In the picture

2023 Victory Defile on Moscow's Red place [Russian TV].

Russia has not sold arms to Latin America for five years now. Without conflicts or direct threats to its security, the region is usually at the bottom of the list in arms purchases. However, the important income that its countries had thanks to the commodities boom led to an increase of expense and Russia was the provider most benefited, coinciding with the anti-US front encouraged by Hugo Chavez. With the end of that singular economic period ten years ago, the acquisition of armaments has decreased and so has Russia's role. For the time being, Moscow's interest in penetrating an area of traditional US influence, returning the pressure Washington applies to Russia in Ukraine, has not translated into a resurgence of its arms trade with Latin America, in which the present economic crisis weighs heavily.

Russia is the second largest arms exporter in the world, after the United States and ahead of France, China and Germany. For its part, Latin America constitutes a large market that during the economic 'boom' of its 'golden decade' (2004-2014) notably increased its purchases Issue , especially in its first five years. Coinciding this, in the political sphere, with the so-called 'Bolivarian cycle', this increase of the military expense gave priority to Russia as provider, which occasionally surpassed the United States as the main arms supplier to the region, thanks mainly to the orders from Hugo Chavez's Venezuela.

After the economic boom period, however, total arms acquisitions declined. If in 2010-2014 military purchases by Latin America accounted for 10% of global arms transfers, in 2015-2019 they fell to 5.7%, representing a 40% drop between the two periods.

SIPRI 's latest report refers to the most recent 2017-2021 timeframe, which has been the five-year period with the fewest arms purchases in the last half-century in the case of South America. In 2017-2021, arms imports from South American countries fell by 55%, marking an accentuation of the trend, fully in line with the economic downturn: the end of the commodity supercycle was followed by the pandemic crisis and, in its aftermath, the problem of high inflation has spread.

In recent years, only Brazil has maintained a substantial expense , albeit in the issue 33rd place in the world and with a 17% drop compared to the previous period (although it has pending the submission of 1100 armored vehicles, 5 submarines, 4 frigates and 31 combat aircraft), followed by Chile, with an increase of 16%. The former accounted for 37% of the arms imports carried out in South America, and the latter for 21%.

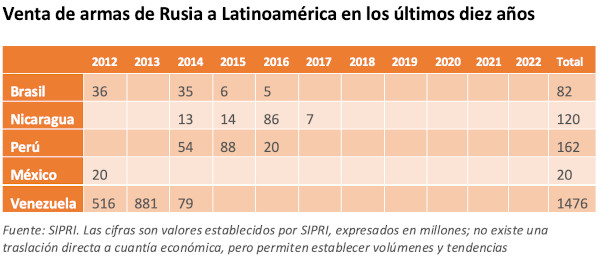

The drop in arms imports has been accompanied by a decline in Russian prominence in Latin America. Since 2017 no country in the region has purchased Russian arms, and in 2017 only Nicaragua did, already below its previous purchasing volumes. In 2015 and 2016 there were only three buyer countries: Brazil, Peru and Nicaragua. Venezuela's last acquisitions were in 2014, while Mexico's were in 2012. In 2015-2019 Russia made only 0.8% of its exports to Latin America - returning to the reduced level prior to the boom already described - and has not made any more since then. In their dwindling purchases, Latin American countries have kept other suppliers.

Russia's global sales performance

The Covid-19 crisis and the Russian invasion of Ukraine have shaped the dynamics of international trade, including arms sales and purchases. Following the pandemic, Russia's GDP fell from $1.69 trillion to $1.47 trillion, while the public expense on defense fell from $65.2 billion to $61.71 billion, down 9.49% and 3.94% respectively. Although the Russian Economics has been hurt by the war, it pushes to an increase of the militaryexpense , which already in 2021 grew by 2.9%, reaching $65.9 billion.

It remains to be seen how international sanctions affect the Russian military industry, as Russia is finding ways to offset their negative impact by increasing trade relations with several countries in the Middle East and Asia. The need for supplies for its own Army in Ukraine, which conditions the current Russian production of military equipment, limits its export capacity; however, there are weapon systems that exceed Russian urgencies on its fronts and from the export of which a revenue-starved Economics can feed.

Between 2017 and 2021, just before the start of the invasion of Ukraine in February 2022, Russia's arms exports decreased from the 24% they accounted for globally to 19% in 2011-2016. Its sales were concentrated in four countries (India, China, Egypt and Algeria), which accounted for 73% of its transfers. 61% of its exports went to Asia and Oceania, 20% to the Middle East, 14% to Africa and almost 5% to Europe (in the case of Latin America, in that period there were only Russian arms sales in 2017, to Nicaragua).