In the picture

network Central American regional electricity connection [business Propietaria de la network]

The Central American electricity interconnection project is 25 years old and is doing so in a global context of sharp increases in electricity consumption prices and disruptions in distribution, aspects that precisely highlight the advantages of regional integration of national markets, as in the case of Central America. The System of Electrical Interconnections of Central American Countries (SIEPAC) recorded record exchanges in 2019; in 2020 the figure fell due to the pandemic, but the imbalances introduced by the pandemic demonstrated the convenience of connections with their neighbours for the countries with the greatest deficits.

In December 1996, six Central American countries (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Panama) signed the Treaty framework of the Central American Electricity Market, an idea that was based on previous binational connections and which in 1987, with the support of the Inter-American Development Bank development (IDB) and especially Spain, began to take serious steps towards its materialisation. The System of Electrical Interconnections of Central American Countries (SIEPAC) allowed the creation of a regional electricalnetwork of 1,800 kilometres, from Guatemala to Panama, which is owned by a consortium of national companies, with the participation of foreign investment; the first section came into operation in 2010 and the last one in 2014.

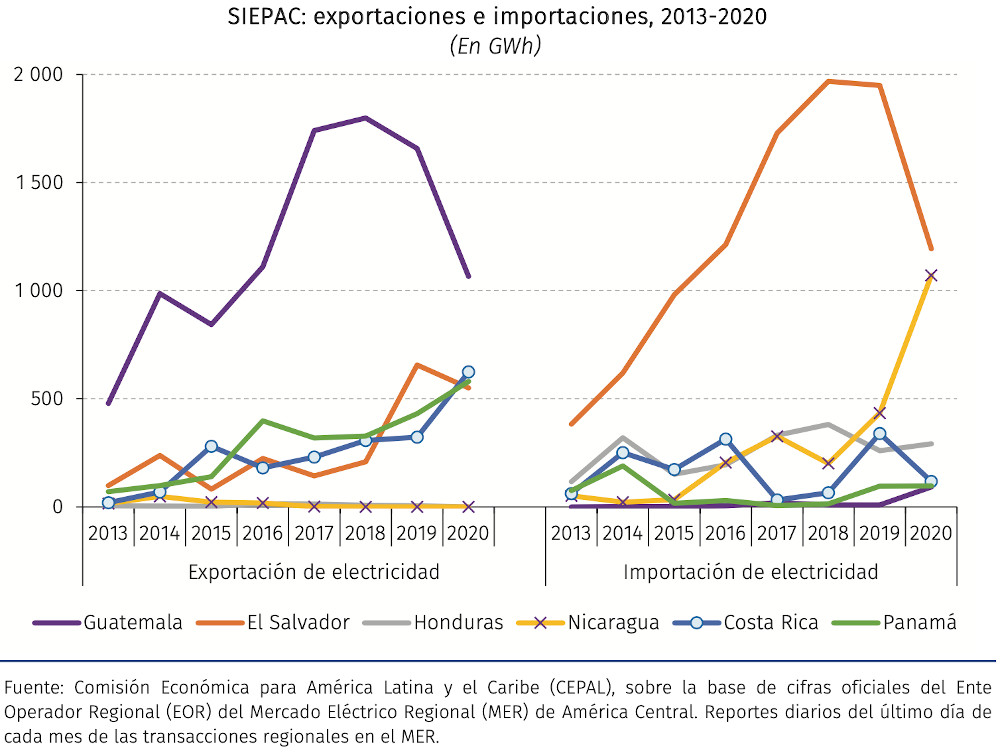

agreement The system has helped to significantly improve the figures for the region's electricity sector: in fifteen years, installed capacity has doubled (from 9,014 MW in 2005 to 18,507 MW in 2020) and annual generation has grown by 50% (from 34,374 GWh in 2005 to 51,521 GWh in 2020), according to a recent ECLACreport . In that time, the international purchases and sales of the signatory countries of the treaty have increased sixfold: from a total of 1,122 GWh in 2005 (half exports and half imports), by 2020 the transnational movement has increased to 7,130 GWh (exports of 3,095 GWh and imports of 4,034 GWh), mostly in the framework of SIEPAC exchanges.

In its evaluation of the functioning of SIEPAC after 20 years of the Treaty, the IDB highlighted that the economic benefits obtained by the signatory countries as a result of transactions in the regional market had been between June 2013 and December 2015, the period that included the full implementation of the network, of USD 305 million: a net benefit of USD 132 million after discounting the charges and credits associated with the energy flows transferred to cover or remunerate the transmission service and the costs of investment, maintenance and operation of the infrastructure. Previous simulations had indicated that SIEPAC would have a positive effect on regional GDP of around 0.3% compared to a scenario without integration. The IDB pointed out, however, that the benefit of project would only occur "as Degree integration increases, determined by the level of coordination of generation expansion planning and regional operation, with the greatest benefits occurring in the case of high demand growth".