In the picture

Ethanol tanks next to a sugarcane field [image created by AI].

Biofuel production is gaining prominence in the transition to a more sustainable future. In this context, Brazil, recognized as an agricultural powerhouse, is emerging not only as one of the world's largest producers, but also as a core topic player in the development of biofuels for the aviation industry, a sector that needs to be greener when it comes to flying.

Biofuels represent a renewable energy alternative that promises to reduce dependence on fossil fuels and mitigate the environmental impact of transportation. Within this panorama, ethanol stands out, a biofuel subject obtained through the fermentation of materials rich in sugars or starches, such as corn, sugar cane and other agricultural crops. Ethanol is used as an oxygenate for gasoline, as it improves engine performance and reduces pollution. Ethanol can also be transformed into other types of fuels, such as sustainable aviation fuel (SAF), which can reduce CO2 emissions by up to 80% compared to conventional kerosene.

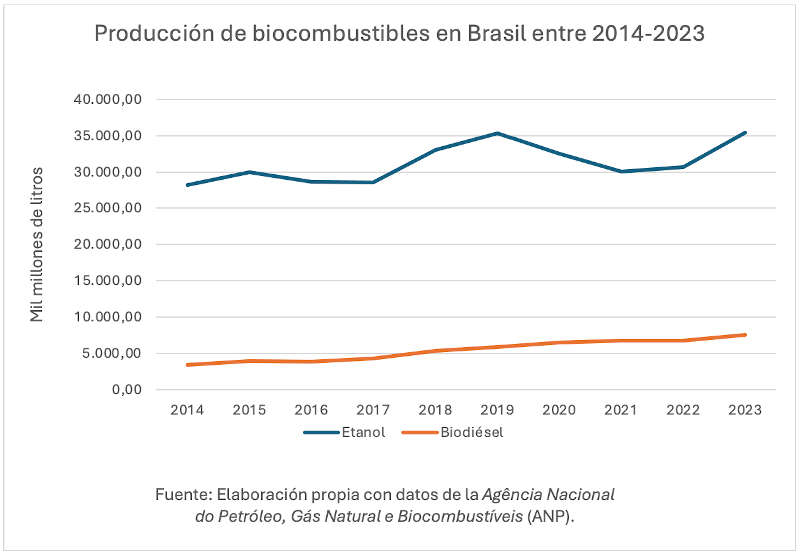

Ethanol production in Brazil reached an all-time record in 2023, the last year with closed data . According to the Brazilian Statisticalyearbook of Petroleum, Natural Gas and Biofuels 2024, Brazil produced a total of 35.4 billion liters of ethanol, representing an increase of 15.5% over the previous year. Brazil is currently the world's second largest ethanol producer, surpassed only by the United States, which leads the market with a production of 58.82 billion liters in 2023. While U.S. ethanol is mostly derived from corn and is mainly destined for road transport, Brazil stands out for using sugarcane as a raw subject , which gives it an advantage in terms of efficiency. For comparison, one hectare of sugarcane can generate 7,500 liters of ethanol, compared to 3,000 liters generated by one hectare of corn.

In addition to ethanol, biodiesel is another important pillar in Brazil's biofuel matrix. This biofuel, produced from vegetable oils such as soybean oil or animal fats, also reached a record production figure in 2023, with 7.8 billion liters, representing a 10% growth over the previous year. Other major biofuel producers, such as the European Union, focus their production on biodiesel, derived mainly from vegetable oils such as rapeseed and recycled oils. China, for its part, has focused its investments on the production of biofuels derived from agricultural waste.

In the Brazilian domestic market, ethanol is marketed as pure ethanol (E100; hydrated ethanol) or blended with gasoline (E27; anhydrous ethanol), under the framework of the RenovaBio policy. Implemented in 2017, this initiative has consolidated ethanol as a core topic component in Brazil's commitments under the Paris agreement . Ethanol production in Brazil has also been boosted by other government policies that promote the use of biofuels. In October, congress approved Law No. 528/2020 "Fuel of the Future", which establishes the obligation for airlines to use a minimum of 1% green fuel in their domestic operations as of 2027, among other measures.