In the picture

Chinese Yuan

At the beginning of the century, China's trade with Latin America took off, with the search for raw materials for its exponential industrialization; for some years now, Beijing has been pushing its partners to have at least part of this trade in yuan. Various currency swap programs have accelerated the trend, which is also favored by Brazil's political purpose to reduce the international role of the US currency and by the lack of dollars in some countries, particularly Argentina, to make foreign payments. Despite the advance of the yuan in Latin America, however, the dollar maintains its dominant position and is not threatened in the medium term deadline.

The Issue of cross-border commercial transactions for the purchase and sale of goods carried out with Chinese currency reached 7.9 trillion yuan (CNY)-1.17 trillion dollars- in 2022, an increase of 37.2% over the previous year, according to the Chinese Ministry of Commerce. Meanwhile, data of the SWIFT interbank system also shows a growing global use of the Chinese currency, which last September reached a record share of 3.71% in international settlements.

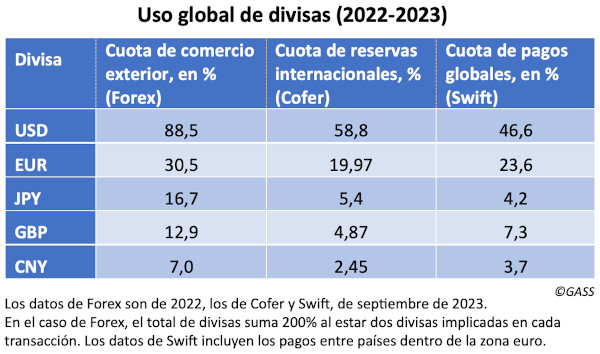

This advance in the weight of the Chinese currency does not constitute, at least for the time being, a particular threat to the position of the dollar, whose role continues to be dominant. In terms of foreign currency reserves accumulated by countries, 58.88% is still in dollars and only 2.45% in yuan, a figure that is below that of another non-traditional currency in the reservation basket, such as the Canadian dollar. In the SWIFT system, the dollar is used in 46.6% of payments and the yuan ranks fifth, with the aforementioned 3.71%, behind the euro, the pound sterling and the Japanese yen. In commercial transactions, the dollar has a share of 88.5%, the euro 30.5% and the yuan, also in fifth place, 7%.

In any case, the yuan is making progress in international markets and China's exchanges with the Latin American continent have not been alien to this growth. Moreover, certain attempts to distance themselves from the United States have led some leaders, such as Brazil's President Luiz Inácio Lula da Silva, to act as a loudspeaker in the Global South for the political desire to reduce the weight of the U.S. dollar in the world.

Brazil has China as its main commercial partner , with a Issue of exchange of goods that in 2022 surpassed the record of 150.5 billion dollars. Beijing's effort to extend the use of its currency in its commercial operations has increased the level of reserves that the Central Bank of Brazil has in yuan, so that reserves in this currency have reached 5.3%, when in 2018 they did not exist, and have surpassed those accumulated in euros. However, reserves in dollars hover around 80%; that same percentage is the total trade that Brazil conducts in the US currency.

If the Brazilian authorities have signed several 'swap' agreements with Chinese currency, the Argentine case is more striking, since part of these currencies have been destined, no longer to buy Chinese goods, but to cover maturities of the IMF's 2018 credit in view of the lack of dollars from the Central Bank of Argentina. A agreementbetween the central banks of both countries, extended in November 2022 and again in April and June 2023 in view of Argentina's financial deterioration due to high inflation, increases the 'swap' with China to an amount of 130 billion yuan (about 18.2 billion dollars) for the three-year deadline . This allowed, for example, Argentine companies to make import payments with the Chinese currency, which in April and May of this year alone amounted to around 1.8 billion dollars. This agreement allows the South American country to have 10,000 million dollars at its disposal as a free reservation availability , such as the funds already earmarked for two IMF payments. The extension of the swap increased the share of the Chinese currency in the international reserves of the Argentine Central Bank to 48%.

In Bolivia, where international reserves have also been reduced and there is a shortage of dollars, the president, Luis Arce, referred to the desire to use yuans in foreign trade operations, although domestic transactions with China are smaller than those of its two large neighbors. "The two largest economies in the region are already trading in yuan in agreements with China", said Arce, who believes that "the trend in the region is going to be like that".

Like Brazil and Argentina, Chile already signed in the last decade a agreement of exchange of foreign exchange with China, which in 2021 was renewed for another five years and amounts to an equivalent of 7.7 billion dollars. Chile was where Latin America's first yuan clearing bank was opened in order to encourage trade between the two nations.

Ecuador and Uruguay could continue on this path, as they are negotiating free trade agreements with China, leading to the adoption of 'swaps' agreements and future exchanges in yuan (the negotiation opened by Uruguay, however, must be accepted and accompanied by the rest of Mercosur members, something so far disputed).