03/01/2023

Published in

The Conversation

José Luis Álvarez

Associate Dean of students, School of Economics

Everything is going up, the cost of living has skyrocketed. This phrase sums up the majority feeling of Spanish society in recent months. But is this a new phenomenon in our recent history? We will develop it in detail later, but I can tell you the answer in advance: no, it is not.

What is the cost of living?

Although we are currently suffering the consequences of extraordinary events - a global pandemic and Russia's invasion of Ukraine - concerns about the cost of living have always existed (and will always exist) because we are all concerned about what affects our quality of life.

Can you define the cost of living? Although it is an expression that we see, hear and use quite often, it is not easy to give an unequivocal definition. I confess that I can't do it myself.

However, we will be able to explain what we are talking about.

In a simple way, we understand by cost of living the resources we need to live. You will say to me, and rightly so, how do we live or how we would like to live? We are not going to go into this question here because it would take us down a different path. We will give the common keys to answer the question in either version.

Productivity and pricing

One way to measure the resources needed to live is by the work cost of obtaining them. As a society, this cost has been reducing over time because, thanks to technological advances, we are able to produce more with the same amount of work. This is what economists call the productivity of work.

As productivity increases, the wages of those who work increase and their purchasing power rises.

Another way of measuring the resources needed to live is in terms of the prices of the goods and services with which we cover our needs and tastes. Of course, this approach is related to the previous one. Our standard of living and cost of living will be given by the comparison between our income and the prices we pay in the markets.

But let's focus on prices, since they receive the most attention. In fact, the expression with which I opened this article, that "everything goes up" makes reference letter to the increase in prices or inflation.

Consumer Price Index (CPI)

The CPI is used to measure the evolution of the prices of goods and services whose consumption maintains a certain standard of living. This indicator measures the cost of acquiring a representative basket of consumption by a Spanish household, although it does not include the cost of housing (a clear limitation of this cost-of-living indicator).

In Spain, the high school National Statistics Office collects thousands of data on a monthly basis throughout the country on some 1,000 goods and services that make up the consumption basket. With this information, it calculates the inflation rate, i.e., the rate at which the basket of goods and services is becoming more expensive.

Its composition is updated periodically because consumption patterns change: new products appear, others are no longer consumed and there are changes in quality. For example, in the last update the shopping basket has incorporated subscriptions to online newspapers and eliminated CDs and DVDs. In this way, the cost of living is measured according to how it is lived at any given moment.

The cost of living, according to the CPI, in recent history

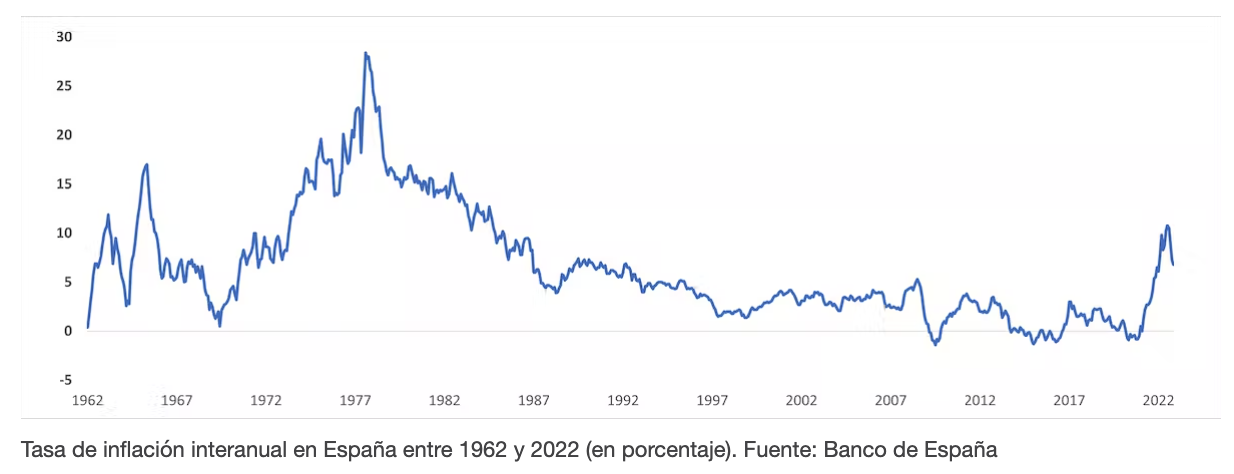

Spain has traditionally had an inflation problem, with continuous increases in the cost of the consumer basket. The most serious episode occurred in the 70s and 80s of the last century, with annual fees increases of over 25%. Even after that period, fees inflation did not fall below 5%. It was not until entrance joined the euro, at the end of the 20th century, that we were able to break that floor and bring fees inflation to acceptable values.

Since then the Spanish Economics has experienced a long phase of price stability; i.e. low inflation fees . Until the current inflationary crisis and since the end of 2012 the inflation rate had not exceeded 3% per year. There have even been moments of falling prices (very infrequent).

And in the two years prior to the pandemic, prices hardly rose at all.

It could be said that we had become accustomed to an environment in which the rising cost of living was no longer a concern. Unfortunately, events have rudely awakened us from this reverie. Little by little, the status seems to be getting under control, but what we have experienced should remind us that nothing should be taken for granted, not even price stability, which will take time to recover.