Ruta de navegación

Menú de navegación

Blogs

Entries with label mexico .

The cancellation of the new CDMX airport, already more than 31% built, sows doubts about the economic success of the new administration.

Andrés Manuel López Obrador arrives to the presidency of Mexico facing the economic world, to which he has put up a fight with his advertisement to paralyze the works of the new airport of the capital, despite the fact that a third of the works have already been carried out. The desire to make clear to the economic power who rules the country and to bury what was to be an emblematic bequest of the PRI -whose historical hegemony he hopes to replace with his own party, Morena- may be behind the controversial decision.

▲ Image of the projected NAICM created by Fernando Romero Enterprise, Foster and Partners.

article / Antonio Navalón

The Mexican PRI returned to the presidency of the country in 2012, led by Enrique Peña Nieto, with the promise of making a major investment in public infrastructure that would put Mexico in the world's showcase. The stellar work chosen was the construction of a new airport, whose project was commissioned to architect Norman Foster and which the Institutional Revolutionary Party (PRI) saw as the inheritance that would always be attributed to it.

This great project was to overshadow any negative bequest of Peña Nieto's term, which has been especially marked by corruption cases and historic record violence figures. Although useful for political marketing, increasing the air traffic capacity of Mexico City (CDMX), whose metropolitan area has 23 million inhabitants, is a necessity for boosting the national Economics .

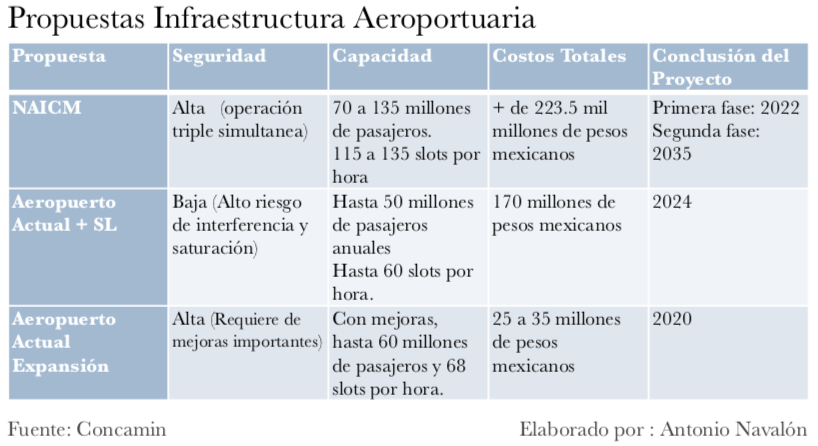

The US$13.3 billion project was one of the largest investments in the country's history. Named Nuevo Aeropuerto Internacional de Ciudad de México (NAICM, later simplified as NAIM) and located at area in Texcoco, a little further away than the current facilities in use, the new infrastructure was to be developed in two phases. The first phase consisted of the construction of a large terminal and three runways, which were initially planned to be ready by 2020, but whose entrance in service had been postponed to 2022 due to construction delays. The second phase would see the construction of three additional runways, plus a second terminal, which would be ready for operation from 2035.

Plans called for NAICM to have the capacity to transport between 70 and 135 million passengers annually, thanks to an operating volume of between 115 and 135 slots per hour. These figures gave a long-term deadline potential benefit of more than $32 billion, according to government estimates.

The project sought first of all to solve the serious air saturation problem suffered by the current Benito Juarez International Airport in Mexico City, caused by the low performance capacity of the two runways that operate simultaneously. In addition, the construction of the NAICM was based on the hope of turning CDMX into a world logistics hub, with the potential to multiply the current airport's cargo transport capacity fourfold.

The level of freight transport in this macro project would be able to reach 2 million tons per year, thus becoming, as its promoters assured, the main distribution center in Latin America. NAICM's ambition, therefore, was to become a reference not only in the American continent but also worldwide, both in the transfer of tourists and in the transport of goods.

NAICM construction began in 2015 and to date 31% of the work has been completed. Although this Degree of completion represents a slight delay compared to the original schedule, the foundation and channeling works are already finished and high Structures intended to hold the wide roof can be seen on the surface. However, despite this progress and the investment already made, the country's new president has announced that he is completely burying the project.

Elections and enquiry

The presidential elections of July 1st were won by the leftist Andrés Manuel López Obrador (inaugurated on December 1st). Former leader of the PRI, thanks to which he served as mayor of the capital, over time he drifted to the left: he first joined the Party of the Democratic Revolution (PRD) and, after losing two elections for the presidency of the country, he created the National Regeneration Movement (Morena). In July, Morena won a majority in both chambers of congress and also conquered the CDMX government, giving AMLO, as the new president is commonly known, broad powers to carry out his policies. While he fell 17 votes short of a qualified majority in the Senate that could change the Constitution, he could gain allies for that purpose.

During the election campaign, Lopez Obrador defended the cancellation of the new airport project alleging its high cost, and raised the possibility that, as an alternative, some improvements could be made to the current airport and the Santa Lucia airport, a military base in the area of the Mexican capital that could be enabled for international flights. But Morena's candidate assured that he would make a enquiry to know the opinion of the Mexican people and that he would abide by the results.

Without waiting to take office as President, Lopez Obrador had Morena carry out this enquiry, which was not organized by the Government but by a political party, and furthermore did not take place in the whole country but in 538 municipalities out of the 2,463 that exist in Mexico. The ballot boxes, set up between October 25 and 28, voted "no" to NAICM: with a participation of only 1% of the national electoral body, 69% voted for the alternative of Santa Lucia and 29% voted to continue the works in Texcoco. López Obrador announced that, in application of result, he will halt the works for the new airport, despite the investment already made.

Some popular movements and also naturalists calling for the preservation of the natural environment applauded the advertisement, but there were also protest marches against the decision in the streets of downtown CDMX. The private sector has greatly regretted the purpose decision to cancel the NAICM project . Leading businessmen in the country and organizations such as the Confederation of Mexican Industrial Chambers (CONCAMIN), which represents 35% of Mexican GDP and 40% of employment in the country, came out in defense of the original project and asked López Obrador to reconsider his decision. Their argument is that any alternative will fall short of the demands of growing air traffic, weighing down the country's development . They also argue that any decision other than continuing with the construction of the NAICM will be more expensive than completing the planned airport [1].

|

Economic impact

For CONCAMIN, "the current airport lacks the infrastructure and any improvement would not fix the fundamental problems it has", and a bet on the Santa Lucia base "would be a waste of time and money, which will create problems rather than solve them", according to the president of this business association , Francisco Cervantes.

José Navalón, of CONCAMIN's Foreign Trade and International Affairs Commission, of which he is a member, warns that López Obrador's decision will be a major blow to Mexico's macroeconomic and financial system. In his words, "it is still too early to assess possible consequences, but it will be necessary to see if Mexico has the appropriate airport infrastructure, in terms of competitiveness and connectivity, for what is the second largest Economics in Latin America". In any case, for the moment "there has been a problem of lack of confidence in the markets, which has been immediately reflected in the fall of the peso and the markets" [2].

Indeed, while López Obrador was greeted in July with a rise in the markets, because his resounding victory seemed to augur stability for Mexico, his inauguration in December is being accompanied by an "exodus" of investors. The peso has fallen nearly 10% against the dollar in August, the stock market is down 7.6% and in October alone investors sold 2.4 billion dollars in Mexican bonds.

"The main questions that investors are asking today," Navalón continues, "is whether it is safe to invest in Mexico and how often this subject of decisions that do not follow any subject of legality will be taken," as important companies will be affected by the cancellation of a project in progress. He also warns that "the election of Bolsonaro in Brazil, whose profile is a magnet for foreign investment, may directly affect investment in Mexico".

The big question is why López Obrador maintains his decision against the new airport, in spite of the economic penalty it will mean for the Government and the risk of investor flight. We must understand that Mexico has always been a country that has been led by economic power. With its attitude towards NAICM, it aims to clearly mark the line of separation between political and economic power, making it clear that the era of economic power is over. A second reason is that NAICM was going to be the PRI's inheritance and López Obrador probably seeks to destroy any subject of association of this macro project with the party he intends to bury.

REFERENCES

[1] CONCAMIN Document "Airport Proposals" 2018.

[2] Personal interviews with Francisco Cervantes and José Navalón.

▲Presidents Enrique Peña Nieto and Donald Trump, in the latest G20 Summit; Hamburg, July 2017 [Presidency of Mexico].

ANALYSIS / Dania Del Carmen Hernández [English version] [Spanish version].

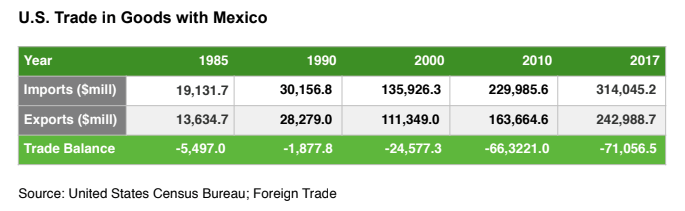

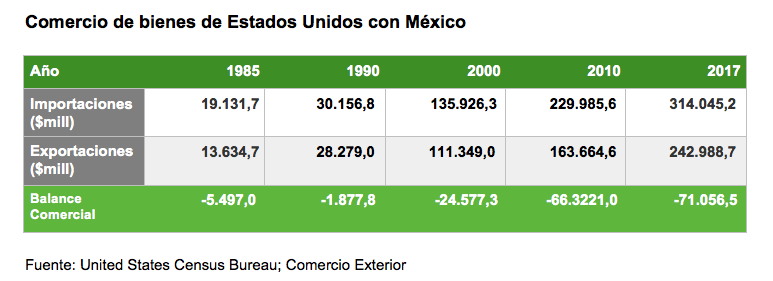

Canada, the United States and Mexico find themselves immersed in the renegotiation of the North American Free Trade Agreement (NAFTA). The trade treaty between these three countries has been controversial in the past few years, especially in the US, where many have doubted its benefits. During the presidential campaign, Donald Trump defended the complete elimination of the treaty; subsequently, when already in the White House, he agreed to make the renegotiation happen. President Trump argues that the pact has hollowed out US manufacturing and caused a trade deficit of over $60 billion with Mexico ($18 billion with Canada), so unless he can rework it in favor of the United States, he said, he won't hesitate to withdraw from it.

Overall, the American people have pretty positive views on the treaty, with 56% of the population who say that NAFTA is beneficial to the country, and just a 33% who say it's bad, according to a poll conducted by Pew Research in November 2017. Out of those who have a negative view, the majority are Republicans with 53% of them claiming Mexico benefits more, compared to Democrats who are generally more supportive of the trade pact and with just 16% who agree with the Republicans on that matter.

|

Regardless of public acceptance, opinion on the treaty hasn't always been so dubious. When President Bill Clinton signed it into law, it was actually considered one of the first successes in his presidency. The same way globalization has liberalized trade all over the world, NAFTA effectively expanded trade and presented a great number of opportunities for the US, all while strengthening the country's economy.

Under NAFTA, US trade in goods and services with Canada and Mexico went from $337 billion in 1994 when the treaty came into force, to about $1.4 trillion in 2016. Under NAFTA, cross-border investment among the three member countries has surged as well, from $126.8 billion in 1993 to $731.3 billion in 2016.

The concern in Washington is that, despite of the increasing volume of trade, in relative terms the US isn't getting fruitful enough results, compared to what its neighbors are getting from it. In any case, Canada and Mexico accept that, almost after 25 years of validity, the agreement must be revised to be able to adapt it to the new productive and commercial conditions, defined by technological innovations that, as is with the case of the development of the internet, were not contemplated when the treaty was signed.

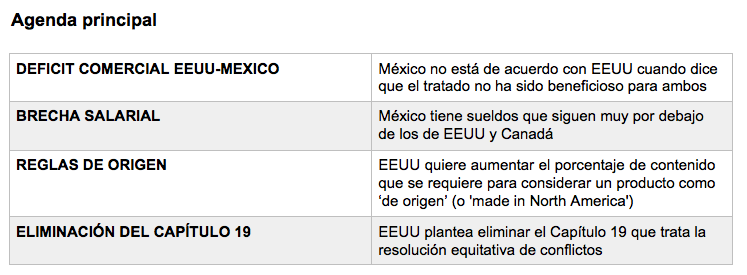

Round to round examination

The discussion between the three countries affects numerous aspects, but we can talk about three main blocks that have to do with certain network lines set by the different parties in the negotiation: rules of origin; the desire of the United States to end the independent system of arbitration, through which Canada and Mexico can terminate the measures that might violate the treaty (elimination of Chapter 19), and finally other proposals, perhaps less decisive but equally important, oriented towards the general wish to update the agreement.

When the negotiations started, in August 2017, the countries expressed a concern to reach a final decision in January 2018. The plan was to have six rounds of meetings. That number has been already overcome: a seventh round is happening at the end of February and there will be possibly more. As we have reached the initial deadline an examination on the state of the discussion is relevant. A good way of doing it is following the evolution of the conversations through the rounds of meetings celebrated and this way we can evaluate the results that have been registered so far.

|

Latest North America Summit, with Presidents Peña Nieto and Obama, and Prime Minister Trudeau; Canada, June 2016 [Presidency of Mexico]. |

1st Round (Washington, D.C.; August 16-20, 2017)

The first round of negotiations set the priorities for each of the three countries on the table; it served to fixate the diary of the principal issues that would be discussed later on, without going into much detail about the measures and the how- to's.

In the first place, Donald Trump had already set clear during his campaign that he considered NAFTA an unjust agreement for the United States, due to the trade deficit that the country has mostly with Mexico, and to a lesser extent, with Canada. According to the Office of the United States Trade Representative (USTR), the US went from a surplus of $1.3 billion in 1994 to a deficit of $64 billion in 2016. The major part of this deficit comes from the automotive industry. For the new administration, this puts in doubt that the treaty may have beneficial effects on American economy. Mexico, less predisposed to introduce important changes, insists that NAFTA has been good for all parties involved.

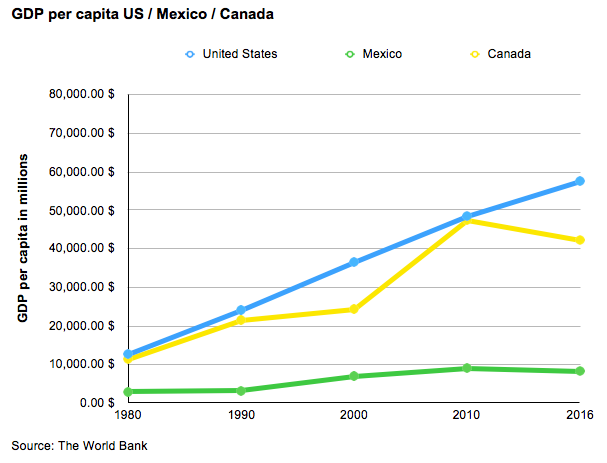

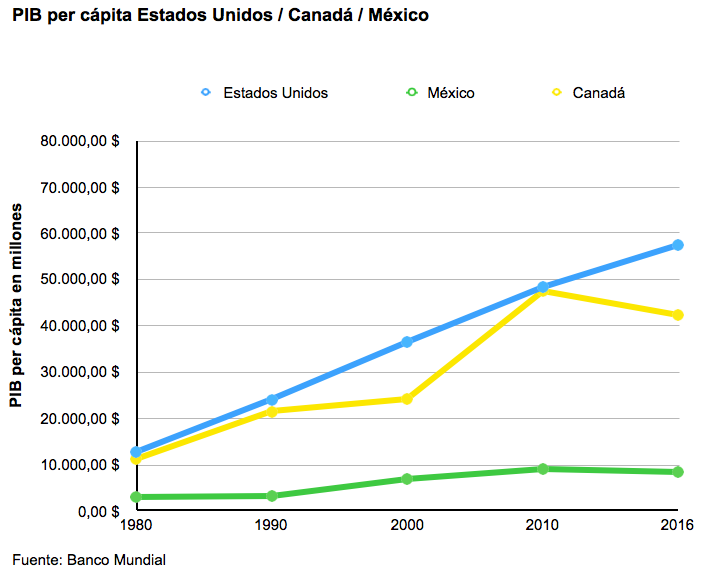

Another topic that was noted was Mexico's salary gap against the US and Canada. Mexico defends that, despite having one of the lowest minimum wages in South America, and having had their medium wage stuck during the two past decades, this shouldn't be taken into account in the negotiations, for it is estimates that Mexican salaries will eventually reach those of their commercial partners. On the contrary, for the US and Canada, this remains a matter of concern; both countries insist that a wage increase would not damage Mexican economy.

Rules of origin was one of the principal recurring topics of discussion. The United States is looking for augmentation in the percentage of content that is required to consider a product as of origin so that it won't be necessary to pay tariffs when moving it between the three countries. This proved to be rather controversial in this first round, as it could negatively affect Mexican and Canadian companies. Specialists have made the remark that a minimum of national content does not exist in any free trade treaties in the world.

Lastly, Trump's administration let their intentions of eliminating Chapter 19 show. A section of the treaty which guarantees equality in the solving of disputes between the countries, making it so that it isn't national laws what will dictate the outcome. The US understands it as a threat to their sovereignty and believes that conflicts should be resolved in a way in which their own democratic processes wont be ignored or jeopardized. For their part, Canada conditioned their permanence in the treaty with the maintenance of the chapter. Mexico also defends guarantees of independence in the resolution of conflicts even though for the moment it hasn't been categorical in this discussion, since it lingers on the side, and will act accordingly to what results most favorable.

|

2nd Round (Mexico City; September 1-5, 2017)

Although considered successful by many analysts, the second round of the renegotiation followed a very slow pace. Some of the matters that made advances were: wages, access to markets, investment, investment, rules of origin, commercial facilitation, environmental issues, digital commerce, SME's, transparency, anti-corruption laws, agronomy and textiles.

The president of Corporate Coordinating Council in Mexico, Juan Pablo Castañon, insisted that for now the salary issue wasn't up for negotiation, and rejected the idea that any of the parties had the intention of pulling out of the treaty, despite the previous threats from the Trump administration. Castañon rallied in favor of Mexico supporting the maintenance of Chapter 19 or the establishment of a similar instrument with the purpose of solving commercial controversies amid the three countries.

3rd Round (Ottawa; September 23-27, 2017)

The delegates made important advances in competition policies, digital commerce, state-owned companies and telecommunications. The principal development had to do with some aspects related to SME's.

The Canadian chancellor, Chrystia Freeland, criticized that the United States had not made any written formal proposals on the most complex areas, demonstrating a passive attitude of the country in the context of the negotiation.

The US trade official, Robert Lighthizer, said that his country is interested in increasing the salaries in Mexico to avoid an unfair competence, seeing that Mexico has attracted factories and investments with their low salaries and their weak trade-union regulations.

Canada endured a firm posture on Chapter 19, which they consider one of the greatest achievements of the current agreement. "Our government is absolutely committed to defending it," said Freeland. Washington requested, though without presenting a formal proposal, the modification of the rules of origin so that they are more strict, avoiding that imports from other nations are considered "made in North America", just because they were assembled in Mexico.

This round took place while the United States fixed a tariff of almost 220% to the CSeries aircrafts by the Canadian manufacturer Bombardier, after considering that the enterprise had used a governmental subsidy to sell its plans to the United States at artificially low prices.

4th Round (Virginia; October 11-17, 2017)

The United States presented their formal proposal of elevating the rules of origin in the automobile industry and suggested introducing a termination clause in the treaty.

The US proposed raising the percentage of components of national origin from any of the three countries from 62.5% to 85% so that the production in the automobile industry can benefit from NAFTA. This way 50% of it will be American production.

It was also debated, in the interest of Washington, the weakening of the system of controversy resolution present in Chapter 19, which was done without registering an approximation of the positions.

To finish, they talked about a termination clause that would give the treaty five years of life and once that time was over, it would automatically disappear, unless, when the time came, the countries decided to renew it. This proposal received several critiques, many claiming that this could infringe the essence of the agreement and that every five years would generate uncertainty in the region, considering that it would affect the investment plans of companies.

These proposals just add to the harsh climax of the negotiation that had been present since the last round in which the US had started to defend difficult proposals like the trials for dumping (selling a product for a price below its normal price) in the imports of perishable Mexican products (tomatoes and berries, governmental and textile purchases.

5th Round (Mexico City; November 17-21, 2017)

|

The fifth round didn't show too many advances. The United States kept their requests and that generated frustration amongst the representatives of Mexico and Canada.

The US didn't receive alternatives to its proposal to change the regional composition from a 62.5% to an 85%, and that at least 50% is American, On the contrary, its commercial partners showed the damage that this proposal could cause to the three economies.

Faced with the US' intentions to limit the number of concessions that their federal government offers to Mexican and Canadian enterprises, Mexican negotiators responded with a proposal to limit the country's public contracts to the number of the contracts attained by Mexican companies with other governments inside the NAFTA. Given that the number of those contracts is significantly reduced, US companies will see their contracting being restricted.

Upon completion of this fifth round, the topics that are now more developed are the ones that involve a regulatory enhancement of telecommunications and the chapter on sanitary and phytosanitary measures. With this last thing, Americans are looking to establish new transparent and non discriminatory norms, that will allow each country to establish the degree of protection they find appropriate.

6th Round (Montreal; January 23-29, 2018)

The Sixth Negotiation Round saw some progress. The chapter on corruption was finally closed, and progress was made in other fields. More importantly, we finally saw a discussion that involved some of the core issues that had been pushed back in the previous negotiations. The progression is slow, but steady.

Robert Lightizer rejected the compromise on rules of origin that Canada had previously proposed. The structure was based on the idea that the rules of origin should be calculated to also include the value of software, engineering and other high-value work, which is currently not counted toward the regional content targets. This would guarantee the safeguarding of high-paying jobs in the area. The US expressed its disapproval to the Canadian proposal. Mexico didn't find this surprising at all, as it already expected the cold shoulder from their American trade partner on this matter.

In another proposal, Canada made a threat as they claimed that they will keep the right to treat their neighbors worse than other countries if they enter into agreements. One of which could be China. The proposal was obviously not passed, as the US and presumably Mexico considered it 'unacceptable'.

Although the countries successfully worked towards installing measures against corruption during the round of negotiations, they were far from successful at reaching an agreement on the topic of modifying rules of origin and calculating the regional content of the country in which automobiles are manufactured. All three countries remain motivated to keep making progress and will resume the negotiations for a speculation of two more sessions before the deadline that has been set in March, in order to avoid interference with the presidential election in Mexico and the US midterm elections in November.

Beyond the deadline

After more than seven months of meetings, as we have seen in the round-by-round examination, the negotiations between the three countries still have not reached the pre-agreement threshold that, even waiting to resolve more or less important points, should confirm the shared will to give continuity to NAFTA. The hard positions of the United States and the pressure of Canada and Mexico to save the treaty have so far resulted in a 'tug-of-war' that has allowed some partial, but not decisive, result. Thus, it remains to be determined if the treaty has actually reached its expiration date or may be reissued instead. For the time being, the three countries agree to continue working towards a renewed treaty.

From what has been seen so far in the negotiations, it is difficult to determine which country will be more willing to give in to the pressure exerted by the others. The most controversial issues have barely been addressed until recently, so it is also not possible to point out what achievements each country achieves in this negotiating process.

The two neighbors of the United States, but especially Canada, continue to warn of Trump's risk to end the treaty. An acceleration of the negotiations could help the positive resolution of the process, but the electoral calendar rather threatens delays. On March 30 begins the campaign of the presidential elections in Mexico, which will take place on July 1. In September, the United States will begin to pay more attention to the November Mid-term elections. A substantial progress before the Mexican elections could put the agreement on track, although some issues should have to be agreed later, but if in the next meetings there is not a breakthrough, the three countries could get used to the possibility of ending NAFTA, what would harm the negotiations.

▲Enrique Peña Nieto and Donald Trump at the July 2017 G20 summit in Hamburg [Presidency of Mexico].

ANALYSIS / Dania Del Carmen Hernández [English version].

Canada, the United States and Mexico are immersed in the renegotiation of the North American Free Trade Agreement (NAFTA). The trade agreement between these three countries has been somewhat controversial in recent years, especially in the US, where its advisability has been questioned. During the presidential campaign, Donald Trump defended the cancellation of the treaty; later, already in the White House, he accepted that there would be a renegotiation. Trump argued that the pact has reduced US manufacturing jobs and generated a trade deficit of more than $60 billion with Mexico ($18 billion with Canada), so unless new conditions substantially reduced that deficit, the US would withdraw from agreement.

Overall, Americans have positive views of the treaty, with 56% of the population saying NAFTA is beneficial to the country, and 33% saying it is detrimental, from agreement with a November 2017 Pew Researchsurvey . Among those who hold a negative view, the majority are Republicans, with 53% saying Mexico benefits the most, while Democrats overwhelmingly support the pact and only 16% view it negatively.

|

Regardless of public acceptance, opinion about the treaty has not always been so dubious. When President Bill Clinton ratified the treaty, it was considered one of the greatest achievements of his presidency. Just as globalization has liberalized trade around the world, NAFTA has also expanded trade very effectively and presented a great issue of opportunities for the U.S., while strengthening the U.S. Economics .

Under NAFTA, trade in U.S. goods and services with Canada and Mexico grew from $337 billion in 1994, when the treaty entered into force, to $1.4 trillion in 2016. The impact has been even greater when taking into account cross-border investments between the three countries, which went from $126.8 billion in 1993 to $731.3 billion in 2016.

Washington's concern is that, despite this increase in trade volume, in relative terms the United States is not achieving sufficiently fruitful results compared to what its neighbors are getting from the treaty. In any case, Canada and Mexico accept that, after almost 25 years in force, the treaty must be revised to adapt it to the new productive and commercial conditions, marked by technological innovations that, as is the case of the Internet development , were not contemplated when the agreement was signed.

Round-by-round examination

The discussion of the three countries touches on numerous aspects, but three blocks can be mentioned, which have to do with certain red lines set by the different parties to the negotiation: the rules of origin; the desire of the United States to end the independent arbitration system, through which Canada and Mexico have the ability to end measures that violate the trade agreement (elimination of Chapter 19), and finally proposals, perhaps less decisive but equally important, aimed at the general update of the treaty.

When negotiations began in August 2017, it was expressed that they could be concluded by January 2018, with six rounds of meetings planned. This issue is already being exceeded, with a seventh round at the end of February, possibly to be followed by others. Now that the initial deadline has been reached, however, it is time to review the status of the discussions. A good way to do this is to follow the evolution of the talks through the rounds of meetings held and thus be able to assess the results that have been recorded so far.

|

Last North American Summit, with Peña Nieto, Trudeau and Obama, held in Canada in June 2016 [Presidency of Mexico]. |

1st Round (Washington, August 16-20, 2017)

The first round of negotiations put on the table the priorities of each of the three countries; it served to set the diary of the main issues to be discussed in the future, without yet addressing concrete measures.

agreement First of all, Donald Trump already made it clear during his election campaign that he considered NAFTA to be unfair to the United States due to the trade deficit that the United States has mainly with Mexico and, to a lesser extent, with Canada.

According to figures from the Office of the US Trade Representative, the US went from a surplus of $1.3 billion in 1994 to a deficit of $64 billion in 2016. Most of this deficit comes from the automotive industry. For the new U.S. Administration, this calls into question whether the agreement will have beneficial effects for the domestic Economics . Mexico, less inclined to introduce major changes, insists that NAFTA has been good for all parties.

Another topic was the wage gap between Mexico and the United States and Canada. Mexico argues that, despite having one of the lowest minimum wages in Latin America, and having had a stagnant average wage for the last two decades, this should not be taken into account in the negotiations, as it believes that Mexican wages will gradually catch up with those of its trading partners. On the contrary, for the US and Canada it is a topic of concern; both countries warn that a wage increase would not harm the growth of the Mexican Economics .

Rules of origin was one of the main topics of discussion. The United States is seeking to increase the percentage of content required to consider a product as originating so that it is not necessary to pay tariffs when moving it between any of the three countries. This was controversial in this first round, as it could negatively affect Mexican and Canadian companies. Specialists warn that the minimum national content requirement does not exist in any free trade agreement in the world.

Finally, the Trump administration hinted at its intentions to eliminate Chapter 19, which guarantees equality in resolving disputes between countries, so that it is not the national laws of each country that resolve the conflict. The United States sees this as a threat to its sovereignty and believes that conflicts should be resolved in such a way that its own democratic processes are not ignored. Canada has conditioned its continued membership in the treaty on the maintenance of this chapter. Mexico also defends guarantees of independence in conflict resolution, although so far in this discussion it was not categorical.

|

2nd Round (Mexico City, September 1-5, 2017)

Although considered successful by many analysts, the second round of renegotiation continued at a slow pace. Some of the issues that advanced were: wages, market access, investment, rules of origin, trade facilitation, environment, digital trade, SMEs, transparency, anti-corruption, agriculture and textiles.

The president of committee coordinator Mexican Businessmen, Juan Pablo Castañón, insisted that for the moment the wage issue was not subject to negotiation, and denied that any of the parties had any intention of leaving the treaty, despite threats to that effect from the Trump Administration. Castañón said he was in favor of Mexico supporting the maintenance of Chapter 19 or the establishment of a similar instrument for the settlement of trade disputes between the three countries.

Round 3 (Ottawa, September 23-27, 2017)

The delegates made important advances in policies on skill, digital commerce, state-owned enterprises and telecommunications. The main progress was on some aspects related to SMEs.

Canadian Foreign Minister Chrystia Freeland complained that the United States had not made any formal or written proposals in the most complex areas, which in her opinion demonstrates a passive attitude on the part of that country in the context of the negotiations.

U.S. Trade Secretary Robert Lighthizer said that his country is interested in increasing wages in Mexico, under the logic that this is unfair skill , as Mexico has attracted factories and investment with its low wages and weak union rules. However, Mexican business and union leaders are resisting such pressures.

Canada stood firm on its position on Chapter 19, which it considers one of the great achievements of the current agreement. "Our government is absolutely committed to defending it," Freeland said. Washington raised, although without presenting a formal proposal , the modification of the rules of origin to make them stricter and prevent imports from other nations from being considered "made in North America", just because they were assembled in Mexico.

This round took place as the United States slapped a tariff of nearly 220% on C Series aircraft made by Canadian aircraft manufacturer Bombardier, which it considered that business had used a government subsidy to sell its aircraft to the U.S. at artificially low prices.

Round 4 (Virginia, October 11-17, 2017)

The United States presented its formal proposal to raise the rules of origin for the automotive industry and its suggestion to introduce a sunset clause to agreement.

The United States proposed raising from 62.5% to 85% the percentage of components of national origin from one of the three countries in order for the automotive industry to benefit from NAFTA, and that 50% be of U.S. production. association The Mexican Automotive Industry Association (AMIA) rejected proposal.

Washington's interest in weakening the dispute settlement system within the treaty (Chapter 19) was also debated, without a rapprochement of positions.

Finally, there was talk of including a sunset clause, which would cause the treaty to cease to exist after five years, unless the three countries decide to renew it. This proposal was widely criticized, warning that this would go against the essence of agreement and that every five years it would generate uncertainty in the region, as it would affect the investment plans of companies.

These proposals add to the tough negotiating climate, as already in the third round the United States had begun to defend difficult proposals, on issues such as lawsuits for dumping (selling a product below its normal price) in the importation of perishable Mexican products (tomatoes and berries), government purchases and the purchase of textiles.

|

Round 5 (Mexico City, November 17-21, 2017)

The fifth round took place without much progress. The U.S. maintained its demands and this generated great frustration among the representatives of Mexico and Canada.

The United States received no alternatives to its proposal of wanting to increase the regional composition from 62.5% to 85%, with at least 50% being U.S.-based. On the contrary, its trading partners put on the table data showing the damage that this proposal would cause to the three economies.

Faced with the U.S. desire to limit the issue of concessions that its federal government offers to Mexican and Canadian companies, Mexican negotiators responded with a proposal to limit the country's public contracts to issue of contracts reached by Mexican companies with other governments under NAFTA. Given that the issue of these contracts is quite small, U.S. companies would be restricted in their contracting.

At the end of this fifth round, the most advanced issues are the regulatory improvement of telecommunications and the chapter on sanitary and phytosanitary measures. With the latter, the Americans seek to establish new transparent and non-discriminatory rules, allowing each country to establish the Degree protection it deems appropriate.

Round 6 (Montreal; January 23-29, 2018)

The sixth negotiation showed some progress. The chapter on corruption was finally closed, and there was progress in other areas. Some of the important issues that had been left aside in the previous negotiations were discussed. Progress is slow, but seems to be making headway.

Robert Lightizer rejected the compromise on rules of origin that Canada had previously proposed. The framework was based on the idea that rules of origin should be calculated to include the value of software, engineering and other high-value work, facets that today are not taken into account with a view to goal regional content.

As a form of pressure, Canada threatened to reserve the right to treat its neighboring countries worse than other countries if they enter into agreements. One of them could be China. The proposal was not considered, as the United States and Mexico found it unacceptable.

Beyond the deadline

After more than seven months of meetings, as reflected in this round-by-round review of the talks, the negotiations between the three countries have still not reached the threshold of a pre-agreement that, while awaiting the resolution of more or less important points, would confirm the shared will to continue NAFTA. The hard stances of the United States and the pressure from Canada and Mexico to save the treaty have so far resulted in a "tug of war" that has allowed some partial, but not decisive result . Thus, it is yet to be determined whether the treaty has actually reached its expiration date or whether it can be reissued. For the time being, the three countries are at agreement working towards a renewed treaty.

From what has been seen so far in the negotiations, it is difficult to determine which country will be more willing to yield to the pressure exerted by the others. The most controversial issues have hardly been addressed until recently, so it is not possible to say what each country has achieved in this negotiation process.

The two neighbors of the United States, but especially Canada, continue to warn of the risk of Trump wanting to kill the treaty. An acceleration of the negotiations could help the positive resolution of the process, but the electoral calendar rather threatens postponements. On March 30, campaigning begins for Mexico's presidential election, which will take place on July 1. In September, the U.S. will begin to look more closely at the November congressional elections. A substantial breakthrough before the Mexican presidential elections could put agreement back on track, even if some issues remain to be closed, but if no breakthrough is made in the next meetings, the three countries could be getting used to the idea of the end of NAFTA, which would weigh down the negotiations.