The inclusion of private investment and the requirement of efficient credits differ from the overwhelming amount of loans from Chinese state banks

The active role of China as lender to an increasing number of countries has forced the United States to try to compete in this area of "soft power". Until last decade the US was clearly ahead of China in official development assistance, but Beijing has used its state-controlled banks to pour loans into ambitious projects worldwide. In order to better compete with China, Washington has created the US International Development Finance Corporation (USIDFC), combining the US Overseas Private Investment Corporation (OPIC) and with USAID's Development Credit Authority (DCA).

▲ The US agency helped to provide clean, safe, and reliable sanitation for more than 100,000 people in Nairobi, at the end of 2020 [USIDFC].

January 22, 2021

ARTICLE / Alexandria Casarano

It is not easy to know the complete amount of the international loans given by China in recent years, which skyrocketed from the middle of last decade. Some estimates say that the Chinese state and its subsidiaries have lent about US$ 1.5 trillion in direct loans and trade credits to more than 150 countries around the globe, turning China into the world's largest official creditor.

The two main Chinese foreign investment banks, the Export-Import Bank of China and the China Development Bank, were both established in 1994. The banks have been criticized for their lack of transparency and for blurring the lines between official development assistance (ODA) and commercial financial arrangements. To address this issue, Beijing founded the China International Development Cooperation Agency (CIDCA) in April of 2018. The CIDCA will oversee all Chinese ODA activity, and the Chinese Ministry of Commerce will oversee all commercial financial arrangements going forward.

An additional complaint about Chinese foreign investment concerns "debt-trap diplomacy." Since the PRC first announced its "One Belt One Road" initiative in 2013, the Chinese government has steadily increased its investment in the developing world even more dramatically than it had in the early 2000's (when Chinese foreign aid was increasing annually by approximately 14%). At the 2018 China-Africa Convention Forum, the PCR pledged to invest US$ 60 billion in Africa that year alone. The Wall Street Journal said of the PRC in 2018 that it was "expanding its investments at a pace some consider reckless." Ray Washburn, president of the US Overseas Private Investment Corporation (OPIC), called the Chinese One Belt One Road initiative a "loan-to-own" program. In 2018, this was certainly the case with the Chinese funded Sri Lankan port project, which led the Sri Lankan government to lease the port to Beijing for a 99-year period as a result of falling behind on payments.

OPIC, founded in 1971 under the Nixon administration, was recommended for elimination in the Trump administration's 2017 budget. However, following the beginning of the US-China trade war in 2018, Washington reversed course completely. President Trump's February 2018 budget recommended increasing OPIC's funding and combining it with other government programs. These recommendations manifested themselves in the Better Utilization of Investment Leading to Development (BUILD) Act, which was passed by Congress on October 5, 2018. The Center for Strategic and International Studies (CSIS) called the BUILD Act "the most important piece of U.S. soft power legislation in more than a decade."

The US International Development Finance Corporation

The principal achievement of the BUILD Act was the creation of the US International Development Finance Corporation (USIDFC), which began operation as an independent agency on December 20, 2019. The BUILD Act combined OPIC with USAID's Development Credit Authority to form the USIDFC and established an annual budget of US$ 60 billion for the new organization, which is more than double OPIC's 2018 budget of US$ 29 billion.

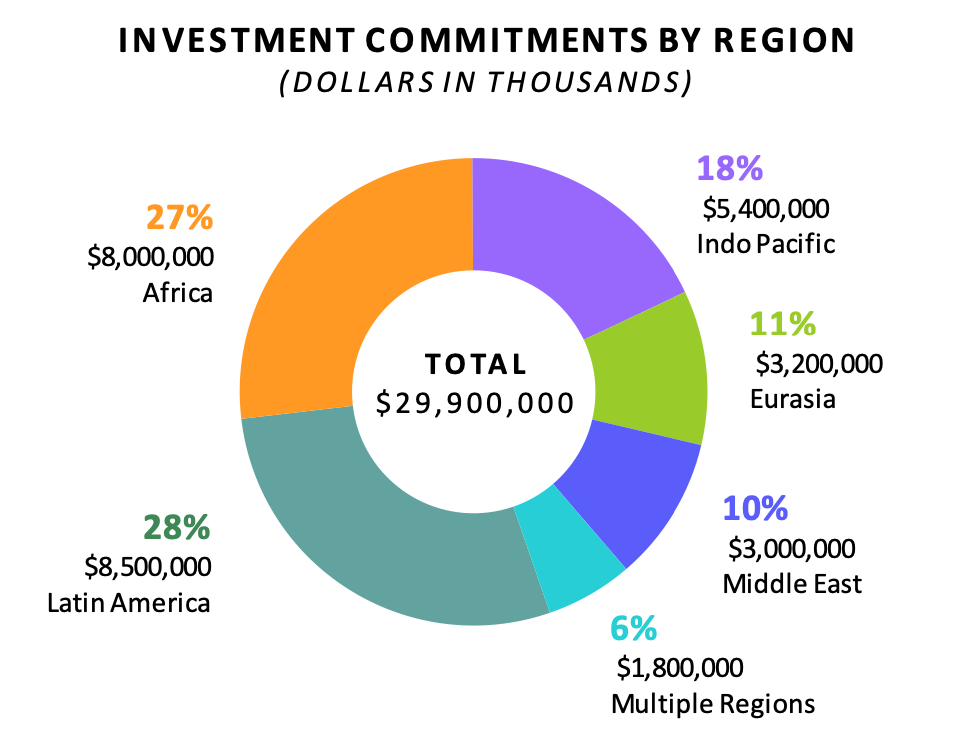

▲ USIDFC's investment commitments by region for the FY 2020. The US$ 29.9 billion is only a fraction of the agency's budget [USIDFC].

According to the Wall Street Journal, OPIC "has been profitable every year for the last 40 years and has contributed US$ 8.5 billion to deficit reduction," a financial success which can primarily be attributed to project management fees. As of 2018, OPIC managed a portfolio valued at US$ 23 billion. OPIC's strong fiscal track record, combined with both the concept of government program streamlining and the larger context of geopolitical competition with China, generated bipartisan support for the BUILD Act and the USIDFC.

The USIDFC has several key new capacities which OPIC lacked. OPIC's business was limited to "loan guarantees, direct lending and political-risk insurance," and suffered under a "congressional cap on its portfolio size and a prohibition on owning equity stakes in projects." The USIDFC, however, is permitted under the BUILD Act to "acquire equity or financial interests in entities as a minority investor."

Both the USIDFC currently and OPIC before its incorporation are classified as Development Finance Institutions (DFIs). DFIs seek to "crowd-in" private investment, that is, attracting private investment that would not occur otherwise. This differs from the Chinese model of state-to-state lending and falls in line with traditional American political and economic philosophy. According to the CSIS, "The USIDFC offers [...] a private sector, market-based solution. Moreover, it fills a clear void that Chinese financing is not filling. China does not support lending to small and medium-sized enterprises (SMEs), and it rarely helps local companies in places like Africa or Afghanistan grow."

In the fiscal year of 2020, the most USIDFC's investments were made in Latin America (US$ 8.5 billion) and Sub-Saharan Africa (US$ 8 billion). Lesser but still significant investments were made in the Indo-Pacific region (US$ 5.4 billion), Eurasia (US$ 3.2 billion), and Middle East (US$ 3 billion). This falls in line with the USIDFC's goal to invest more in lower and lower-middle income countries, as opposed to upper middle countries. OPIC had previously fallen into the pattern of investing predominantly in upper-middle countries, and while the USIDFC is still legally authorized to invest in upper-middle income countries for national security or developmental motives.

These investments serve to further US national interests abroad. According to the USIDFC webpage, "by generating economic opportunities for citizens in developing countries, challenges such as refugees, drug-financed gangs, terrorist organizations, and human trafficking can all be addressed more effectively." Between 2002 and 2014, financial commitments in the DFI sector have increased sevenfold, from US$ 10 billion to US$ 70 billion. In our increasingly globalized world, international interests increasingly overlap with national interests, and public interests increasingly overlap with private interests.

Ongoing USIDFC initiatives

The USIDFC has five ongoing initiatives to further its national interests abroad: 2X Women's Initiative, Connect Africa, Portfolio for Impact and Innovation, Health and Prosperity, and Blue Dot Network. In 2020, the USIDFC "committed to catalyzing an additional US$ 6 billion of private sector investment in global women's economic empowerment" by joining the 2X Women's Initiative which seeks global female empowerment. About US$1 billion for this US$ 6 billion commitment has been specially pledged to Africa. Projects that fall under the 2X Women's Initiative include equity financing for a woman-owned feminine hygiene products online store in Rqanda, and "expanding women's access to affordable mortgages in India."

Continuing the USIDFC's special focus on Africa follows the Connect Africa initiative, under which the USIDFC has pledged US$ 1 billion to promote economic growth and connectivity in Africa. The Connect Africa initiative involves investment in telecommunications, internet access, and infrastructure.

Under the Portfolio for Impact and Innovation initiative, the USIDFC has dedicated US$ 10 million to supporting early-stage businesses. This includes sponsoring the Indian company Varthana, which offers affordable online learning for children whose schools have been shut down due to the Covid-19 crisis.

The Health and Prosperity initiative focuses on "bolstering health systems" and "expanding access to clean water, sanitation, and nutrition." Under the Health and Prosperity initiative, the USIDFC has dedicated US$ 2 billion to projects such as financing a 200+ mile drinking water pipeline in Jordan.

The Blue Dot Network initiative, like the Connect Africa initiative, also invests in infrastructure, but on a global scale. The Blue Dot Network initiative differs from the aforementioned initiatives in being a network. Launched in November 2019, the Blue Dot Network seeks to align the interests of government, private enterprise, and civil society to facilitate the successful development of infrastructure around the globe.

It is important to note that these five initiatives are not entirely separate. Many projects fall under several initiatives at once. The Rwandan feminine products e-store project, for example, falls under both the 2X Women's initiative and the Health and Prosperity initiative.