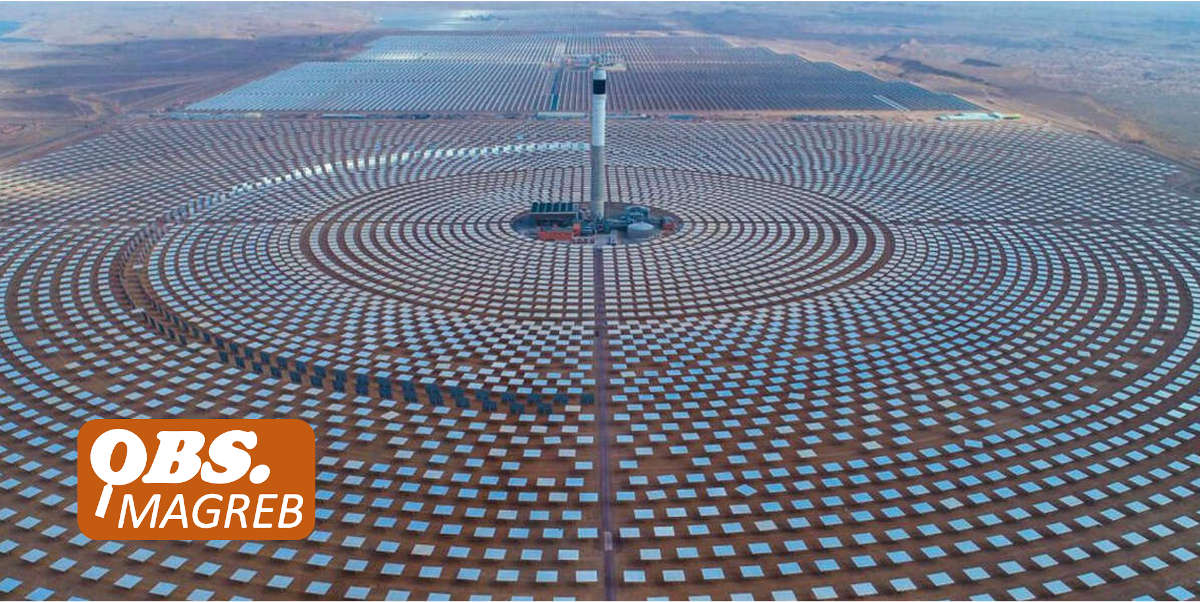

In the picture

The Noor Ouarzazate solar park in central Morocco [MASEN].

In the last decade, Morocco has been seeking to strengthen its international image in order to present itself as a climate leader in North Africa - and partner , which is close to the European Union in the energy transition due to its geographical proximity - through its ambitious renewable energy projects. The Alawi kingdom's major energy transformations are a strategic factor in the country's economic development , which still imports more than 90% of its energy needs. With

To reduce its energy dependence, in 2009 the Maghreb country adopted the National Renewable Energy Strategy with the goal of increasing the share of electricity capacity from renewable sources to 52%, thus becoming a benchmark for energy transition in North Africa and atrans-Mediterranean hub. Although the plan drove a strong expansion of both wind and solar power, Morocco did not meet its 2020 goal , with its installed renewable energy capacity reaching just 37% that year. While the North African country missed itsprovisional 2020 goal , the market is now on track to meet its 2030 goal , according to a recent report by consultancy Ernst & Young. By 2030, Morocco is aiming for 52% of installed generation capacity to be renewable, a breakthrough for which Rabat is seeking financial aid from partners such as the United Kingdom and investment from the European Union. For the time being, it combines this progress with the fact that in 2021, 37% of its electricity was produced from coal.

Among Morocco's ambitions is the Noor Ouarzazate solar park, the world's largest concentrated solar thermal power facility, with 580 megawatts (MW) of installed capacity, owned by the Saudi fund ACWA in a consortium with the Moroccan business Masen. The complex extends over 3,000 hectares and consists of four solar power plants using different technologies. The first phase of project was commissioned by a consortium of the Spanish companies Acciona, Sener and TSK. The Noor I plant has 160 MW of power generated using parabolic trough technology. Sener was in charge of the construction of the second and third phases, which include the Noor II plant, also equipped with parabolic trough mirrors, and the Noor III plant, consisting of a central tower with heliostat fields. Meanwhile, the Noor IV plant uses conventional photovoltaic cells. The financial support ofEuropean institutions has been essential for the infrastructure at development , with funds amounting to 60% of the total cost of the plant.

Morocco's partnership with Europe on subject renewable energy is already materializing, with the Alawite kingdom aiming to export green electricity to the United Kingdom by 2030 via an undersea cable thatwould stretch 3,800 kilometers (km) across the territorial waters of Portugal, Spain and France. The initiative, dubbed the "UK-Morocco Power Project," would harness power generated at a 1,500 km2 photovoltaic and wind power plant located in Morocco's Guelmim-Oued Noun region to supply electricity to the UK via four high-voltage direct current (HVDC) submarine cables. According to the projections of Xlinks, the British business in charge of executing the project, the mega facility - which foresees a capacity of 10.5 GW per year - could meet 8% of the UK's electricity needs. The project also envisages the construction of an energy storage battery facility with a capacity of 20 gigawatt hours (GWh), with financial support from energy technology pioneer Octopus Energy Group and German consultancy Conenergy. The viability of project has been questioned due to the electrical losses associated with the submarine cable, estimated at 13% by Xlinks.

Given the length of the submarine cable, the project faces major challenges to its successful execution. Xlinks' subsidiary, XLCC, will be at position to manufacture the cable and build a specialized vessel to lay, lift and maintain the subsea cables. HVDC technology does not present a novelty, but the length of the subsea cable intended to be built for this project exceeds that of any existing HVDC subsea cable. The longest submarine power cable currently stretches only 720 km between the UK and Norway, barely a fifth of that planned for the project with Morocco. Adding to this challenge is the slow pace of discussions between Xlinks and the UK government, which must guarantee that consumers will pay a fixed price of £48 per megawatt-hour (MWh) for the power delivered.

Advantages and obstacles

Morocco is located in an area that benefits from more than 3,000 hours of solar exhibition per year, with an irradiation of more than 5.6 kilowatts (KW) per hour. As for wind energy, it has 3,500 km of Atlantic coastline with a wind speed of between 7.5 and 11 meters per second (almost half of this extension corresponds to Western Sahara, which increases the Moroccan interest in securing possession of this territory). In addition to the natural and geographical advantages already available to the country, there is an investment of 130 million dirhams, the equivalent of 13 billion dollars earmarked for green energy. In addition, the Moroccan renewable energy market continues to attract foreign investment, with theDutch business Lekela Power being one of the latest players to demonstrate its intention to enter the growing clean energy market in the Alawi kingdom. Similarly, Morocco is the first country to sign the association Green with the European Union. While the agreement seeks to strengthen cooperation in the fight against climate change, advance energy transition projects and stimulate green Economics , it is sample of European interest in the Moroccan renewables market.

While its geographical location is a great advantage for renewable energy production, one of the main challenges facing Morocco's energy transition is to reduce the use of coal as an electricity source source . In 2020, coal accounted for 68% of the electricity produced in the country. Despite its efforts towards decarbonization, Morocco remains tied to electricity production from coal. In 2020, ONEE, the main electricity operator in the country signed a agreement with the 2,056 MW Jorf Lasfar coal-fired mega plant to buy its entire production until 2044. Built in 2014 with financing from the Emirati Taqa fund, the Jorf Lasfar plant covers nearly 40% of Moroccan electricity demand. However, true to its green ambitions, at COP26 in Glasgow Morocco was among the 20 countries committed to no longer building coal-fired power plants. More recently, the North African country pledged to increase the share of green energy in its mix to 70% by 2040 and 80% by 2050, one of the highest targets compared to its regional peers.

Green hydrogen ambitions

Morocco has now added another ambitious goal to its energy diary : it aims to become the world market leader in green hydrogen production. Morocco launched its national green hydrogen strategy in January 2021, betting on its production from electrolyzers with renewable energies. Given Morocco's potential to generate large amounts of solar energy required for the production of this clean energy source , European countries - especially Germany - have bet on the Moroccan energy transition. sample of the foreign push in the sector is the Germany-Morocco Hydrogen agreement . Signed in Berlin in June 2020, the agreement provides for the Federal Republic to support Morocco in the construction of a green hydrogen production plant of 10,000 tons per year financed by the German Bank of development (KfW). The agreement was stalled in 2021 as result of Morocco's suspension of diplomatic relations with Germany due to Berlin's stance on Western Shara. As Germany aims to reduce its dependence on fossil fuels in the wake of the Russia-Ukraine war, green hydrogen is of particular interest to it. In October 2022, the German Embassy in Morocco reported that Germany will support Morocco with a financial aid 38 million euros for the construction of the first green hydrogen plant on the African continent in the Maghreb country.

Despite this progress, there is still a long way to go before Morocco is in a position to export green hydrogen. The production of this hydrogen is made from green energy and water. Hydrogen is produced from the two components with the electrolysis process financial aid , but about 40% of the energy of the electricity used is lost. First, Morocco must produce much more electricity from renewable sources than it does today. In 2021, only 7.58% % of all electricity produced came from solar panels, 13.37 % from wind power and 16.14 % from hydropower.

On the other hand, the Maghreb country lacks the water needed for hydrogen production, which stands at 9 liters of water for one kilogram of hydrogen. Many regions of the country are already struggling with water shortages, giving rise to discontent and despair in agriculture-dependent Morocco. For this reason, Morocco is building 20 desalination plants in various regions of the country, hoping to reach more than one billion cubic meters per year by 2050. However, these plants will also have to run on green electricity for the hydrogen produced to be truly 'green'.