Domestic demand will increase, in contrast to more advanced regions

In the coming decades, oil consumption in Latin America will continue to grow, in the face of a trend to leave that is already on the horizon in many advanced countries. Population growth and the increase in class average explain this increase in demand. This domestic demand will serve to strengthen the extractive industries of Latin American crude oil producers, but will make the refining deficit suffered by the region chronic.

article / Ignacio Urbasos

The oil industry is experiencing a change in export and consumption patterns in the Latin American region. The sector's classic orientation towards the United States has changed in a new context in which exports are much more diversified with a shift towards emerging Asian countries. Similarly, domestic demand is steadily increasing due to population and economic growth. However, refining capacity in the region will remain insufficient. This paper will offer an analysis focused on the long term to try to provide a better understanding of the region's energy future, mainly in terms of consumption, extraction and subsequent refining.

First, the demographic and economic expectations for Latin America must be taken into account: population growth will increase by 800 million people by 2050, and economic growth could be 2% per year for at least the next decade. A direct effect of this will be a 91% increase in electricity demand by 2040 and an increase in the issue of vehicles in the region from 94 million in 2016 to the 165 million expected by 2040.

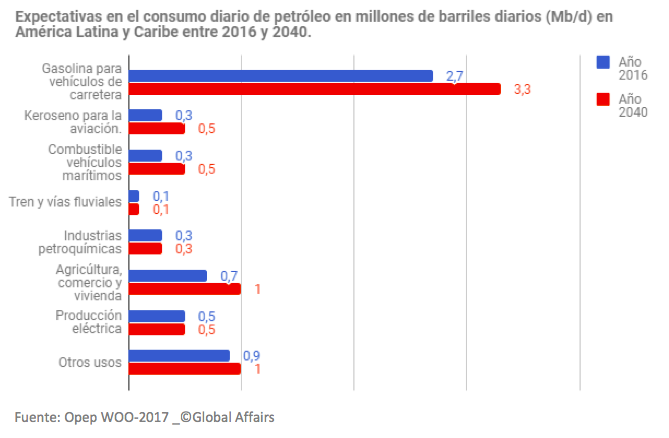

As can be seen in the graph below, the greatest demand for oil in the region will be associated with transportation, which will tend towards greater efficiency in consumption, but the promised arrival of the electric car is still a long way off, with expectations of less than 4% by 2030 worldwide. Similarly, the increase in theaverage class by 126 million people by 2030 will have a direct impact on the increase in air transport, which is expected to grow by an average of 3.4% per year until 2034, agreement to the latest ICAO report , with a consequent increase in kerosene consumption.

|

It should be taken into account that in Latin America there are subsidies for both gasoline and diesel, which generate more affordable prices, clearly distorting demand upwards. These subsidies respond mainly to the logic that citizens should be beneficiaries of their country's possession of natural resources, and are concentrated in traditional oil-producing countries such as Ecuador, Venezuela, Mexico or Argentina. However, these countries import fuel to a large extent due to their limited refining capacity, generating a double trade and fiscal deficit, as ECLAC points out. The future of these subsidies is unknown, but any change would have a high political cost, since affecting the price of a basic good would have consequences on broad social sectors with great electoral impact.

For its part, the contribution of oil to electricity generation will remain constant at 500,000 barrels per day, its importance dropping from the current 46%, according to figures for Latin America from the International Renewable Energy Agency. The region will benefit enormously from the increased presence of renewable energies, a sector that it already leads due to its incomparable geographic conditions, highlighting the enormous importance of hydroelectric energy.

Over the coming decades, two major phenomena will occur in Latin America: universal access to energy and a new energy model with less oil and biofuel (wood and waste) in favor of gas and alternative energies. One of the great challenges facing the region is to develop a more integrated national and international electricity system that increases consumption efficiency and allows greater flexibility in production sources. However, there are already several regional projects in this direction: the Andean Electrical Interconnection System, which includes the countries of the Andean Community plus Chile, and the Electrical Interconnection System of Central American Countries (SIEPAC).

Refining deficit

This rise in consumption is not accompanied by an increase in refining capacity, which is already highly deficient, and generates a critical dependence on imports of gasoline and other derivatives from the US. A trend that is likely to be a constant in the short and medium term for the region and adds to the 14% decline in refining activity in the region since 2012 (World Oil Outlook 2017), which already adds up to a loss of one million barrels refined per day since that year. High installation and maintenance costs, at around 2% of annual installed cost, add to the region's chronic political uncertainty that is largely scaring off private investment.

An illustrative case is that of the Pacific refinery in Ecuador, which was presented as the largest refinery project in the country at the beginning of Rafael Correa's presidency in 2007. The project began with a 49% financial participation by PDVSA and 51% by Petroecuador, in addition to the award of the project to the construction company Odebrecht. Today, PDVSA has withdrawn its contribution and the Brazilian construction company is facing trials in the country for corruption, result in a lost decade and forcing Lenin Moreno to reformulate the project, including the name: now Manabí Refinery.

|

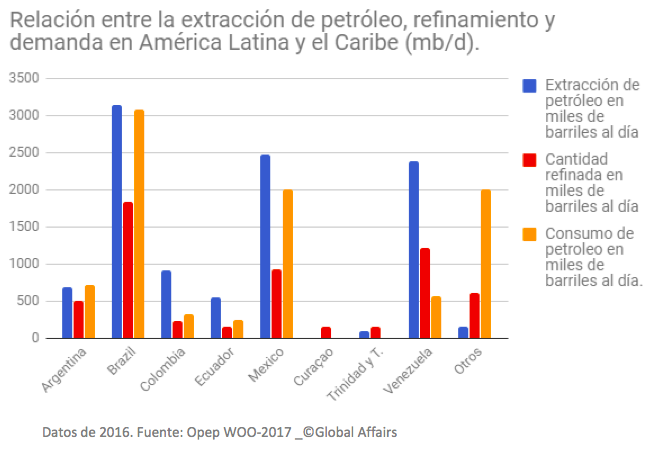

As we can see in the graph, Latin America's major oil producers have a deficit in refining capacity. It should be noted that in the region there is not only undercapacity, but also underactivity, which generates an even greater gap. The activity of these plants is currently around 70% of their total capacity. Those countries that do not have oil production, but do have a relevant refining industry, are Curaçao, which has one of the largest PDVSA centers, Chile and Peru.

In final, the Latin American oil sector faces the coming decades with enormous doubts about its refining capacity and far from achieving self-sufficiency. The lack of capacity to attract foreign investment from historically oil producing countries has generated a disappointing scenario that aggravates the already limited industry in the region. The social transformations inherent to a society that is growing demographically and economically require investment in infrastructure in order to meet the expectations of universal access to the electricity network and the consumption of the incipient class average.