In the picture

Gas deposits in Bolivia [YPFB].

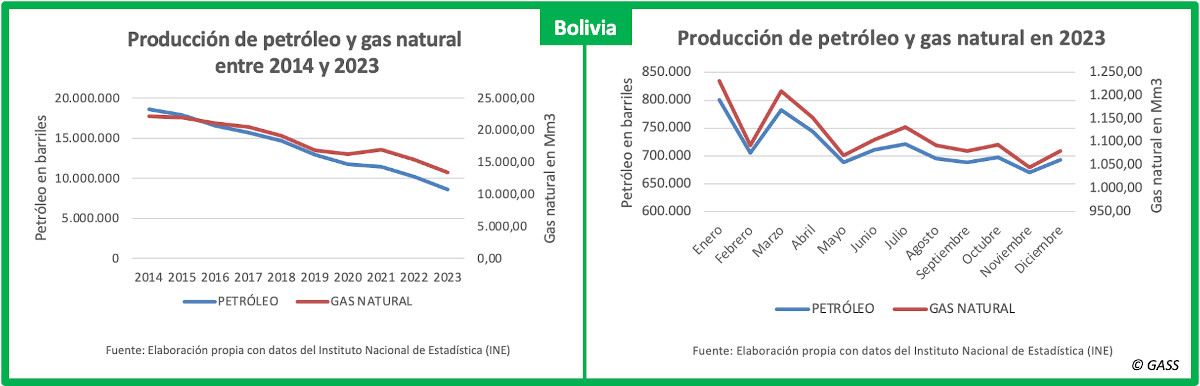

A bad governmental management of the gas boom is pushing Bolivia into a financial crisis of difficult exit. With hardly any reinvestment in the hydrocarbons sector during the boom years of high international prices, production is now falling exponentially: in 2022 oil extraction fell by 10.9% and gas by 9.2%; in 2023 the decline was 15.6% and 13% respectively. From exporting hydrocarbons worth US$6,624 million in 2014, Bolivia exported US$2,058 million in 2023, a third less than the fuels it had to import. The accumulated balance of payments deficit has left the country with hardly any foreign currency.

Bolivia had an overabundance of gas ten years ago. In 2014, production reached 22,187 million cubic meters. Although natural gas has been in these years the great economic asset and the main export value of Bolivia, also oil, although in much more modest volumes, knew its development, with a production that 2014 of 18.6 million barrels. But since then there has been a progressive decline that has accelerated in recent years, falling to figures that are half of those of a decade ago: in 2023, 13,390 million cubic meters of gas and 8.6 million barrels of oil were extracted, according to the Bolivian National Institute of Statistics.

The gas boom came about thanks to international investment in exploration and exploitation before Evo Morales and his Movement Towards Socialism (MAS) came to power in 2006. Only months after becoming president, Morales nationalized the sector, giving all the leading role to the state-owned Yacimientos Petrolíferos Fiscales Bolivianos (YPFB). Throughout fifteen years, the income achieved by the country in the business reached 50,000 million dollars, from agreement according to the Ministry of Hydrocarbons and Energies. This helped to finance the MAS governmental project , which certainly included an increase of the social expense ; however, the short term political interest reduced what should be destined to reinvestment, both for the maintenance of the wells and for the exploration of new deposits. Existing wells were overexploited and the capitalization of YPFB was neglected. This negligence resulted in the complicated financial situation that Bolivia suffers today.

The government of Luis Arce, also from MAS (although the party is now divided), has tried to remedy this with an Upstream Reactivation Plan launched in 2021 and which includes 36 exploratory projects. Arce was Minister of Economics and Finance with Morales and shares the same ideological prevention towards private and foreign initiative, which leaves YPFB with the contributions that the State may make as the only possible extra financing and this is probably insufficient.

This same ideological restriction has hindered the exploitation of lithium in Bolivia, a country with the largest reserves of this strategic mineral, but which has not yet begun to extract it. Finally, the Arce government has opened up to the participation of Russian and Chinese companies, and could perhaps seek some partner in the gas sector. In October 2023 YPFB and the Venezuelan PDVSA signed an agreement agreement of partnership by which the former will carry out activities in Venezuela; this cooperation could also reverse in the opposite direction.

Until a year ago, the Government did not recognize the seriousness of the decline of gas, a product of national pride, but finally Arce himself has admitted that the country has "hit bottom" in gas production. The country's lack of foreign currency, which affects many citizens, is directly related to the lower export of hydrocarbons and the Government had to publicly point to the cause.