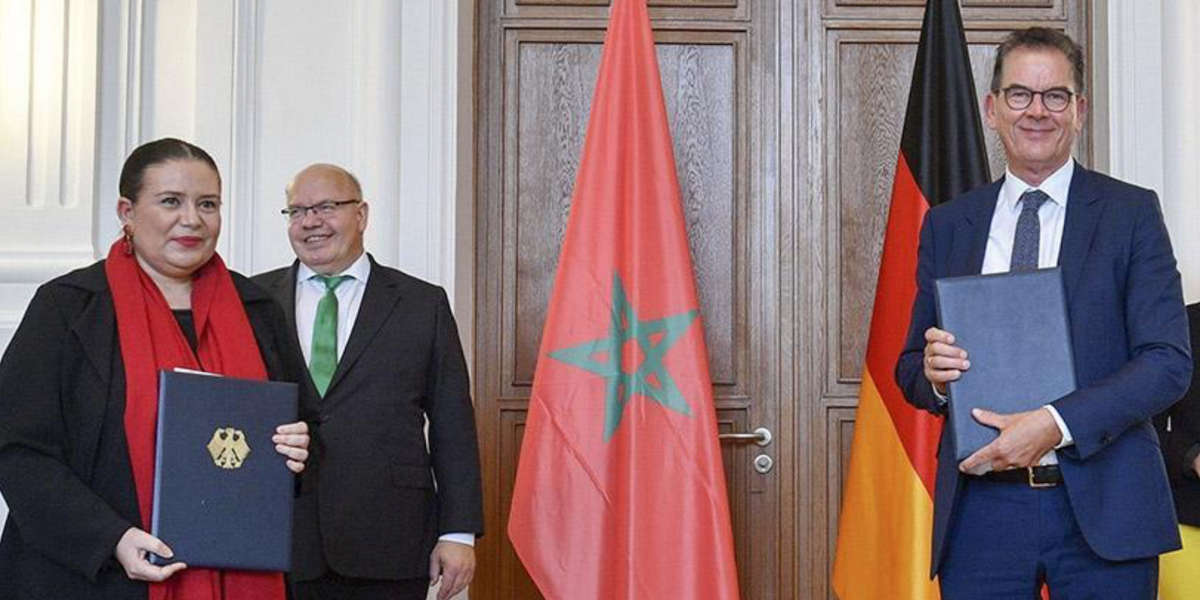

In the picture

signature in Berlin in June 2020 of the agreement on green hydrogen, between the Moroccan ambassador and the German minister of development [Gov. Morocco].

The last two months have seen Morocco and Germany rebalance their relationship, with significant signals from both sides. The new German government, led by Social Democrat Olaf Scholz, opened in mid-December by accepting the formula of autonomy for Western Sahara; in early January President Frank-Walter Steinmeier invited King Mohammed VI to Berlin, and two weeks later the Moroccan ambassador returned to her post in the German capital. Morocco's pressure worked, and Germany's investment in Morocco's green hydrogen production, on which the Central European power is relying to guarantee its future energy security, has been cut off.

Morocco's ambitious plan to development of its renewable energy capacities, in order to overcome its current energy dependence and in the long term deadline even become an exporter of electricity and hydrogen, intersects, in its need for financing, with Germany's interest in guaranteeing energy security with as little linkage as possible to Russian gas. The war in Ukraine has only given urgency to projects that Berlin was already pushing for. One of them, signed with Morocco in 2020 to study the development of green hydrogen for export, with a German investment in the Maghreb country of up to 300 million euros, has been blocked in the last year by Rabat's diplomatic strategies in relation to the Western Sahara issue. The change in Germany's position, as a result of this pressure and the arrival of a new government, has made it possible to overcome the diplomatic crisis and unblock investments that, after the invasion of Ukraine and the sanctions against Russia, have become particularly important for Berlin.

Morocco is recognised, as the International Energy Agency notes in its report on the country, as a future energy power in the new geopolitics of renewables. report on the country, as a future energy power in the new geopolitics of renewables. Starting from a high energy dependence of 93.6 per cent - the country does not have the hydrocarbon wealth of other Maghreb neighbours such as Algeria and Libya - the reign of Mohammed VI made an early commitment to alternative sources, taking advantage of its abundant wind and solar resources. In 2009 Morocco launched the National Renewable Energy Strategy and the following year its main implementing arm, MASEN (Moroccan Agency for Sustainable Energy), was set up. The country went from producing 1.7% of its electricity from renewables in 2010 to generating 20% in 2020, amid a serious revitalisation of the sector. In 2017, the Moroccan Parliament set the goal target of reaching an installed renewable energy capacity of 52% by 2030, which could even be achieved by 2025. With this purpose, Morocco plans to invest 40 billion dollars over the next 15 years. For the time being, it combines this progress with the fact that in 2020, 68% of electricity was produced from coal.

The country's wind and solar potential is clear. Morocco is located in an area that benefits from a high solar radiation potential of more than 3,000 hours per year, equivalent to about 1,825 kWh per square metre. In terms of wind energy, it has 3,500 km of Atlantic coastline with a wind speed of between 7.5 and 11 metres per second (almost half of which corresponds to Western Sahara, which increases Morocco's interest in securing possession of this territory). Its geographical position close to Europe is also an incentive for the generation of surplus electricity for export, although various logistical aspects would have to be resolved in order to reach the centre of the continent.

Morocco's commitment is also geared towards green hydrogen. A high level of electricity generation through renewables should lead to using part of this power to produce hydrogen without releasing polluting emissions. In January 2021, the country launched its national green hydrogen strategy, which aims to achieve a world market share of 4% by 2030. Morocco is thinking of exports, especially to the European Union, but also of its use in the production of ammonia, which it now has to import for the manufacture of fertilisers from its vast wealth of phosphates (Morocco and Western Sahara account for 70 per cent of the world's reserves).

The report of the International Renewable Energy Agency (IRENA) of January 2022 on the 'hydrogen factor' mentions Morocco as the third largest green hydrogen exporter of the future, behind Australia and Chile (it places Spain in a potential fourth place, but warns that the cost of production may make it less competitive). He also sees it as the third largest producer by 2050. It considers that by 2030, Morocco could supply a local market of 4 TWh and an export of 10 TWh; to do so, it would have to build 6 GW of new renewable generation capacity. This sector could create 15,000 direct and indirect jobs work . Among the countries that will need to import hydrogen, IRENA's report refers to Germany and underlines the importance of the bilateral agreements established between Berlin and Rabat.

Germany is interested

Germany, which has set itself the goal of energy neutrality by 2030 ( goal ), approved its National Hydrogen Strategy in June 2020. In early 2021, it launched the H2Global programme, established a company for intermediation (the Hydrogen Intermediary Network or Hint.co) and has sought agreements with countries with production potential, such as Morocco, Chile, Saudi Arabia and the United Arab Emirates.

In agreement with this strategy, Germany has approached the Rabat authorities with a view to signature a partnership agreement in June 2020. The agreement envisages promote 'X' technologies in Morocco and building the first plant in Africa to apply this technology to the production of green hydrogen. The initiative involves a partnership between German institutions and the Moroccan MASEN; it includes knowledge transfer and a possible association with the Institute for research on Solar Energy and New Energies (IRESEN).

Morocco could meet up to 4% of global demand for Power-to-XX a market that could exceed 600 billion euros by 2050), according to the German Fraunhofer Institute. This is a particularly important potential for synthetic ammonia, the basic ingredient in fertilizers. Morocco currently imports between one and two million tons of fossil-based ammonia each year; that source estimates that by 2030 the country could be producing, through power-to-XX carbon-neutral emissions, the same Issue for domestic use and a similar amount for export.

Despite the attractiveness of the German investment programme, as it allowed Morocco to make serious progress in its goal bid to become a leader in green hydrogen production and gain influence in Europe through its export, Rabat preferred to use it as leverage on Berlin to try to achieve its geopolitical priority - international acceptance of Moroccan sovereignty over Western Sahara - which takes precedence over its energy priority,

Following the Trump administration's recognition of this in December 2020, in exchange for Morocco establishing diplomatic relations with Israel, Rabat has tried to get several EU countries to follow suit and stop demanding compliance with UN resolutions that once called for a referendum of the Sahrawi people to determine their future. France, a country with historic ties to Morocco, has come out in favour of the autonomy formula for the disputed territory, which would remain under Moroccan sovereignty. Paris has referred to Rabat's proposed plan as "a serious and credible basis for negotiation".

Spain, the former coloniser of Western Sahara, insists instead on the validity of the UN's requirements. In an attempt to force a reversal of Spain's position, Morocco facilitated the arrival of thousands of migrants in Ceuta in May 2021. The EU criticised the use of migration as a means of diplomatic blackmail.