27% of Latin America's total private wealth is deposited in territories offering favorable tax treatment

Latin America is the world region with the highest percentage of private "offshore" wealth. The proximity of tax havens, in various countries or island dependencies in the Caribbean, can facilitate the arrival of these capitals, some generated illicitly (drug trafficking, corruption) and all evaded from national tax institutions with little supervisory and coercive force. Latin America missed out on taxes in 2017 to the tune of $335 billion, which represented 6.3% of its GDP.

![Caribbean beach [Pixabay] [Pixabay]. Caribbean beach [Pixabay] [Pixabay].](/documents/10174/16849987/paraiso-fiscal-blog.jpg)

▲ Caribbean beach [Pixabay].

article / Jokin de Carlos Sola

The natural wealth of Latin American countries contrasts with the precarious economic status of most of their societies. Lands rich in oil, minerals and primary goods sometimes fail to feed all their citizens. One of the reasons for this deficiency is the frequency with which companies and leaders tend to evade taxes, driving capital away from their countries.

One of the reasons for the tendency to evade taxes is the large size of the underground Economics and the shortcomings of the States to implement tax systems. Another is the close presence of tax havens in the Caribbean, basically linked historically to the United Kingdom. These territories with beneficial tax characteristics have attracted capital from the continent.

History

The history of tax evasion is long. Its relationship with Latin America and the British Caribbean archipelagos, however, has its origins in the fall of the British Empire.

Beginning in 1945, Britain gradually began to lose its colonial possessions around the world. The financial effect was clear: millions of pounds were lost or taken out of operations throughout the empire. To cope with this status and to be able to maintain their global financial power, the bankers of the City of London thought of creating fields of action outside the jurisdiction of the Bank of England, from where bankers from all over the world (especially Americans) could also operate in order to avoid their respective national regulations. A new opportunity then arose in the British overseas territories, some of which did not become independent, but maintained their ties, albeit loose, with the United Kingdom. This was the case of the Caribbean.

In 1969 the Cayman Islands created the first banking secrecy legislation. It was the first overseas territory to become a tax haven. From offices established there, the City banks were generating networks of operations unregulated by the Bank of England and with hardly any local supervision. Soon other Caribbean jurisdictions followed in the same footsteps.

Tax havens

The main tax havens in the Caribbean are British overseas territories such as the Cayman Islands, the Virgin Islands and Montserrat, or some former British colonies that later became independent, such as the Bahamas. These are islands with small populations and small Economics . Many of the politicians and legislators in these places work for the British financial sector and ensure secrecy within their territories.

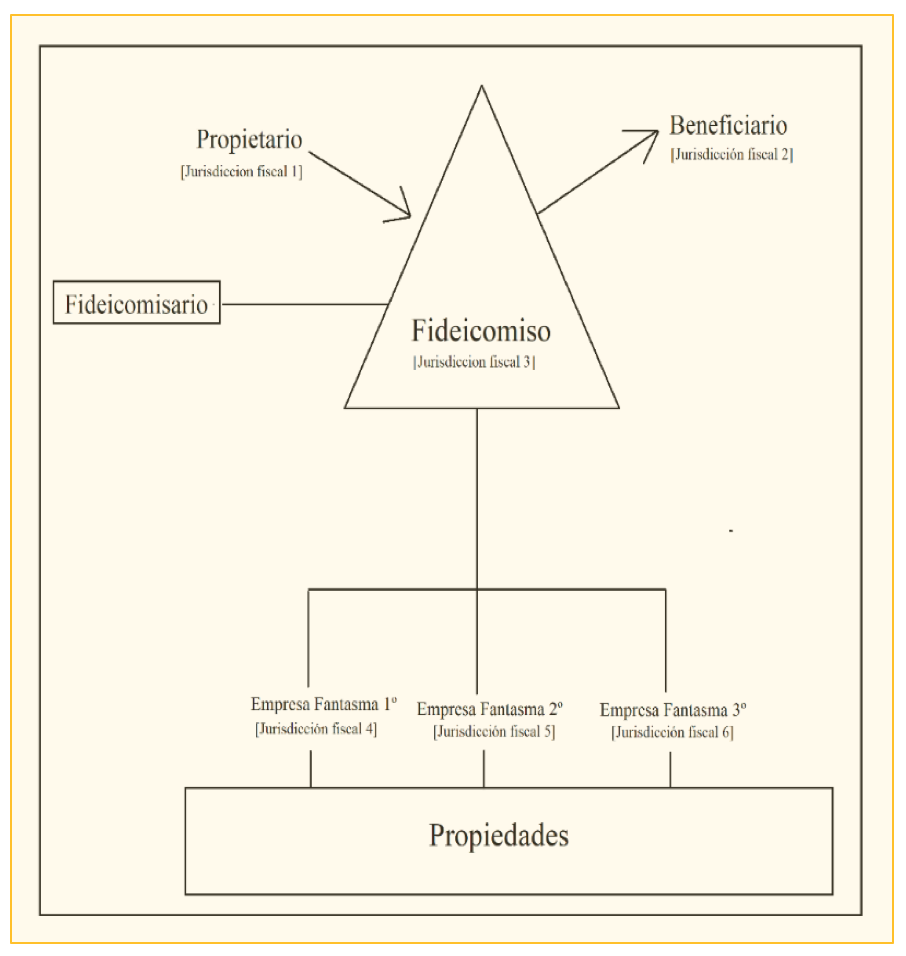

Unlike other locations that can also be considered tax havens, the British-influenced islands of the Caribbean offer a second level of secrecy in addition to the legal one: the trust. Most of those who hold assets in companies established in these territories do so through the figure of the trust. Under this system the beneficiary holds his assets (shares, properties, companies, etc.) in a trust which is administered by a trustee. These elements (trust, beneficiary, trustee, shell companies, etc.) are distributed in different Structures linked to different Caribbean jurisdictions. Thus, a trust may be established in one jurisdiction, but its beneficiaries may be in a different one, the trustee in a third and the shell companies in a fourth. This is a subject of Structures that are almost impossible for governments to dismantle. Therefore, when overseas governments undertake to share banking information, under pressure from Washington or Brussels, it is of little use because of the secrecy structure itself.

Impact in Latin America

Bank secrecy legislation arose in Latin America with the goal of attracting capital obtained in a licit manner. However, during the 1970s and 1980s, this protection of current account data also attracted capital obtained through illicit means, such as drug trafficking and corruption.

During those years, drug lords such as Pablo Escobar used the benefits of the Cayman Islands and other territories to hide their fortunes and properties. On the other hand, several Latin American dictatorships also used these mechanisms to hide the enrichment of their leaders through corruption or even drugs, as happened with Panama's Manuel Noriega.

Over time, the international community has increased its pressure on tax havens. In recent years the authorities in the Cayman Islands and the Bahamas have made efforts to ensure that their secrecy Structures are not used to launder money for organized crime, but not all territories considered tax havens have done the same.

These opaque networks are used by a considerable part of Latin America's great fortunes. Twenty-seven percent of Latin America's total private wealth is deposited in countries that offer favorable tax treatment, making it the region in the world with the highest proportion of private capital in those places, agreement to a 2017 Boston Consulting Group study. According to this consulting firm, this diversion of private wealth is greater in Latin America than in the Middle East and Africa (23%), Eastern Europe (20%), Western Europe (7%), Asia-Pacific (6%) and the United States and Canada (1%).

Tax havens are the destination of a difficult-to-precise part of the total of 335 billion dollars subject to tax evasion or avoidance that there was in the region in 2017, a figure that constituted 6.3% of Latin American GDP (4% left out of income tax for individuals and 2.3% in VAT), as specified in ECLAC'sFiscal Panorama of Latin America and the Caribbean 2019 report . This UN economic commission for the region highlights that on average Latin American countries lose more than 50% of their income tax revenues.

The connection with London

There have been several theories about the role played by London in relation to tax havens. These theories coincide in presenting a connection of interests between the opaque companies and the City of London, in a network of complicity in which even the Bank of England and the British government could have participated.

The most important one was expressed by the British author Nicholas Shaxson in the book Treasure Island. The thesis was later developed by the documentary film Spiders Web, produced by the Tax Justice Network, whose founder, John Christiansen, worked as an advisor to the government of Jersey, which is a special jurisdiction.

The City of London has a separate administration, elected by the still existing guilds, which represent the commercial and banking class of the city. This allows financial operations in this area of the British capital to partially escape the control of the Bank of England and government regulations. A City that is attractive to foreign capital and prosperous greatly benefits British Economics , since its activity accounts for 2.4% of the country's GDP.

British sovereignty over the overseas territories that serve as tax havens sometimes leads to accusations that the United Kingdom is complicit with these financial networks. Downing Street responds that these are territories that operate with a great deal of autonomy, even though London sets the governor, controls foreign policy and has veto power over legislation passed in these places.

In addition, it is true that the UK government has in the last decade supported greater international coordination to increase scrutiny of tax havens, forcing the authorities there to submit relevant tax information, although the structure of the trusts still works against transparency.

Correcting the status

Latin America's problems with tax evasion may be more related to the fragility of its own fiscal institutions than to the presence of tax havens close to the American continent. At the same time, some tax havens have benefited from political instability and corruption in Latin America.

The effects of the flight of national capital to these places with special tax regimes are clearly negative for the countries of the region, as it deprives them of greater economic activity and revenue-raising possibilities, thus hindering the State's capacity to undertake the necessary improvement of public services.

It is therefore imperative that certain corrective policies be established. In the field of national policies, mechanisms should be created to prevent tax evasion and avoidance. At the same time, at the international level, diplomatic initiatives should be set up to put an end to the Structures of the trusts. The OAS offers, in this sense, an important negotiating framework not only with certain overseas territories, but also with its own metropolises, since these, as is the case of the United Kingdom, are permanent observer members of the hemispheric organization.