Ruta de navegación

Menú de navegación

Blogs

Entries with label argentina .

The risk of military use of the facility, fuelled by confidentiality clauses, fuels discussion in Argentina and suspicion in Washington.

China's arrival on the far side of the moon has put the spotlight on Chinese space developments. For this new degree program, Beijing has a tracking and observation station in Patagonia, the first on its own territory. In Argentina, there has been an extensive discussion about possible unacknowledged purposes of these facilities and alleged secret clauses negotiated at the time by the Kirchner administration. The government of Mauricio Macri guarantees the peaceful uses of the station, but the controversy has not ceased.

Chinese space station in the Argentinean province of Neuquén [Casa Rosada] ▲ Chinese space station in the Argentinean province of Neuquén [Casa Rosada].

article / Naomi Moreno Cosgrove

After years of gradual economic penetration, which has led it to become the leading commercial partner in several South American countries and a major lender and investor throughout the region, China's incursion into Latin America is no longer silent. The influence it has achieved in various nations - for example, it acquires almost 90% of Ecuador's oil exports and its credits have been essential for the subsistence of Venezuela and certain Brazilian public companies - means that China's activities are attracting special attention and its expansion is becoming increasingly clear.

China's growing power in Latin America is especially noted by the United States, although its own neglect of the region, sometimes presented as a consequence of its pivot towards Asia, has contributed to national governments' attempts to meet its needs by seeking other partners from reference letter.

Already suspicious of China's growing presence in the Americas, any activity in strategic fields such as security arouses particular suspicion in Washington. This has also been the case with moves made by Moscow, such as the siting of a station for the Russian Global Navigation Satellite System (Globalnaya Navigatsionnaya Sputnikovaya Sistema or GLONASS) in Managua (Nicaragua). The secrecy surrounding the operation of the facility has caused mistrust among the population itself, raising suspicions as to whether its use is intended solely to provide a higher quality of the Russian navigation system or whether there is the possibility of strategic exploitation by Russian aerospace defence forces.

Negotiation

Suspicions about the so-called Far Space Station, the Chinese National Space Administration (CNSA) station in Patagonia, in the province of Neuquén, stem from entrance from the fact that it was negotiated at a time of particular disadvantage for Argentina, due to the financial weakness of Cristina Fernández de Kirchner's government and its need for urgent credit. When Argentina was out of the international credit markets for having defaulted on nearly 100 billion dollars in bonds, the Asian country was a blessing for the then president.

In 2009, in the midst of the financial crisis, China sent representatives to Latin America to discuss an issue that had little to do with currency fluctuations: Beijing's space interests. This was due to China's desire to have a centre in the other hemisphere of the globe that could support its space activity, such as the expedition to the far side of the moon.

After months of negotiation under great secrecy, the Chinese government and the government of the province of Neuquén signed a agreement in November 2012, giving China the right to use the land - rent-free - for fifty years. The technical agreement was signed by the Chinese state-owned business Launching Security and Control Satellite (CLTC) and the Argentinean National Commission for Space Activities (CONAE).

Enormous in size, the larger of the two circular antennas - it is twelve stories high, weighs 450 tons and has a large diameter - and visible from a great distance due to its location in the middle of a desert plain, the station soon became an ideal target for controversy and suspicion. Fears that, in addition to its declared civilian use, it might also have a military purpose and be used to gather information by intercepting communications in that part of South America, fuelled the controversy.

After becoming Argentine president in 2015, Mauricio Macri entrusted the then foreign minister Susana Malcorra and the Argentine ambassador in Beijing, Diego Guelar, with the task of negotiating that agreement should include the specification that the station would only be used for peaceful purposes, which the Chinese accepted.

In spite of everything, the discussion about the risks and benefits of the Chinese base is still alive in Argentine public opinion. Politicians from civil service examination in Neuquén consider that "it is shameful to renounce sovereignty in your own country", as Congresswoman Betty Kreitman said when provincial legislators heard about project.

Beyond Argentina's borders, White House officials have called project a 'Trojan Horse', reflecting US concerns about the initiative, according to sources quoted by The New York Times. Even apart from any strategic dispute with the United States, some Latin American leaders have doubts and regrets about established ties with China, worrying that previous governments have subjected their countries to excessive dependence on the Asian power.

Confidentiality

The main questioning of the Chinese base, then, has to do with its possible military use and the possible existence of secret clauses. The latter have been the main cause of international suspicion, as Macri himself came to validate the existence of these clauses when they became a weapon against the Kirchner government, and promised to reveal them when he became president, something he has not done. However, the Argentine space authorities themselves deny any section secrecy.

Perhaps the misunderstanding can be found in the fact that the contract signed between the Chinese CLTC and the Argentinean CONAE states that "both parties will maintain confidentiality regarding the technology, activities and monitoring, control and acquisition programmes of data". Although confidentiality regarding third parties in relation to technology is a common internship , in this case it contributes to public mistrust.

Given that the CLTC reports to the Chinese People's Army, it is difficult to deny that the data it obtains will come under the domain of the Defence hierarchy and may end up being put to military use, although not necessarily for military purposes. Experts also say that antennas and other equipment used to support space missions, similar to those the Chinese have in Patagonia, are likely to increase China's intelligence-gathering capabilities. "A giant antenna is like a huge hoover. It sucks up signals, information, all subject of things," Dean Cheng, an expert on China's national security policy, was quoted as saying in the NYT.

The constant expansion of soy production within the MERCOSUR countries exceeds 50% of total world production

While many typically associate South American commodities with hydrocarbons and minerals, soy or soybean is the other great commodity of the region. Today, soy is the agricultural product with the highest commercial growth rate in the world. China and India lead world consumption of this oleaginous plant and its byproducts, thus making South America a strategic supplier. Soy profitability has encouraged the expansion of crop production, especially in Brazil and Argentina, as well as in Paraguay, Bolivia and Uruguay. However, such expansion comes at an environmental cost; such as recent deforestation in the Amazon and the Gran Chaco.

ARTICLE / Daniel Andrés Llonch [English version] [Spanish version].

Soy has been cultivated in Asian civilizations for thousands of years; today its cultivation is also widespread in other parts of the world. It has become the most important oilseed for human consumption and animal feed. Of great nutritional properties, due to its high protein content, soybeans are sold both in grain and in their oil and flour derivatives.

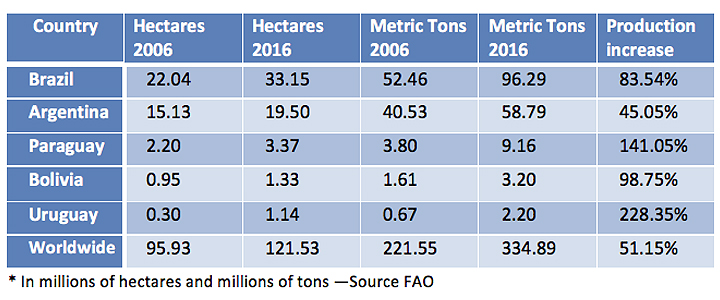

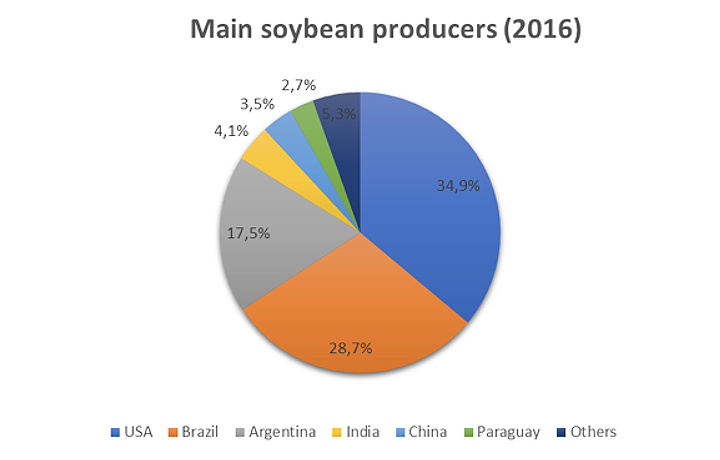

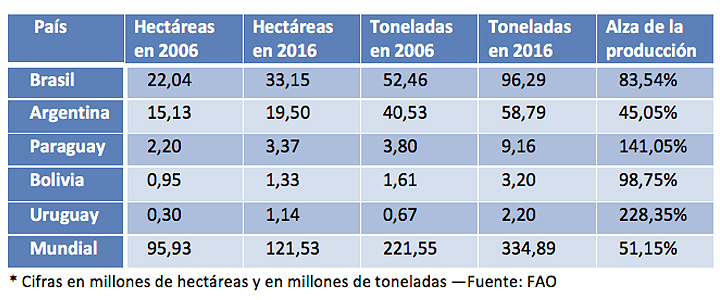

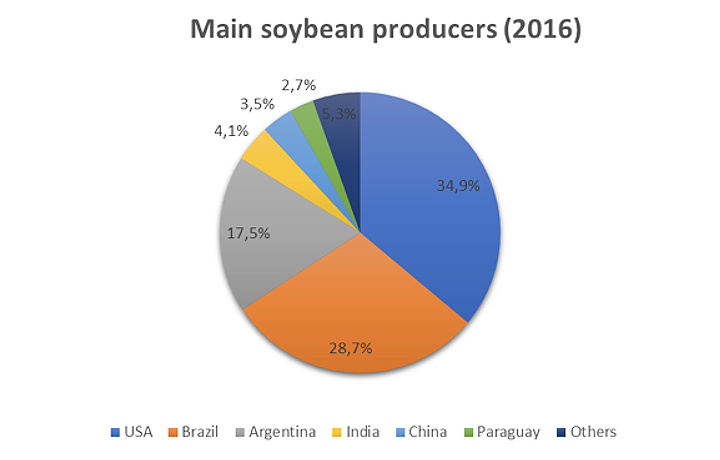

Among the eleven largest soybean producers, five are in South America: Brazil, Argentina, Paraguay, Bolivia and Uruguay. In 2016, these countries were the origin of 50.6% of world production, whose total reached 334.8 million tons, according to FAO data. The first producer was the United States (34.9% of world production), followed by Brazil (28.7%) and Argentina (17.5%). India and China follow the list, although what is significant about this last country is its large consumption, which in 2016 forced it to import 83.2 million tons. Much of these import needs are covered from South America. Furthermore, the South American production focuses on the Mercosur nations (in addition to Brazil and Argentina, also Paraguay and Uruguay) and Bolivia.

The strong international demand and the high relative profitability of soybean in recent years has fueled the expansion of the cultivation of this plant in the Mercosur region. The price boom for raw materials, which also involved soy, led to benefits that were directed to the acquisition of new land and equipment, which allowed producers to increase their scale and efficiency.

In Argentina, Bolivia, Brazil and Paraguay the area planted with soybeans represents the majority (it constitutes more than 50% of the total area sown with the five most important crops in each country). If we add Uruguay, where soybean has enjoyed a later expansion, we have that the production of these five South American countries has gone from 99 million tons in 2006 to 169.7 million in 2016, which constitutes a rise of 71%. In addition, the production of Brazil and Bolivia has almost doubled their production, somewhat exceeded by Paraguay and Uruguay, where it has tripled. In the decade, this South American area has gone from contributing 44.7% of world production to 50.6%. At that time, the cultivated area increased from 40.6 million hectares to 58.4 million.

|

Countries

As the second largest producer of soybeans in the world, Brazil reached 96.2 million tons in 2016 (28.7% of the world total), with a cultivation area of 33.1 million hectares. Its production has been in a constant increasement, so that in the last decade the volume of the harvest has increased by 83.5%. The jump has been especially B in the last four years, in which Brazil and Argentina have experienced the highest growth rate of the crop, with an annual average of 936,000 and 878,000 hectares, respectively, according to the United States Department of Agriculture (USDA).

Argentina is the second largest producer of Mercosur, with 58.7 million tons (17.5% of world production) and a cultivated area of 19.5 million hectares. Soybeans began to be planted in Argentina in the mid-70s, and in less than 40 years it has had an unprecedented advance. This crop occupies 63% of the areas of the country planted with the five most important crops, compared to 28% of the area occupied by corn and wheat.

Paraguay, for its part, had a harvest of 9.1 million tons of soybeans in 2016 (2.7% of world production). In recent seasons, soy production has increased as more land is allocated for cultivation. According to the USDA, in the last two decades, the land dedicated to the cultivation of soybeans has constantly increased by 6% annually. Paraguay currently has 3.3 million hectares of land dedicated to this activity, which constitutes 66% of the land used for the main crops.

As far as Bolivia is concerned, soybeans are grown mainly in the Santa Cruz region. According to the USDA, it represents 3% of the country's Gross Domestic Product, and employs 45,000 workers directly. In 2016, the country harvested 3.2 million tons (0.9% of world production), in an area of 1.3 million hectares.

Soybean plantations occupy more than 60 percent of Uruguay's arable land, where soybean production has been increasing in recent years. In fact, it is the country where production has grown the most in relative terms in the last decade (67.7%), reaching 2.2 million tons in 2016 and a cultivated area of 1.1 million hectares.

|

Increase of the demand

The production of soy represents a very important fraction in the agricultural GDP of the South American nations. The five countries mentioned together with the United States make up 85.6% of global production, so they are the main suppliers of the growing global demand.

This production has experienced a progressive increase since its insertion in the market, with the exception of Uruguay, whose product expansion has been more recent. In the period between 1980 and 2005, for example, the total world demand for soybean expanded by 174.3 million tons, or what is the same, 2.8 times. In this period, the growth rate of global demand accelerated, from 3% annually in the 1980s to 5.6% annually in the last decade.

In all the South American countries mentioned, the cultivation of soy has been especially encouraged, because of the benefits that it entails. Thus, in Brazil, the largest regional producer of oilseed, soybean provides an estimated income of 10,000 million dollars in exports, representing 14% of the total products marketed by the country. In Argentina, soybean cultivation went from representing 10.6% of agricultural production in 1980/81 to more than 50% in 2012/2013, generating significant economic benefits.

The outlook for growth in demand suggests a continuation of the increase in production. The United Nations Food and Agriculture Organization estimates that global production will exceed 500 million tons in 2050, which doubles the volume harvested in 2010 and clearly, much of that demand will have to be met from South America.

The constant expansion of the crop in Mercosur countries has led them to exceed 50% of world production.

Soybean is the agricultural product with the highest commercial growth in the world. The needs of China and India, major consumers of the fruit of this oleaginous plant and its derivatives, make South America a strategic granary. Its profitability has encouraged the extension of the crop, especially in Brazil and Argentina, but also in Paraguay, Bolivia and Uruguay. Its expansion is behind recent deforestation in the Amazon and the Gran Chaco. After hydrocarbons and minerals, soybeans are the other major commodity in South America subject .

article / Daniel Andrés Llonch [English version].

Soybean has been cultivated in Asian civilizations for thousands of years; today its cultivation is also widespread in other parts of the world. It has become the most important oilseed grain for human consumption and animal feed. With great nutritional properties due to its high protein content, soybeans are marketed both in grain and in their oil and meal derivatives.

Of the eleven largest soybean producers, five are in South America: Brazil, Argentina, Paraguay, Bolivia and Uruguay. In 2016, these countries were the origin of 50.6% of world production, whose total reached 334.8 million tons, according to FAO's data . The first producer was the United States (34.9% of world production), followed by Brazil (28.7%) and Argentina (17.5%). India and China follow on the list, although what is significant about the latter country is its large consumption, which in 2016 forced it to import 83.2 million tons. A large part of these import needs are covered from South America. South American production is centered in the Mercosur nations (in addition to Brazil and Argentina, also Paraguay and Uruguay) and Bolivia.

Strong international demand and the high relative profitability of soybeans in recent years have fueled the expansion of soybean cultivation in the Mercosur region. The commodity price boom, in which soybeans also participated, led to profits that were directed to the acquisition of new land and equipment, allowing producers to increase their scale and efficiency.

In Argentina, Bolivia, Brazil and Paraguay, the area planted with soybean is the majority (it constitutes more than 50% of the total area planted with the five most important crops in each country). If to group we add Uruguay, where soybean has enjoyed a later expansion, we have that the production of these five South American countries has gone from 99 million tons in 2006 to 169.7 million in 2016, which is an increase of 71.2% (Brazil and Bolivia have almost doubled their production, somewhat surpassed by Paraguay and Uruguay, a country where it has tripled). In the decade, this South American area has gone from contributing 44.7% of world production to total 50.6%. In that time, the cultivated area increased from 40.6 million hectares to 58.4 million hectares.

|

Countries

As the second largest soybean producer in the world, Brazil reached in 2016 a production of 96.2 million tons (28.7% of the world total), with a crop area of 33.1 million hectares. Its production has known a constant increase, so that in the last decade the volume of the crop has increased by 83.5%. The jump has been especially B in the last four years, in which Brazil and Argentina have experienced the highest rate of increase of the crop, with an annual average of 936,000 and 878,000 hectares, respectively, from agreement with the United States Department of Agriculture (USDA) department .

Argentina is the second largest producer in Mercosur, with 58.7 million tons (17.5% of world production) and a cultivated area of 19.5 million hectares. Soybean began to be planted in Argentina in the mid 1970s, and in less than 40 years it has made unprecedented progress. This crop occupies 63% of the country's areas planted with the five most important crops, compared to 28% of the area occupied by corn and wheat.

Paraguay, meanwhile, had a 2016 harvest of 9.1 million tons of soybeans (2.7% of world production). In recent seasons, soybean production has increased as more land is allocated for its cultivation. From agreement with the USDA, over the last two decades, land devoted to soybean cultivation has steadily increased by 6% annually. There are currently 3.3 million hectares of land in Paraguay dedicated to this activity, which constitutes 66% of the land used for the main crops.

In Bolivia, soybeans are grown mainly in the Santa Cruz region. According to the USDA, it accounts for 3% of the country's Gross Domestic Product, and employs 45,000 workers directly. In 2016, the country harvested 3.2 million tons (0.9% of world production), on an area of 1.3 million hectares.

Soybean plantations occupy more than 60 percent of the arable land in Uruguay, where soybean production has been increasing in recent years. In fact, it is the country where production has grown the most in relative terms in the last decade (67.7%), reaching 2.2 million tons in 2016 and a cultivated extension of 1.1 million hectares.

|

Increased demand

Soybean production represents a very important fraction of the agricultural GDP of South American nations. The five countries mentioned above, together with the United States, account for 85.6% of global production, making them the main suppliers of the growing world demand.

This production has experienced a progressive increase since its insertion in the market, with the exception of Uruguay, whose expansion of the product has been more recent. In the period between 1980 and 2005, for example, total world soybean demand expanded by 174.3 million tons, or 2.8 times. During this period, the growth rate of global demand accelerated from 3% per year in the 1980s to 5.6% per year in the last decade.

In all the South American countries mentioned above, soybean cultivation has been especially encouraged, due to the benefits it brings. Thus, in Brazil, the largest regional producer of the oleaginous grain, soybeans contribute revenues estimated at 10 billion dollars in exports, representing 14% of the total products marketed by the country. In Argentina, soybean cultivation went from representing 10.6% of agricultural production in 1980/81 to more than 50% in 2012/2013, generating significant economic benefits.

The outlook for growth in demand suggests that production will continue to rise. The Food and Agriculture Organization of the United Nations estimates that global production will exceed 500 million tons in 2050, double the volume harvested in 2010. Much of this demand will have to be met from South America.