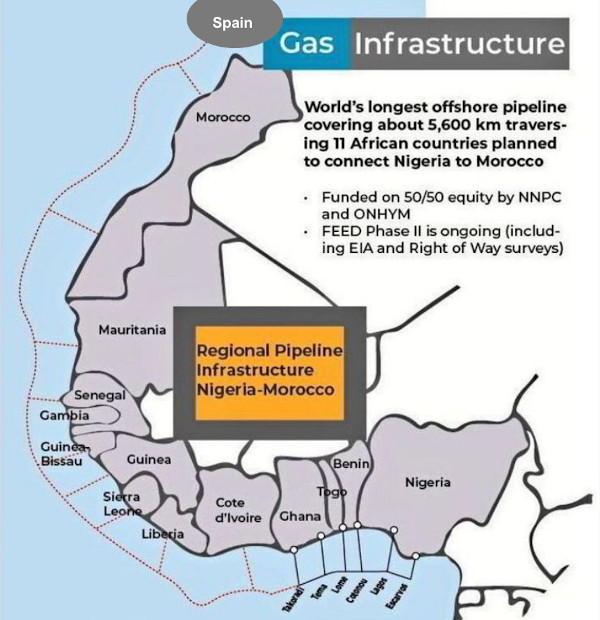

The project is being financed by ONHYM and NNPC, with each party contributing half of the estimated cost of almost 25 billion euros. financial aid Both entities, however, have benefited from financial support from the Organization of the Petroleum Exporting Countries (OPEC), which has contributed 14.3 million euros, and the Islamic Bank of development (IBD), which is partially covering the preliminary programs of study phase.

design In 2022 the Australian-American business Worley was contracted to carry out the front-end engineering design (FEED), which should establish the specific requirements of the project, as well as the approximate costs, in order to safely face the final disbursement for the execution of the project. The general services for this phase are managed from the Netherlands by Intecsea BV, Worley's engineering consultancy service .

Implications in Africa

The gas connection between Nigeria and Morocco brings together the interests of the major African producer and the country which, from the Maghreb, wishes to become an energy supply hub for Europe. Nigeria is the largest hydrocarbon power in Africa; specifically in terms of gas, it has more than 5.66 million cubic meters of exportable reserves. Morocco, on the other hand, is one of the countries with the least natural resources in this area; however, it is making a major commitment to renewable capacities, especially in subject solar energy and green hydrogen, as well as wishing to take advantage of its geographical position as a connector between sub-Saharan Africa and Europe.

In the case of Nigeria, the pipeline could set a great precedent for "south-south" cooperation between different African countries. The bilateral agreement between the two states, in addition to enabling the supply of gas to the countries through whose waters it runs, would also indicate that African states can compete in terms of economic partnership and construction of large-scale infrastructures.

The ambitious project is a great economic opportunity for Nigeria, as it can make its natural resources even more profitable. Strengthening its Economics can help the country deal with serious problems such as Jihadist threats (Boko Haram and ISWAP), armed gangs in the northwest and piracy in the Gulf of Guinea. The construction of the NMGP will provide the country with a powerful financial capacity to respond to the lack of security and reduce violence on its territory. On the other hand, in the international framework , the fact of co-leading this project, as well as controlling the export of a strategic resource such as natural gas, is always an interesting asset to gain weight in any negotiation with regional and international actors.

On the other side of the pipeline, Morocco would strengthen its new role as an energy hub in the region. The Alawi kingdom is leading on two fronts in terms of energy innovation. First, it is advancing in the field of renewable energies, particularly in terms of solar energy and green hydrogen. It was in 2009 that Morocco began developing the National Renewable Energy Strategy in order to take advantage of its wind and solar resources. In 2017 Morocco set out to reach an installed renewable energy capacity of 52% by 2030, and in terms of green hydrogen it aims to become the leader in energy production through electrolysis. Secondly, the African Atlantic Gas Pipeline will make it possible to control the export of energy to southern European countries.

The Moroccan development is not only limited to the energy sector. The North African country has carried out different measures such as the creation of Casablanca Finance City (CFC), where more than 200 companies benefit from tax advantages while producing wealth in the region. Another example is that this country hosted the annual meetings of the World Bank and the International Monetary Fund (IMF) in Marrakech last October. As a result of this development, Morocco can enhance its position as the main African financial center. group In fact, in March, the Financial Action Task Force (FATF) removed Morocco from its gray list by including South Africa. This list is relevant, as the accredited specialization of a country on it implies that it does not comply with one or more of the FATF's 40 recommendations. Morocco is therefore emerging as an energy hub as well as a regional financial center. Both spheres are expected to favor each other, so that the state of Mohamed VI will become a continental power in the coming years.

As for third countries in the region, the construction of this project could mark a turning point in the relationship between Morocco and Algeria. The two countries have always maintained a shifting diplomacy between détente and rivalry. That is why the conflict in Western Sahara between the Polisario Front and the North African monarchy serves to determine the current state of relations. It should be mentioned that Algeria collaborates directly with the Polisario Front, a political party that rejects Moroccan claims in the region; as a result of the growing tension, Morocco and Algeria broke diplomatic relations in 2021. So the construction of an oil pipeline that could rival the Algerian-controlled Maghreb-Europe pipeline could end up weakening relations between the two regional powers. Morocco's rise as a leader in the area may heighten tension between the two countries, since historically, a position of asymmetric vulnerability of one vis-à-vis the other has tended to reinforce rivalry.

In this context, if Nigeria continues to collaborate with Morocco, it will find its historical alliances totally at odds with its current economic interests. Since, the visit of King Mohamed VI to Nigeria in 2016, the latter country has been moving closer to the Alawite kingdom and away from the Polisario Front (and thus Algeria). One can expect that, if this diplomatic line is followed, Nigerians will increasingly support Morocco's territorial integrity in Western Sahara.

This rivalry in North Africa also extends to the field of energy infrastructures. Algeria is proposing an alternative to the NMGP to carry Nigerian gas to the Mediterranean. It is the project Trans-Saharan Gas Pipeline(TSGP), a 4,128 kilometer project with the capacity to transport 30 billion cubic meters per year, which would connect with the Maghreb-Europe Gas Pipeline, which links Algeria with Spain, and with the one that links it with Italy, a country with which it has strengthened energy cooperation.

Although the TSGP route is more complex because it has to cross the particularly conflictive area Sahel and the plan itself has taken few steps, the prospect of Nigerian gas has boosted the project Hybla, which would materialize the partnership between the Italian business Sasol and the Algerian energy company Sonatrach. The aim would be to produce hydrogen (blue hydrogen) and synthesis gas through gas imported from Nigeria in an infrastructure in Sicily. This duality of energy projects not only pits Morocco against Algeria, but would also force the EU to choose between Italy or Spain to take the lead in importing Nigerian gas.

Implications for Europe

The energy dependence of most of the countries of the European continent is well known. This advantage has been used on more than one occasion in political and economic terms by external states. source To such an extent that in 2020 more than 50% of the gas needs came from the same status . status After the outbreak of the Russian-Ukrainian war and the ups and downs of Algeria (which depend on its momentary relationship with Morocco) Europe finds itself in a situation of need and could see the African-Atlantic Gas Pipeline as an opportunity to diversify its suppliers. In particular, Spain and Portugal are suffering, first hand, from the uncertainty of depending on Algeria. The possibility of turning the tap off to Morocco and, above all, of having a branch line to take Nigerian gas to Cadiz (from there the gas could continue through national connections or take advantage of Spanish LNG plants to be shipped to the rest of Europe) would generate security in the energy market of southern Europe, by reducing dependence on the Algerian state and diversifying gas importers. This liberation could be an important factor to take into account in the face of the Western Sahara conflict.

In relation to the Iberian country and Morocco, they maintain a stable relationship that, due to conflicting positions on challenges such as the Western Sahara crisis or immigration, have suffered several cyclical crises. In the 1990s the term "cushion of interests" was coined to describe the creation of multiple relations between both actors to counteract those points where Spain and Morocco have always clashed. It is true that the aforementioned doctrine has been insufficient to prevent diplomatic crises between both kingdoms, but the possibility of offering Morocco to export gas coming from Nigeria could bring the former closer to Spain, in order to be able to take joint decisions on those latent challenges such as immigration or military cooperation. The decision of the Spanish Prime Minister, Pedro Sanchez, to agree to recognize the jurisdiction of Mohamed VI over Western Sahara is part of this line of détente through the partnership. It is a move that not only pleases the neighboring country, but also facilitates the laying of the NMGP underwater gas pipeline, which will have to pass through waters currently administered only by Morocco.

In addition, the pipeline would be an opportunity to further strengthen ties between Nigeria and Spain. In 2022 the President of Nigeria, Muhammadu Buhari, visited Madrid and signed a joint declaration on subject economic, energy, migration cooperation, maritime security and the fight against terrorism. The African country is one of Spain's main suppliers of oil and natural gas, so increasing export capacity through Morocco can only benefit the Iberian country given the current energy status . Likewise, Nigeria will benefit from Spain's international partnership in terms of security and terrorism prevention.

However, the EU's foreign policy chief, Josep Borrell, has expressed his doubts about the significance for Europe of the gas connection with Nigeria, since the estimated 25 years of construction seem sufficient for the EU to have achieved the desired ecological transition.

Conclusion

For all the above reasons, the Atlantic gas pipeline, which will branch out into a multitude of Atlantic African countries until it reaches Morocco, may have significant consequences in the region and affect other actors such as the EU and Russia. Despite the difficulties for its construction and the long period of time needed to complete the work, it is a project followed with attention by the affected states.

The African-Atlantic Gas Pipeline would benefit Nigeria at subject economically, by being able to obtain a high return on one of its main natural resources. The use of this financing could strengthen a state that is facing serious security problems. For Morocco, this project would enable it to consolidate its position as a strategic energy center and advance in its desire to become a regional financial power. subject It would not only be decisive in terms of economic benefits, but would also constitute a victory over Algeria, its main geopolitical and now energy rival.

However, this new relationship favored by the construction of the pipeline would shake the status quo in North Africa, since Algeria would suffer the consequences of having skill in the gas export market. The Algerian response could materialize in the form of increased diplomatic pressure, as well as in the Western Sahara conflict, where Morocco is being strengthened by the rapprochement of Spain and Nigeria. It will be core topic the role of the latter country which, due to the gas pipeline, finds its interests divided between the two fronts of the conflict.