In the picture

Evolution of the Bimbo logo, business multinational company from Mexico.

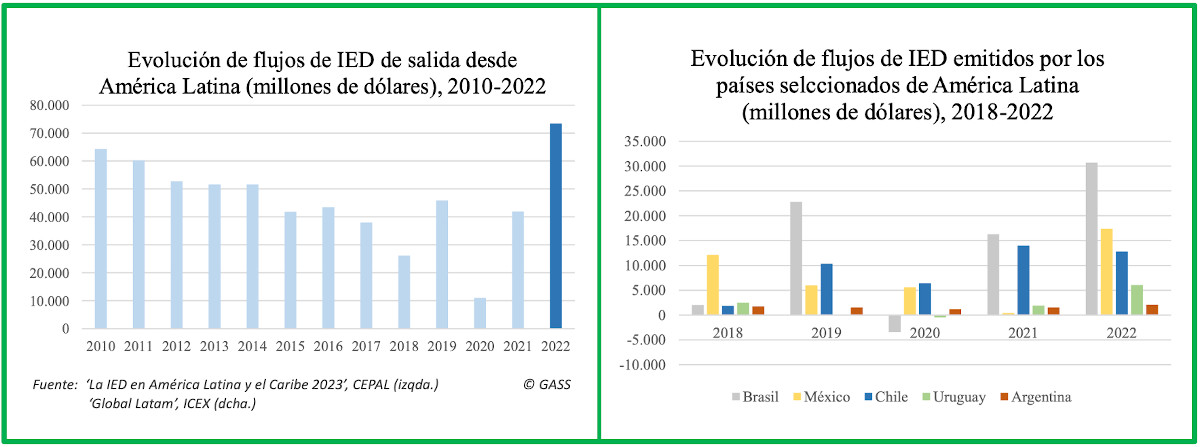

The large transnational companies in Latin America - known as multilatinas - have emerged strongly from the difficult status period of the pandemic. After almost ten years of progressive reduction in the flow of foreign investment, in 2022 foreign direct investment from Latin American countries reached an all-time high, with an 80% increase over the previous year. The data still to be known for 2023 will indicate whether this is a rebound from the containment during the pandemic crisis or whether it consolidates an upward trend.

Latin America and the Caribbean were particularly hard hit by the Covid-19 health emergency. It was the world region with the highest incidence of death from the pandemic in relative terms and recorded a 7% decline in GDP, barely offset by a 7.3% growth in 2021. Contrary to what might have been anticipated in a complex global political and economic context, 2022 was a positive year for the Latin AmericanEconomics . The region experienced growth of 4.1%, higher than the global average. In addition, Foreign Direct Investment (FDI) from entrance in Latin America showed a significant rebound, reaching a record US$224.579 billion, 55.2% higher than that documented in 2021.

However, if there is one indicator that deserves special attention in the region, it is outward FDI. Latin American companies invested more abroad in 2022 than ever before, reaching unprecedented levels: US$74.677 billion. This amount represented an 80% increase over 2021, thus exceeding the amount invested that previous year by more than $30 billion. These operations are in addition to the investment stock of Latin American and Caribbean companies, which in 2021 was US$741 billion, according to UNCTAD's data .

This took place in a favorable domestic context, as the region was able to benefit from the collateral consequences of the conflict in Ukraine, mainly from the rise in commodity prices, generating additional income in countries exporting energy, metals and food. For their part, central banks were able to anticipate rising inflation in 2021. The rise in interest rates resulted in two positive trends: the strengthening of regional currencies (essential for the internationalization of companies) and the credibility of monetary policies.

However, without underestimating the levels achieved in outward FDI, these figures should be placed in the global context, as they represent less than 3% of global FDI flows. Moreover, only in the light of the investment made in 2023 will it be possible to determine whether we are in an upward cycle: forecasts of lower economic growth in Latin America for this year and 2024 - around 2.3% according to the IMF - do not point to any particular momentum.