In the picture

Exxon vessel in Guyana's Stabroek block [Exxon].

Guyana is, on paper, a huge success story: it is the country with the highest economic growth in the world, which this year will approach 40% of GDP. The finding of 'off-shore' oil fields in 2015 and the start of their exploitation in 2019 are bringing this country an unprecedented 'boom'. But Guyana, one of the poorest countries in the Americas, faces the 'resource curse': the risk of overdependence on a single source income and the prospect of a socio-economic imbalance resulting from the rapid and exclusive enrichment of a few elites.

The case of Guyana is quite unique, although it is a story that has been repeated many times before. Since the recent finding of important oil deposits off its coasts, Guyana is at a crossroads. Investing in the oil and gas industry will undoubtedly bring many benefits to this small South American country of just 815,000 inhabitants and high fees poverty, but there are serious risks that should be taken into account.

The exploitation of several wells in a large Guianese off-shore area (the Stabroek block) by an international consortium led by Exxon is producing 380,000 barrels of oil per day and is expected to reach 1.2 million barrels per day by 2027. This last figure exceeds the current production of Venezuela, a country that is precisely disputing the control of these waters, in a dormant conflict which now, as a result of the enrichment of the former British colony, the Venezuelan government in crisis is stirring up.

Positive effects: economic improvement

In the best case scenario, Guyana could manage its oil industry well and imitate successful producers such as the United States, Canada and Norway. It will probably not reach those levels, but the production and export of hydrocarbons will be an economic advantage, as Guyana is the fourth poorest country in the Western Hemisphere, surpassed only by Haiti, Suriname and Nicaragua. The beginning of the exploitation is already being revolutionary for the Guyanese economy, boosting GDP growth which, depending on the quantities extracted and the international price of crude oil, could be between 300% and 1000% by 2025, making it the economy with the highest per capita income in South America. Thus, with oil exploitation, since 2020 the increase in GDP has been in double digits (43.5% in 2020; 20.1% in 2021; 62.3% in 2022, and an estimated 38.4% in 2023), raising per capita GDP from US$6,950 in 2020 to US$20,560 in 2023, a figure that will undoubtedly multiply in the coming years.

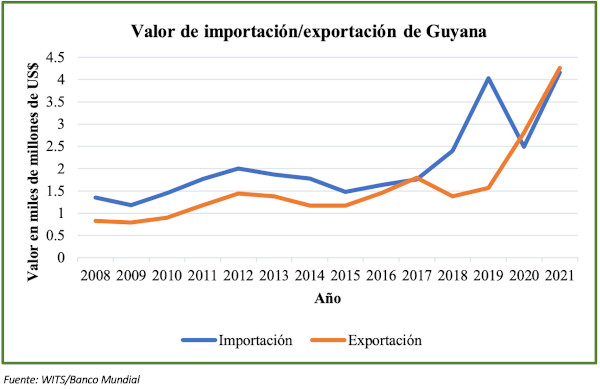

In Guyana, half of the population lives below the poverty line and after the first years of oil extraction, the Guyanese economy is seeing the benefits. Export values have soared, making it possible for the import of goods to also increase at the same rate, without the risk of trade deficit, making products previously unattainable or only imported in a short Issue available to Guyanese society. In 2019 the item of petroleum, petroleum products and other related materials accounted for only 0.1% of the total value of Guyana's exports; in 2020 it accounted for 40% in 2020, and 70% in 2021.

Some companies have already come to Guyana, such as Exxon, which has invested $30 billion in Guyana, $450 million of which has gone to local suppliers, some to local charities and research initiatives, as well as having trained more than 3,000 Guyanese employees to work in the hydrocarbon industry. Increased foreign investment is expected to expand production in sectors such as agriculture, housing, health and transportation, and improve Guyana's electrical infrastructure.

The benefits are not only economic, Guyana will gain geopolitically with increased foreign interest, particularly from Brazil. Guyana currently has a major border dispute with Venezuela over the Essequibo region. Brazil has always maintained that it does not want conflict on the continent and has tried to maintain the 'status quo' and protect Guyana's borders. Currying favor with Brazilian oil companies and closer ties with Brazil in general would help Guyana preserve its territorial integrity in the face of an increasingly irredentist regime in Venezuela.