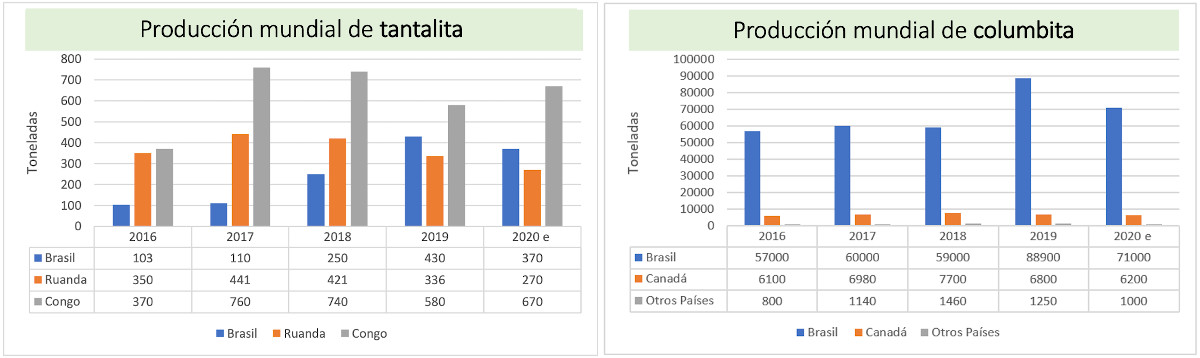

As for tantalite, Brazil surpassed Rwanda's production in 2019, thus becoming, with a record 430 tons that quadrupled the Issue of only two years earlier, the world's second largest producer after the Democratic Republic of Congo, according to the USGS's report . The three countries mentioned above produced 77% of the tantalite mined worldwide. Brazil, which has estimated reserves of 99,000 tons, is the main provider of this mineral, with 40%, to the United States.

Global production had an estimated 20% decline in 2020 attributed to the pandemic, as aircraft manufacturers had to reduce tantalite consumption and replace it with super alloys; electronics industry production lines cut back on the manufacture of GPS systems, mobile phones or satellites.

Illegal mining in Colombia and Venezuela

The size of Brazil's official mining sector reduces the relative importance of illegal mining, which is very significant in many parts of South America. Nevertheless, it is worth noting that Brazil has 321 points of illegal extraction of different minerals in 132 areas, mainly in the Amazon, according to the networkAmazonian Geo-referenced Socio-environmental Information (RAISG). In its 2018 report, the RAISG computed 2,312 points in the Amazon region where there is illegal mining activity, of which 1,899 correspond to Venezuela.

To date, illegal coltan mining is almost the only production of coltan in Colombia. The Colombian Geological Service has put the country's coltan reserves at around 1 billion tonnes, although the Mining and Energy Planning Unit (UPME) warns that this is not an official evaluation. "There is much speculation and misinformation about Colombia's coltan reserves. Officially, only potential areas and some alluvium have been identified, but this does not allow us to conclude anything about the potential or reserves of the mineral in Colombia", says a presentation from that governmental body. It specifies that the Colombian Geological Service detected in 2012 a coltan potential areain the Departmentsof Vichada and Guanía, where it is believed that illegal extraction has been taking place in recent years.

This illegal activity, often in natural parks, is sometimes carried out by indigenous communities and sometimes by criminal or guerrilla groups, attracted by the high price coltan fetches on the foreign market. It is precisely this illegal nature that makes production highly variable; the UPME reports an annual production of between 702 (2016) and 22,591 tonnes (2015). Occasionally, the security forces seize part of this raw merchandise, which is destined for smuggled exports. In March 2021, 6 tonnes of coltan black sands were seized, in July 1.2 tonnes of the mineral were seized and in August another 1.5 tonnes; the operations were carried out in border areas of DepartmentsGuainía and Vichada, involving FARC dissidents and the ELN.

It is unclear whether the seized ore was extracted in Colombia or in neighbouring Venezuela. In fact, the Colombian UPME itself claims that Venezuela has significant deposits, while the illegal mining activity of Colombian criminal groups in Venezuelan territory is more than proven.

The location of coltan reserves in the Orinoco border area was once announced by Hugo Chávez, who ordered surveillance of the region to prevent illegal extraction and commercialisation. However, Chávez and his successor, Nicolás Maduro, have protected illegal Economicsactivities carried out by the FARC and ELN, and Venezuela's own security forces have been closely linked to these groups. While the Venezuelan government has tried to sell the country's mineral resources, often illicitly, there is no firm evidence of state involvement in the coltan trade.

In May 2018, Venezuela made its first official export of this compound mineral to Italy, in a shipment of 5 tonnes and a value of 300,000 euros. Three years later, and after continuing with the commercialisation of this mineral between both countries, in 2021 the authorities of the transalpine country seized coltan of Venezuelan origin, as the Italian government showed its concern following reports denouncing the enrichment of the Venezuelan government through the trafficking of coltan, and even pointing out that the managerof these commercial operations was Nicolás Maduro Guerra, son of the Venezuelan president.

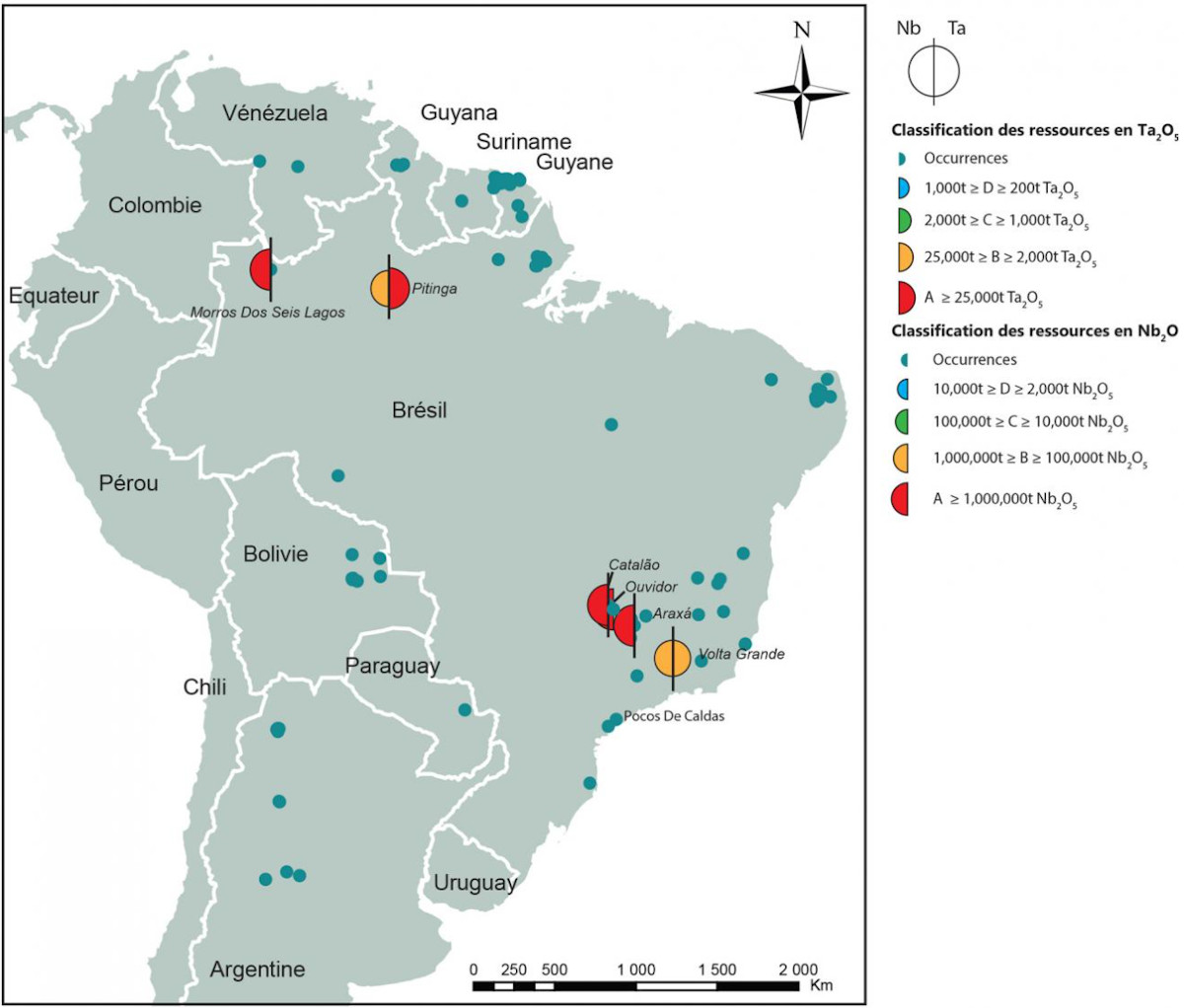

The existence of coltan in other South American countries led France to study the existence of coltan in its territory of French Guiana. A reportby the French Bureau of Geological and Mining Research (BRGM) concluded in 2019 that there are several coltan-rich coves in the overseas dependency, although it lacks significant deposits. The study estimated reserves of between 850 and 1,130 tonnes.