In the picture

Mining operations of Antamira, a company that extracts copper in Peru and has received loans from Chinese commercial banks [Antamina].

The interest of the People's Republic of China in Latin America arises in the framework of the 'Going-Out' strategy, born from the report presented by former Chinese President Jiang Zemin at the 14th congress of the Communist Party of China in October 1992. Thus, the first Chinese investment in the region dates back to December 1 of the same year: China Shougang Group, owned by the State-Owned Assets Supervision and Administration Commission, acquired 98.4% of the shares of the mining company Hierro Perú, today called Shougang Hierro Perú S.A.A., for 118 million US dollars (USD).

In the 21st century, China has found in Latin America a region rich in natural resources as basic as wheat or soybeans and as precious as oil, gas, copper or gold; A market of 650 million people, with a combined Gross Domestic Product (GDP) worth USD 5.49 trillion, and a favorable geopolitical environment, with some socialist rulers ideologically aligned with Chinese foreign policy (the 'Bolivarian cycle') and the relative withdrawal of the region by the United States, more oriented towards the Middle East, Europe and Asia. This has been a great opportunity for the main Chinese economic initiatives: the Belt and Road Initiative (BRI), presented in 2013, and the Regional Comprehensive Economic association (RCEP), which brings together Asia-Pacific and Australia and came into force on January 1, 2022.

In 1998, former President Jiang Zemin defended the internationalization of Chinese lending by arguing that Africa, the Middle East, Central Asia and South America are vast regions at development with very large markets and abundant resources and that China should seize the opportunity to enter them. However, Chinese bank lending and credit did not reach Latin America until 2005; it began that year through the development Bank of China (CDB), the Export-Import Bank of China (EIBC) and the Industrial and Commercial Bank of China (ICBC), targeting the infrastructure, energy, mining, transportation and real estate sectors.

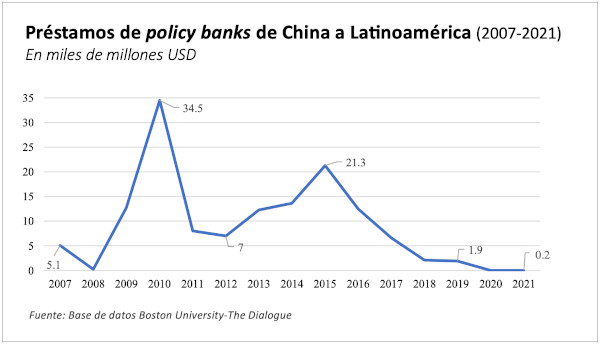

development Chinese financing quickly proved to be more attractive than financing from international organizations, such as the Inter-American Development Bank (IDB), the World Bank (WB) and the Export-Import Bank of the United States (EXIM), because it did not require structural, political, economic or social reforms. From 2005 to 2011, Chinese banking institutions granted cumulative financing lines of USD 83.805 billion to the region, compared to USD 66.933 billion for the IDB, USD 53.364 billion for the WB or USD 1.302 billion for EXIM.

2005-2012: First multi-million dollar financings

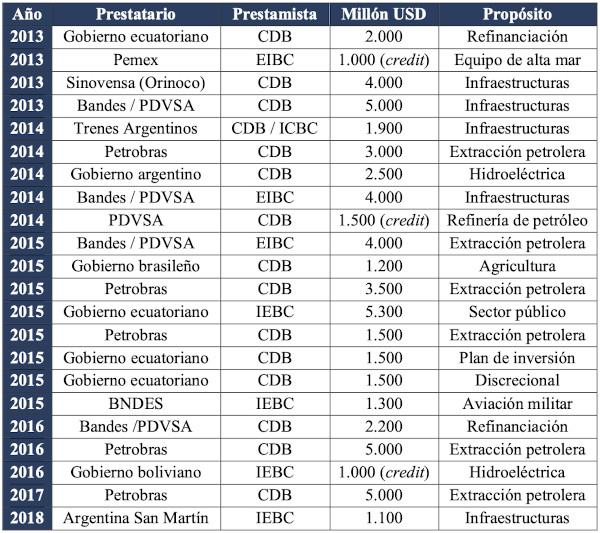

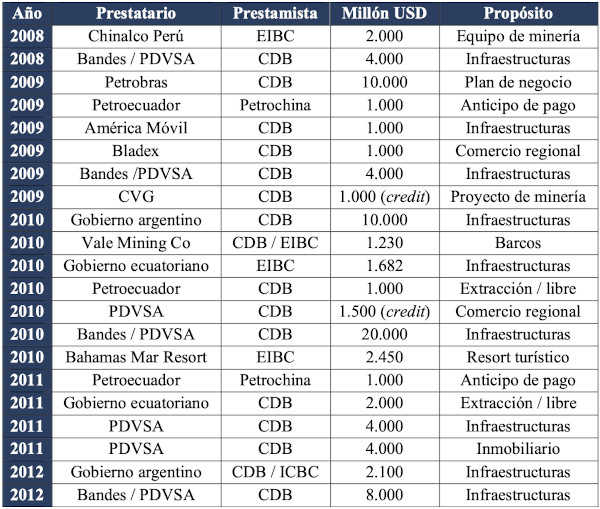

In 2005 and 2007, the first Chinese financing deals in Latin America were closed: USD 201 million from ICBC to Brazil's business Gerdau Açominas S.A. for the purchase of steel equipment, and USD 45 million from EIBC to the Jamaican government for the construction of the Montego Bay convention center. But it was not until the financial crisis of 2008 that the first billion-dollar contributions took place. These multi-billion dollar Chinese loans and credits are shown in the following tables, the contents of which are taken from Boston University's database on Chinese investment (Boston University, 2008). data on Chinese investments from Boston University (they do not include billionaires, as they are comparable to syndicated bank loans from entities of credit common).

In the first table (2005-2012), the CDB funds for Banco de development de Venezuela (Bandes) and Petróleos de Venezuela S.A. (PDVSA) stand out. The delicate political situation and hyperinflation in the country would call into question the viability of their amortization; however, these are financial deliveries in exchange for oil in the future. Although Venezuelan oil production has been declining, it is estimated that the government of Nicolás Maduro would have been able to cancel, by the beginning of 2023, close to 80% of the debt contracted with Beijing in the last decade and average.