Correct policies

If from the period analyzed by the IMF we exclude the 1970s and 1980s, prior to the economic reforms implemented by the Dominican Republic, we have an annual GDP growth rate of 5.2%, which is slightly higher than average . In the last 30 years, there have only been notable slowdowns in 1998 due to the Asian financial crisis and the Russian 'default'; in 2003 due to the banking sector crisis that the country experienced, and in 2020 due to the COVID-19 pandemic.

This growth has its roots in the reforms implemented after the debt crisis suffered by the region in the 1980s, as well as in other subsequent measures, and constitutes a successful example of the macroeconomic orthodoxy and market liberalization introduced by the Washington Consensus.

In 1990, the first major structural reform carried out was the tariff reform, which involved the repeal of the 1968 industrial protection law, one of the central laws of the model Import Substitution Industrialization Law then in force in most of the American countries. This tariff reform was followed by a change in monetary policy by the Central Bank, which applied the "One Currency-One Exchange Rate" criterion, making it clear to investors that, with these changes, the era of subsidies and exchange taxes was over.

Various reforms were also undertaken at subject fiscal goal to encourage foreign direct investment. This was the case of the law regulating the already existing free trade zones, thus providing greater legal certainty to foreign investors.

The next step was the measures aimed at market liberalization, which sought to put an end to the various monopolies that emerged during the Import Substitution Industrialization stage, and to put an end to the large public enterprises that emerged during the Trujillo regime. The reforms began with the introduction of skill in these sectors.

The line taken with all these initiatives, adopted by President Joaquín Balaguer (1986-1996) following the advice of the IMF, the World Bank and other international organizations, was maintained by his successor, Lionel Fernández (1996-2000), who applied a policy of continuity in spite of the more social character he wanted to introduce. Thus, in the period that began in 1996, actions were taken to advance economic stability, liberalization and tax reform.

Beginning in 2000, the greater liberal commitment of the government of Rafael Mejía (2000-2004) led to a second wave of structural reforms, among which the hydrocarbons tax reform and the development of a transparent and simple tax regime should be highlighted. Another major reform was the creation of the Dominican Social Security System, moving from an unsustainable pay-as-you-go system to an individually capitalized system model . He also gave independence to the Central Bank and proceeded to the first major issuance of public debt in the country. Mejía closed his mandate with the signature of the free trade agreement with Central America and the United States (known in English as DR-CAFTA), which was negotiated with great speed and has brought important opportunities to the Dominican Republic.

Rapid growth facilitated improper banking procedures and this led to a banking crisis in 2003 that generated a deficit of 30% of GDP and led to the return to power of Lionel Fernandez (2004-2012) a year later. His success in stabilizing the situation and improving institutional confidence by boosting government transparency led to his re-election four years later. In his second term, he launched an ambitious public investment plan in crucial infrastructure for the Dominican development . Thanks to this and increased revenues from gold mining concessions, the country was able to weather the global financial crisis of the time.

The same political program was implemented by Danilo Medina (2012-2020), also from the Dominican Liberation Party (PLD). Among his most significant measures are the renegotiation of exploitation agreements with foreign mining companies and a more proactive policy focused on achieving energy autonomy, creating several power plants and joining Petrocaribe, Chavismo's initiative to gain influence in the regional environment by supplying oil to credit especially soft. These measures succeeded in reducing the sovereign debt and improved the country's investment attractiveness (eventually the Dominican Republic decided to cancel its relationship with Petrocaribe). At the same time, the government launched an ambitious public investment plan, mainly in infrastructure, which contributed to Medina's re-election.

The turning point came in 2020 with the pandemic, which hit the Dominican economy hard, although the 6.7% contraction in GDP was less of a setback than in most American countries. Despite the strong economic impact of the social distancing measures implemented during the pandemic, especially in sectors core topic of its economy, as in the case of tourism, which accounted for 15.3% of GDP in 2019, the government of Luis Abinader (2020-2024) effectively managed the status, so that in 2021 GDP was able to grow by 12.3%, reaching pre-pandemic levels in a single year. The rapid recovery allowed the country's debt to drop to around 56% in 2023, when in 2020 it exceeded 70%, as indicated by the macroeconomic picture analyzed by the IMF.

Postpandemia

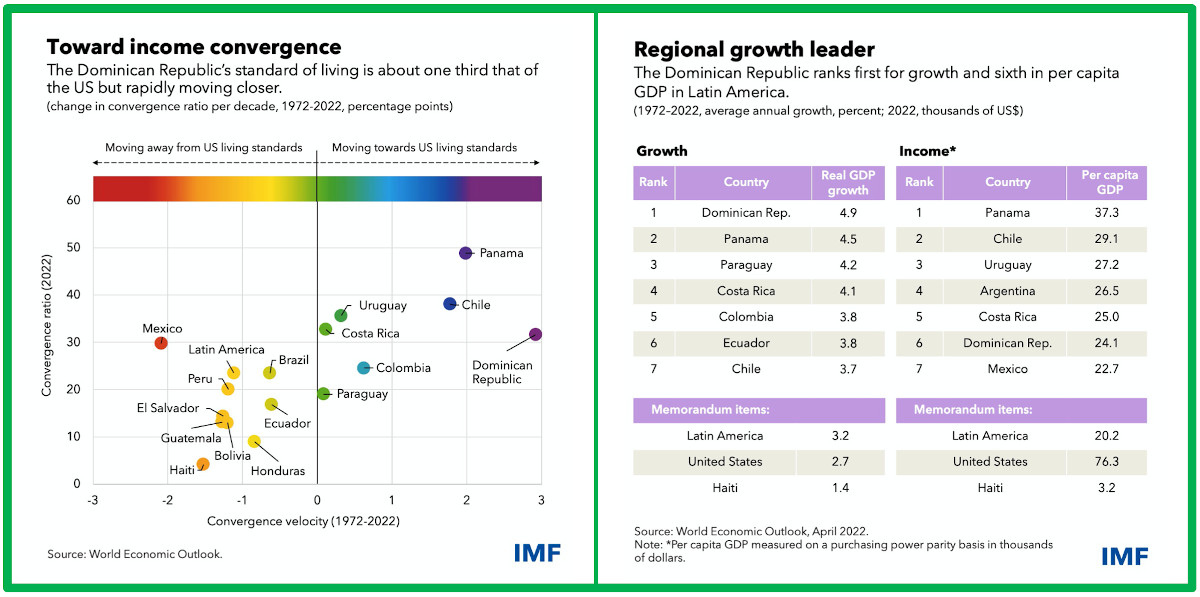

The global economic situation in 2022 and 2023, following the outbreak of the war in Ukraine and the tightening of global financial conditions, caused a general economic slowdown, which as far as the Dominican Republic is concerned led to GDP growth in 2022 of 4.9% and an estimated 3% in 2023. The slowdown had a particular effect on the construction sector as a result of the rising cost of materials due to high inflation in many countries. For 2024, however, the IMF expects growth of 5.2%, which would be maintained in the following years; ECLAC's projection is one point lower, at 4.1%.

The fiscal and monetary measures adopted to overcome the economic and social emergency of the pandemic created a sense of security and increased the attractiveness for foreign capital. The good economic performance may help Abinader's reelection in this year's presidential elections, as polls indicate. However, a change of government -Lionel Fernandez is running again- would hardly mean a change in economic policy: the consensus around the market Economics has been maintained in the last decades and is the reason for the country's progress.

The political discussion rather focuses on whether this progress is merely macroeconomic and benefits the wealthiest sectors or whether the wealth generated reaches a large part of society. The povertyrate has certainlybeen falling - by mid-2023 it stood at 23.4% of the population - a reduction of two-thirds compared to the 1990 value; the Gini coefficient has improved by 25%. At the same time, however, the cost of living is rising for citizens and job insecurity is high, with an unemployment rate of 7.1%.

Geopolitical trends could benefit the Dominican Republic, especially the 'nearshoring' that can be carried out by the US Economics ; in fact, the Dominican 'miracle' has been greatly contributed to by the export processing zones, whose success has been based on a relatively skilled labor force at a low price right at the doorstep of North America.