In the picture

Gustavo Petro's speech at the UN summit on climate change in Dubai in December 2023 [Alexa Rochi, Presidency)

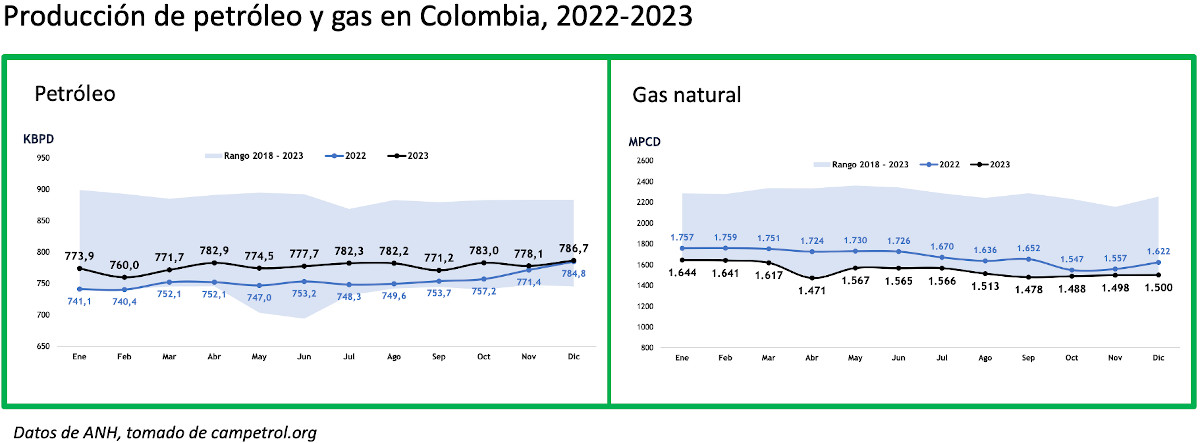

Colombia is facing the reduction of its hydrocarbon production without being able to meet its energy needs in the short and medium term with the renewable energies of which President Gustavo Petro wants to be the champion. The decision already in place not to grant any more licenses for hydrocarbon exploration will mark a decline in the oil and gas sector: oil production is expected to fall in 2024, while gas production already fell by 7.8% in 2023.

While awaiting the details of the Just Energy Transition(TEJ) Roadmap promoted by President Gustavo Petro, whose implementation has been delayed for almost a year, calculations on the future of Colombia's energy sovereignty are already being affected by the decision of fail the signature of coal, gas and oil exploration contracts. The very existence of this suspension, which applies from January 2023, has been the subject of intense internal discussion between the Ministry of Finance and the Ministry of Mines and Energy. It was confirmed by the Colombian President at the United Nations Climate Change Summit held last December in Dubai (COP 28).

"Colombia has decided not to sign any more exploration contracts in coal and oil and gas," Petro said, in his commitment to reduce greenhouse emissions by 51% by 2030. He specified that the country will continue producing hydrocarbons, because both current exploitation contracts and exploration contracts signed so far continue, but there will be no expansion of new operations. "From these current exploration contracts, there may be more oil and more exploitable coal, but the fact that the political decision is not to sign new contracts means that we have set a time limit," he added.

Although Petro left open the possibility that the current licenses could temporarily lead to an increase in hydrocarbon production, the truth is that the decline has already begun, before a greater development of renewable energies allows the substitution of some sources for others.

In Colombia, 74% of primary energy consumption is dominated by hydrocarbons (31% oil, 28% natural gas and 15% coal), while renewable energy accounts for 25% (22% hydroelectric energy, 3% other renewable sources), according to data 2020. The opposite occurs in the electricity mix, with 75% of electricity production generated in 2021 from renewable sources (basically from reservoirs and dams).

This last figure suggests that Colombia is within reach of approaching 100% green electricity generation if the government intensifies its energy transition drive. However, given the low use of electric motors in transportation and the low electrification of other sectors, what the country can advance in wind and solar generation will hardly cover the demands of industry and mobility.

It is true that oil production (760,000 barrels per day in 2021) far exceeds domestic consumption (328,000). Therefore, a lower extraction would not affect the country's supply in the medium or even long term, although it would significantly affect the income Colombia obtains from these sales (the sector is 60% dominated by the state-owned Ecopetrol). The deficit, on the other hand, is already a reality in terms of gas, with growing consumption, which in 2020 was 21.5% higher than production.

According to agreement with the Ministry of Commerce, Industry and Tourism, in 2022 oil exports constituted 32.4% of the country's total exports. In 2021, oil revenues would make up 3.4% of GDP and coal revenues 0.7%. The fall in these sales would mean losses for Colombia that the association Colombiana de Petróleo y Gas de Colombia estimates at 18 billion pesos (US$4.59 million) for the period 2022-2026 in fiscal contributions and would amount to 104 billion pesos in 2032 (US$26.5 million).

Petro has decided to promote renewable energies while imposing a contraction of hydrocarbons (perhaps he could have limited it to coal), unlike the line followed by Lula da Silva in Brazil, who with one hand also flies the flag of environmentalism, but with the other rocks the national oil company, Petrobras, seeking the expansion of its business.

The unidirectional path of the Colombian president has fueled the political and social discussion in the country. There are questions that have put special pressure on the government, resulting in a change of leadership at the Ministry of Mines and Energy, where Irene Vélez was replaced in mid 2023 by Andrés Camacho.