Spain sells less defense material to Latin American countries than it would be entitled to according to the trade Issue

-

In 2019 there was a recovery in Spanish arms sales to Latin America, surpassing 2018 figures, which were the lowest in a long time

-

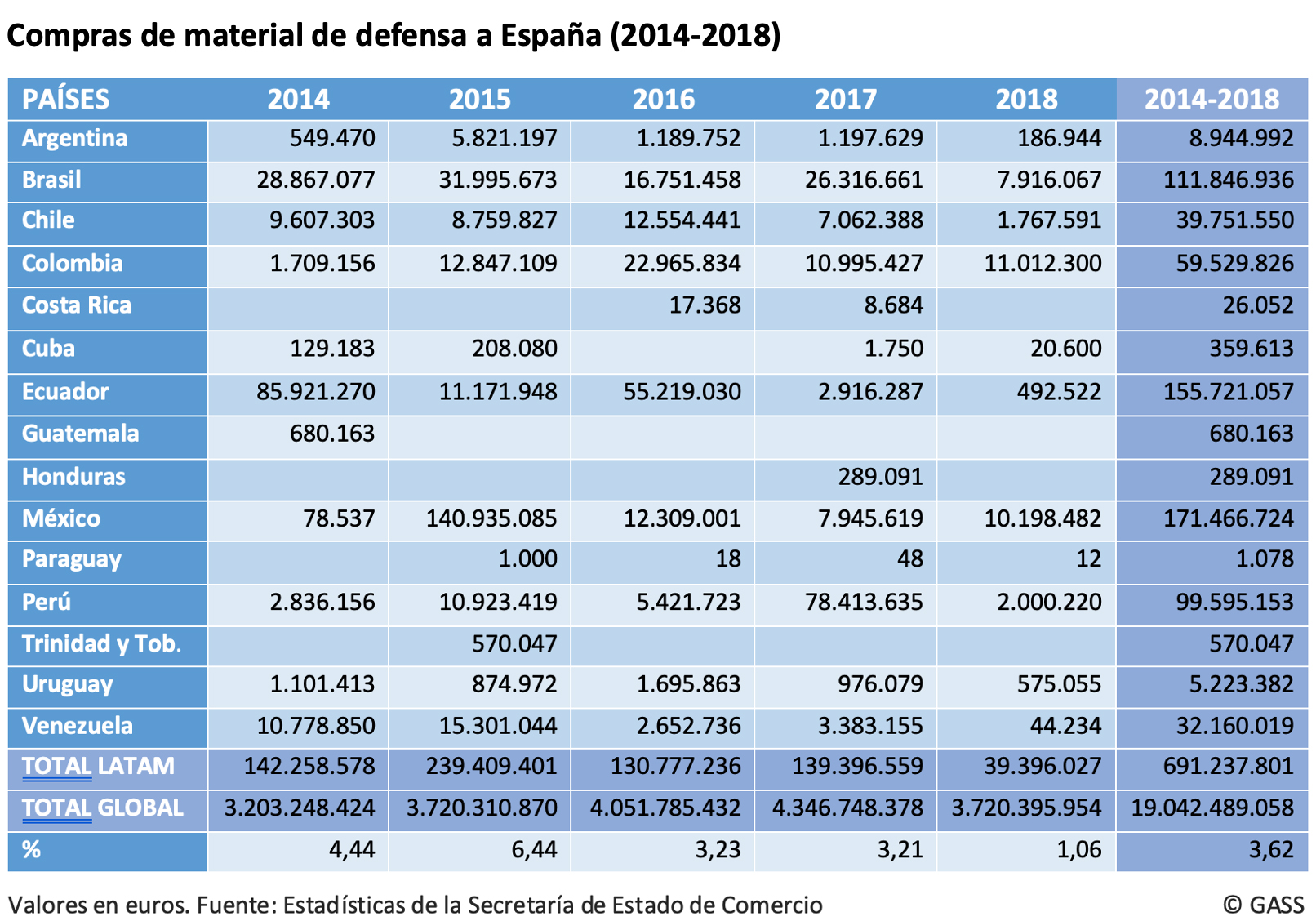

In the last five years, Spain sold 691.2 million euros worth of defense material to the region, 3.6% of its world arms exports.

-

Mexico (24.8%), Ecuador (22.5%), Brazil (16.1%), Peru (14.4%) and Colombia (8.6%) are the five countries that purchased the most material from Spain in the last five years.

![Airbus NH90 helicopter, whose final assembly is carried out at Airbus Military facilities in Spain [Airbus]. Airbus NH90 helicopter, whose final assembly is carried out at Airbus Military facilities in Spain [Airbus].](/documents/10174/16849987/espana-armas-blog.jpg)

▲ Airbus NH90 helicopter, with final assembly at Airbus Military facilities in Spain [Airbus].

report SRA 2020 / Álvaro Fernández[PDF version]

MAY 2020-Latin American countries are an area of clear commercial interest for Spain. However, despite being the seventh largest exporter of armaments in the world and therefore particularly active in this sector, Spain sells less defense material to Latin America and the Caribbean than it would be entitled to by the overall export quota it maintains with the region.

If between 2014 and 2018 Spain maintained its overall export of products to Latin America between 5.3% and 6.5% of its global exports, in the case of the arms sector it moved around 3.2% in 2016 and 2017 and fell to 1.06% in 2018. It is to be expected that this minimum percentage will have risen again in 2019, a year for which there are still no complete official data , but in view of those of the first semester , it would seem that it will not even be close to 3%.

The explanation for this lower weight of arms exports in the overall Spanish exports to Latin America can be found in two facts. One is the smaller budget dedicated to the purchase of this subject of material by most Latin American countries, compared to some large buyers(in 2018 Spain's first customer was Germany - in turn the fourth largest exporter in the world -, which cornered 33% of Spanish sales). The other is that Latin American nations have other important market options: the United States, Russia and China (first, second and fifth largest arms exporters in the world; France is the third).

In 2018 there was a significant drop in Spanish defense exports to Latin America, which were 38.3 million euros, well below any of the preceding years. Partial data for 2019 indicate a recovery, although without reaching the figures recorded in 2015, when a peak of €239.4 million was reached, or those of the previous years of 2016 and 2017, when they were €130.7 million and €139.3 million, respectively.

The decline in 2018 corresponds to a smaller purchase list from most Latin American customers. Of the five largest customers over the past five years, Colombia was the only one to maintain a similar level of purchases, worth €11 million. Colombia and the next largest buyer, Mexico, were the only ones to slightly increase their imports in 2017, although they were lower than in previous years. The reduction was significant for the next two customers in 2018, Brazil and Peru. That year marked a further reduction in imports by Ecuador, which over the five-year period has been steadily cutting its order book to Spain.

The figures considered in this article only take into account defense material, not other subject material, which the administrative office of State of Commerce considers separately, such as riot control material, hunting and sporting weapons, as well as dual-use technology products.

General and Latin American sales

Spain has around 130 companies dedicated to the armaments sector. Among them are Airbus Military, Navantia and Indra, which are among the 100 largest defense and security companies in the world. Most of the sector are private companies, although there are some unique cases of public ownership, such as Navantia, dedicated to shipbuilding, both civil and military, created in 2005 when the assets of another public business , the IZAR group , were spun off.

According to the official data of the administrative office of State of Commerce, the issue of exports of defense material has been increasing notably during the last years. More than half of the Spanish arms exports during 2018 and the first semester of 2019 had as recipients countries belonging to NATO or the European Union. In 2017 they exceeded 4.3 billion euros, after several years of rises in this market. In contrast, arms worth €3,720.4 million were sold in 2018, which was 14.4% less. The first semester of 2019, however, saw an improvement, reaching €2,413 million, an increase of 41.5% compared to the same period of the previous year.

As regards trade with Latin America, between 2014 and 2018 Spain sold military equipment worth €691.2 million to the region, a figure that represents 3.6% of the total of €19,042 million exported by Spain for arms.

In the five years as a whole, the first importer was Mexico, which with purchases worth 171.4 million euros (of which 140.9 million corresponded to 2015 alone), acquired a quarter (24.8%) of the defense material sold by Spain to Latin America in that five-year period. As the second country, Ecuador stands out, with 155, 7 million and 22.5% (slightly more than half -85.9 million- were purchases made only in 2014). It is followed by Brazil, which made more regular acquisitions throughout this time, with 111.8 million and 16.1%); Peru, with 99.5 million and 14.4% (the largest amount -78.4 million- was executed in 2017), and Colombia, with 59.5 million and 8.6%.

Some countries

Mexico figures as the first buyer of Spanish defense material in the last five years (2014 and 2018) due to purchases made in 2015, when it acquired four transport aircraft, worth €127.2 million. In 2018 it only imported €10.1 million in parts, pieces and spare parts for Spanish-made aircraft, equipment for engines of an aircraft derived from a European cooperation program and instruments of an air surveillance system.

Brazil is one of the countries with the greatest diversity in the destination of its imports. In recent purchases, 19.7% were for private business , 74.2% for the Armed Forces and the remaining 5.9% were for individuals. In 2018, it purchased €7.9 million in pistols, rifles and magazines for private individuals, as well as day sights, spare parts for armored vehicles and spare parts for Spanish and U.S.-made aircraft for the Armed Forces.

Colombia imported in 2018 a total of €11 million in spare parts for artillery howitzer maintenance, artillery ammunition, spare parts for Spanish and U.S.-made armored vehicles, and parts for Spanish-made transport aircraft.

Until a few years ago, Venezuela was an important client for the Spanish arms industry. However, after the authoritarian drift taken by the government of Nicolás Maduro, relations in this field have weakened. Even in 2015, Spain sold him defense material worth 15.3 million euros, in operations that were shrouded in controversy since some of the exported equipment could be used in the severe repression carried out against citizens. Since then, with the increase of tensions between the Chavista regime and the United States or the European Union, a series of restrictions have been placed on the export of this subject of material to Venezuela. Thus, sales went from having a value of 3.3 million euros in 2017 to only 44,000 euros in 2018, corresponding to the payment for spare parts and parts for the modernization of French-made armored vehicles, in a transaction that was approved before the trade restrictions on this subject imposed by the EU.

The official data provided by the State Trade administrative office distinguish between authorized exports and realized exports. Authorizations do not always materialize in actual sales and sometimes these are executed in subsequent years. The difference is noteworthy especially in Venezuela, whose political status forced to restrict exports for that country. In 2018 Spain suspended four licenses already approved for Caracas, related to helicopter maintenance and the provision of electro-optical supplies and systems. In addition, extensions of contracts for the modernization of battle tanks were denied.

Bolivia and Nicaragua have stopped buying defense material from Spain: if between 2014 and 2018 they made no purchases, between 2007 and 2013 they imported 1.5 million and 62,000 euros, respectively.

Cuba, which had a peak in purchases in 2015 at €208,080, in 2018 spent €20,600 on pistols and pistol barrels for the Police.