In the picture

Paraná River, in August 2021, affected by drought [Euronews].

In a context of increasingly frequent extreme weather events, in 2023 South America experienced for the third consecutive year a severe drought, the worst in a century. Argentina and Brazil, two of the world's largest granaries, have faced the consequences of a triple La Niña episode. The role of Brazil and Argentina in global food supply highlights the need for a strategic and sustainable approach to address the emerging challenges of climate change on food security in the region.

The World Meteorological Organization defines La Niña as a phenomenon that produces a large-scale cooling of the surface waters of the central and eastern parts of the equatorial Pacific, in addition to other changes in tropical atmospheric circulation, affecting winds, pressure and precipitation. It generally has weather and climate effects opposite to those of El Niño, which is the warm phase of the El Niño-Southern Oscillation (ENSO). However, such natural phenomena now occur in the current context of climate change driven by greenhouse gas emissions. This leads to an increase in global temperature average , changes in precipitation patterns, continued sea level rise, reduction of the cryosphere and accentuation of extreme weather patterns. These variations have pronounced consequences in a region as directly related to the natural environment as Latin America.

Argentina

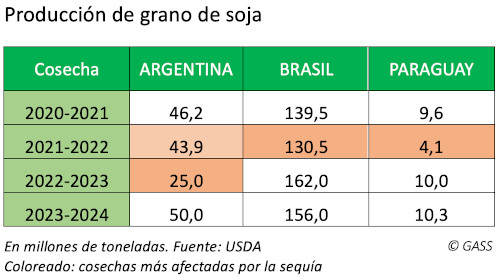

Argentina, the world's third largest soybean producer and exporter behind Brazil and the United States, suffered a historic 43% drop in its crop for the 2022/2023 season compared to the previous season due to drought. In the 2021/2022 season, Argentina produced 43.90 million tons of soybeans, a figure that reached just 25 million tons in the 2022/2023 season. result As a result, the oilseed complex, which includes soybeans, soybean oil and soybean meal, among other by-products, saw its exports decrease. To supply the demand, Argentina bought soybeans from Brazil, becoming the second destination of Brazilian soybeans, after China. The drop in production also had a negative impact on Argentina's position in key markets where the country used to be the world's leading exporter, such as soybean meal, a position it left in the hands of Brazil after 25 years. Between January and August 2023, Brazil exported 15.34 million tons of soybean meal, while Argentine shipments amounted to 11.74 million tons.

The agricultural sector represents around 7% of Argentina's GDP, as well as 55% of its exports. The soybean complex leads the South American country's agricultural exports, followed by corn and wheat. The decline in the soybean harvest had an impact on the country's foreign currency income, which stood at US$ 11.03 billion in the first semester of 2023, a 42% year-on-year drop.

Aware of the vulnerability of its crops to climatic phenomena, in April 2023, the Argentine government launched the Integral Plan Argentina Irrigada, which plans to increase the area under irrigation in the country by 90%. There is no timeframe to achieve this goal; the plan currently includes 95 infrastructure projects. At present, only 5% of the 42 million hectares cultivated in Argentina are under irrigation. In this regard, in September 2023 the Inter-American Bank of development (IDB) approved a credit 100 million dollars to execute rural infrastructure works through the Provincial Agricultural Services Program (PROSAP). The loan obtained for PROSAP will favor the adoption of technologies that promote environmental sustainability, adaptation to climate change, and economic profitability for small and medium-size agricultural producers.

Brazil

Brazil faces similar challenges. La Niña brought more rainfall to the north and northeast of the country and drought to the south, affecting corn, soybean and wheat growing regions. While corn and wheat have limited tolerance to heat, climate stress has a more moderate effect on soybean production. After a drop of about 9% in soybean production in the 2021/2022 season, Brazil harvested a record crop production in the 2022/2023 harvest, representing a 23.1% increase over the previous year. The South American country also achieved record corn production in the 2022/2023 season, positioning it as the world's leading exporter of soybeans and the second leading exporter of corn in 2022.

Agriculture is one of the main instructions of Brazil's Economics , accounting for 6.8% of GDP. In recent decades, irrigation has played a role core topic in the growth of Brazilian agriculture, with 54% of the country's water consumption going to irrigation systems. However, decreasing precipitation, longer dry periods and warmer temperatures resulting from climate change are expected to increase water evaporation fees , reducing both surface and groundwater availability . This reality raises serious concerns about the long-term sustainability of irrigation systems, highlighting the urgent need for adaptive and sustainable strategies to ensure water security and resilience of the agricultural sector in the face of emerging climate challenges.

Heat waves in Brazil are increasingly frequent, threatening the physical integrity or even the lives of Brazilians. In 2023, the country experienced an intense heat wave that affected several cities, with record temperatures and extremely high thermal sensations, reaching 58.5 Degrees Celsius in Rio de Janeiro. According to the World Bank, extreme weather events - such as droughts, flash floods and overflowing rivers in cities - cause annual losses in Brazil of around R$13 billion a year. Added to this are the challenges of deforestation in the Amazon, which recorded a net loss of forest mass of 430.4 km2 in January 2022 alone. After an acceleration of deforestation in the Amazon during Jair Bolsonaro's government, logging was reduced by 33.6% in the first semester of 2023. The above effects underscore the need for policies that help mitigate the adverse impacts of climate change and safeguard the country's environmental and economic future.