15/01/2023

Published in

The Conversation

José Luis Álvarez

Associate Dean of students, School of Economics

Inflation, one of the great economic evils, can damage any country's Economics . And also its external competitiveness.

Inflation is unfair

The generalized rise in prices brings with it many problems. The most obvious is the loss of purchasing power. But it is accompanied by other important difficulties, even if our income rises.

Inflation forces us to dedicate resources to defend ourselves from its effects. We have to think about where to put our savings to avoid their depreciation. We have to spend more time informing ourselves about the prices we will pay. Because, when prices dance continuously, it is more difficult to compare alternatives.

Something similar happens for those who sell their products. In an environment of inflation and uncertainty, they often have to decide at what prices to sell. They must also take care to inform their customers, knowing that they will not like these decisions.

All of the above occurs, moreover, in an unfair manner. Inflation hits hardest those who have fewer resources to protect themselves. It also forces us to pay more taxes, even though our real economic capacity has not increased.

Inflation causes inefficiency

In addition to being unfair, inflation makes Economics work worse. Why? Because the signals that the markets transmit to us via prices are more confusing, more uncertain. They complicate our decision-making. These effects are aggravated the higher and more variable inflation is, because uncertainty increases.

In extreme cases of hyperinflation, the results are dramatic and can destroy confidence in money. It is very difficult to trust your currency if you see prices rising every day, as in Venezuela. Or as happened in Ecuador, where they officially replaced their currency, the sucre, with the U.S. dollar to avoid further problems.

Inflation affects external competitiveness

Whenever a Economics suffers inflation, and the consequent loss of efficiency, its external competitiveness suffers. The explanation is simple. When prices rise, customers look for cheaper suppliers elsewhere and, therefore, exports fall.

Let's think about tourism. Suppose a German family wants to go on vacation in the Mediterranean. If they see that prices in Spain have skyrocketed, they might choose to go to Croatia. Spain would lose exports corresponding to expense of that family during their vacation.

Likewise, with rising prices, Spaniards would try to buy cheaper abroad. Imports would then increase and the balance of trade would worsen: the difference between the value of exports and imports would be less favorable for Spain.

How to measure external competitiveness?

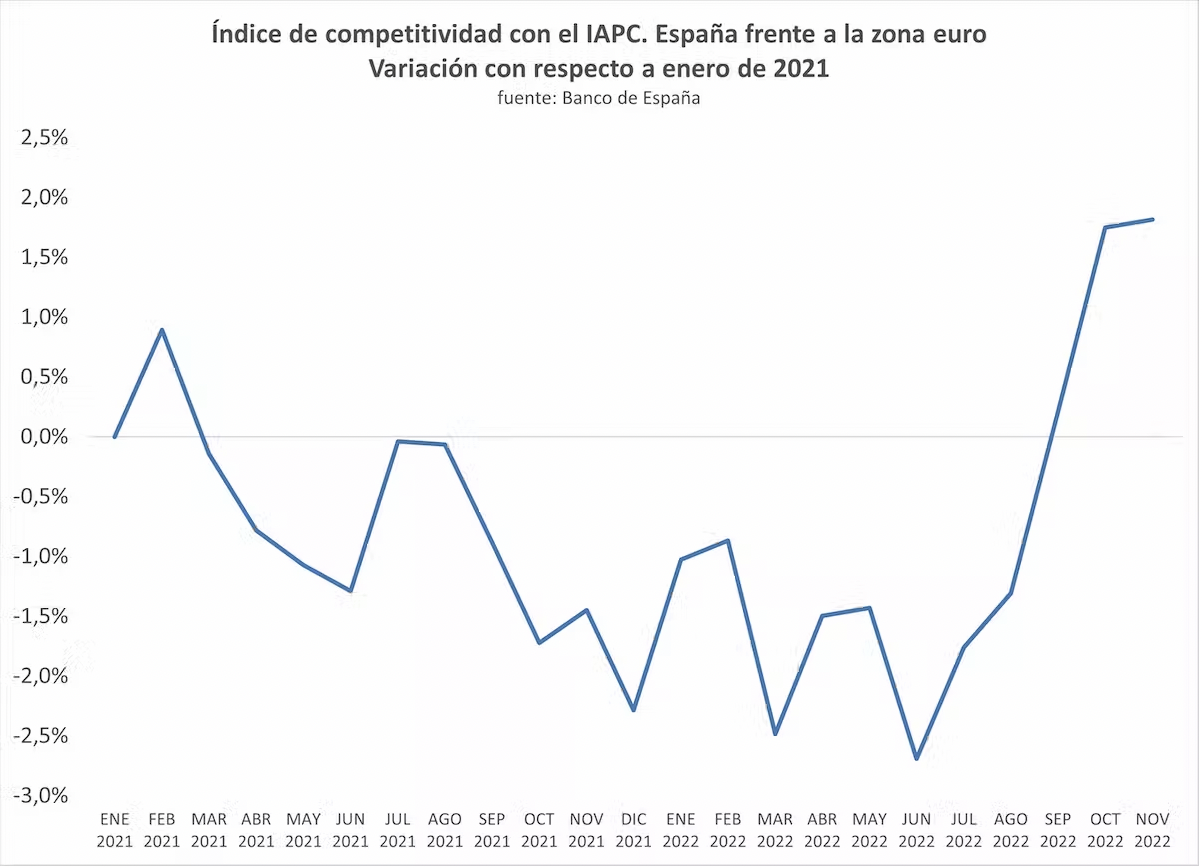

To measure competitiveness, it is not enough to look at inflation. Spain has a high inflation rate, but so do other countries. Right now, without going any further, Spanish inflation is the highest leave of the Eurozone. As consumer prices grow more abroad, Spain would be gaining competitiveness, after months of losses.

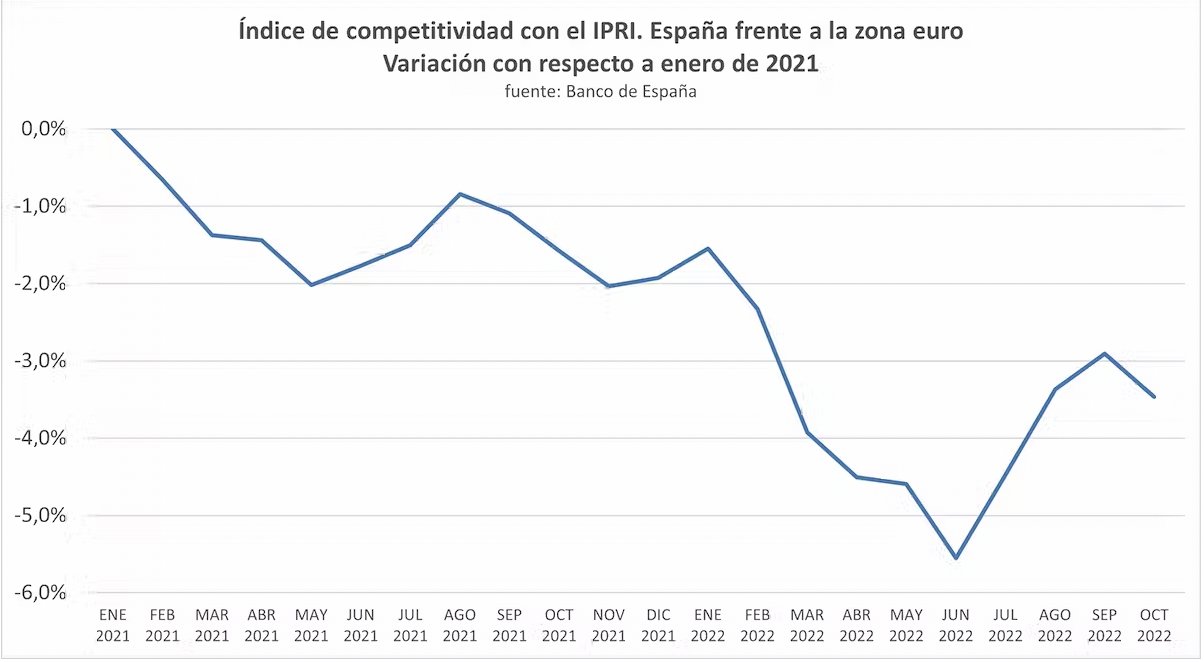

The competitiveness indicator of a Economics simply compares the evolution of inflation inside and outside the country. There are more indexes with which inflation could be calculated to measure the competitiveness of Spanish companies. Such as the industrial price index (IPRI), which measures the sales prices of industrial products at the factory gate.

According to this indicator, with respect to the beginning of 2021, Spanish companies are still losing competitiveness with their Eurozone competitors. This is a good example of how different indicators can give different results. Looking at them all together gives a better picture of what is happening in a Economics.

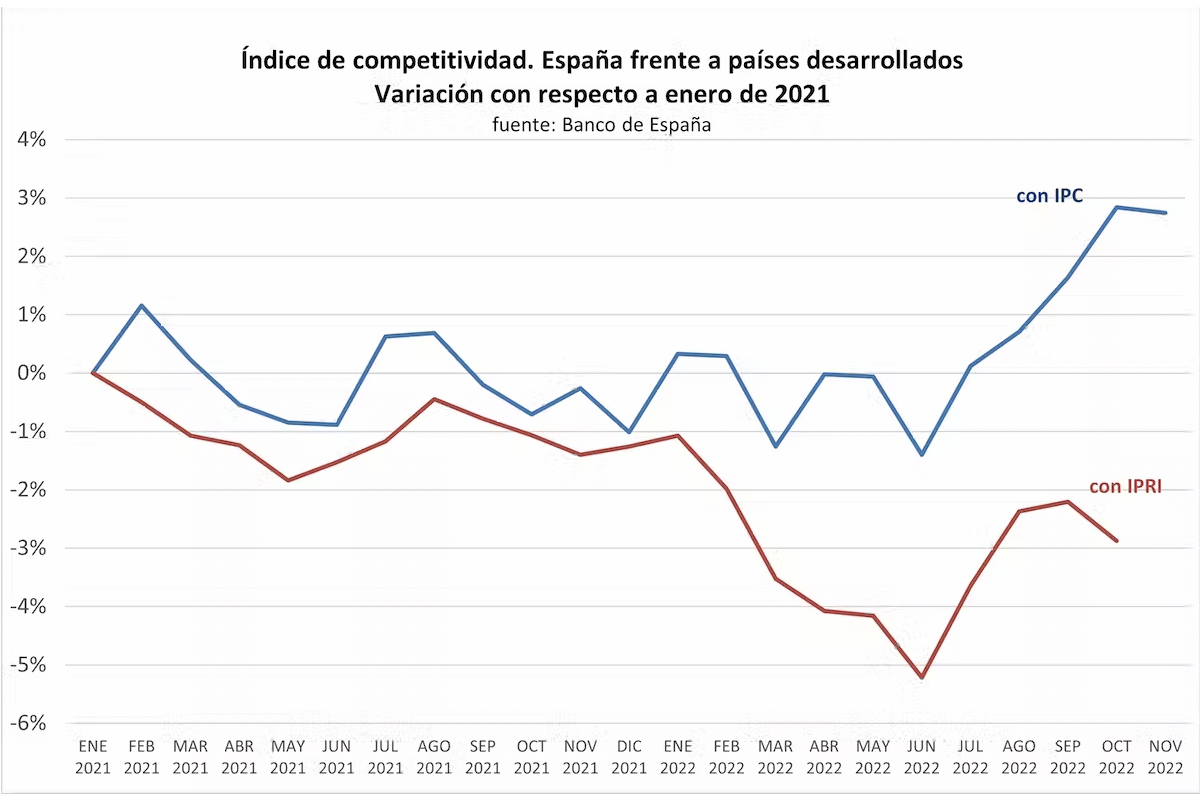

But what if we want to compare Spanish results with those of countries that do not use the euro? In that case, it is not enough to compare inflation levels, but also to take into account what happens with the subject exchange rate.

Let us imagine that the dollar appreciates against the euro. This means that exports will be cheaper for those who pay in dollars. On the other hand, it will be more expensive to go abroad to buy products invoiced in dollars. The result is, therefore, that national products (sold in dollars but produced in euros) gain competitiveness. Thus, by combining fees inflation with exchange rates, we obtain another indicator of external competitiveness.

The graph sample shows that the two versions of this indicator are behaving like the two previous ones. This is because the calculation takes into account the fact that a large part of Spanish trade is with other Eurozone countries.

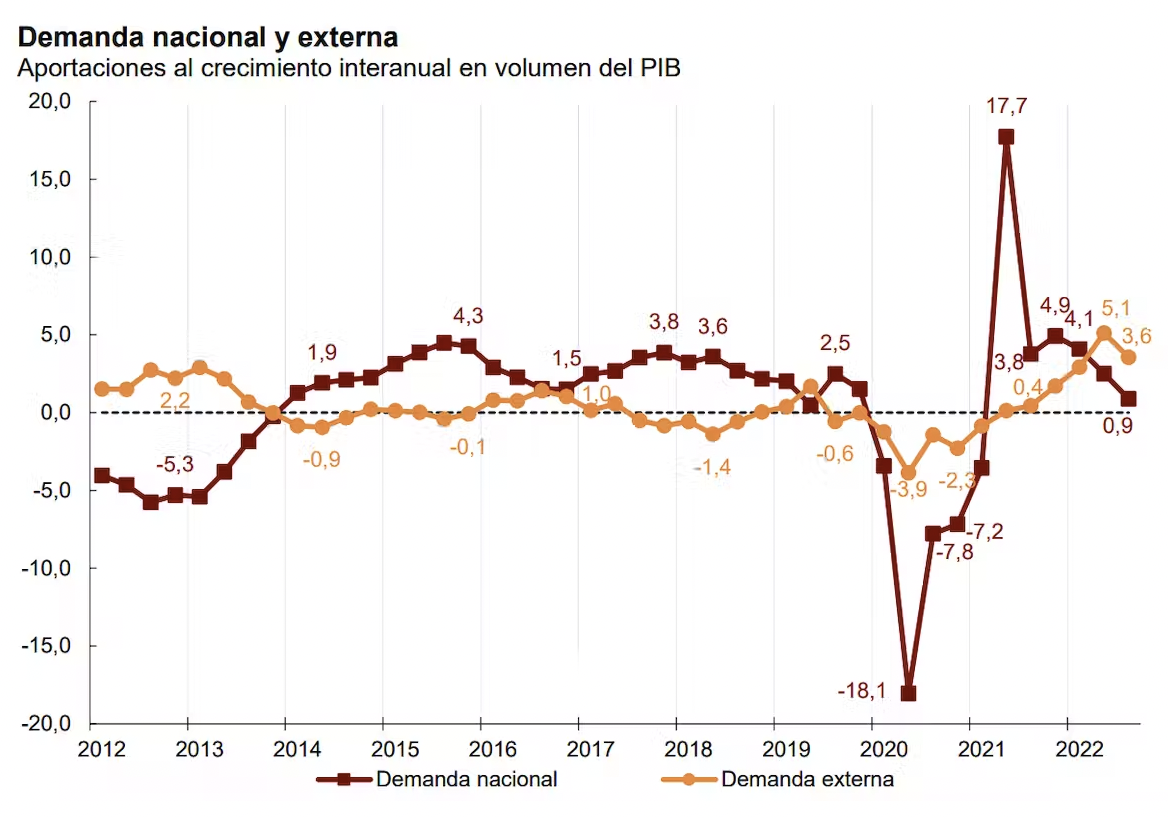

What is happening with the foreign sector?

Spain's foreign trade is influenced by more factors than price competitiveness. They range from economic growth to people's preferences, as well as economic policies. In any case, the latest available data indicate a certain worsening of the trade balance. Imports are growing more than exports.

We will have to pay attention to these events. They may be temporary. But foreign trade was driving growth. Losing competitiveness would be very bad news for the Spanish Economics .