14/03/2023

Published in

The Conversation

Álvaro Bañón

professor at School of Economics

How is it possible that an entity with 40 years of history, 30 of them without losses, had to be rescued?

First of all, we must remember how a bank's balance sheet works. On the assets side, in addition to its buildings and offices, sample the loans it grants to customers, its investments and its liquidity. On the liabilities side, in addition to capital and reserves, customer deposits and current accounts.

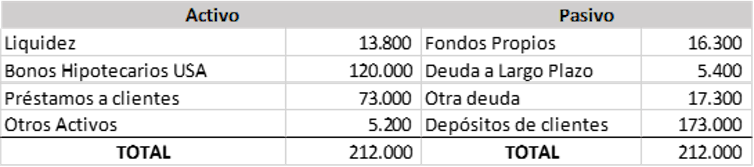

We have to know that when we deposit money in an account or place money at deadline fixed we are lending money to the bank and for the entity it is a liability, an obligation. In a very simplified, but real way (source reservation Federal), the SVB balance sheet on December 31, 2022 was like this:

SVB.

A bit of history

We must go back to 2021. During that year, given the euphoria of investments and cheap money post-covid, the bank captured customer deposits and these rose from $102 billion to $189 billion, according to data of the reservation Federal itself.

This increase in liabilities (remember a bank's balance sheet) was offset by an investment on the asset side of about half in long-term mortgage bonds deadline, in the expectation that interest rates would not rise as much.

But inflationary pressures prompted the reservation Federal to make the fastest interest rate hikes in 40 years. These hikes produced, specifically for the SVB, two lethal effects:

-

Depositors compared and preferred to invest in risk-free 4.5% Treasury bills rather than in a bank deposit with a lower return and higher risk, and withdrew their SVB deposits at an unprecedented speed.

-

When market interest rates rise, long-term bonds deadline lose value, and they lose more value the faster rates rise and the more long-term deadline the bond is. In this case, for SVB these rate hikes have resulted in losses in its portfolio of billions of dollars. Losses that were not realized (at the time), but have been booked.

Thus, depositors began to withdraw large amounts from their accounts (liabilities). Faced with this flight of deposits, the bank, unable to apply for its money to the customers to whom it had lent money at fixed terms, was forced to sell, in order to meet its customers' demand for cash, the bonds (assets) it had bought as investments, but had to sell them at a huge loss. These latent losses materialize, accelerate and the bank is in danger of running out of liquidity.

The Federal reservation has intervened, bailing out account holders and depositors, insuring all their money (beyond the $250,000 guaranteed by the FDIC) but shareholders and bondholders of the bank will not be bailed out.

At this point, it should be noted that when a bank is rescued, its deposit and account customers are rescued. Its shareholders, its owners, are not rescued and lose everything, as is logical. Likewise, neither are those who invested in bonds issued by the SVB. The managers have been replaced and we still do not know at this stage whether the rapid intervention of the Fed will succeed in tackling the problem. But we can already draw several conclusions:

-

Apparently, the managers' mistake has been to finance long term investments with short term money (deposits) deadline (bonds).

-

The banking business is based on trust. What the bank does with our money is to lend it and invest it. When we deposit money in a bank, we are lending it to the bank and the entity, in part, lends it or invests it. That is its function. I have peace of mind as long as I trust that my money is safe.

-

Such a rapid and large increase in interest rates always has consequences.

-

The era of free or almost free money that we have lived through has been a huge distorter of reality and of the risk/return binomial.

At the time of writing this article intervention by the reservation Federal has apparently calmed the markets, but status is volatile to say the least.