In the picture

Visitor centre next to one of the locks of the Panama Canal [Canal Authority] [Autoridad del Canal].

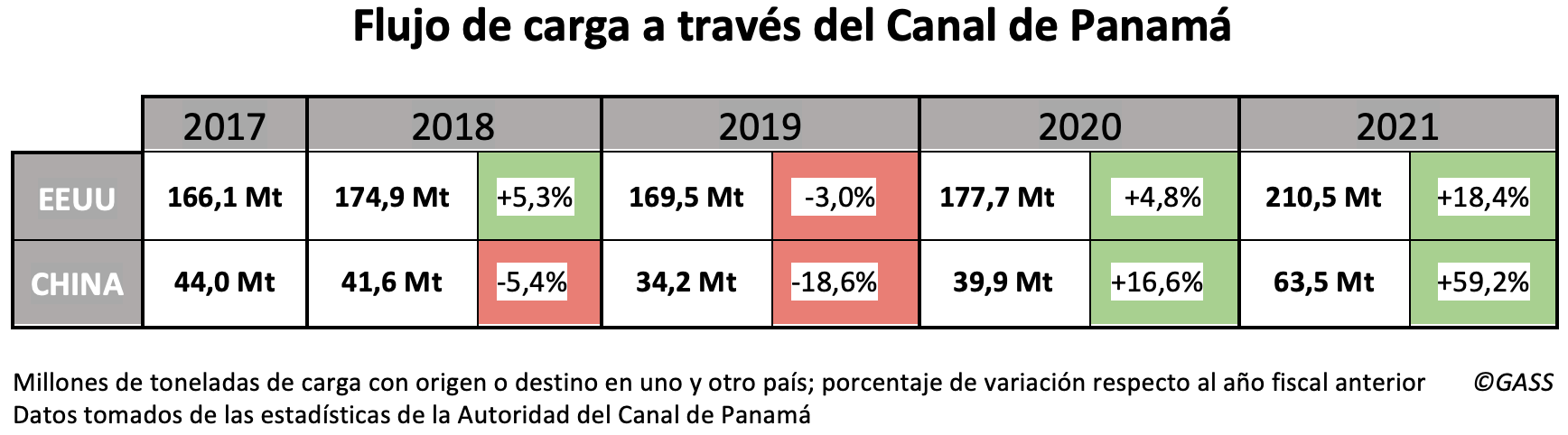

A singular strategic point in world trade flows, the Panama Canal is a good thermometer of the political and economic vicissitudes of the planet. The figures for cargo traffic through its waters over the last few years reflect well, consecutively, the commercial pulse maintained between the United States and China (2018-2019), the paralysis of industrial activity due to the confinements forced by the pandemic (2019-2020) and the subsequent economic reactivation (2020-2021). The US remains the canal's main customer, but Beijing has increased its role as the second largest beneficiary in the last year: 22.1% of the total tons transiting the canal correspond to cargoes originating in or destined for China.

The Panama Canal is the main connecting route for maritime traffic between the Atlantic and Pacific Oceans, as it is located in a geographically strategic point that reduces both transport costs and the duration of routes. The canal has been one of the main drivers of economic growth in developed countries (especially the United States) and has boosted economic expansion worldwide.

As the 'membrane' connecting the national economies of much of the world, it is particularly sensitive to changes in different parts of the world. Looking back over the last five years, several movements are reflected in the traffic figures through the channel, starting with Donald Trump's campaign to try to limit purchases from his big Asian competitor, and thus reduce the large US trade deficit in favour of Beijing.

The year 2018 was characterised by the trade war between the US and China, which began in March 2018, following Trump's advertisement decision to impose tariffs on numerous Chinese products. Trump defended his decision by arguing constant "unfair" trade practices, intellectual property theft and other illegal acts by the Chinese government. Beijing responded by also imposing tariffs on many US exports to China. Both measures were reflected in international trade and also in the traffic of goods through the Panama Canal.

Although an important part of the trade that the United States maintains with the Asian power is carried out from the US West Coast, the demographic and economic weight of the US East Coast also forces a significant portion of the flow between the two countries to pass through the canal, which is why traffic between the two powers through this transoceanic route also suffered.