In the picture

António Guterres, University Secretary , and Mohamed bin Zayed, President of UAE, at COP 28 held in late 2023 in Dubai.

The Spanish government, through the mouth of its vice-president Yolanda Díaz, described as "dystopian" the fact that COP 28 - the United Nations climate change conference held last year at lecture - took place in the United Arab Emirates (UAE), a mainly oil-producing country, and that it was chaired by Al Yaber, director executive of ADNOC, the Emirati national hydrocarbons company.

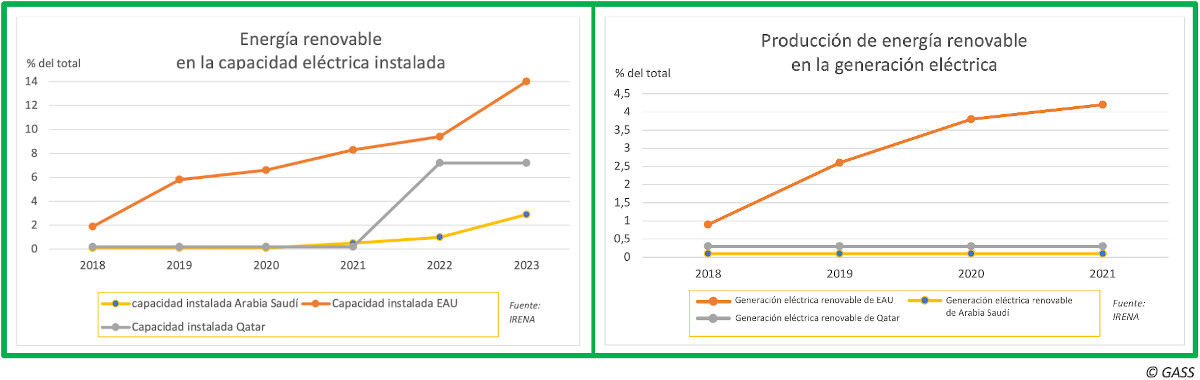

However, the visibility of the UAE - and other neighbors such as Saudi Arabia and Qatar - at the UN's lecture highlighted the commitment expressed by these nations, along with the rest of the participants, to move towards a decarbonized world. At the summit, various leaders of the Persian Gulf countries added their signature to agreement which decreed "the beginning of the end" of the fossil fuel era, despite the fact that their economies are based on the production and marketing of these products. In essence, rather than betting on the end of the oil paradigm, what these countries were doing was committing themselves to the development of clean energies, so that these would also grow in their national energy mix and help them to move towards a global model in which, although hydrocarbons will continue to be extracted for various uses, they will no longer be the fuel that moves the world.

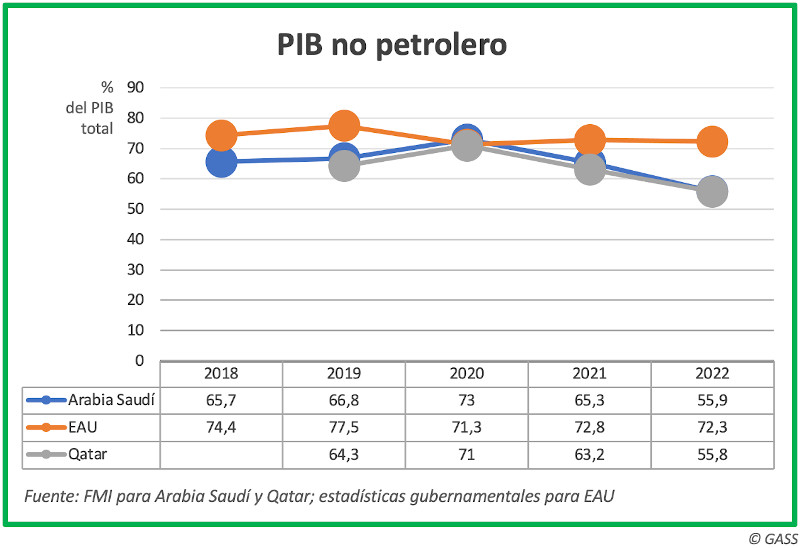

The Gulf countries have been faced with the dilemma of either closing themselves off to any change, turning their backs on international conventions, or joining the general efforts for an energy sustainable Economics . The decision has not been an easy one, because for them hydrocarbons have been a major component of their GDP and because in recent decades they have represented a strategic resource that has given them great influence in the world. In the last decade, however, Saudi Arabia and other neighboring nations have been planning an economic diversification to ensure their adaptation to a new era of reduced fossil fuel consumption.

COP 28 Dubai Commitments

Confronting the climatic consequences of hydrocarbon exploitation and promote an effective solution requires a joint international response. An important breakthrough was the Paris Treaty, in force since 2016, which among other measures established a commitment to policies aimed at limiting global warming to 1.5 Degrees centigrade, recovering the levels presented by the planet in pre-industrial times. framework The treaty was agreed by the United Nations Framework Convention on Climate Change (UNFCCC), of which the COP is the supreme decision-making body. Notable milestones have been the Kyoto protocol , the Copenhagen agreement or the aforementioned Paris agreement .

At COP 28, held in Dubai from November 30 to December 12, 2023 (COP 29 will take place at the end of 2024 in Azerbaijan, another oil producer), the global assessment of the Paris agreement was carried out, noting that small progress has been made, but without achieving the targets set, thus highlighting the need to develop more effective policies. Specifically, the signatories set themselves the goal target of reducing greenhouse gas emissions by 43% by 2030 and 60% by 2035.

The Dubai agreement , adopted unanimously by the plenary, welcomed the commitment to triple global renewable energy capacity by 2030, accelerate the phase-out of coal-based energy use, create a fund for countries most vulnerable to climate impact and, above all, achieve the withdrawal of fossil fuels to reach net zero emissions by 2050.

Importance of fossil energy for the Gulf

Control of energy sources has been and continues to be a condition of political and economic power, which is why those who control these resources may be reluctant to lose global influence. The weight of the Middle East in the world is due precisely to its hydrocarbon production, something that the Gulf countries have asserted in recent decades and also today.

In 1973, the surprise joint attack by Egypt and Syria on Israel during Yom Kippur led, after the Jewish victory, to an oil boycott by the Arab OPEC nations against the West. This oil crisis causeda major recession in many countries, including the United States, which suffered 12% inflation.

The strategic value of fossil energy control has again been highlighted by the Ukrainian war and the resulting economic sanctions on Russia. The imbalance in the market as a result of the war led to a dramatic rise in fuel prices, especially through 2022.

This status, onerous for the West, is presented as an opportunity for the countries of the Middle East, both because it represents an additional contribution of income derived from hydrocarbons, and because of Europe's greater dependence on supplies from specific countries, as is the case of liquefied natural gas from Qatar (the Al Thani dynasty, aware of the energy needs of the old continent, is developing a plan to increase its production by 80%).

The strategic importance of the Persian Gulf countries as major energy sources explains why Saudi Arabia, the main crude oil exporter, and the Emirates, together with Iran, joined BRICS+ this year, an organization that brings together countries that account for 44% of the world's oil production.

Crude oil is the world's most traded commodity in monetary terms, affecting a money supply of $1.45 trillion in 2022. The year 2023 saw an all-time high in global demand, led by China and emerging markets. With all this, it is not surprising that Saudi Aramco (business Saudi state-owned oil company) recorded $161 million in profit in 2022, surpassing the combined results of other major energy companies such as Shell, BP, ExxonMobil and Chevron, and constituting a record profit in any international market arena. Fossil fuel revenues have directly contributed to the Arabian Peninsula states (counting their GDP as a bloc) overtaking countries such as Russia and Brazil to rank among the world's top 10 economies.