In the picture

Paper money, dollars [Pixabay].

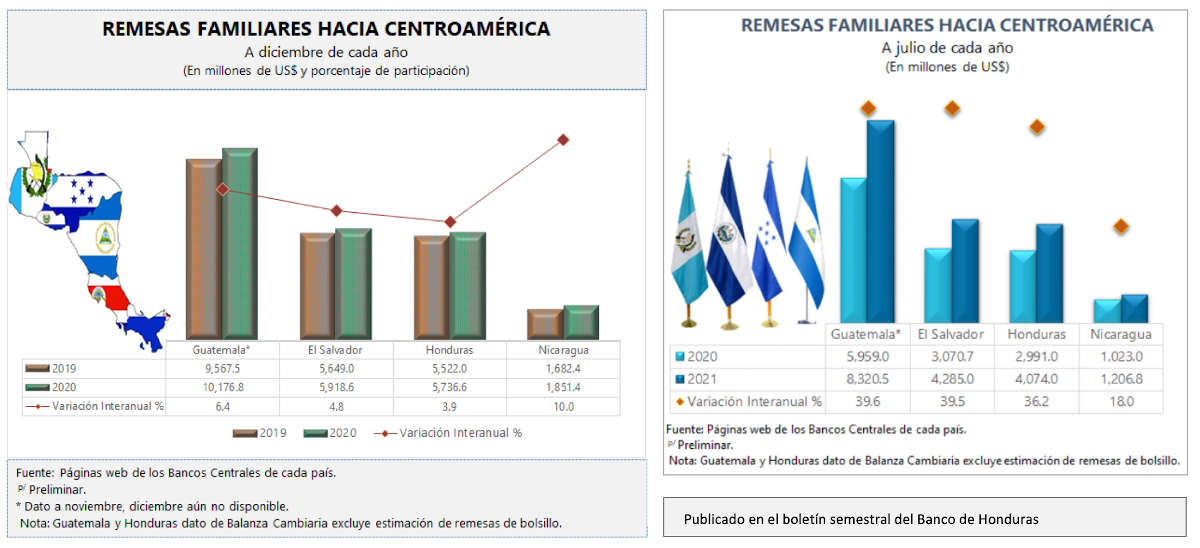

While the crisis caused by covid-19 reduced remittances worldwide by 1.6% in 2020, remittances from Latin American emigrants to their countries of origin grew by 6.5%, the highest in the region. The persistence of the flow despite the serious economic status has to do with the rapid recovery of the United States, where a large number of Latin American migrants reside, especially from Mexico and Central America, and with family cultural values, which lead to special solidarity in difficult times.

"As Covid-19 continues to devastate families around the world, remittances remain a critical lifeline for the poorest and most vulnerable," the World Bank found in the middle of this year. The Covid-19 pandemic has greatly damaged economic and social conditions in much of the world, most notably B in Latin America. Migrants in the US, mainly from Mexico and Central America, were extremely vulnerable to the impact of the economic and health crisis. All of this status led initially to believe that the flow of remittances would decline in 2020. However, while this was the case globally, with a -1.6% decline in remittances worldwide, remittances to Latin America increased to $103 billion, an increase of 6.5%, the highest regional figure. Without financial aid, GDP declines in several Latin American countries would have been even larger.

At the beginning of 2020, several programs of study warned that the pandemic was going to generate high unemployment in the United States, which in turn would have a negative impact on the remittances that immigrants residing in that country had to send. In March of that year, Dialogue expert Manuel Orozco considered that close to one million Latin American immigrants could lose their employment in the US; and a few months later, a report of this Washington-based organisation calculated that up to April remittances to Latin America had fallen by 17% compared to the same period the previous year (they also fell in the second quarter, but then recovered in the third and fourth quarters).

The decline in remittances certainly ended up occurring in most parts of the world. According to the World Bank's data published last May, low- and middle-income countries received officially recorded remittance flows of $540 billion in 2020, a drop of -1.6% compared to 2019. The big difference was made by Latin America, with growth of 6.5%, followed by South Asia (5.2%) and the Middle East-North Africa (2.3%). There were particular declines in East Asia and Pacific (-7.9%), Europe and Central Asia (-9.7%) and especially Sub-Saharan Africa (-12.5%). The World Bank forecasts that in 2021, remittances to Latin America will continue to outpace the average: remittances to the region will grow by 4.9%, compared to 2.6% globally.

The good performance, against all odds, of remittances sent to Latin America, largely from the United States, can be seen in the amounts sent to Mexico. According to a study by BBVA Research, in 2020, US$40,607 million arrived in Mexico, a growth of 11.4% and a fifth consecutive record-breaking year. In real terms, taking into account the subject exchange rate and the inflationary factor, the increase can be put at 20.6%. To get an idea of the Issue of these contributions, this amount exceeded Mexico's federal budget for 2021 for the Ministries of Public Education , Health, work and Social Welfare, Welfare and Culture combined. The geographic proximity of both countries, which allows for frequent contact, and the fact that Mexicans represent the largest group of immigrants in the United States facilitate these important monetary transfers.