price increases for the goods and services they need, and also that the relative weight of basic foods and energy in their usual shopping basket is greater than in higher income groups. Likewise, it is not surprising that respondents with a lower level of Education are the most affected by inflation (83%) compared to 76% of people with a high level of Education , given the relationship between the level of Education and salary levels.

The analysis by voting recall in the November 2019 elections sample does not show major differences in the respondents' perception of the cost of living. If anything, it is surprising that voters of a left-wing party such as Podemos declare themselves less affected by inflation (73%) than voters of other political formations such as PSOE, PP, Ciudadanos or Vox (82% approx). Along the same lines, data shows that those surveyed who are politically on the left say they are less affected by the increase in the cost of living (79%) than those who are in the center (80%) or on the right (82%).

International comparison

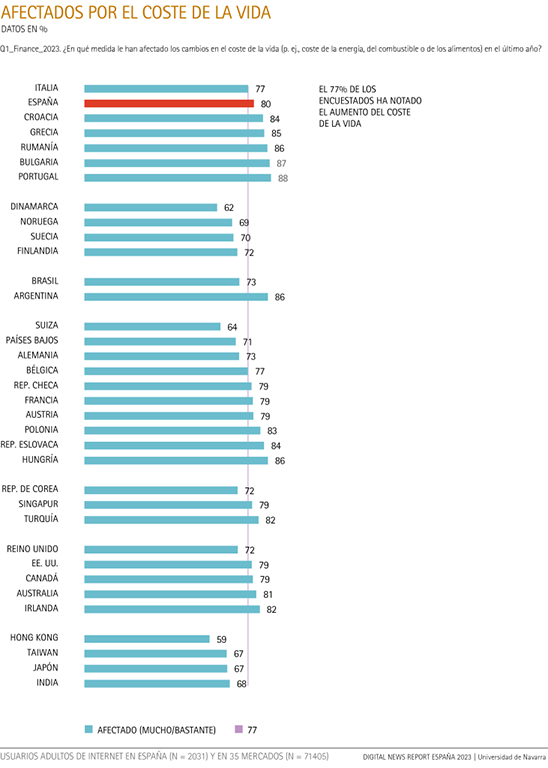

The comparison of Spain with the rest of the countries (see graph) places it slightly above average (77%). Comparison with other European countries leaves Spain at lower levels than other southern European countries, similar to those of most central European countries and higher than Nordic countries such as Denmark (62%), Norway (69%), Finland (72%) and Sweden (70%).

Outside the European continent, in most English-speaking countries, such as Australia, Canada, the United Kingdom and the United States, the percentage of affected respondents is similar to that of Spain. For example, in the United States and Canada the figure is 79%, while in Ireland it is 82%. Asian countries are a separate case, with the lowest figures for those affected by inflation: India, Japan and Taiwan (67%) and Hong Kong (59%).

Main sources of economic information

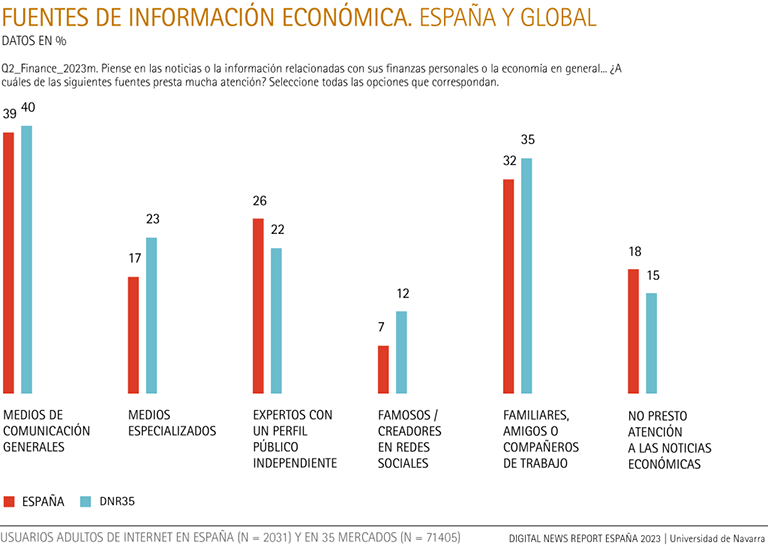

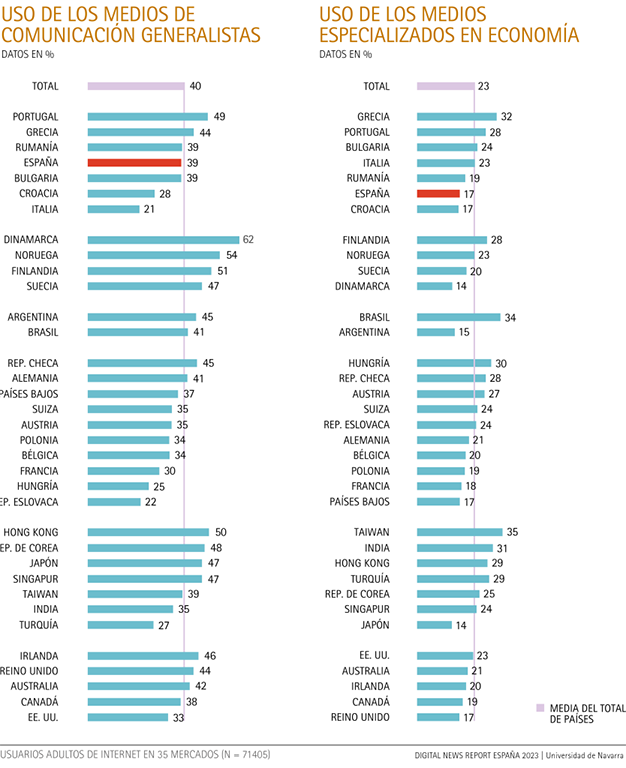

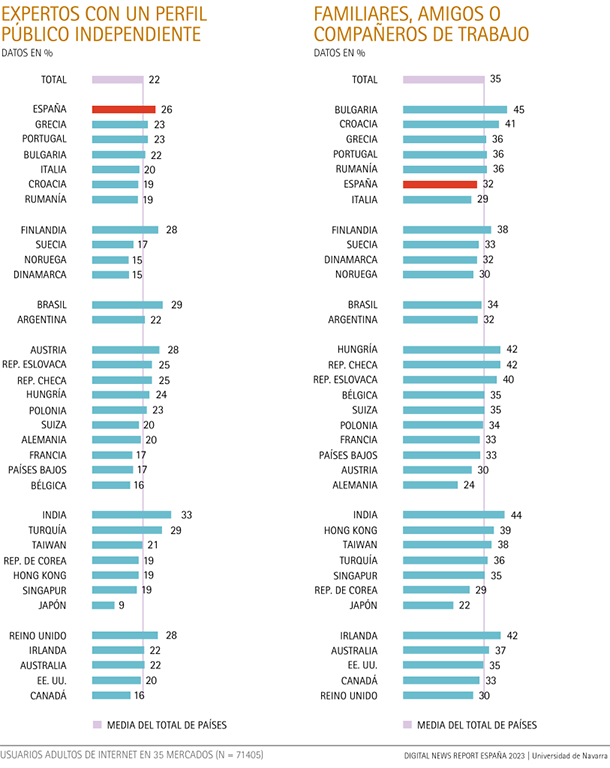

With this generalized concern about the increase in the cost of living, it was interesting to know what are the main sources of economic information for Spaniards. As can be seen in the graph, the majority of those surveyed (39%) tend to use the general media (non-specialized), a figure very similar to the average for the countries analyzed (40%). In second place, 32% of Spaniards turn to relatives, friends or colleagues at work as source for economic information. This is followed by the use of experts with an independent public profile (26%) and the media specialized in Economics, finance and business (17%). Finally, 7% are informed about economic matters through celebrities and creators in social networks, and a relevant 18% declare that they do not pay attention to economic or financial news.

The analysis of socio-demographic factors sample that men use slightly more generalist media (38%) and experts with profile independent audiences (31%), while women turn more to relatives, friends or colleagues of work as source for economic information (38%). However, the differences by gender are quite small overall.

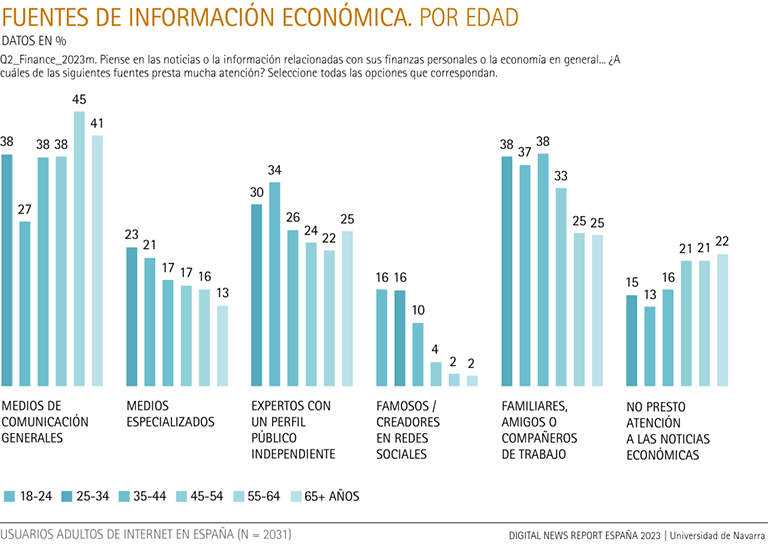

As for the relationship between age and the subject of source of economic information used, some significant differences are observed. Firstly, although all age groups use the general media as the main source of economic information source , their use is more intense among the older groups (45% of those over 55 years of age use them compared to 38% of those under that age). Secondly, the family and social environment is a more common resource among the younger groups (38%) than among those over 55 years of age (25%). In addition, young people turn more frequently to experts with an independent profile audience (34%) than those over 55 (23%), and also make greater use of specialized media (23% vs. 14%, respectively). Finally, celebrities and creators on social networks are a regular source of economic information for 15% of those under 34 while it is practically non-existent for older cohorts.

At summary, we can conclude a more traditional use of information sources by older age groups, while younger people are open to explore other more novel avenues, such as experts with an independent audience profile , celebrities and creators in social networks or even other sources that are not strictly informative. And yes, it also highlights that the older the age, the higher the percentage of respondents who do not pay attention to economic news.

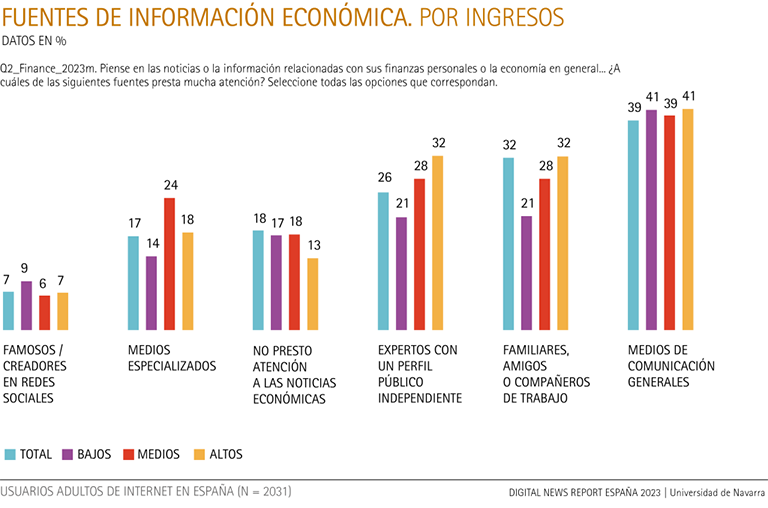

The analysis between income level and the use of economic information sources in Spain sample shows some slight differences. With the exception of their use of the general media, which is practically identical at all income levels, people with higher incomes tend to turn more to other sources, whether specialized information sources (24% vs. 14%), experts (32% vs. 21%) or the social and family environment (32% vs. 21%).

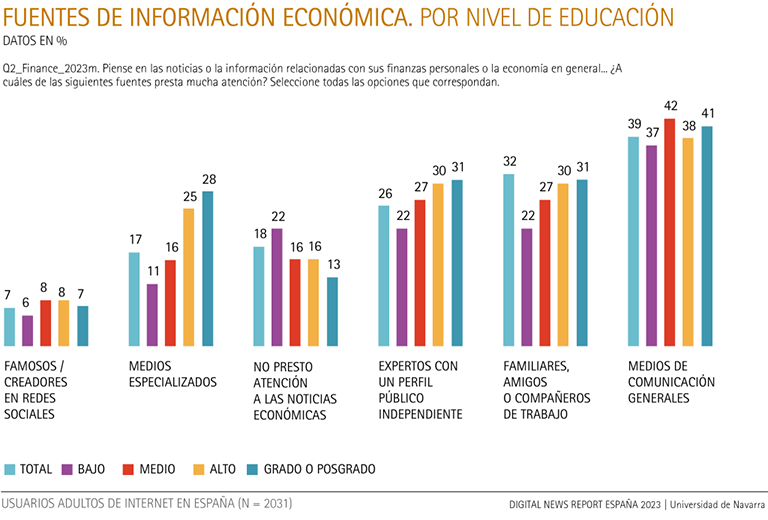

The analysis of the relationship between the level of educational and the use of economic information sources in Spain offers similar conclusions: except for the similar use of general media, those respondents with a higher level of Education tend to make more intensive use of the main sources of information analyzed, whether specialized information sources (28% vs. 11%), experts (31% vs. 22%), or the social and family environment (31% vs. 22%). Likewise, only 13% of graduates/postgraduates do not usually pay attention to economic information, compared to 22% of those who have Education basic.

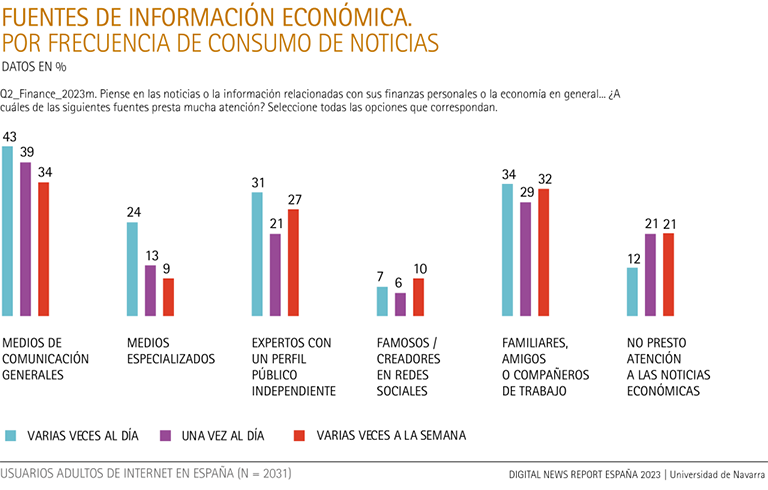

In addition to sociodemographic factors, the analysis of news consumption habits and their possible relationship with the subject of source of economic information employee reveals some notable differences. Thus, data suggests that the greater the frequency of news consumption, the greater the use of news sources, both generalist (43% of those who get information several times a day mention them compared to 34% of those who get information several times a week), as well as experts (31% vs. 27%) or specialized media (24% vs. 9%). Not surprisingly, those who report less frequently pay less attention to economic news (21%) than those with more established reporting habits.

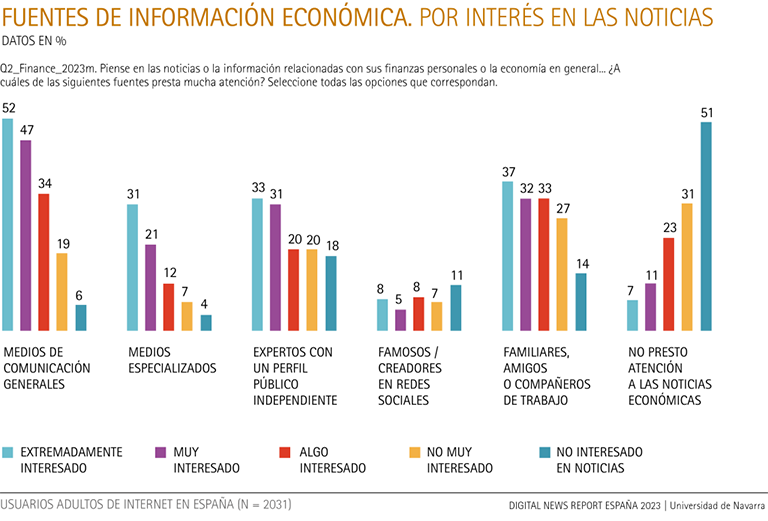

Secondly, and analyzing news interest, data indicates that those who show a greater interest in news use more sources than those who are not very interested, whether general news sources (52% vs. 19%), specialized sources (31% vs. 7%), expert sources (33% vs. 20%) or non-informative sources (37% vs. 27%). It is also not surprising that 31% of those who are not very interested in news in general do not pay attention to economic news either, a percentage that rises to 51% among those who are completely disinterested in information.

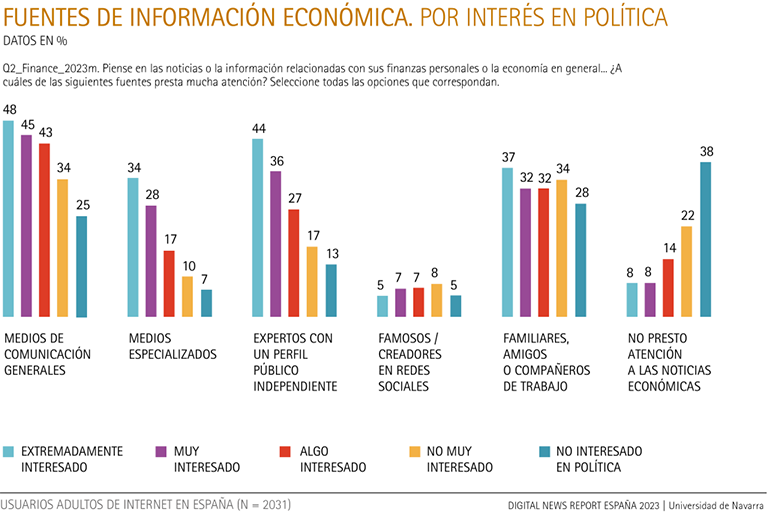

The Degree of interest in political affairs also seems to condition the subject of sources used to be informed about economic, financial and business news. Although there are practically no differences in the resource to the social and family environment, there are differences in the use of information sources, such that the greater the interest in politics, the higher the percentage of generalist, specialized and expert sources.

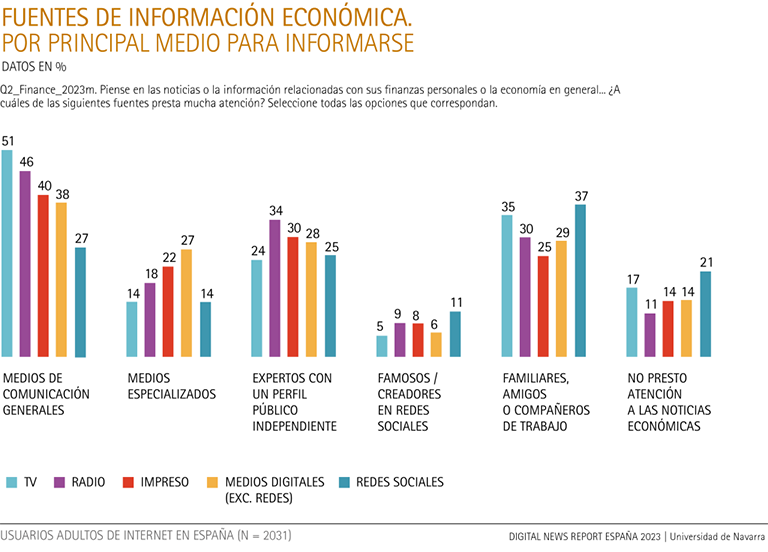

As for the main means of being informed in general, it is worth highlighting the sources of economic information used by those who are regularly informed through social networks. As can be seen in graph XX, this group is informed of economic news through friends, family or colleagues of work (37%), they make a relatively low employment of the general media (27%), experts with an independent public profile (25%) and specialized media (14%). It is also the group that pays least attention to economic news (21%).

Apart from this specific group , the general trend (with nuances) is that those who are mainly informed by digital formats tend to make a relatively lower use of general media and experts with profile independent audience, and a higher use of specialized media.

COMPARATIVE ANALYSIS OF THE USE OF FONTS IN DIFFERENT COUNTRIES

General media

The general media represent a primary source of economic and financial information in all countries ( source ). In comparative terms, the use of these sources in Spain (39%) is in the medium-low range with respect to the rest of the countries where this issue has been analyzed. The Nordic countries lead in the use of this subject of source information: Denmark (62%), Finland (51%) and Norway (54%), while Italy (21%) and the Slovak Republic (22%) have the lowest percentages in Europe.

As far as Southern Europe is concerned, Spain is in the medium-high range. Portugal (49%) and Greece (44%) show a higher use of general media, while Italy, as mentioned above, has the lowest percentage.

Media specialized in Economics

In Spain, 17% of people use specialized media as their main source of economic and financial information source . This percentage is below the global average of 23%. Compared to other European countries, Spain is in the medium-low range in terms of the use of specialized media.

Compared to other continents, Asia stands out for its greater propensity to use specialized media. In countries such as Taiwan and Singapore, 35% and 24% of people, respectively, use specialized media as source for economic and financial information.

Regarding possible patterns in the use of specialized media, it is observed that countries with more advanced and complex economies tend to have a greater use of specialized media. This may be due to the fact that these media are better able to provide detailed and specialized information on Economics, financial markets and corporate management . On the other hand, in countries with less advanced economies, people may not see the need to resort to these media, as their interest in Economics and finance may be lower.

Experts with profile independent public

In Spain, 26% of people use experts with independent public profile as source for economic and financial information. This percentage is above the global average of 22%. When compared with other European countries, Spain is in the medium-high range in terms of the use of this source. For example, Portugal (23%) and France (17%) have lower usage percentages, while Austria (28%) and the Slovak Republic (25%) have usage percentages similar to Spain.

In general, the countries where this subject source is most used are India (33%), Turkey and Brazil (29%) and the United Kingdom and Finland (28%), followed by Spain.

Non-informative sources: social and family environment

Regarding the role of family, friends and colleagues of work as sources of information, a fairly uniform use is observed in all the countries analyzed and apparently there is no patron saint behavior from a geographical point of view. If anything, the data indicates that it is a source much more used in Asian countries such as India (44%), Hong Kong (39%) Taiwan (38%) but also in other latitudes such as Bulgaria (45%), Croatia (41%), Hungary and Czech Republic (42%) or Ireland (42%).

They do not pay attention to economic news

Finally, the issue of people who declare that they do not pay attention to economic news is comparatively low (18%). However, the data may suggest that, in those countries with a higher Degree of development economic , both in Europe (Italy, Spain, France, Germany, Netherlands, United Kingdom) and in Asia (Japan and Singapore) or North America (USA and Canada) there is a higher percentage of people disinterested in economic news than in other less prosperous territories. Undoubtedly this issue deserves further analysis, but data could indicate a lower perceived relevance of Economics in everyday life or a sense of information saturation in these countries.

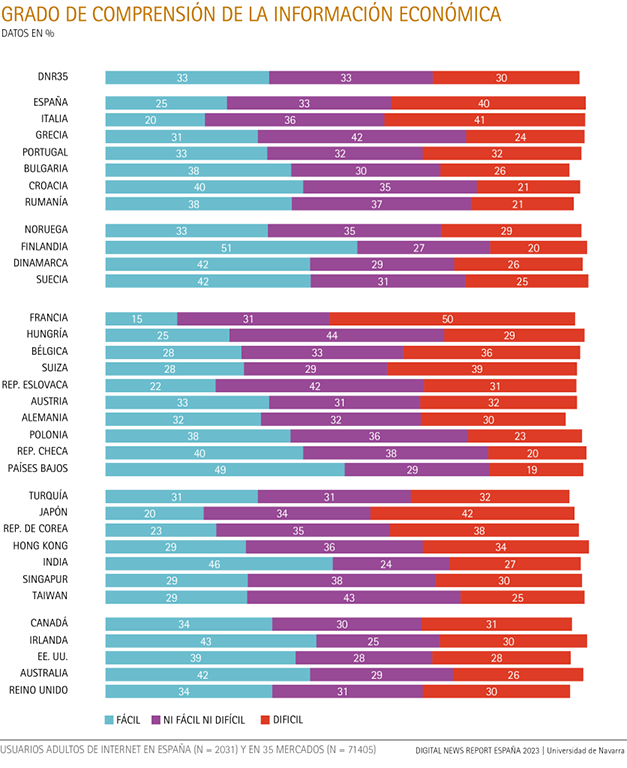

The majority of Spaniards (40%) do not understand economic information

In Spain, only 25% of the population considers that economic information is easy to understand, which is significantly lower than the overall average of 33%. This puts Spain among the countries with the least easy understanding of economic information, far behind countries such as Finland (51%), the Netherlands (49%) and India (46%). By contrast, 40% of the population in Spain perceives economic information as difficult to understand. This is 10 percentage points above the overall average, placing Spain among the countries with the greatest perceived difficulty in understanding economic information.

These data suggest that there may be room for improvement in economic communication and Education to make information more accessible and understandable to the general public. Second, these data may reflect the existence of a significant issue of people in Spain who feel excluded or disoriented by economic information, which may have implications for economic and political decision making in the country.

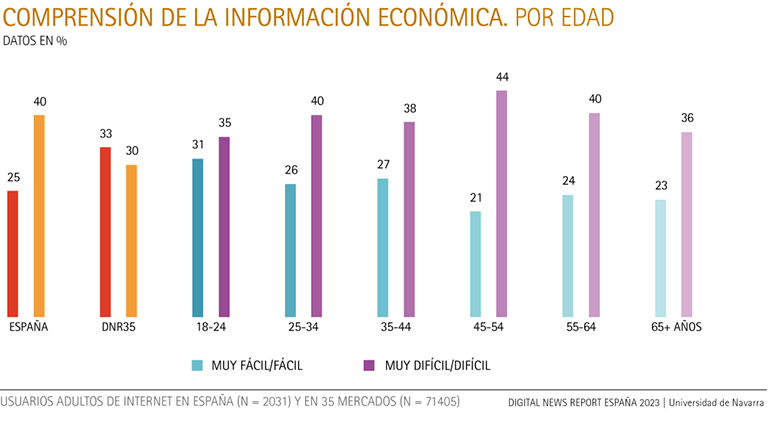

The sociodemographic analysis sample that 48% of the women surveyed consider that understanding news about finance and Economics is very difficult or difficult, compared to 31% of men. This difference could be related to the gender gap in financial Education and participation in economic activities.

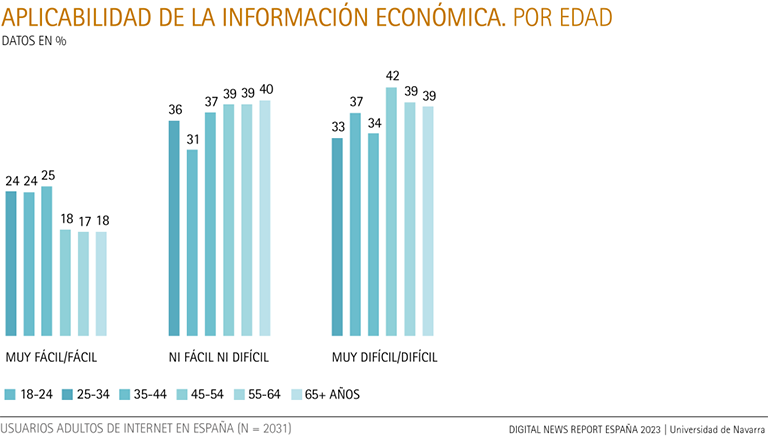

On the other hand, when analyzing the data according to age, it is observed that, with nuances, respondents of younger ages have less difficulty in understanding economic news, This result could be due to the greater exhibition of young people to new technologies and to the financial Education currently taught in schools and universities.

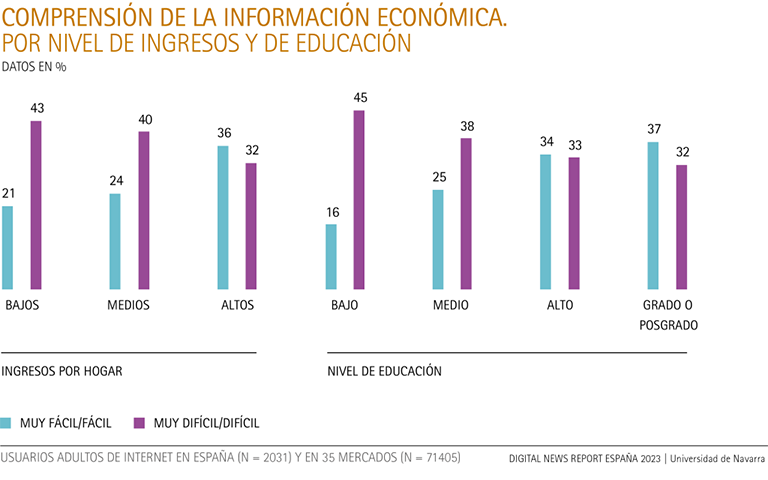

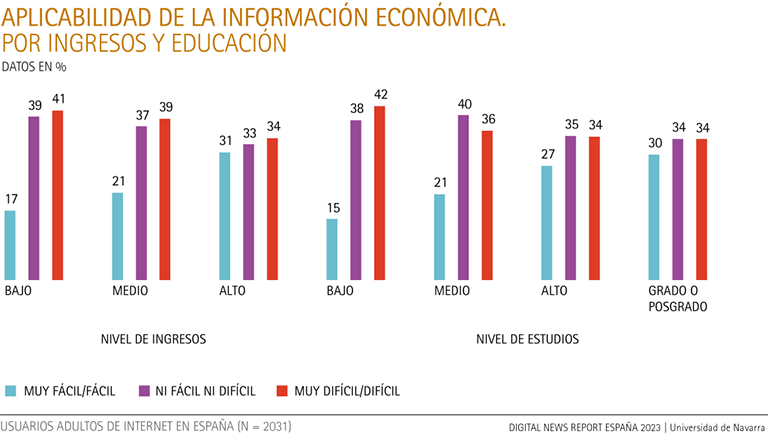

Finally, there is a clear relationship between the Degree of understanding economic information and the variables income level and level educational. The graph sample that people with lower incomes and lower educational levels have more difficulty understanding economic news, while people with higher incomes and higher educational levels find it easier to understand.

Moreover, the differences between groups are quite pronounced. For example, the percentage of people who find economic news very difficult or difficult to understand ranges from 43% among those with low incomes to 32% among those with high incomes. Similarly, the percentage of people who find economic news very easy or easy to understand ranges from 16% among those with low educational levels to 37% among those with high educational levels.

And they don't find it easy to apply the economic news to their daily lives either.

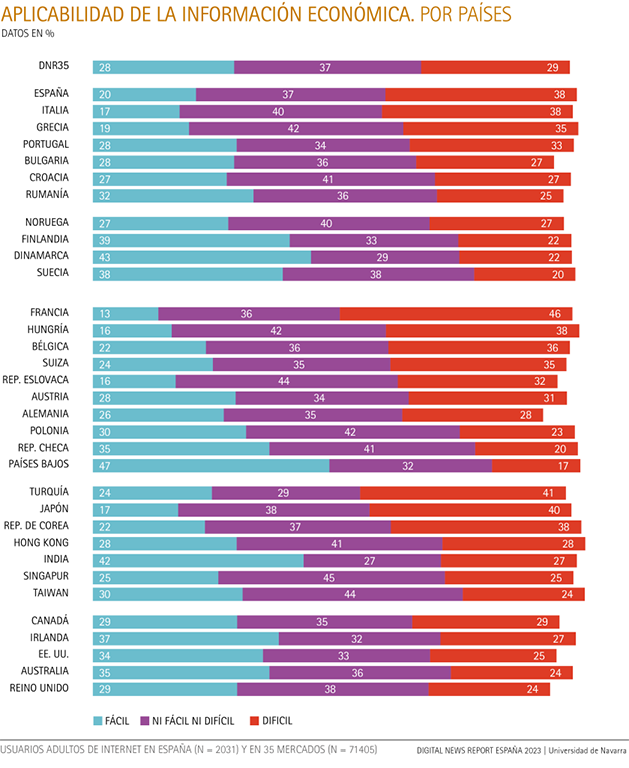

In Spain, only 20% of the population considers that applying economic information to their daily lives is easy, which is significantly lower than the overall average for the rest of the countries analyzed (28%). In contrast, Spain has a very high percentage of respondents (38%) who consider it difficult to apply economic news in their daily lives, significantly above the average of the other countries analyzed (29%).

When we compare Spain with the rest of Europe, we observe that the percentage of Spaniards who consider it easy to apply economic information to their daily lives is one of the lowest. Only France, Hungary and the Slovak Republic have lower percentages in this category. In contrast, as can be seen in the graph, Spain is at the upper end, along with Turkey, Hungary and France, of countries where citizens perceive it difficult to apply economic information. It is B that Spain has a higher percentage than many of its European neighbors, including Portugal, Italy and Germany.

These figures suggest that, compared to other European countries, a higher proportion of Spaniards find it challenging to apply economic information to their daily lives. This may reflect differences in economic Education , the presentation of economic information in the media, or even cultural and socioeconomic differences in the perception of Economics. At final, the data show that there may be room for improvement in economic communication and Education in Spain. This could involve making economic information more accessible and relevant to people's daily lives, or working to remove barriers to the understanding and application of economic information. In this way, Spanish citizens could feel more empowered to make informed decisions in their daily lives.

Who needs more support to be able to apply economic information in their daily lives?

The analysis by sex sample shows notable differences between men and women. Thus, a higher proportion of women rated as very difficult/difficult to apply economic information compared to men (42% vs. 34%). In contrast, a higher proportion of men considered it very easy/easy to apply economic news (26% vs. 15%). As for differences by age bracket, the data show significant differences between those under 44 and those over this age. Younger people perceive less difficulty in applying economic news (35%) than those over 45 (39%).

In terms of income levels, the very easy/easy category is significantly more popular among respondents with high incomes (31%) than among lower incomes (17%). And when examining the levels of EducationThe very easy/easy category was significantly more popular among high-income respondents (31%) than among lower-income respondents (17%). The very easy/easy category was most often selected by those with a Degree or postgraduate program (30%) compared to group with a lower level of Education (15%). This suggests that a higher Education may facilitate the understanding and application of economic information, possibly due to the development of critical thinking skills, numerical literacy and knowledge of economic concepts.

These data suggest that both income level and Education level may play a significant role in the perceived applicability of economic information. People with higher income and Education levels are likely to have a greater ability to understand and apply this information, which has important implications for the knowledge dissemination of economic information and for Education economic policies. This analysis also highlights the need to improve access to economic Education and to provide additional resources for those with lower incomes and Education levels to level the playing field.

For example, financial Education programs could be developed that specifically target these groups, using more accessible language and concepts and providing additional learning resources. This could help improve their understanding and application of economic information, enabling them to make more informed financial decisions and potentially improve their economic well-being.