In the picture

Nickel mine in Moa operated by Cuba's General Nickel and Canada's Sherritt International [Sherritt].

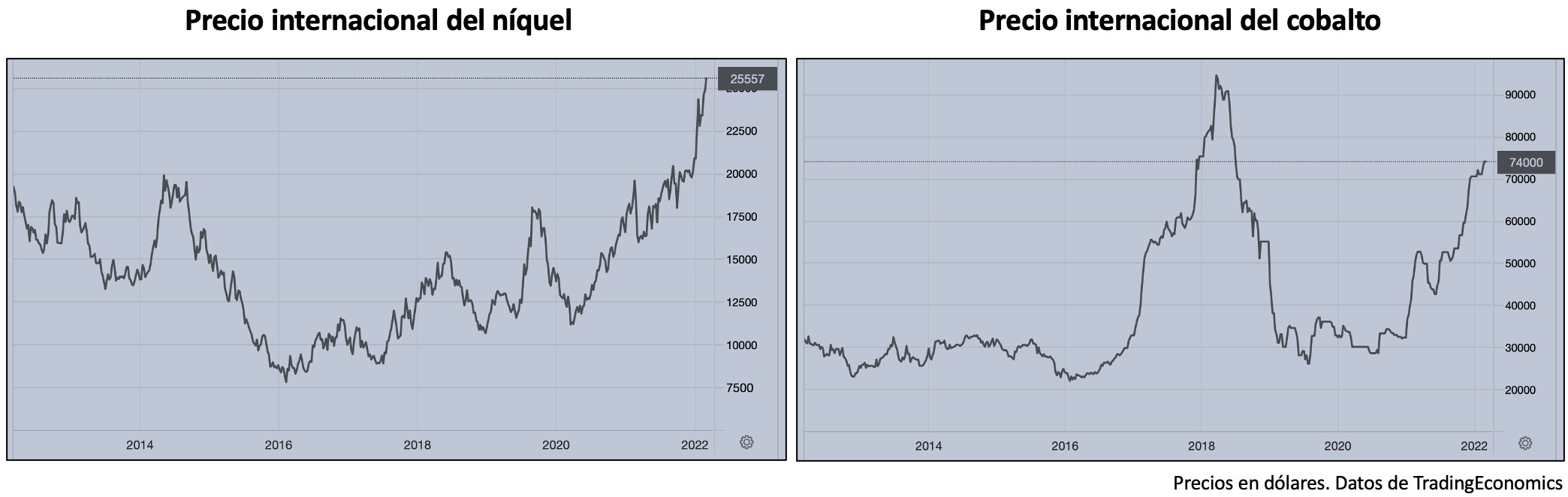

The increase in recent years in the international price of certain strategic metals and minerals that Cuba produces has brought slight relief to its sinking economy Economics. Cuba is relying on the recovery of a tourism industry that has collapsed due to the confinements caused by the Covid-19 pandemic, but the rise in the price of resources such as nickel and cobalt, as a result of international sanctions against Russia over the war in Ukraine, could also improve the Cuban state's income, as it aims to increase production of these metals. However, the lack of capital to increase mining extraction hinders a greater economic impact of the sector.

The rise of new technologies and the shift towards a green energy system have led to a worldwide increase in demand for metals such as nickel and cobalt. Cuba is among the countries with the largest reserves of these raw materials, which constitute some of the island's most valuable exports, especially in the case of nickel. Other metals or minerals, such as zinc, copper and iron, are also occasionally important in Cuba's exports, which are in any case headed by tobacco and sugar, although Cuba does not stand out in terms of their production worldwide.

Nickel is a mineral employee mainly used in the manufacture of stainless steel, as well as in metal alloys in high performing and, more recently, in rechargeable batteries. Like nickel, cobalt is an indispensable metal in the manufacture of many electronic devices in electric cars and mobile phones, which has increased its demand in recent years. According to the report According to the United States Geological Survey (USGS) global forecast for 2021, Cuba ranks as the world's ninth largest producer of nickel and fifth largest producer of cobalt, positioning it as a major contributor in these areas.

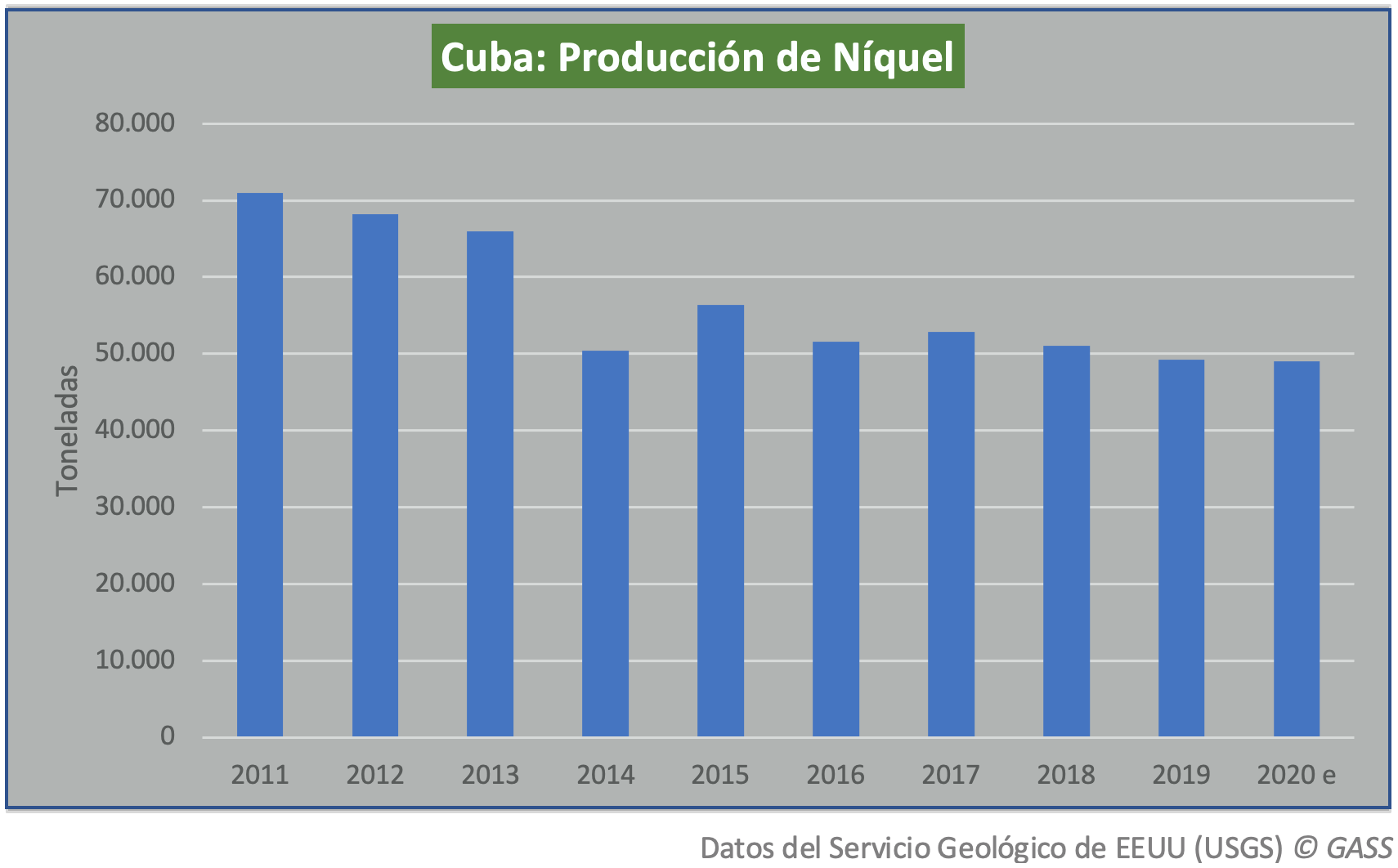

During the first decade of the century, Cuba produced around 70,000 tonnes of nickel per year, but production subsequently declined due to maintenance operations at the plants and the ups and downs in international prices (the drop in 2014, coinciding with the abrupt end of the then 'boom' in the price of hydrocarbons and some other materials, discouraged investment to increase extraction). The production figure has remained stable since 2014, with a average of approximately 56,000 tonnes per year. The Caribbean island has significant nickel reserves, some 5.5 million tonnes, but despite its comparative wealth, it only produced an estimated 49,000 tonnes in 2020. Indonesia is the world's leading nickel producer, consistent with its reservation of 21 million tonnes. Australia, Brazil and Russia follow, with reserves of 20, 16 and 6.9 million tonnes, respectively.