In the picture

Sugarcane cultivation for biofuel production at the GranBio experimental station in the Brazilian state of Alagoas [Marcus Carmoq].

Brazil is the largest economic power in South America, with the highest regional GDP. Its economic strength is due in part to the importance of its agribusiness, a sector in which it has always stood out for its high productivity: Brazil is the fourth largest agricultural producer in the world. This not only provides it with a significant income source - by 2023 Brazilian production is expected to reach US$234 billion - but also generates a large number of jobs. employmentwith a total of 28.3 million jobs work. Thus, agribusiness represents a quarter of GDP (in 2022 it accounted for 25% and its weight is expected to continue to grow).

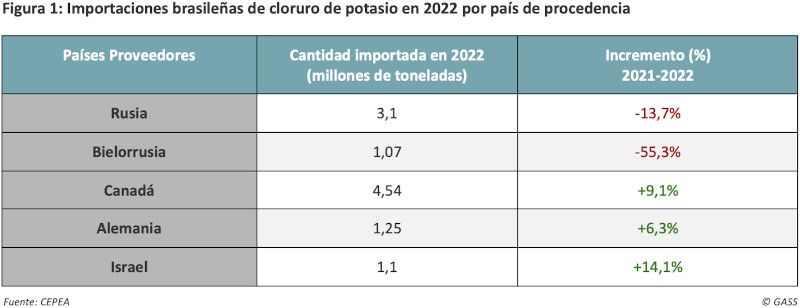

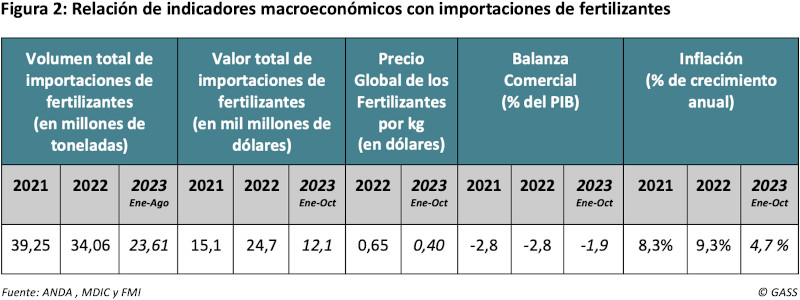

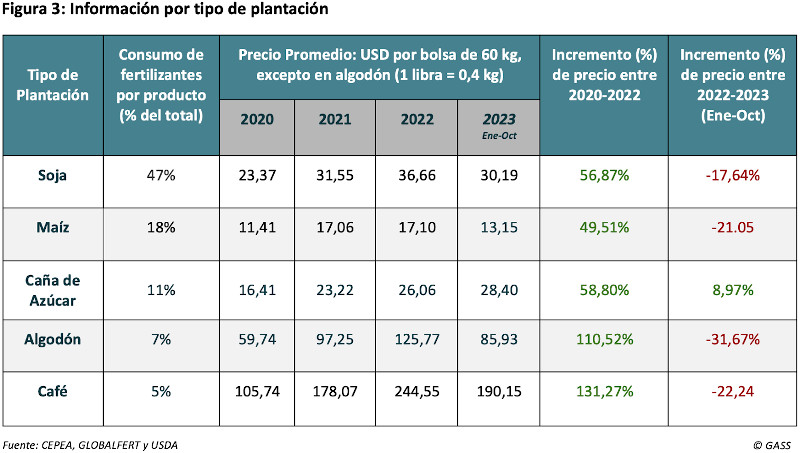

Despite being considerable in numerical terms, agribusiness needs to import certain essential assets to guarantee its productive activity. Thus, Brazil is the fourth largest consumer of fertilizers in the world, accounting for 8% of total world fertilizer consumption. These are substances of which it is the world's leading importer, with an international market share of 16.9% in 2021; in 2022, the country imported a total amount of approximately 34.6 million tons.

Within the broad field of fertilizers, the most significant, in terms of imports, are those containing NPK macronutrients (nitrogen, phosphorus and potassium), which are responsible for providing plantations with the nutrients necessary for proper growth.

The lack of domestic fertilizer production has led the Brazilian government to focus its efforts on the security and affordability of fertilizer supply. However, it was not until recently, with the Covid-19 pandemic and the war in Ukraine, that the government was really encouraged to try to alleviate status through development of the National Fertilizer Plan (PNF).

This analysis intends to show the effects that fertilizer imports have recently had on the country's macroeconomic status , as well as on the crop production chain. It also exposes the strategy being followed by government to overcome this havoc, in order to supply the rising fertilizer consumption, through the promotion of the national industry Chemistry .