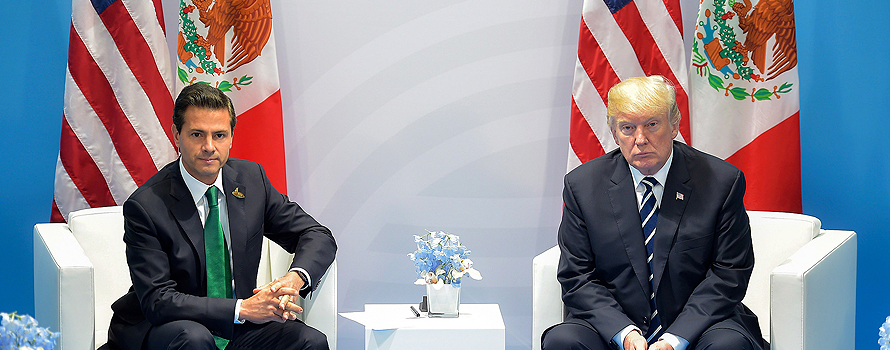

▲Enrique Peña Nieto and Donald Trump at the July 2017 G20 summit in Hamburg [Presidency of Mexico].

ANALYSIS / Dania Del Carmen Hernández [English version].

Canada, the United States and Mexico are immersed in the renegotiation of the North American Free Trade Agreement (NAFTA). The trade agreement between these three countries has been somewhat controversial in recent years, especially in the United States, where its appropriateness has been questioned. During the presidential campaign, Donald Trump defended the cancellation of the treaty; later, once in the White House, he accepted that there should be a renegotiation. Trump argued that the pact has reduced US manufacturing jobs and generated a trade deficit of more than $60 billion with Mexico ($18 billion with Canada), so unless new conditions substantially reduced that deficit, the US would withdraw from the agreement.

Overall, Americans have positive views of the treaty, with 56% of the population saying NAFTA is beneficial to the country, and 33% saying it is detrimental, agreement to a November 2017 Pew Researchsurvey . Among those who have a negative opinion, the majority are Republicans, with 53% of them saying Mexico benefits the most, while Democrats mostly support the pact and only 16% view it negatively.

Regardless of public acceptance, opinion about the treaty has not always been so dubious. When President Bill Clinton ratified the treaty, it was considered one of the greatest achievements of his presidency. Just as globalization has liberalized trade around the world, NAFTA has also expanded trade very effectively and presented a great issue of opportunity for the United States, while strengthening the U.S. Economics .

Under NAFTA, trade in U.S. goods and services with Canada and Mexico grew from $337 billion in 1994, when the treaty entered into force, to $1.4 trillion in 2016. The impact has been even greater when taking into account cross-border investments between the three countries, which went from $126.8 billion in 1993 to $731.3 billion in 2016.

Washington's concern is that, despite this increase in the trade Issue , in relative terms the United States is not achieving sufficiently fruitful results compared to what its neighbors are getting from the treaty. In any case, Canada and Mexico accept that, after almost 25 years in force, the agreement must be reviewed to adapt it to new production and trade conditions, marked by technological innovations that, as in the case of Internet development , were not contemplated when the agreement was signed.

Round-by-round examination

The discussion of the three countries touches on numerous aspects, but there are three blocks, which have to do with certain red lines set by the different negotiating parties: the rules of origin; the desire of the United States to end the independent arbitration system, through which Canada and Mexico have the ability to end measures that violate the trade agreement (elimination of Chapter 19), and finally proposals, perhaps less decisive but equally important, aimed at the general update the treaty.

When negotiations began in August 2017, it was hoped that they could be concluded by January 2018, with six rounds of meetings planned. This issue is already being surpassed, with a seventh round at the end of February, possibly to be followed by others. Now that the initial deadline has been reached, however, it is time to review the status of the discussions. A good way to do this is to follow the evolution of the talks through the rounds of meetings held and thus be able to assess the results that have been recorded so far.

|

Last North American Summit, with Peña Nieto, Trudeau and Obama, held in Canada in June 2016 [Presidency of Mexico].

|

1st Round (Washington, August 16-20, 2017)

The first round of negotiations put on the table the priorities of each of the three countries; it served to set the diary for the main issues to be discussed in the future, without going into concrete measures.

First of all, Donald Trump already made it clear during his election campaign that he considered NAFTA to be an unfair agreement for the United States due to the trade deficit that the country has mainly with Mexico and, to a lesser extent, with Canada.

According to figures from the Office of the US Trade Representative, the US went from a surplus of $1.3 billion in 1994 to a deficit of $64 billion in 2016. Most of this deficit comes from the automotive industry. For the new U.S. Administration, this casts doubt on whether the agreement will have beneficial effects for domestic Economics . Mexico, less inclined to introduce major changes, insists that NAFTA has been good for all parties.

Another topic that was mentioned was the wage gap between Mexico and the United States and Canada. Mexico argues that, despite having one of the lowest minimum wages in Latin America, and having had a stagnant average wage for the last two decades, this should not be taken into account in the negotiations, as it believes that Mexican wages will gradually catch up with those of its trading partners. On the contrary, for the US and Canada it is a topic of concern; both countries warn that a wage increase would not harm the growth of the Mexican Economics

Rules of origin was one of the main topics of discussion. The United States is seeking to increase the percentage of content required to consider a product as originating so that it is not necessary to pay tariffs when moving it between any of the three countries. This was controversial in this first round, as it could negatively affect Mexican and Canadian companies. Specialists warn that the minimum national content requirement does not exist in any free trade agreement in the world.

Finally, the Trump administration hinted at its intentions to eliminate Chapter 19, which guarantees equality in resolving disputes between countries, so that it is not the national laws of each country that resolve the conflict. The United States sees this as a threat to its sovereignty and believes that conflicts should be resolved in such a way that its own democratic processes are not ignored. Canada has conditioned its continued membership in the treaty on the maintenance of this chapter. Mexico also defends guarantees of independence in conflict resolution, although so far in this discussion it was not categorical.

2nd Round (Mexico City, September 1-5, 2017)

Although considered successful by many analysts, the second round of renegotiation continued at a slow pace. Some of the issues that advanced were: wages, market access, investment, rules of origin, trade facilitation, environment, digital trade, SMEs, transparency, anti-corruption, agriculture and textiles.

Juan Pablo Castañón, President of Mexico's Business committee coordinator insisted that the wage issue was not subject to negotiation for the moment, and denied that any of the parties had any intention of leaving the agreement, despite threats to that effect from the Trump Administration. Castañón said he was in favor of Mexico supporting the maintenance of Chapter 19 or the establishment of a similar instrument for the settlement of trade disputes between the three countries.

Round 3 (Ottawa, September 23-27, 2017)

The delegates made significant progress on skill policies, digital commerce, state-owned enterprises and telecommunications. The main breakthrough was on some aspects related to SMEs.

Canadian Foreign Minister Chrystia Freeland complained that the United States had not made any formal or written proposals in the most complex areas, which in her opinion demonstrates a passive attitude on the part of that country in the context of the negotiations.

U.S. Trade Secretary Robert Lighthizer said that his country is interested in increasing wages in Mexico, under the logic that this is an unfair skill , as Mexico has attracted factories and investments with its low wages and weak union rules. However, Mexican business and union leaders are resisting such pressures.

Canada stood firm on its position on Chapter 19, which it considers one of the great achievements of the current agreement. "Our government is absolutely committed to defending it," Freeland said. Washington raised, although without presenting a formal proposal , the modification of the rules of origin to make them stricter and prevent imports from other nations from being considered "made in North America", just because they were assembled in Mexico.

This round took place while the United States imposed a tariff of almost 220% on C Series aircraft from Canadian manufacturer Bombardier, considering that the business had used a government subsidy to sell its aircraft to the United States at artificially low prices.

Round 4 (Virginia, October 11-17, 2017)

The United States presented its formal proposal to raise the rules of origin for the automotive industry and its suggestion to introduce a sunset clause in the agreement.

The United States proposed raising from 62.5% to 85% the percentage of components of national origin from one of the three countries in order for the automotive industry to benefit from NAFTA, and that 50% be of U.S. production. The Mexican Automotive Industry association (AMIA) rejected the proposal.

Washington's interest in weakening the dispute settlement system within the treaty (Chapter 19) was also debated, without a rapprochement of positions.

Finally, there was talk of including a sunset clause, which would cause the agreement to cease to exist after five years, unless the three countries decide to renew it. This proposal was widely criticized, warning that this would go against the essence of the agreement and that every five years it would generate uncertainty in the region, as it would affect companies' investment plans.

These proposals add to the tough negotiating climate, as already in the third round the United States had begun to defend difficult proposals, on issues such as lawsuits for dumping (selling a product below its normal price) in the importation of perishable Mexican products (tomatoes and berries), government purchases and the purchase of textiles.

Round 5 (Mexico City, November 17-21, 2017)

The fifth round took place without much progress. The U.S. maintained its demands and this generated great frustration among the representatives of Mexico and Canada.

The United States received no alternatives to its proposal to increase the regional composition from 62.5% to 85%, with at least 50% being U.S.-based. On the contrary, its trading partners put on the table data showing the damage this proposal would cause to the three economies.

Faced with the U.S. desire to limit the issue of concessions that its federal government offers to Mexican and Canadian companies, Mexican negotiators responded with a proposal to limit the country's government contracts to the issue of contracts reached by Mexican companies with other governments under NAFTA. Since the issue of these contracts is quite small, U.S. companies would be restricted in their contracting.

At the end of this fifth round, the most advanced issues are the regulatory improvement of telecommunications and the chapter on sanitary and phytosanitary measures. With the latter, the Americans are seeking to establish new transparent and non-discriminatory rules that will allow each country to establish the Degree of protection it deems appropriate.

Round 6 (Montreal; January 23-29, 2018)

The sixth negotiation showed some progress. The chapter on corruption was finally Closed , and there was progress in other areas. Some of the important issues that had been left out of the previous negotiations were discussed. Progress is slow, but seems to be making headway.

Robert Lightizer rejected the compromise on rules of origin that Canada had previously proposed. The framework was based on the idea that rules of origin should be calculated to include the value of software, engineering and other high-value work, facets that today are not taken into account with a view to the regional content goal

As a form of pressure, Canada threatened to reserve the right to treat its neighboring countries worse than other countries if they enter into agreements. One of them could be China. The proposal was not considered, as the United States and Mexico found it unacceptable.

Beyond the deadline

After more than seven months of meetings, as reflected in this round-by-round review of the talks, the negotiations between the three countries have still not reached the threshold of a pre-agreement that, while awaiting the resolution of more or less important points, would confirm the shared will to continue NAFTA. The tough positions of the United States and the pressure from Canada and Mexico to save the treaty have so far resulted in a "tug of war" that has allowed some partial, but not decisive, result . Thus, it remains to be determined whether the treaty has actually reached its expiration date or whether it can be reissued. For the time being, the three countries agreement to continue working towards a renewed treaty.

From what has been seen so far in the negotiations, it is difficult to determine which country will be more willing to yield to the pressure exerted by the others. The most controversial issues have hardly been addressed until recently, so it is not possible to say what each country has achieved in this negotiating process.

The two neighbors of the United States, but especially Canada, continue to warn of the risk of Trump wanting to kill the treaty. An acceleration of the negotiations could help the positive resolution of the process, but the electoral calendar rather threatens postponements. On March 30, campaigning begins for Mexico's presidential election, which will take place on July 1. In September, the U.S. will begin to look more closely at the November congressional elections. A substantial breakthrough before the Mexican presidential elections could put the agreement back on track, even if some issues remain to be closed, but if the next meetings fail to take that big step, the three countries could start to get used to the idea of the end of NAFTA, which would weigh down the negotiations.