Ruta de navegación

Menú de navegación

Blogs

Entries with Categories Global Affairs Economics, Trade and Technology .

The island faces the most serious economic crisis in twenty years: Venezuela's collapse and Trump's pressure highlight Havana's immobilism

The end of the USSR, a major subsidiser of the Castro regime, did not lead Havana to the economic and political opening that took place in most of the former communist bloc. After a time of severe hardship in the 1990s, known as the "special peacetime period", Cuba got another saviour in Venezuela, thus avoiding the necessary reforms. Today, the Venezuelan collapse and the pressure being exerted by Washington once again highlight Havana's unwillingness to change, as it faces another "special period", less intense but equally painful for the Cuban people.

![Street in the historic centre of Havana [Pixabay]. Street in the historic centre of Havana [Pixabay].](/documents/10174/16849987/cuba-economia-blog.jpg)

▲ Street in the historic centre of Havana [Pixabay].

article / Patricia Urdánoz

agreement Cuba's Economics could have closed 2019 with a growth of barely 0.5% of GDP and could repeat this poor performance in 2020, according to estimates by ECLAC, the UN Economic Commission for Latin America and the Caribbean. These are figures that place the island on the brink of recession, given that there could be a negative quarter. Although the Cuban government puts its economic goal for this year at 1%, its 1.5% target for 2019 may have been off by as much as one percentage point (international organisations, in any case, cannot audit Cuba's accounts); moreover, the elements contributing to the economic performance have worsened.

Growing economic difficulties have generated fears among Cubans of a return to the 'special period', as the 1990s were known when the dissolution of the USSR left the island without the massive financial aid assistance provided by Moscow. That time of special hardship was superseded by the financial aid that from 2002 onwards began to arrive from Hugo Chávez's Venezuela. It was the Venezuelan collapse that prompted Raúl Castro to seek salvation through rapprochement with the Obama Administration, but the Trump Administration's new restrictive measures have left Havana with no prospects.

Cubans have begun to suffer shortages of basic products such as medicines and food, and long, endless queues are once again appearing in the Cuban capital. The Economics has been stagnant since 2014: although there was a clear upturn the following year, 2016 saw a contraction, which the government put at 0.9% of GDP, meaning it had fallen into recession for the first time since the "special period" twenty years ago.

Although it is unlikely that Cuba will reach the dramatic figures of much of the 1990s, when the island's Economics contracted by approximately 35%, some estimates, reported by the Wall Street Journal, consider that if Venezuela were to completely cancel its financial aid there could be a contraction of 8% or 10%.

Before the "special period", the island was 82% dependent on the Soviet Union. Dependence on Venezuela is comparatively less and is also decreasing due to the severe crisis in that country. Venezuela's financial aid , basically by sending oil in exchange for the attendance of doctors, sports trainers and other staff, for which Caracas also pays, accounted for 22% of Cuba's GDP in 2013; by 2017 it had fallen to 8.5%.

The economic outlook, in any case, is not good and a worsening in several areas is to be expected for 2020, which will at least prolong the stagnation.

Venezuelan oil now in Russian hands

Although Venezuela's financial aid has been decreasing, Caracas' contributions continue to be important, so any further erosion of this aid would have an effect on Cuba's Economics . The 100,000 barrels of oil per day that Venezuela has been sending to Cuba for many years has recently been reduced to around 60,000 barrels. A further reduction is not to be expected, but the control of PDVSA's production that Russia is acquiring leaves the regime of Nicolás Maduro less room for political control over oil.

Fewer doctors abroad

Venezuela's out-of-control inflation could force a reduction in the payment Venezuela makes for the services provided on Venezuelan soil by staff Cubans. Carmelo Mesa-Lago, an economist specialising in Cuba, points out that Venezuela, which purchases 75% of this professional Cuban service abroad (an important means of access to hard currency), has already reduced its purchases by 23% between 2014 and 2017 and could be forced to make further cuts. Havana, on the other hand, stopped making cash in 2019 with the doctors it had stationed in Brazil and the same will happen in 2020 with those in Bolivia, after political changes in those countries forced their return to the island.

Below goal of 5 million tourists

The expectations opened on subject for tourism with the increase in travel from the US due to the facilities provided by President Obama have been frustrated by the restrictions again imposed by his successor. issue In 2018 there was a drop of 4.7 million tourists to 4.7 million, a figure that fell by 10% in 2019 to 4.3 million. Although the government says it expects an increase in 2020, it has stopped setting goal as a target to reach 5 million tourists. The limitation already imposed by Trump in 2018 on US-based cruise travel is followed by the recently announced limitation on direct flights, which could affect the income from tourism (those who arrive by plane tend to spend more during their stay).

Moderate exports

Export revenues could improve, but neither production nor prices look set to increase significantly. Nickel production has been rather stagnant and sugar production is recovering from its all-time low in 2017-2018.

Remittances will continue to flow

The restrictive measures imposed by the Trump Administration on remittances arriving in Cuba from the US, which are the majority, do not seem likely to affect their amount, as the established limit remains above the amount of most remittances. As a study by The Havana Consulting Group indicates, the current average amount sent is between 180 and 220 dollars per transaction, and as 95 per cent of Cubans who send remittances to their relatives on the island do so once a month, the limit of 1,000 dollars per quarter imposed by Washington, which came into force last October, is not reached. In addition, the study states that 45% of remittances to Cuba arrive through informal channels. In 2018, Cuba received 3,691 million dollars, a figure that practically doubles if non-cash remittances are taken into account.

Insufficient foreign investment

source Remittances should play an important role in boosting the national Economics , and in fact since the economic opening of 2010 they have functioned as an income source similar to foreign investment, as they were behind the start-up of many "cuentapropista" businesses. These self-employed businesses reached 535,000 workers in 2016, according to official statistics, but the stagnation in the growth of tourism is putting this private activity in difficulties. The Havana Consulting Group study concludes that "unlike most Latin American countries, the Cuban government does not take advantage of the potential of remittances as a way to attract investment capital to the country". Foreign direct investment, in any case, has been increasing, but the slowness in making the special zone of the port of Mariel attractive and the added difficulties from the US with the entry into force in 2019 of degree scroll fourth of the Helms-Burton Act, which encourages the presentation of lawsuits for the assets expropriated during the Cuban revolution, dampens the island's investment attractiveness.

DECENTRALISATION, BUT TIMID OPENING

The problem of the inefficiency of Cuba's Economics is largely due to its model centralisation, which creates shortages for consumers and great uncertainty for businesses. Along with other burdens that the country has carried since its beginnings, such as corruption, illegalities, low levels of savings, indebtedness and insufficient export revenues. Cuba's foreign debt between 1958 and 2017 multiplied by 190 times. And there is a difficult situation for the emergence of the private sector.

The island needs new structural economic reforms by the government, and it would also be interesting to follow the economic strategies of countries such as Vietnam and China, which have known how to open up to the international market under a communist government. For its own geopolitical interests, Washington should take care that its pressure measures do not drive the island into the arms of China and Russia.

Raúl Castro's successor as president, Miguel Díaz-Canel, and his appointed prime minister, Manuel Marrero, have announced the beginning of a process of economic decentralisation this year that will give greater autonomy to state-owned companies. It remains to be seen whether progress will actually be made along these lines and whether this will increase the efficiency of Cuba's Economics , as the reforms promised by Castro have been a very timid opening, not particularly transformative.

Brazil's congress approves ratification of agreement Technology Safeguards signed by Trump and Bolsonaro

With the reactivation of its Alcantara launch centre, the best located in the world due to its proximity to the Equator, the Brazilian space industry expects to reach a turnover of 10 billion dollars a year from 2040, with control of at least 1% of the global sector, especially in the area space launch sector. Jair Bolsonaro's government has agreed to guarantee technological confidentiality to the US, reaching a agreement that Washington had already tried unsuccessfully before the Workers' Party came to power.

![area space launch facility at the Brazilian Alcantara space centre [AEB]. area space launch facility at the Brazilian Alcantara space centre [AEB].](/documents/10174/16849987/alcantara-blog.jpg)

▲ area space launch site of the Brazilian space centre of Alcantara [AEB].

article / Alejandro J. Alfonso [English version].

Brazil wants to be part of the new space age, in which private initiative, especially from the United States, will play a major role, alongside the traditional role of the national agencies of the major powers. With the agreement Technology Safeguards, signed last March by Presidents Donald Trump and Jair Bolsonaro, rockets, spacecraft and satellites equipped with US technology can be launched at the strategic Alcântara base.

The guarantee of technological confidentiality - access to certain parts of the base will only be authorised to staff from the US, although jurisdiction will remain with the Brazilian Air Force - will mean that Alcántara will no longer have to negotiate contracts with only 20% of the world market, as has been the case until now, something that hindered the base's economic viability. However, the agreement also has a limiting aspect, as it only authorises Brazil to launch national or foreign rockets and aircraft that contain US-developed technological parts.

The new political context in Brazil meant that the agreement was ratified without problems on 22 October by the Chamber of Deputies and on 12 November by the Senate, a very different status to the one experienced in 2000, when congress blocked a similar agreement promoted by President Fernando Henrique Cardoso. The subsequent arrival of the Workers' Party to power, with the presidencies of Luiz Inácio Lula da Silva and Dilma Rousseff, cooled relations between the two countries and Washington temporarily put aside its interest in Alcántara.

Brazil's space aspirations go back a long way; its aerospace industry is the largest in Latin America. In the 1960s it developed a first launch base, Barrera do Inferno, near Natal. In 1994 the military parent of research was transformed into the civilian Brazilian Space Agency (AEB). In addition to development of satellites, AEB launched its first rocket in 2004. In 2006 a Brazilian astronaut joined the International Space Station, of which Brazil is partner.

The Alcántara launch centre is located in Maranhão, a state in northeastern Brazil. Alcántara is a small colonial town located 100 kilometres from the state capital São Luís. The town has 22,000 inhabitants and has access to the sea. The launch site was built during the 1980s and covers an area of 620 square kilometres. In addition, the launch base is located 2.3 Degrees south of the equator, which makes it an ideal location for launching satellites into geostationary orbit. The unique geographical conditions of the launch site attract companies interested in launching small to medium-sized satellites, typically used for communications or surveillance satellites. Unfortunately, the institution suffered a bad reputation when operations were briefly halted due to a failed launch in 2003, resulting in the death of 21 technicians and the destruction of some of the facilities. In 2002 the Agency

The US is interested in Alcantara because of its strategic location. As mentioned above, the launch site is located 2.3 Degrees south of the equator, which allows US rockets to save up to 30 per cent in fuel consumption compared to launches from Cape Canaveral, Florida. Also, due to its proximity to the equator, the drag to reach orbit is lower than Cape Canaveral, which means that companies can increase the weight of the rocket or the cargo it carries without adding additional fuel. This location therefore offers US companies the same advantages enjoyed by their European counterparts who use a launch site in French Guiana, located nearby, north of the equator. The agreement Technology Safeguards signed between Presidents Bolsonaro and Trump in March aims to attract these US companies by assuring them that US companies that do use the Alcantara facility will have the necessary protection and safeguards in place so that their technology is not stolen or copied by Brazilian operators or engineers.

The Brazilian government is clearly interested in the Americans using the Alcantara site. The global space industry is worth approximately $300 billion, and Brazil, which still has a space agency at development, could use the funds from leasing the launch site to further develop its space capabilities. The Brazilian Space Agency has been underfunded for many years, so additional revenues are particularly desirable. In addition, Brazilian officials have speculated that investment in the launch site will bring further investment in the Alcantara region in general, improving the quality of life at area. For example, the Kourou base in French Guiana generates 15% of the French overseas territory's GDP, providing employment directly or indirectly to 9,000 people. In conclusion, the Bolsonaro government hopes that this agreement will deepen the relationship with the US, and that it will also provide the monetary means to invest in the launch site and its surroundings, and invest in the Brazilian Space Agency.

However, this agreement has also been criticised. In 2000, President Cardoso's government attempted to sign a similar agreement with the George W. Bush administration, which was ultimately blocked by the Brazilian congress for fear that Brazil would cede its sovereignty to the US. These same fears are still present today. Former Brazilian Foreign Minister Samuel Pinheiro Guimarães Nieto declared that the US is seeking to establish a military base in Brazil, thus damaging the sovereignty of the Brazilian people. Criticism is also directed at essay of agreement itself, which states that the money the Brazilian government earns from the US use of the launch site cannot be invested in rockets from development exclusively Brazilian, but can be invested in other areas related to the Brazilian Space Agency.

In addition to arguments about the integrity of Brazilian sovereignty, there is also a defence of the Quilombolas, descendants of Brazilian slaves who escaped their masters, who were displaced from their coastal lands when the base was built. The government is currently proposing to increase the size of the Alcantara launch site by 12,000 hectares, and Quilombo communities fear that they will once again be forced to move, causing them further impoverishment. This has been the subject of discussion on both the Brazilian congress and the UScongress , with Democratic House representatives introducing a resolution calling on the Bolsonaro government to respect the rights of the Quilombolas.

The agreement Technology Safeguards is a primarily commercial agreement in order to attract more US companies to Brazil for the Alcantara site, which would save these companies money due to the ideal location of the launch site, while giving them the opportunity to invest in the Brazilian space programme. However, due to the controversies mentioned above, some may consider this as a unilateral agreement where only US interests prevail, while the Brazilian government and people lose sovereignty over a strategic site. Nevertheless, it should be noted that Brazil has traditionally developed an important aeronautical industry (Embraer, recently bought by Boeing, is an excellent example) and the Alcantara base provides the opportunity for Brazil to leap into the new space age.

For decades, the U.S. closed its doors to Mexican avocados; Today it needs it to meet its growing demand

2019 will see record imports of Mexican avocados into the United States: almost 90% of the one million tons of avocados consumed by Americans will come from the neighboring country, which leads the world in production. After being banned for decades in the U.S. – alleging phytosanitary issues, especially invoked by California producers – the creation of the North American Free Trade Agreement opened the doors of the U.S. market to this Mexican product, first with reservations and since 2007 without restrictions. The arrival of Trump to the presidency marked a decline in imports, but since then they have not stopped rising.

▲ Interest in healthy food has led to an increase in avocado consumption around the world

article / Silvia Goya

Social trends such as veganism or "real fooding" have increased the global production of avocados, a fruit valued for its healthy fat and vitamin content, which enlivens a multitude of dishes. In the United States, moreover, the food tradition of millions of Hispanics – the avocado is born from a tree native to Central and South America (Persea americana) – has encouraged the consumption of a product that, like few others, marks relations between the United States and Mexico.

The department The U.S. Department of Agriculture (USDA) predicts that in order to meet the growing national consumption of avocados (which has multiplied by 5.4 since 2000, from 226,000 tons to 1.2 million in 2018), in 2019 the country will have to increase its imports significantly, so that they will constitute 87% to 93% of the country's economy. availability of product. This will mean an increase in imports from Mexico, which in 2018 already contributed 87% of avocados from abroad. This need for imports is due in part to production problems in California, the state with the highest production in the US (around 80%), well ahead of the second, Florida, and a major litigator in the past to prevent the production of the skill of the Mexican avocado.

Donald Trump's first year in the White House saw a slight decrease in Mexican avocado imports, which in 2017 fell to 774,626 tons. However, in 2018 a new record was reached, with 904,205 tons, with an increase of 17%, in a context of non-materialization of the trade threats launched by the Trump Administration, which finally agreed to the renewal of the free trade agreement with Mexico and Canada. Last year, imports from Mexico accounted for 87% of total avocado purchases abroad; the rest, up to 1.04 million tonnes, corresponded to those from Peru (8%), Chile (2.5%) and the Dominican Republic (2.5%).

History of a veto

The B The rise in avocado sales in the U.S. has attracted the attention of drug cartels, which have clashed to control the business in some Mexican states such as Michoacán – the major producer of avocados, especially of the Hass variety, which is the most commercialized – giving rise to a "new drug trafficking." However, the history of controversy between the two countries over this berry goes back a long way. It was in 1914 that the then U.S. Secretary of Agriculture signed a notice A quarantine decree declaring the need to ban the import of avocado seeds from Mexico due to a weevil that the seed carried. In 1919 the "Quarantine of Nurseries, Plants and Seeds" was enacted. That framework was in place for decades.

During the 1970s, the discussion of the entrance of Mexican avocados in the U.S. market remained in the political spotlight due to the insistence of officials from Mexico's Plant Health Service. Investigations in several Mexican avocado-producing states, however, found weevils in some of the seeds, which did not allow the regulatory policy of the Animal and Plant Inspection Service (APHIS) to be changed. department U.S. Department of Agriculture. For this reason, in 1976 the USDA, in a letter addressed to its Mexican counterpart, stated that it should continue "as in the past, against the issuance of permits for the importation of avocados from Mexico."

Following these events, U.S. policy on avocados from neighboring China remained restrictive until trade liberalization and harmonization of sanitary and phytosanitary measures began to change the context in which governments examined plant health and import issues. For most of the twentieth century, the policy of protection had been to deny access to products that could harbor pests; In the last decade, however, the rules began to change.

The creation of the North American Free Trade Agreement (NAFTA) in 1994 and the World Trade Organization in 1995 paved the way for new Mexican requests for access to the U.S. avocado market. Although the goal One of the main aspects of NAFTA was the elimination of tariffs by 2004, and it also provided for the harmonization of sanitary and phytosanitary measures among trading partners. Nonetheless, this free trade agreement explicitly recognizes that each country can establish regulations to protect human, animal, and plant life and health, so when the risk of pest infestation is high, the country has legitimacy to put restrictions on trade.

With the implementation of NAFTA in 1994, the U.S. government came under increased pressure to facilitate the importation of agricultural products from Mexico, including avocados. This led to a shift in USDA's phytosanitary policy toward a new "mitigation or technological solutions" policy. APHIS is the branch of government in charge of implementing the phytosanitary provisions of NAFTA in the case of the United States. This body considered that fruit flies – present in a wide variety of species – could also be found in Mexican avocados, so officials from Mexico's Plant Health Service had the difficult task of proving that this insect was not present in their avocados and that those of the Hass variety were not susceptible to attack by the Mexican fruit fly. Between 1992 and 1994, Mexico submitted two plans for work with their respective investigations. The former was rejected while the latter, despite pressure from the California Avocado Commission (CAC), was accepted.

This second plan called for Mexican avocado access to 19 of the 50 U.S. states during the months of October through February. At the end of June 1995, the USDA issued a proposal of rule which described the conditions under which Hass avocado grown on approved plantations in Michoacán could enter the U.S. It was at the end of 1997 that the USDA published a rule authorizing the importation of these avocados to the United States. This was the first time the USDA used the so-called "approach systems" to manage the risks posed by quarantine pests.

At the end of the second shipping season, in February 1999, Mexico requested the expansion of the programme to increase the issue of U.S. states to which it could export and allow the shipping season to start a month earlier (September) and end a month later (March). In 2001, the USDA met with the Mexican Plant Health Service and agreed to consider expanding the importing states to 31 and import dates from October 15 through April 15. The good relationship established between Presidents George W. Bush and Vicente Fox had a clear influence on this expansive movement.

![Imports in tonnes. In 2018, imports of 1.04 million tonnes (87% from Mexico) [source: USDA] Imports in tonnes. In 2018, imports of 1.04 million tonnes (87% from Mexico) [source: USDA]](/documents/10174/16849987/aguacate-grafico.png)

Imports in tonnes. In 2018, imports of 1.04 million tonnes (87% from Mexico) [source: USDA]

Liberalization

For five years, Mexican avocados had been shipped to the U.S. without detecting a single pest. Although the expansion of Mexican avocado imports seemed inevitable, the CAC filed a lawsuit against the USDA from California, alleging that Mexican avocados did have pests. In response to this, the USDA carried out a research and published in 2003 a draft from "assessment pest risk" which confirmed that Mexican avocados did not carry the fruit fly.

The USDA had shifted from its previous position of domestic protection to a new position that benefited imports. Thus, in 2004 the USDA issued a new rule to expand the import program to all 50 states for 12 months of the year. This rule It envisaged that in California, Florida and Hawaii the importation of avocados would be delayed for up to a year in order to test the effectiveness of the proposed regulations. Therefore, until January 2007, Mexico was not allowed to export avocados to California and Florida; Since then, it has been allowed to export to all states year-round, quickly making the U.S. the world's largest importer of Mexican avocados.

Until 2017, the import of Mexican avocados remained stable; However, as previously indicated, with the arrival of Trump to the White House, relations between the US and Mexico once again faltered around various issues, one of them being the export of food from Mexico to the US, with avocados as an emblematic case. The new U.S. president threatened a 20% tariff on Mexican avocados to finance the wall he intended to build on the border.

In June 2018, Trump again threatened to impose a 25% tariff on avocados, and later in May 2019 threatened to impose a 5% tariff on all goods from Mexico.

In March 2019, when the migratory wave occurred, the US president threatened to close the border with Mexico and consecutively withdrew his decision, however, the simple fact that Trump threatened to close the border has already caused the price of avocados to rise by 34%.

U.S.-Mexican avocado relations remain unstable. Although much progress has been made since the implementation of NAFTA, various interests are still at stake that could lead the US to reduce the import of Mexican avocados. It is difficult for avocados to escape the uncertainty inherent in the bond between the United States and Mexico.

With its mega-city and technology zone project , the Saudis are seeking to consolidate an economic alternative to oil.

NEOM, an acronym for New Future, is the name of the new economic-technological city and area , with an area three times the size of Cyprus, which Saudi Arabia is promoting in the north-west of the country, opposite the Sinai Peninsula. In addition to seeking alternatives to oil, with NEOM the Saudis aim to rival the urban innovations of Dubai, Abu Dhabi and Doha. The project also involves shifting Saudi interest from the Persian Gulf to the Red Sea and closer neighbourhoods with Egypt, Jordan and Israel.

![The future NEOM megacity, from agreement with the vision of its promoters [NEOM Project]. The future NEOM megacity, from agreement with the vision of its promoters [NEOM Project].](/documents/10174/16849987/neom-blog.jpg)

▲ The appearance of the future NEOM megacity, from agreement with the vision of its promoters [NEOM Project].

article / Sebastián Bruzzone Martínez

Middle Eastern states are seeking to diversify their revenues and avoid potential collapse of their economies in order to counteract the end-of-oil crisis expected in the mid-21st century. Arabs' preferred sectors are renewable energy, luxury tourism, modern infrastructure and technology. Governments in the region have found ways to unify these four sectors, and Saudi Arabia, along with the United Arab Emirates, seems to want to position itself at the forefront of the Arab technology degree program .

While the world looks towards Sillicon Valley in California, Shenzhen in China or Bangalore in India, the Saudi government has begun preparations for the creation of its first independent economic and technological zone: NEOM (short for the Arabic term Neo-Mustaqbal, New Future). The project was until recently headed by Klaus Kleinfeld, former CEO of Siemens AG, who has been replaced by Nadhmi Al Nasr as CEO of NEOM since his appointment as an advisor to the Saudi Crown.

On 24 October 2017, at the Future Investment Initiative lecture in Riyadh, Saudi Crown Prince Mohammed bin Salman announced the $500 billionproject , part of the Saudi Vision 2030 policy programme. average The territory where NEOM will be located is in the border area between Saudi Arabia, Egypt and Jordan, on the shores of the Red Sea, through which almost ten percent of world trade flows, has a temperature 10ºC lower than that of the rest of the countries of the Gulf Cooperation committee , and is located less than eight hours' flight from 70% of the world's population, so it could become a major passenger transport hub.

As announced by the Saudi government, NEOM will be a special economic city, with its own civil and tax laws and Western social customs, covering 26,500 square kilometres (the size of Cyprus multiplied by three). The main objectives are to attract foreign investment from multinational companies, diversify the oil-dependent Saudi Economics , create a free market space and home to millionaires, "a land for free and stress-free people; a start-up the size of a country: a blank sheet of paper on which to write the new era of human progress", says a promotional video on project. All this under the slogan: "The world's most ambitious project: an entire new land, purpose-built for a new way of living". According to the website and official accounts of project, the 16 sectors of energy, mobility, water, biotechnology, food, manufacturing, communication, entertainment and fashion, technology, tourism, sport, services, health and wellness, Education, and livability will generate 100 billion dollars a year.

Thanks to a report published by The Wall Street Journal and prepared by the consulting firms Oliver Wyman, Boston Consulting Group and McKinsey & Co., which, according to them, had access to more than 2,300 confidential planning documents, some of the ambitions and luxuries that the futuristic city will have have have have come to light. These include flying cars, holograms, a Jurassic Park-style robot dinosaur theme park and edition Genetics , never-before-seen technologies and infrastructure, luxury hotels, resorts and restaurants, cloud-creating mechanisms to cause rainfall in arid areas, glow-in-the-dark sandy beaches, and even an artificial moon.

Another aim of project is to make NEOM the safest city on the planet, through state-of-the-art surveillance systems including drones, automated cameras, facial and biometric recognition machines and AI capable of reporting crimes without the need for citizens to report them. Similarly, the leaders of the urban development initiative themselves predict that the city will be an ecological centre of great projection, basing its power supply system solely on solar and wind energy obtained from panels and windmills, as they have a whole desert to install them in.

At the moment, NEOM is only a project in its infancy. The land on which the big city will be located is a desert terrain, mountains up to 2,500 metres high and 468 kilometres of pristine coastline of turquoise blue water, with a palace and a small airport. NEOM is being built from scratch, with an initial outlay of $9 billion from the Saudi Arabian sovereign wealth fund Saudi Arabia Monetary Authority (SAMA). Apart from foreign business investment, the Saudi government is looking for workers from all professional sectors to help in their respective fields: Jurists to draft a civil, criminal and tax code; engineers and architects to design a modern, efficient and technological infrastructure and energy plan; diplomats to collaborate in its promotion and cultural coexistence; scientists and doctors to encourage clinical and biotechnological research and welfare; academics to promote Education; economists to make income and expenditure profitable; personalities specialising in tourism, fashion and telecommunications... But, above all, people and families to inhabit and give life to the city.

As reported by the Arabic daily Rai Al Youm, Mohammed bin Salman has C a proposal prepared by a joint Saudi legal committee with the UK, which consists of providing a VIP document that will offer special visas, residency programrights to investors, senior officials and workers in the future city. Contracts business have already been awarded to the US engineering firm Aecom and construction contracts to the UK's Arup Group, Canada's WSP, and the Netherlands' Fugro NV.

However, not everything is as ideal and straightforward as it seems. Despite the strong interest of 400 foreign companies in project, according to the local government, there is uncertainty about its profitability. Problems and scandals related to the Saudi crown, such as the imprisonment of family members and dissidents, corruption, unequal rights, the military intervention in Yemen, the case of the murder of journalist Khashoggi and the possible political crisis following the future death of King Salman bin Abdulaziz, Mohammed's father, have caused investors to tread carefully. Moreover, in the region where the city is to be built there are villages of locals who would be relocated, and "compensated and supported by social programmes", according to the Saudi government, which will be criticised by human rights groups.

In conclusion, NEOM is a unique project and a match for the Arab sheikhs themselves, who have adopted a far-sighted economic vision. It is expected that by 2030 it will be possible to live in the city, even if construction is still underway and not yet fully completed. According to the markets, the project, still far from completion, seems to be on track. It already has a structural financing commitment with BlackStone of 20 billion euros, and a technology financing commitment with SoftBank of 45 billion euros. Because such a project has never been seen before and therefore there are no references, it is difficult to determine whether the visionary plan will be successfully consolidated or whether it will remain just smoke and mirrors and a huge loss of money.

essay / Jairo Císcar Ruiz [English version].

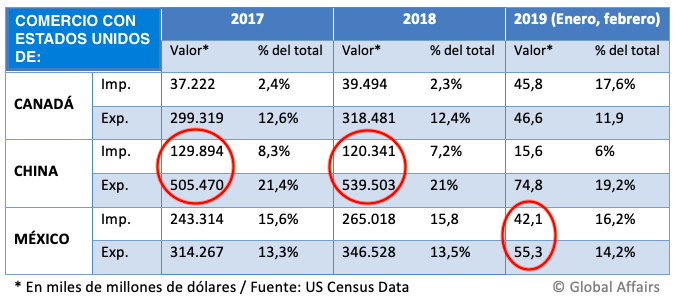

In recent months, the open trade hostilities between the United States of America and the People's Republic of China have dominated the main general headlines and specialized economic publications around the world. The so-called "trade war" between these two superpowers is nothing more than the successive escalation of the imposition of tariffs and special levies on original products and manufactured goods from the countries in confrontation. This, in economic figures, means that the US imposed in 2018 special tariffs on US$250 billion of imported Chinese products (out of a total of US$539 billion), while China for its part imposed tariffs on 110 out of US$120 billion of US import products [1]. These tariffs meant an increase of US$3 billion in additional taxes for American consumers and businesses. This analysis is therefore intended to explain and show the position and future of the European Union in this trade war in a general way.

This small reminder of the figures illustrates the magnitude of the challenge for the global Economics posed by this clash between the world's two economic locomotives. It is not China who is paying the tariffs, as Trump literally said on May 9 during a meeting with journalists [2], but the reality is much more complex, and, evidently, as in the case of the inclusion of Huawei in the trade blacklist (and therefore the prohibition to purchase any item on US soil, whether hardware or software, without a prior agreement with the Administration), which may affect more than 1.200 American companies and hundreds of millions of customers globally according to the BBC [3], the economic war may soon start to be a great burden for Economics globally. On June 2, Pierre Moscovici, European Commissioner for Economic Affairs, predicted that if the confrontation continues, both China and the USA could lose between 5 and 6 tenths of GDP, stressing in particular that "protectionism is the main threat to world growth" [4].

As can be inferred from Moscovici's words, the trade war is not only of concern to the countries directly involved in it, but is closely followed by other actors in international politics, especially the European Union.The European Union is the largest Single Market in the world, this being one of the premises and fundamental pillars of the EU's very existence. But it is no longer focused on internal trade, but is one of the major trading powers for exports and imports, being one of the main voices advocating healthy trade relations that are of mutual benefit to the different economic actors at global and regional level. This openness to business means that 30% of the EU's GDP comes from foreign trade and makes it the main player when it comes to doing import and export business. To illustrate briefly, from agreement with the data of the European Commission [5] in the last year (May 2018-April 2019), the EU made imports worth €2,022 billion (a growth of 7%) and exported 4% more, with a total of €1,987 billion. The trade balance is therefore a negative balance of €35 billion, which, due to the large volume of imports and exports and the nominal GDP of the EU (taking the figure of 18.8 trillion euros) is only 0.18% of the EU's total GDP. The USA was the main place of export from the EU, while China was the first place of import. These data are revealing and interesting: an important part of the EU's Economics depends on business with these two countries and a bad performance of their Economics could weigh down the EU member countries' own.

Another data that illustrates the importance of the EU in subject trade is that of Foreign Direct Investment (FDI). In 2018, 52% of global FDI came from countries within the EU and the EU received 38.5% of total investment globally, leading on both indicators. It can therefore be said that the current trade war may pose a serious problem for the future European Economics , but, as we will see below, the Union can emerge strengthened and even benefit from this status if it manages to mediate well between the difficulties, businesses and strategies of the two countries. But let us first look at the EU's relations with both the US and China.

The US-EU relationship has traditionally been (albeit with ups and downs) the strongest in the international sphere. The United States is the main ally in defense, politics, Economics and diplomacy of the European Union and vice versa. They share the economic, political and cultural model , as well as the main world collective defense organization, NATO. However, in the so-called transatlantic relationship, there have always been clashes, accentuated in the recent times of the Obama Administration and habitual with Trump. With the current Administration, not only have reproaches to the EU arisen within NATO (regarding the failure of member countries to invest the required budget ; shared criticism with the United Kingdom), but a full-fledged tariff war has begun.

In barely two years we have gone from the TTIP (Transatlantic Trade and Investment Partnership) negotiations, the announced basis for 21st century trade that finally failed in the final stages of Obama in the White House, to the current status of extreme US protectionism and EU response. Particularly illustrative is the succession of events that have taken place in the last year: at the stroke of Twitter, in March 2018 the US unilaterally imposed global tariffs on steel (25%) and aluminum (10%) to protect American industry [6]. These tariffs did not only affect China, they also inflicted great damage on companies in European countries such as Germany. Tariffs of 25% on European vehicles were also in the air. After a harsh climate of mutual reproaches, on July 25, Jean Claude Juncker, President of the European Commission, announced together with Trump a agreement to lower tariffs on agricultural products and services, and the US committed itself to review the imposition of metallurgical tariffs on the EU, as well as to support within the World Trade Organization the European calls for a reform of Intellectual Property laws, which China does not respect [7]. However, after the reiteration of the transatlantic friendship and Trump's advertisement of "we are heading towards zero tariffs" [8], soon the intemperate boxes have been rung again. In April this year, on April 9, Trump announced on Twitter the imposition of tariffs on the EU worth US$11 billion for the EU's support to Airbus (skill of the American Boeing, Lockheed Martin...), blowing up the principle of agreement of July last year. The EU, for its part, threatened to impose tariffs of €19 billion for the US state support to Boeing. As can be seen, the EU, despite its traditional conciliatory role and often subjugated to the US, has decided to fight back and not allow any more outbursts on the American side. The latest threat, in mid-July, is against French wine (and due to the European mechanism, against all wines of European origin, including Spanish wines). This threat has been described as "ridiculous" [9], since the USA consumes more wine than it produces (it is the world's largest consumer) and therefore, the supply available could be considerably reduced.

It is still too early to see the real impact that the trade war is having on the US, beyond the 7.4% drop in US exports to China [10] and the damage that consumers are suffering, but the Nobel laureate of Economics Robert Schiller, in an interview for CNBC [11] and the president of the World Trade Organization, Roberto Azevedo, for the BBC; have already expressed their fears that if status and protectionist policies continue, we could be facing the biggest economic crisis since the end of the Second World War. It is difficult to elucidate what the future relationship between Europe and its main exporter partner , the USA, will be like. All indications are that friction and escalation will continue if the US Administration does not decide to tone down its rhetoric and actions against free trade with Europe. Finally, it must be clear (and in the spirit of lowering the sometimes excessively alarmist tone of the news) that between the threats (either by Twitter or spokespersons) from both sides and the actual imposition of tariffs (in the US after the relevant advertisement from the Office of the US Trade Representative; in the EU through the approval of the 28) there is a long way to go, and we must not confuse potential acts and facts. It is clear that despite the harsh tone, the negotiating teams on both sides of the Atlantic are still at contact and are trying to avoid as far as possible actions detrimental to both sides.

On the other hand, the relationship between China and Europe is frankly different from the one with the USA. The Belt and Road Initiative (BRI) (to which Italy has formally adhered) is the confirmation of China's bid to be the next leader of the world's Economics . Through this initiative, President Xi Jinping aims to redistribute and streamline trade flows to and from China by land and sea. To this end, the stability of South Asian countries such as Pakistan and Afghanistan is vital, as is the ability to control vital maritime traffic points such as the Strait of Malacca and the South China Sea. The Asian "dragon" has an internal status that favors its growth (6.6% of its GDP in 2018 which, being the worst figure for 30 years, is still an overwhelming figure), as the relative efficiency of its authoritarian system and, especially, the great support of the State to companies boost its growth, as well as possessing the largest foreign currency reserves, especially dollars and euros, which allow a great stability of the country's Economics . The Chinese currency, the Renminbi, has been declared by the IMF as a world currency reservation , which is another indicator of the good health that is predicted for the future of the Chinese Economics .

For the EU, China is a competitor, but also a strategic partner and a negotiator partner [12]. China is the EU's main importer partner , accounting for 20.2% of imports (€395 billion) and 10.5% of exports (€210 billion). The volume of imports is such that, although the vast majority reach the European continent by sea, there is a railway connection that, under the BRI, links the entire Eurasian continent, from China's manufacturing capital, Yiwu, and the last stop at the southernmost tip of Europe, Madrid. Although some of the imports are still so-called "low-end" goods, i.e. products of basic manufacture and cheap unit price, since China joined the WTO at entrance in December 2001, the concept of material produced in China has changed radically: the great abundance of rare earths in Chinese territory, together with the progress in its industrialization and investment in new technologies (in which China is a leader) have meant that China is no longer thought of only as a mass producer of bazaars; on the contrary, the majority of imports into the EU from China were high-end, high-tech machinery and products (especially telecommunications and processing equipment from data).

In the aforementioned statement press release from the European Commission, China is warned to comply with the commitments made in the Kyoto Protocols and Paris Agreements regarding greenhouse gas emissions; and urges the Asian country to respect the dictates of the WTO, especially in subject on technology transfer, state subsidies and illegal practices such as dumping.

These aspects are vital for economic relations with China. At a time when most countries in the world signed or are part of the Paris Agreements for the reduction of greenhouse gas emissions, while the EU is making efforts to reduce its pollution (closing coal plants and mines; putting special taxes on energy obtained from non-renewable sources...), China, which totals 30% of global emissions, increased in 2018 by 3% its emissions. This, beyond the harmful effects for the climate, has industrial and economic benefits: while in Europe industries are narrowing their profit margins due to the rise in energy prices; China, which is fueled by coal, provides cheaper energy to its companies, which, without active restrictions, can produce more. An example of how the climate affects economic relations with China is the recent advertisement [13] of AcerlorMittal to reduce by 3 million tons its total steel production in Europe (out of 44 million tons of usual production) due to high electricity costs and increased imports from countries outside the EU (especially China) which, with excess production, are lowering prices worldwide. This internship, which is especially used in China, consists in flooding the market with an overproduction of a certain product (this overproduction is paid with government subsidies) to lower prices. As of December 2018, in the last 3 years, the EU has had to impose more than 116 sanctions and anti-dumping measures against Chinese products [14]. Which sample that, despite the EU's attempts to negotiate on mutually satisfactory terms, China does not comply with the stipulations of the agreements with the EU and the WTO. Particularly thorny is the problem with government-controlled companies (a ban on 5G networks in Europe, controlled by Chinese providers, is being considered for security reasons), which have a virtual monopoly inside the country; and above all, the distorted reading of legality by the Chinese authorities, who try to use all possible mechanisms in their favor, making it difficult or hindering direct investment by foreign capital in their country, as well as imposing requirements (need to have Chinese partners, etc.) that hinder the international expansion of small and medium-sized companies. However,

The biggest friction with the EU, however, is the forced transfer of technology to the government, especially by companies of strategic products such as hydrocarbons, pharmaceuticals and the automotive industry [15], imposed by laws and conditio sine qua non companies cannot land in the country. This creates a climate of unfair skill and direct attack on international trade laws. The direct investment of Chinese capital in critical industries and producers in the EU has caused voices to be raised calling for greater control and even vetoes on these investments in certain areas due to Defense and Security issues. The lack of protection of intellectual rights or patents are also important points of complaint by the EU, which aims to create through diplomacy and international organizations a favorable climate for the promotion of equal trade relations between the two countries, as reflected in the various European guidelines and plans concerning topic.

As we have seen, the trade war is not only limited to the US and China, but third parties are suffering from it and even actively participating in it. The question arises here: can the EU benefit in any way and avoid a new crisis? Despite the pessimistic mood, the EU can derive multiple benefits from this trade war if it manages to maneuver properly and avoid as far as possible further tariffs against its products and keeps the market open. If the trade war continues and the positions of the US and China harden, the EU, being partner the main beneficiary of both, could benefit from a redistribution of trade flows. Thus, to avoid the loss due to tariffs, both China and the US could sell heavily taxed products to the European market, but especially import products from Europe. If a agreement is reached with the US to lift or minimize tariffs, the EU would find itself facing a huge market niche left by Chinese products vetoed or taxed in the US. The same in China, especially in the automotive sector, from which the EU could benefit by selling to the Chinese market. Alicia Garcia-Herrero, of the Belgian think tank Bruegel, states that the benefit for Europe will only be possible if it does not lean towards any of the contenders and remains economically neutral [16]. He also stresses, like the European Commission, that China must adopt measures to guarantee reciprocity and market access, since the European Union still has a greater volume of business and investments with the USA, so that the Chinese offer should be highly attractive for European producers to consider directing products to China instead of the USA. The UN itself estimates at US$70 billion the benefits that could be absorbed by the EU thanks to the trade war [17]. Definitely, if the right measures are taken and the 28 draw up an adequate road map, the EU could benefit from this war, without forgetting that, as the EU itself advocates, coercive measures are not the solution to the trade problem, and hopes that, due to their ineffectiveness and damage caused to both consumers and producers, the tariff war will come to an end and, if differences persist, they will be resolved in the WTO Appellate Body, or in the Permanent Court of Arbitration of the United Nations.

This trade war is a highly complex and nuanced topic ; this analysis has attempted to address many of the issues, data and problems facing the European Union in this trade war. It has been generally analyzed what the trade war consists of, as well as the relations between the EU, China and the USA. We are facing a gray future, with the possibility of multiple and quick turns (especially on the part of the US, as seen after the G20 summit in Osaka, after which it has allowed the sale of components to Huawei, but has not removed the company from its blacklist) and from which, if the requirements and the conditions set out above are met, the EU will definitely benefit, not only economically, but if it remains united and making a common front, it will be an example of negotiation and economic freedom for the whole world.

REFERENCES

Thomas, D. (14-5-2019) Who loses in the China-US trade war. BBC. Retrieved from.

Blake, A. (9-5-2019) Trump's rambling, disappointing Q&A with reporters, annotated. The Washington Post. Retrieved from.

3. Huawei: US blacklist will harm billions of consumers (29-5-2019) BBC. Retrieved from

4. EU warns China and the US: a trade war would subtract 0.6 points of GDP(3-6-2019) El Confidencial. Retrieved from

5. European Union Trade Statistics. (18-6-2019) European Commission.Retrieved from: http://ec.europa.eu/trade/policy/eu-position-in-world-trade/statistics/

6. Pozzi, S. (2-3-2018) Trump reaffirms protectionism by raising tariffs on imported steel and aluminum. El País (New York correspondent)Retrieved from.

7. Inchaurraga, I. G. (2013). China and GATT (1986-1994): Causes and consequences of the failure of a negotiation. Cizur Menor, Navarra: Aranzadi. pp. 204-230.

8. Tejero, M. (25-7-2018) agreement EU-US: "zero tariffs" on industrial goods; more soybeans and liquefied gas. El Confidencial. Retrieved from.

9. Pardo,P. & Villaécija, R. (17-6-2019) Trump threatens Spanish wine. El Mundo. Retrieved from.

10. A quick guide to US-China Trade War (14-5-2019) BBC. Retrieved from

11. Rosenfeld, E. & Soong, M. (25-3-2018) Nobel-winner Robert Shiller warns of an 'economic crisis' from trade war threats. CNBC. Retrieved from.

12. EU reviews relations with China and proposes 10 actions. (12-3-2019) European Commission- statement de Prensa.

13. Asturias takes 23% of Arcelor's new EU production cut.(6-5-2019) 5 Days Retrieved from.

14. Morales, R. (26-12-2018) EU increased 28.3% its antidumping measures in 3 years: WTO. El Economista Mexico. Retrieved from

15. Warning about forced technology transfer to Chinese government.(20-5-2019) Infobae. Retrieved from

16. García-Herrero, A.; Guardans, I. & Hamilton, C. (28-6-2018) Trade War Trinity: analysis of global consequences. Bruegel (lecture). Retrieved from.

17. European Union, the big beneficiary of the trade war between China and the U.S.(4-2-2019) UN News . Retrieved from

Iran Country Risk Report (June 2019)

After some months of implementation, the re-imposed US sanctions against Iran are seriously affecting Iranian economy and forcing disputed political and even military reactions. The present report attempts to provide an analysis of Iran by addressing: the consequences of sanctions, the current and future state of its energy sector, the internal situation of the country, and the future prospect of the Iran-US relations.

C. Asiáin, M. Morrás, I. Urbasos

Report [pdf. 14,1MB] [pdf. 14,1MB

Report [pdf. 14,1MB] [pdf. 14,1MB

EXECUTIVE SUMMARY

The US unilateral withdrawal from the JCPOA on May 8, 2018, reshaped the Iranian domestic and international reality. On the one hand, the JCPOA enabled Iran to increase its GDP above 7% in the period of 2016-2018, more than double its oil exports and maintained President Rouhani in office after the 2017 elections. On the other hand, the US reimposition of the previously lifted sanctions demonstrated the deep vulnerabilities of the Iranian economy and its huge diplomatic isolation.

US sanctions will affect the whole of Iran's foreign relations due to its extraterritorial nature. The EU will try to avoid its effect through legal protection of its companies and citizens with mechanisms such as the SPV, whose scope and effectivity is yet to be proved. China, as it is less exposed to the US financial and political influence, will be able to better circumvent sanctions but still far from being totally unaffected. Other countries such as India, Turkey or Russia will find difficulties to handle secondary sanctions, but will be able to maintain a certain degree of trade with the Islamic Republic. Japan or South Korea will have to follow US demands because of its strategic alliance in the Asia-Pacific region and resume energy imports and investments.

The Iranian economy is expected to enter into recession during 2019, GDP growth is expected to be -4.5% and unemployment rate will increase to the 15.4%. This economic hardship will concentrate the political discussion in the 2020 legislative and 2021 presidential elections, whose outcome will determine if a moderate or hardliner political faction seizes power. Social unrest from ethnic minorities and opposition is expected to rise if the economic conditions do not improve, challenging the current political equilibrium of the country.

The energy sector will be deeply affected by US sanctions as it banned all countries from investing and purchasing Iran's energy products. Sanctions are expected to reduce Iran oil exports to 1million barrels a day from the 2017 levels of 2.4 mbdp, decreasing governmental revenues drastically and freezing most foreign investments. The lack of FDI and technology will aggravate the problems of the Iranian energy sector with possible irreversible effects depending on the sanctions duration.

US-Iran relations are expected to worsen at least until the US 2020 Presidential elections, when a more dialoguing candidate could substitute the hawkish Trump administration. The United States is expected to maintain its current strategic alliances with Saudi Arabia and Israel, whose common goal of pressuring Iran can have unexpected consequences for the Middle East. Domestic politics in Iran, US, Israel and Saudi Arabia will play a major role in the evolution of the events.

ESSAY / Albert Vidal

What once achieved great successes oftentimes seems to lose its momentum and, sometimes, it even can become obsolete forever. When this occurs, there are usually two options: one can either try to reform it and save it, or adapt to the changes and play resiliently. But taking that decision involves sacrifices, and there will always be victims, no matter what one chooses. We can see this happening today with the World Trade Organization (WTO), particularly in regards to its function as a forum for the multilateral liberalization of trade.

In this essay, I argue that the WTO has lost its function as a forum for the multilateral liberalization of trade; rather, its only function is now to settle disputes through the Dispute Settlement Mechanism (DSM).

I have developed three main arguments to support my opinion. First, the failure of the Doha Round has marked an inflection point. With tariffs in its lowest point ever, states decided to abandon the WTO structure due to its slowness and resort to other mechanisms such as Free Trade Agreements (FTAs) and Regional Trade Agreements (RTAs) to liberalize the remaining barriers. The WTO has been deprived of one of its core functions, which could be toxic for smaller economies. Second, the uniqueness and effectiveness of the WTO's DSM has conquered many hearts in the international arena and most states rely on it to solve its disputes. It has functioned so well, that it is now dealing with some disputes that had previously been part of trade liberalization negotiations. Third, the WTO does not have a clear mandate to decide on today's most significant trade barriers: behind-the-border barriers. Most FTAs and RTAs deal with them in a more effective way than the WTO. Let's now develop these reasons.

Toward a system of elites

The first argument that supports my thesis has to do with the failure of the Doha Round and its consequences. If we look back to the average tariff rates of the past decades, we see how they went down from 22% in 1947, to 15% in 1965 and to less than 5% after the Uruguay Round[1]. In 2004, the average tariff rate was less than 3.8%, and global tariffs remained highest in the least developed regions of the planet. The Doha Round, which began in 2001, was thought to address the remaining agricultural subsidies and other minor tariffs that still were in place. But in 2008, talks collapsed due to a lack of commitment by many parties[2]: lobbies in Western countries pushed hard to maintain the agricultural subsidies, while developing economies demanded more protection for farmers.

Suddenly, some countries (in particular the biggest economies) realized that engaging in negotiations within the WTO framework wasn't worth it, since reaching consensus for such sensitive issues would be an almost impossible task. Besides, very few tariffs actually remained in place. Thus, they decided to resort to other channels, such as Free Trade Agreements (FTAs) and Regional Trade Agreements (RTAs). What were the consequences of such drift?

Since 2001, more than 900 FTAs[3 ] and 291 RTAs[4] have been signed: there has been a true explosion. They are attractive, because they deal with areas where the WTO has failed[5] (e.g., non-tariff barriers and investment). FTAs and RTAs are technically allowed by the WTO, but they are problematic, because the members of such trade agreements end up forming their own blocs to trade freely, which excludes other minor countries. Consequently, FTAs and RTAs are now undermining the multilateral trading system[6], because them being preferential provokes trade diversion and increased costs. Besides, they reduce the value of a potential outcome from the Doha Round and, by abandoning the WTO framework, it is easier for bigger economies to use their bargaining power.

In short, powerful and rich members have removed the function of freeing trade from the WTO by engaging in FTAs and RTAs. They once came together to give this organization a role in liberalizing trade; now, following the functionalist theory, they have come together again to remove such function. One might ask, what will then happen with the WTO? Actually, not everything is lost.

What remains of the WTO: the most effective international tribunal

A second reason is that the WTO's DSM has functioned so well, that it has even absorbed some of the issues that were previously dealt with in negotiations. The DSM was created with the aim of resolving trade disputes among members, being one of the two initial functions of the WTO. Since 1995[7], members have filled more than 570 disputes and over 350 rulings have been issued, most of which have been complied with (compared to less than 80 rulings of the International Court of Justice in a longer span of time). Almost 100 cases have been settled by a mutually agreed solution before advancing to litigation. Such figures make it the most widely used and effective international tribunal in existence.

One might wonder how this is possible. The secret rests in its five features: first, its procedure is extremely quick (it should take just one year to settle a dispute without appeal); second, it allows for Alternative Dispute Resolution mechanisms and encourages diplomacy before going for the judicial option; third, it allows for appeal; fourth, its panel is made by experts; fifth, it allows for retaliation.

Some may object by pointing out to the paralysis that the DSM is suffering due to Trump's blockage of nominations to seats on the appellate body, which could leave the system inoperable[8]. My answer to that is that Trump is the exception to the rule, and everything should be going back to normal with the coming administration.

The increasing number of active disputes (Appendix B) does not necessarily mean that law is being broken more often; rather, it is a reflection of the growing faith countries have in the DSM. In fact, the lack of progress in the Doha Round has pushed some countries toward the WTO's DSM to solve disputes that should have been part of trade liberalization negotiations[9] (e.g., agricultural subsidies).

Non-tariff barriers are better dealt with outside the WTO

A third reason to justify why the WTO no longer functions as a forum for multilateral trade liberalization is that the unclarity of the extent to which the WTO can decide on non-tariff barriers makes states uneasy when it comes to negotiating such issues within the WTO framework. I may also remind that most of the barriers still in place today are non-tariff ones, and the WTO has not yet developed universally recognized rules on them.

Again, solving issues like the harmonization of standards through the required-consensus of the WTO's rounds is incredibly complex. This means that states prefer either to simply bring them to the WTO's DSM or to deal with those challenges bilaterally and through regional deals.

That is why, in my opinion, the WTO needs to undertake certain reforms to regain its lost function: it should promote non-litigious dialogue outside the official frameworks[10]. Simultaneously, it should develop relationships with the existing FTAs and clarify the extent to which it will decide on behind-the-border measures.

Final reflection

To put it briefly, the WTO has lost one of its two core functions due to three main factors. The most important one is that many countries are tired of the rigid WTO structure for trade negotiations, and have decided to work toward the same direction but with different methods. At the same time, the DSM has earned a tremendous reputation for almost two and a half decades and, although it is now going through difficult situation, it has a bright future ahead. Lastly, the bulk of barriers to trade that remain standing are so complex, that the WTO cannot effectively address them.

I would like to end by referring to the reflection with which I began this essay. It seems to me that we can still save the WTO as a forum to liberalize trade multilaterally, but we cannot pretend for it to be as it was in the past. It will never again be the central and unique leader of the process. Instead, it will have to develop relationships with existing FTAs, RTAs, and other functioning partnerships and agreements. But at least, we can try to reform it and soften the damaging consequences that are affecting countries outside these elite clubs.

[1] Tariff rate, applied, weighted mean, all products (%). (2017). Retrieved from

[2] How to rescue the WTO. (2018). The Economist. Retrieved from

[3] Ibid

[4] Regional Trade Agreements. (n.d.). Retrieved from

[5]Jackson, K., & Shepotylo, O. (2018). No deal? Seven reasons why a WTO-only Brexit would be bad for Britain. Retrieved February 21, 2019, from

[6] Meltzer, J. (2011). The Challenges to the World Trade Organization: It's All About Legitimacy. Washington DC. Retrieved from

[7] McBride, J. (2018). What's Next for the WTO. Retrieved April 26, 2019, from

[8] America holds the World Trade Organisation hostageTitle. (2017). The Economist. Retrieved from

[9] Meltzer, Op. cit., p. 4.

[10] Low, P. (2009). Potential Future Functions of the World Trade Organization. Global Governance, 15, 327–334.

Iran Country Risk Report (May 2019)

The sanctions that the United States is implementing against the Islamic Republic of Iran since November 2018 are the toughest sanctions ever imposed on Iran. They threaten to cut off foreign countries and companies dealing with Iran from the US financial system in order to deter business with Iran so to curtail the impact of proxy groups on the Middle East's security and stability. The aim of this country report is to provide the most recent analysis of the Iran's economic and political situation, and estimate its evolution in the short and medium term. It presents an overlook of specific clues about matters related to political risk, as well as the effect that sanctions may have on the Iranian economy, and the prospects for political stability all over the region.

Alona Sainetska

Report [pdf. 13,5MB] [pdf. 13,5MB

Report [pdf. 13,5MB] [pdf. 13,5MB

EXECUTIVE SUMMARY

Effects of sanctions

The re-imposition of US sanctions will maintain the Iranian economy in recession during the remaining months of 2019. Notwithstanding the foregoing, the economic meltdown will be very unlikely to happen, as the volume of oil exports is still significant, crude prices are going to continue to rise and other major powers' opinion will still differ from the US's. The multinational companies dependent on US financial system will continue leaving the Iranian market, partially leading to declining of the foreign investment, but SMEs will be almost unaffected and new forms of trading are likely to emerge soon.

Iran is likely to build stronger economic and political ties with India, China and Russia, thus giving them more power and openness to new trading opportunities, basically due to lack of any other possible partner on the horizon in the mid-term.

The prices are likely to keep growing up in the following months reaching the average inflation of 31.2% in 2019-20; still the risk of hyperinflation is discarded due to the fact that Iran is able to meet a significant share of local demand through local production.

Backed by support from the EU, Iran is promised to obtain in the mid-term a special mechanism of payments (Special Purpose Vehicle) for its oil and other exports (possibly through a barter system) in order to conduct trading outside of the competence of the US sanctions. This is likely to create some tensions between Europe and the US but they will not be powerful enough to split the long-lasting alliance between the two.

Oil and gas

The Iran's production of oil will probably continue to decrease affecting the world's oil price.

Five from the eight initial major buyers (Italy, Greece and Taiwan have already stopped their purchases from Iran) are and will be buying Iranian oil now that the waivers have been extended for the following 90 days. Thereby, the Iranian oil will still remain in demand during the following years, and Iran's government is likely to find solutions for its selling and exportation, even though illegally, in the mid and long-term. Thus, the United States is unlikely to meet its earlier target of driving Iranian oil exports to zero.

Iraq will continue to buy natural gas from Iran in order to use it in the production of electricity, becoming the second largest customer. Taking into account the fact that there is a sort of competence between US and Iran for the influence over Iraq, it can fuel a further deterioration of their relations. It is also plausible that more buyers will emerge if some new forms of trading, which do not rely on dollar, appear soon.

Even though the modest production growth is likely to continue, Iran won't be able to unilaterally monetise its natural gas resources due to lack of financial partners and investment, especially from the West. However, it will be able to fulfil its domestic demand and sustain trade with Turkey.

Iran's ability to increase production and exports of natural gas will be almost improbable, unless the relations with the United States are improved or support from international partners in defiance of sanctions is reinforced. Nevertheless, if Iran manages to accomplish current development projects, its export pipeline capacity will increase from 46.4 bcm/year in 2018, to 119.7 bcm/year to the regional and global markets in a long run. China, India and Pakistan will play a significant role in Iran's natural gas sector.

The domestic scene

Iran will continue demonstrating considerable resilience in coping with US sanctions, and is likely to continue to fully implement the commitments of JCPOA as long as China, Russia, or countries which are non-members of the deal, such as India, continue to trade with it, and if EU continues maintaining its constructive attitude. In this case, even a greater international support and United Nations diplomatic intervention is expected in the mid-term. However, on a longer run, the JCPOA future will depend upon the economic situation and complex political battles between moderates and hardliners in Tehran.

The current deterioration of the economic conditions in Iran, the rial devaluation and growing inflation, together with already-high unemployment will provoke a further popular discontent which is likely to maintain the protests but without any considerable probability to threaten the Iranian political stability or lead to leadership's rupture during the upcoming years.

The sanctions are likely to produce some adverse effects on the local political scene over the longer term, as Iranian hardliners may take advantage of them and the popular frustration and obtain the victory in the coming 2020 parliamentary elections and the 2021 presidential poll. As a result, any possibility for future cooperation with US will equal zero.

The positive consequences of the free trade agreement will derive more from the end of uncertainty than from the new provisions introduced.

After a year and a half of negotiations, the new treaty between the United States, Canada and Mexico (this country has named it T-MEC, the other two speak of USMCA) is still pending approval by the legislative chambers of each country. In Washington, the political discussion should begin shortly; it will be important what effects are foreseen for the US Economics and that of its two neighbors. The first programs of study disagree on some aspects, although they agree that the changes introduced in the renegotiation of the agreement that existed since 1994 will not have a special impact.

![signature of the U.S.-Mexico-Canada free trade agreement at framework of the G-20 in November 2018 [Shealah Craighead-White House]. signature of the U.S.-Mexico-Canada free trade agreement at framework of the G-20 in November 2018 [Shealah Craighead-White House].](/documents/10174/16849987/tmec-blog.jpg)

▲ signature of the U.S.-Mexico-Canada free trade agreement at framework of the G-20 in November 2018 [Shealah Craighead-White House].

article / Ramón Barba

The renegotiation of the formerly North American Free Trade Agreement (NAFTA, or NAFTA for its acronym in English) and now baptized as the Treaty of the United States, Mexico and Canada (T-MEC or, in its Anglo-Saxon version, USMCA), has been one of the main points on the Trump Administration's diary . C by the three negotiating parties at the end of 2018, now the treaty is pending ratification by the legislative chambers of each country.

Launched in 1994, the agreement had been described by Trump as "the worst trade agreement in history". From the beginning of his presidency, Trump set out to modify some aspects of agreement to reduce the large trade deficit with Mexico (some $80 billion, double the deficit the US has with Canada), and at the same time refund activity and jobs to the US Rust Belt, where the echo of his promises had been decisive for his electoral victory.

What has each country gained and what has each country lost in the renegotiation of the treaty? And, above all, what effects will it have on each country's Economics ? Will the United States improve its trade balance? Will Mexico or Canada be negatively affected by some of the modifications introduced? We will first examine how the claims of each of the partners were left at the end of the negotiations, and then we will look at the possible economic effect of the new version of the treaty in the light of two recent reports programs of study, one by an independent body of the U.S. Administration and the other by the IMF.

Tug of war

In the negotiations, which dragged on for nearly a year and a half, Mexico and Canada managed to "maintain the status quo in many important areas," but while the actual changes were modest, as analyzed by the Brookings Institution, they "went almost uniformly in the direction of what the United States wanted." "Trump's aggressive and threatening approach ," which challenged with breaking the treaty for good, "succeeded in obtaining modest concessions from his partners."

In the automotive industry core topic , the US managed to increase from 62.5% to 75% the proportion of the production of a car that must be made within the free trade area , to force 30% of the work needed to manufacture a car to have a wage of $16/hour (40% as of 2023) -a measure aimed at appeasing the US unions, since in Mexico the average wage of an automotive worker today is $4/hour-, and to set a tariff of 25% for cars coming from outside the country.

Mexico and Canada were granted their demand that an autonomous termination clause not be introduced after five years if there was no prior consensus for the renewal of the agreement, put on the table by Washington. Finally, the T-MEC will last for 16 years, renewable, with a review in the sixth year.

Justin Trudeau's government had to make some concessions to the U.S. dairy sector, but preserved what had been its main red line from the beginning: the validity of Chapter 19, concerning the settlement of disputes through independent binational arbitration.

Mexico, for its part, gained the peace of mind that comes with the survival of the agreement, avoiding future uncertainty and guaranteeing close trade relations with the large U.S. market. However, the labor conditions of Mexican workers can work as a double-edged sword for the Aztec Economics , since on the one hand it can favor an improvement in the standard of living and encourage consumption, but on the other hand it can affect the location of companies due to less competitive salaries.

Regardless of these changes in one direction or another, the update of the treaty was necessary after 25 years of a agreement that was signed before the Internet revolution and the digital Economics that it has brought. On the other hand, the change of name of the treaty was a "gimmick" devised by Trump to sell to his electorate the renewal of a agreement whose previous name was associated with criticisms made over the last two decades.