Pandemic reinforces the value of production centers in the same subregions

The free trade zones of Central America and the Caribbean have been an important driving force for the economies of the region. Favored by the increasing globalization of recent decades, they could now be boosted by a phenomenon in the opposite direction: "glocalization", the desirability of having production centers in the same sub-region, close to major markets, to avoid the problems in distant supply chains seen during this Covid-19 crisis that has so affected transportation and communications. The two leading Latin American free trade zone countries, the Dominican Republic and Costa Rica, offer affordable and sufficiently skilled labor at the doorstep of the United States.

![One of the free trade zones of the Dominican Republic [CNZFE]. One of the free trade zones of the Dominican Republic [CNZFE].](/documents/10174/16849987/zonas-francas-blog.jpg)

▲ One of the Dominican Republic's free trade zones [CNZFE].

article / Paola Rosenberg

The so-called free trade zones, also known in some countries as free zones, are strategic areas within a national territory that have certain tax and customs benefits. In them, commercial and industrial activities are carried out under special export and import rules. It is a way of promoting investment and employment, as well as production and exports, thus achieving the economic development of a part of the country or of the country as a whole.

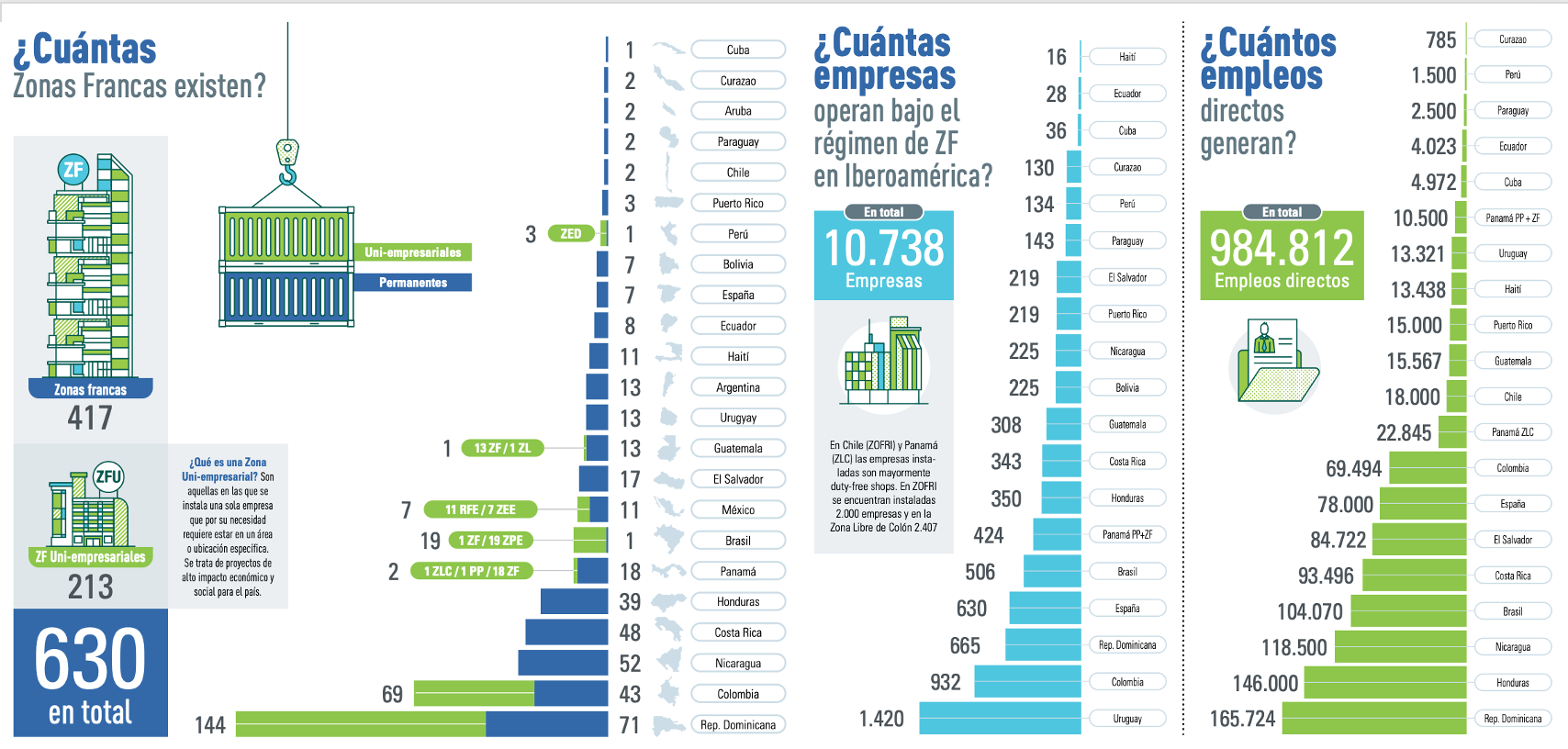

Free trade zones are important in Latin America and, in the case of the smaller economies, they are the main production and export hubs. agreement to the association of Free Trade Zones of the Americas (AZFA), there are some 3,500 free trade zones in the world, of which 400 are in Latin America, representing 11.4% of the total. Within this region, they have a special weight in the countries of Central America and the rest of the Caribbean basin. They are particularly important in the Dominican Republic and Costa Rica, as well as in Nicaragua, El Salvador, Colombia and Uruguay (also in Puerto Rico).

These countries benefit from having abundant labor (especially trained in the Costa Rican case) and at low cost (especially in the Nicaraguan case), and this close to the United States. For manufacturers wishing to enter the U.S. market, it may be interesting to invest in these free trade zones, taking advantage of the tax advantages and labor conditions, while their production will be geographically very close to their destination.

The latter is gaining ground in a post-Covid-19 world. The trend toward subregionalization, in the face of the fractured dynamics of globalization, has been highlighted for other areas of the American continent, as in the case of the Andean Community, but it also makes a great deal of sense for greater integration between the United States and the Greater Caribbean. To the extent that the United States moves towards a certain decoupling from China, the free trade zones in this geographic area may also become more relevant.

Reproduction of the graphic report of the association of Free Trade Zones of the Americas (AZFA), 2018.

Export processing zones

Free zones can be export-oriented (external market), import substitution (internal market) or both. The former may have a high industrial component, either seeking diversification or depending on maquilas, or emphasizing logistics services (in the case of Panama's free zones).

Free zones for exporting products have been particularly successful in the Dominican Republic and Costa Rica. As AZFA indicates, of the $31.208 billion exported from Latin American free zones in 2018, first place went to the Dominicans, with $5.695 billion, and second to Costa Ricans, with $4.729 billion (third place went to Puerto Rico, with $3 billion). Exports from the Dominican Republic's free trade zones accounted for 56% of all exports made by that country; in the case of Costa Rica it was 48% (the third in the ranking was Nicaragua, with 44%).

The Dominican Republic is the country with the highest issue of free trade zones (71 multi-company zones) and its 665 companies generated the highest number of direct jobs (165,724). Costa Rica has 48 free zones (in third position, after Nicaragua), and its 343 companies generated 93,496 direct work (in fifth position).

In terms of the profitability for the country of this economic modality , for every dollar exempted between 2010 and 2015, Costa Rica's free zones generated an average of US$6.2 and US$5 for those of the Dominican Republic (El Salvador ranked second, with US$6).

With specific reference to Costa Rica, a report at the end of 2019 by the Costa Rican foreign trade promotion agency, Procomer, placed the contribution of free trade zones at 7.9% of GDP, generating a total of 172,602 work, both direct and indirect, with annual growth in the issue of jobs averaging 10% per year between 2014 and 2018. These areas account for 12% of the country's formal private sector employment . An important fact about the contribution to the development the local Economics is that 47% of the purchases made by the companies located in the free trade zones were from national companies. An important social dimension is that the zones contributed 508 million dollars to the Costa Rican Social Security Fund in 2018.

The Dominican Republic's free trade zone regime is particularly applauded by the World Bank, which describes the country as a pioneer in this subject productive and commercial promotion instrument, presenting it as "the best-known success story in the Western Hemisphere". agreement to the statistics of the Nationalcommittee of Export Processing Zones (CNZFE), these have contributed in recent years to 3.3% of GDP, thus contributing to the significant growth of the country's Economics in recent years (one of the highest fees in the region, with an average of over 6% until the onset of the current global crisis). The geographical proximity to the United States makes its free trade zones ideal for US companies (almost 40% of investment comes from the US) or for companies from other countries that want to export to the large North American market (34% of exports go to the US).